United States Diabetes Care Drugs and Devices Market Size, Share, Trends and Forecast by Offering, Distribution Channel, and Region, 2025-2033

United States Diabetes Care Drugs and Devices Market Size and Share:

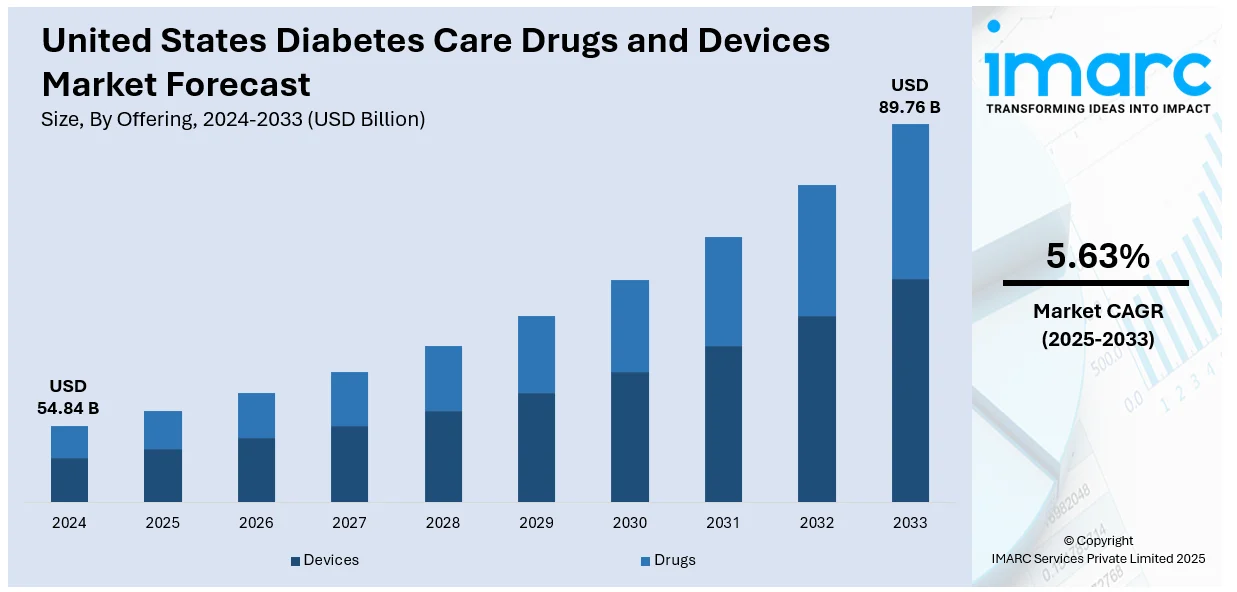

The United States diabetes care drugs and devices market size was valued at USD 54.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 89.76 Billion by 2033, exhibiting a CAGR of 5.63% from 2025-2033. The market is driven by the rising prevalence of diabetes, largely due to sedentary lifestyles, poor diets, and an aging population. Additionally, supportive government policies, increasing healthcare expenditures, and collaborations between pharmaceutical and technology firms contribute to the development of next-generation solutions, accelerating market expansion and improving patient outcomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.84 Billion |

| Market Forecast in 2033 | USD 89.76 Billion |

| Market Growth Rate (2025-2033) | 5.63% |

The growth of the diabetes care drugs and devices market in the U.S. is primarily driven by the growing prevalence of diabetes, fueled by sedentary lifestyles, poor dietary habits, and increasing obesity rates among the masses. According to the Centers for Disease Control and Prevention (CDC), millions of Americans are affected by diabetes, with type 2 diabetes being the most common form. More than 38 million Americans, about 1 in 10, have diabetes, and 90% to 95% of them have type 2 diabetes. Type 2 diabetes often develops in individuals over age 45, but it is rising in children, teens, and young adults. The aging population further contributes to market expansion, as older individuals are more susceptible to the disease. Additionally, advancements in drug formulations, such as insulin analogs and non-insulin therapies, enhance treatment efficacy, driving the demand for innovative diabetes management solutions.

Technological advancements in diabetes care devices – United States are another major driver of the market. The increasing adoption of continuous glucose monitoring (CGM) systems, insulin pumps, and smart insulin pens reflects the growing emphasis on personalized and efficient disease management. Rising healthcare expenditures and supportive government policies, including Medicare and Medicaid coverage for diabetes treatments and devices, further stimulate market expansion. As per industry reports, U.S. health care spending grew 7.5% in 2023 to USD 4.8 Trillion, led by Medicaid and private health insurance, which reached a record high of 93% insured. Spending per person is estimated at USD 15,074 in 2024. National health spending is projected to grow 5.2% in 2024, with a decline of 11.2% in Medicaid enrollment. Moreover, collaborations between pharmaceutical companies and technology firms are fostering the development of next-generation solutions, such as artificial pancreas systems and digital health platforms, which are enhancing patient outcomes and further accelerating U.S. diabetes care drugs and devices market share.

United States Diabetes Care Drugs and Devices Market Trends:

Growing Adoption of Digital Health Solutions

The integration of digital health technologies in diabetes management is transforming patient care in the United States. The increasing adoption of mobile health applications, wearable glucose monitoring devices, and artificial intelligence-driven analytics is enhancing disease monitoring and treatment personalization. On 27th June 2024, Cleveland Clinic and FitNow, Inc. developed the Cleveland Clinic Diet app launched in 2024, featuring personalized health and diet advice plus food and fitness tracking. BodyGuard and HeartSmart are two tracks intended to help lead users toward better nutrition and improved cardiovascular well-being. Expertly guided support works toward sustainable changes in lifestyle leading to better health. Smart insulin pens and automated insulin delivery systems are gaining popularity due to their ability to improve glycemic control and reduce the burden of disease management. Additionally, telemedicine services have expanded significantly, enabling remote consultations and continuous patient engagement. This trend is fueled by increasing internet penetration, smartphone usage, and healthcare providers' growing focus on data-driven treatment strategies, making diabetes management more efficient and accessible.

Advancements in Non-Insulin Diabetes Therapies

The shift toward innovative non-insulin therapies as alternatives to traditional insulin treatments is acting as one of the significant United States diabetes care drugs and devices market trends. The development of GLP-1 receptor agonists, SGLT2 inhibitors, and dual-acting therapies is gaining momentum due to their effectiveness in controlling blood sugar levels while offering cardiovascular and renal benefits. On 18th December 2024, Merck and Hansoh Pharma entered into an exclusive, global license agreement for HS-10535, an investigational oral GLP-1 receptor agonist. Merck is to pay USD 112 Million upfront and up to USD 1.9 Billion in milestone payments. The collaboration is intended to offer benefits beyond weight loss for cardiometabolic benefits. Besides this, pharmaceutical houses are investing large sums of money in research and development to introduce novel drug formulation that allows better patient adherence and reduction of side effects. Combination therapies, incorporating multiple classes of drugs into a single treatment regime, also are increasingly popular, leading to better ease of use and effectiveness. The increasing recognition of the need for a more personalized treatment approach is pushing the boundaries of conventional insulin-based management of diabetes. Therefore, this is creating a positive United States diabetes care drugs and devices market outlook.

Expansion of Continuous Glucose Monitoring (CGM) and Insulin Pump Technologies

Technological advancements in diabetes management devices, particularly continuous glucose monitoring (CGM) systems, and insulin pumps are significantly impacting the market. CGM devices are increasingly replacing traditional blood glucose meters due to their real-time monitoring capabilities and improved accuracy. The integration of CGM systems with insulin pumps is further enhancing automated insulin delivery, reducing the risk of hypoglycemia, and improving long-term glycemic control. On 29th May 2024, Tandem Diabetes Care and Dexcom, the leading makers of diabetes solutions, announced that Tandem Mobi is now available to integrate seamlessly with both the Dexcom G6 and Dexcom G7 Continuous Glucose Monitoring systems, which provides two different options for better flexibility in their management of the disease. It will be downloadable by the user as part of a remote software update. The market is also growing with the development of closed-loop systems, which is also known as artificial pancreas technology. This system adjusts insulin delivery based on glucose readings without the need for patient intervention. Such developments drive patients to require sophisticated diabetes management solutions which therefore encourage further investment in medical device technologies.

United States Diabetes Care Drugs and Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States diabetes care drugs and devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on offering and distribution channel.

Analysis by Offering:

- Devices

- Monitoring Devices

- Self-monitoring Blood Glucose Devices

- Continuous Blood Glucose Monitoring

- Management Devices

- Insulin Pump

- Insulin Syringes

- Insulin Cartridges

- Disposable Pens

- Monitoring Devices

- Drugs

- Oral Anti-Diabetes Drugs

- Insulin Drugs

- Combination Drugs

- Non-Insulin Injectable Drugs

The diabetes care devices segment includes continuous glucose monitoring (CGM) systems, blood glucose meters, insulin pumps, smart insulin pens, and lancets. The rise in the popularity of continuous glucose monitoring systems compared to standard glucose meters is expanding this market segment, as real-time monitoring does augment glycemic control and complications considerably. In addition, insulin pumps and closed-loop systems are artificial pancreas devices that lead the way; their adoption has increased since it is convenient to have a self-administered insulin injection. Furthermore, digital health technologies, including mobile applications and cloud-based analytics, enhance the functionality of these devices and promote effective patient adherence to their usage.

The diabetes care drugs segment includes insulin therapies, oral antidiabetic drugs, and emerging non-insulin treatments. Insulin continues to be a vital component; rapid-acting, long-acting, and combination formulations of insulin have made it easier to manage the disease. On the other hand, GLP-1 receptor agonists, SGLT2 inhibitors, and DPP-4 inhibitors have gained popularity to offer alternatives to traditional insulin therapy. Newer drug classes now provide better control of blood sugars while providing extra cardiovascular and renal benefits. The need for tailored treatment approaches is increasingly driving the pharmaceutical industry to invest in research and development toward innovative formulations that enhance patient outcomes and adherence.

Analysis by Distribution Channel:

- Online

- Offline

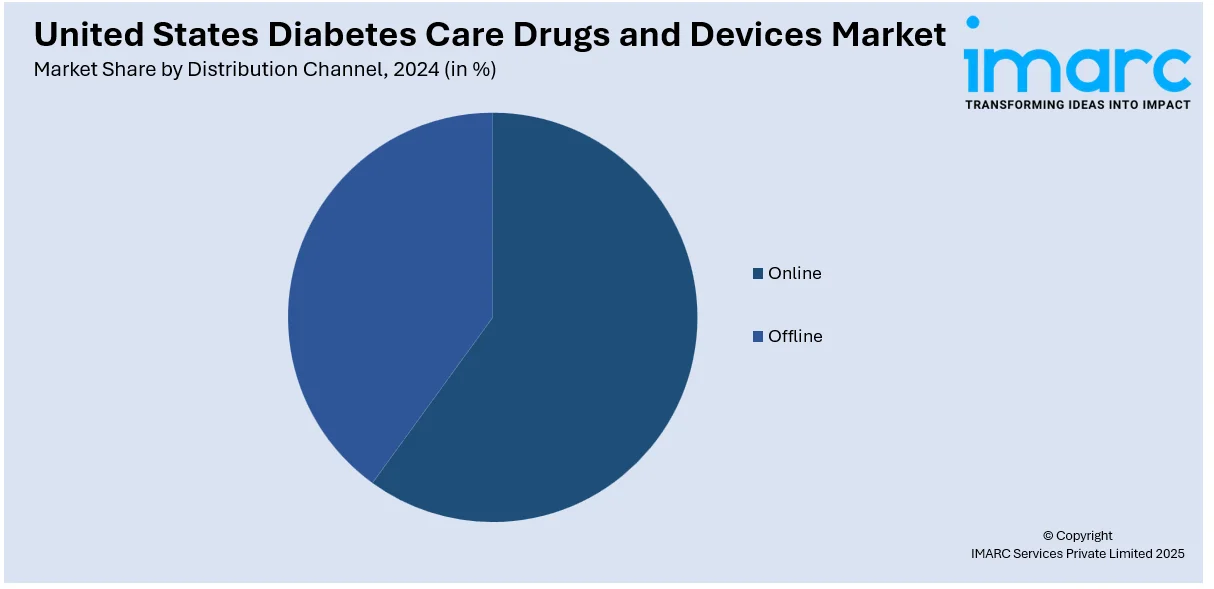

With growing demand for e-commerce platforms and digital pharmacies, the online channel is witnessing growth. Patients and healthcare providers are increasingly using online retail options due to home delivery convenience, competitive pricing, and access to a wider range of diabetes care products. Subscription-based models for CGM sensors and insulin pump supplies are emerging, where devices are provided with no lapses in time. Telemedicine coupled with online pharmacies continues to simplify the management of diabetes through remote appointments and filling of prescriptions.

Offline channels, hospitals, retail pharmacies, and specialty diabetes clinics account for the biggest share of this market. A significant number of patients prefer to buy diabetes drugs and devices from physical stores since they get professional guidance from pharmacists and healthcare providers. Hospitals continue to be a large outlet for ensuring the timely availability of insulin and many other drugs, especially for those newly diagnosed. Real pharmacies also provide insurance support, medication counseling, and device demonstrations that improve patient adherence. Even with the growth of sales from online sources, the services offered by offline channels are relevant and necessary for personalized healthcare services and immediate product availability.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Advanced healthcare infrastructure and high healthcare expenditure have positioned the Northeast as a prime location for diabetes care drugs and devices. Innovation in diabetes management has also received momentum from strong research institutions in states such as New York and Massachusetts. The high prevalence of diabetes with increased insurance coverage and government initiatives drives market growth. Top pharmaceutical companies also support the region's role in diabetes care.

The Midwest has a rising United States diabetes care drugs and devices market demand due to increasing obesity rates and lifestyle-related diabetes. States such as Illinois and Ohio face growing cases of diabetes, leading to higher adoption of monitoring devices and medications. Limited healthcare access in rural areas is enhancing telemedicine solutions. Additionally, the presence of major medical device manufacturers in the region supports advancements in diabetes treatment technologies.

The South has the highest prevalence of diabetes throughout the U.S., making it a significant source of demand for care drugs and devices. States such as Texas and Florida have large diabetic populations, so demand continues to rise regarding insulin, oral medications, and monitoring devices. Socioeconomic disparities and limited healthcare access in rural areas present major challenges, but growing knowledge and telehealth services help bridge this gap. The involvement of the private sector and government health programs expands the market further.

The West is a rapidly growing market for diabetes care, driven by technological advancements and a strong focus on digital health solutions. States such as California and Washington lead in wearable glucose monitors and telehealth integration. A large aging population and increasing health-consciousness contribute to market expansion. The presence of leading biotech companies and research institutions further accelerates innovation, making the West a dynamic region for diabetes care advancements.

Competitive Landscape:

The market for diabetes care drugs and devices in the United States is characterized by intense competition, yet it is primarily shaped by the dominance of well-established pharmaceutical and medical device companies, alongside emerging innovators. Participants in this market prioritize research and development efforts to unveil new technologies, which include advanced therapies, novel insulin formulations, and state-of-the-art monitoring devices. Continuous glucose monitoring systems and digital solutions in health products are driving technological advancements. Other strategies include business expansions through collaborative agreements, buyouts, mergers, joint ventures, licensing agreements, pricing pressures, changes in regulatory scenarios, and developments in personalized or patient-centric medical care models for further competition advancement. Additionally, digital health integration and artificial intelligence-driven diabetes management solutions are augmenting the U.S. diabetes care drugs and devices market size, promoting innovation and efficiency.

The report provides a comprehensive analysis of the competitive landscape in the United States diabetes care drugs and devices market with detailed profiles of all major companies, including:

- Astrazeneca

- Eli Lilly

- Sanofi

- Boehringer Ingelheim

- Novo Nordisk

- Becton and Dickinson

- Medtronic

- Abbott

- Johnson & Johnson

- Insulet Corporation

- Dexcom

Latest News and Developments:

- October 21, 2024: Novo Nordisk's oral diabetes drug Rybelsus, or semaglutide, lowered heart-related risks by 14% in a late-stage trial of 9,650 patients with type 2 diabetes and cardiovascular or kidney disease. The company intends to file for label expansions in the U.S. and EU by year-end, with more detailed results to be presented at a 2024 scientific conference.

- August 07, 2024: Medtronic won the FDA approval for its Simplera disposable continuous glucose monitor, an all-in-one, compact design intended to be used with its InPen smart insulin pen and MiniMed 780G system. Additionally, the company announced that it was entering into a global strategic partnership with Abbott to include Abbott's advanced continuous glucose monitoring technology with Medtronic's insulin delivery systems, making it easier for individuals to manage diabetes.

- June 12, 2024: AstraZeneca's FARXIGA® (dapagliflozin) has been approved by the FDA for the improvement of glycemic control in pediatric patients aged 10+ with type-2 diabetes (T2D), based on the T2NOW Phase III study, which showed a significant A1C reduction at -1.03% compared to placebo. This approval addresses the growing prevalence of T2D among young people as nearly 30,000 U.S. patients are reportedly diagnosed below 20 years of age and 5,300 new cases annually.

- March 15, 2024: Eli Lilly and Company joined Amazon Pharmacy to supply GLP-1 medicines Mounjaro and Zepbound, made available on the LillyDirect site to meet escalating demand for obesity, diabetes, and migraine treatments.

United States Diabetes Care Drugs and Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States diabetes care drugs and devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States diabetes care drugs and devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States diabetes care drugs and devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States diabetes care drugs and devices market was valued at USD 54.84 Billion in 2024.

The United States diabetes care drugs and devices market growth is driven by the rising prevalence of diabetes due to sedentary lifestyles, poor diets, and an aging population. Additionally, advancements in drug formulations, technological innovations in devices, supportive government policies, and collaborations between pharmaceutical and technology firms are key drivers.

The United States diabetes care drugs and devices market is projected to exhibit a CAGR of 5.63% during 2025-2033, reaching a value of USD 89.76 Billion by 2033.

The major players in the market include Astrazeneca, Eli Lilly, Sanofi, Boehringer Ingelheim, Novo Nordisk, Becton and Dickinson, Medtronic, Abbott, Johnson & Johnson, Insulet Corporation, and Dexcom, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)