United States Dental Implants Market Report by Material (Titanium Dental Implants, Zirconium Dental Implants), Product (Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants), End Use (Hospitals, Dental Clinics, Academic and Research Institutes, and Others), and Region 2026-2034

Market Overview:

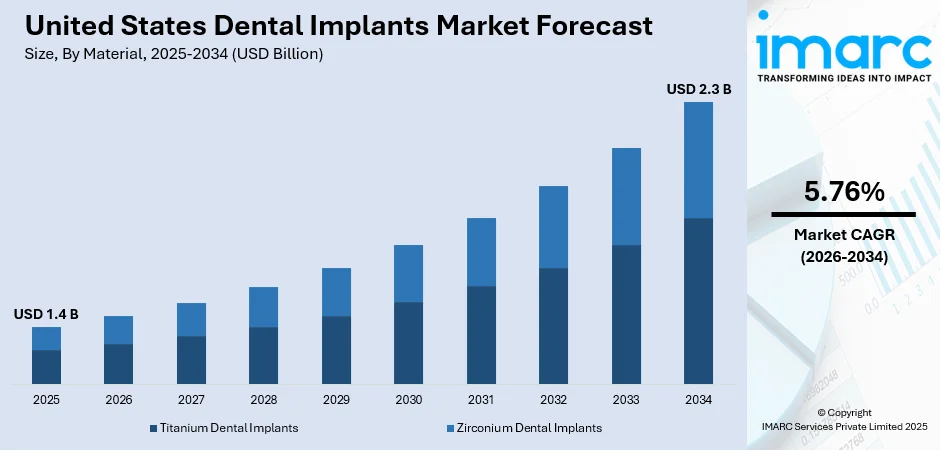

The United States dental implants market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.76% during 2026-2034. The growing geriatric population, the rising prevalence of dental disorders, various technological advancements, an increase in dental tourism in emerging markets, and the growing awareness and preference for aesthetic dentistry are some of the major factors propelling the United States dental implants market share.

United States Dental Implants Market Analysis:

- Growth Drivers: Rising geriatric population, increasing prevalence of tooth loss, advanced dental implants technology, higher aesthetic awareness, and growing disposable income thus aiding the United States dental implants market growth.

- Key Market Trends: Digital dentistry, three-dimensional (3D) printing, minimally invasive surgeries, and customized implant solutions are trending, enhancing precision and patient outcomes. Increasing dental implants tourism and corporate dental implants chains also shape market evolution.

- Market Opportunities: Expansion in underserved United States, integration of artificial intelligence (AI) and CAD/CAM tools, affordable implant solutions, and strategic partnerships among clinics and manufacturers present lucrative opportunities for growth and innovation in dental implants.

- Market Challenges: High cost of procedures, limited insurance coverage, regulatory hurdles, and shortage of skilled professionals restrict widespread adoption. Patient fear and preference for alternatives also challenge market expansion efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 2.3 Billion |

| Market Growth Rate (2026-2034) | 5.76% |

Access the full market insights report Request Sample

Dental implants are prosthetic devices used to replace missing teeth by surgically placing them into the jawbone. They serve as artificial tooth roots that provide a stable foundation for dental restorations, such as crowns, bridges, or dentures. They are typically made of biocompatible materials, such as titanium, that fuse with the jawbone through a process called osseointegration. The procedure for dental implants involves a surgical placement where the implant is inserted into the jawbone that integrates with the bone, providing a secure and durable anchor for the replacement tooth or teeth. They offer several advantages, including improved functionality, aesthetics, and oral health, and restore the ability to chew and speak properly, enhancing oral function.

To get more information on this market Request Sample

The market is primarily driven by the growing incidences of periodontal disease, decay, or accidents. Dental implants provide a reliable and long-lasting solution for individuals seeking to replace missing teeth. In addition, the growing geriatric population is leading to the escalating demand for dental implants Also, the shift in the dental industry towards aesthetic dentistry, driven by increased awareness and patient preference for natural-looking and functional teeth replacements is influencing the market growth. Dental implants are highly regarded for their ability to replicate the look, feel, and function of natural teeth, this aesthetic appeal, with the advantages of stability and durability, has led to the rising demand for dental implants among individuals seeking cosmetic dental treatments. Furthermore, several technological advancements, and numerous innovations in implant materials, such as the use of titanium alloys and zirconia, have improved the success rates and longevity of dental implants representing another major growth-inducing factor.

United States Dental Implants Market Trends/Drivers:

Various technological advancements

Technological advancements and innovations in dental implant materials and techniques are driving market growth. In addition, the introduction of computer-aided design and computer-aided manufacturing (CAD/CAM) technology has revolutionized the dental implant process, allowing for precise planning, implant placement, and customized prosthetics representing another major growth-inducing factor. Additionally, the development of new biomaterials and surface treatments has improved the success rate and longevity of dental implants which enhance patient outcomes, reduce treatment time, and increase the acceptance of dental implants among patients and dental professionals are influencing the market growth. Besides this, various advancements in imaging technologies, such as cone beam computed tomography (CBCT), enable dentists to accurately plan and place dental implants with high precision, increasing patient confidence in dental implant procedures, and further contributing to the United States dental implants market growth.

Rising dental tourism

Dental tourism is a growing trend in the United States, which is positively impacting the dental implant market. In addition, increasing numbers of Americans are traveling to access affordable dental implant procedures, primarily in countries offering cost-effective options without compromising quality contributing to the market growth. This trend has encouraged domestic dental clinics to remain competitive by offering competitive pricing, advanced technologies, and superior patient experiences, thereby stimulating the growth of the dental implants market. Moreover, the increasing popularity of dental tourism, as it allows individuals to access specialized procedures that may not be readily available or affordable in their home countries influencing the market growth. Some countries have developed a reputation for providing high-quality dental care and advanced implant techniques, attracting patients seeking specific treatments or expertise. Besides this, the easy availability of high-quality dental care, advanced dental clinics, and skilled dental professionals in the United States attracts patients from around the world, driving the United States dental implants market growth.

United States Dental Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States dental implants market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on material, product, end use.

Breakup by Material:

- Titanium Dental Implants

- Zirconium Dental Implants

Titanium dental implants dominate the market

The report has provided a detailed breakup and analysis of the market based on the material. This includes titanium dental implants and zirconium dental implants. According to the report, titanium dental implants represented the largest segment.

Based on the United States dental implants market analysis, the titanium has become the preferred choice for dental implants due to its excellent biocompatibility, durability, and ability to integrate with the surrounding bone tissue. In addition, the escalating demand for titanium dental implants due to their biocompatibility ensures the implant is well-tolerated by the body, reducing the risk of rejection or allergic reactions contributing to the market growth. Moreover, titanium dental implants’ surface properties promote osseointegration, allowing the implant to fuse with the jawbone, providing a strong and stable foundation for the dental prosthesis representing another major growth-inducing factor. Besides this, titanium's exceptional strength and resistance to corrosion make it an ideal material for long-term dental implant solutions, and the durability of titanium implants ensures their longevity, providing patients with a reliable tooth replacement option that can withstand the daily demands of chewing and biting forces accelerating the market growth. Additionally, the versatility of titanium allows for various implant designs and configurations to cater to individual patient needs propelling the market growth. Also, dental professionals can choose from different shapes, sizes, and surface treatments to achieve optimal implant placement and maximize success rates.

Breakup by Product:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

The report has provided a detailed breakup and analysis of the market based on the product. This includes endosteal Implants, subperiosteal Implants, transosteal Implants, and intramucosal Implants.

Endosteal implants are implants are directly placed into the jawbone and provide a strong foundation for dental prostheses such as crowns or bridges, and offer stability, durability, and natural functionality, making them a popular choice among patients. Moreover, subperiosteal implants are placed on top of the jawbone, beneath the gum tissue, which is typically used when the jawbone does not have sufficient height or width to support endosteal implants representing another major growth-inducing factor. Subperiosteal implants offer an alternative for patients who may not be suitable candidates for traditional implants.

Besides this, transosteal implants involve the insertion of metal posts through the jawbone, providing a framework for dental restorations which is used in cases where there is a significant loss of bone in the jaw and traditional implants are not feasible. Furthermore, intramucosal implants are a newer type of dental implant that is placed directly into the mucosal tissue instead of the jawbone deployed in situations where patients have limited bone volume or density that offer a minimally invasive solution for tooth replacement propelling the market growth.

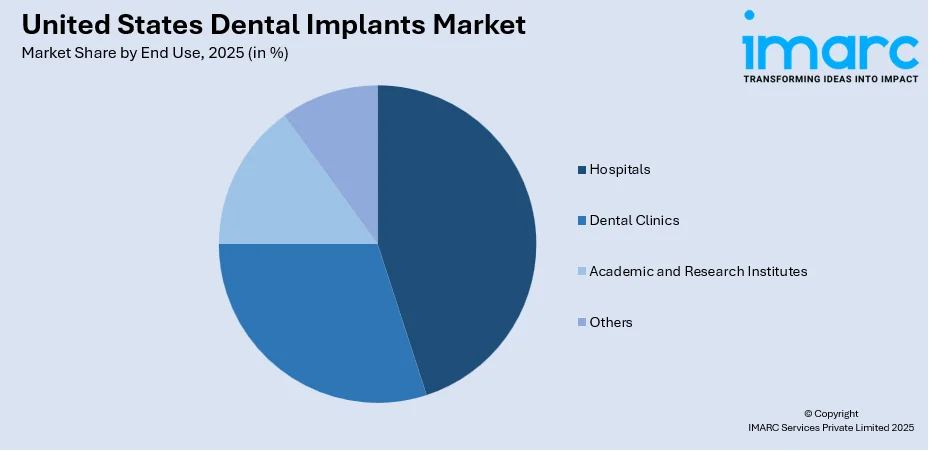

Breakup by End Use:

To get detailed segment analysis of this market Request Sample

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

Dental clinics hold the largest share of the market

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, dental clinics, academic and research institutes, and others. According to the report, dental clinics represented the largest segment.

Dental clinics serve as primary healthcare settings for patients seeking dental implant treatments. They provide a range of services, including initial consultations, implant placement, prosthetic restoration, and post-operative care, all under one roof contributing to the market growth. The convenience and comprehensive care offered by dental clinics make them a preferred choice for patients requiring dental implant procedures. These clinics are dedicated dental healthcare facilities equipped with specialized equipment, technologies, and trained professionals to perform dental implant surgeries and offer comprehensive dental care. Furthermore, dental clinics have the infrastructure and resources to provide a sterile and controlled environment for dental implant surgeries. They are equipped with advanced diagnostic tools, surgical equipment, and anesthesia facilities, ensuring safe and efficient implant procedures. Also, the easy availability of such resources within dental clinics enhances patient comfort and safety, contributing to their preference for these settings.

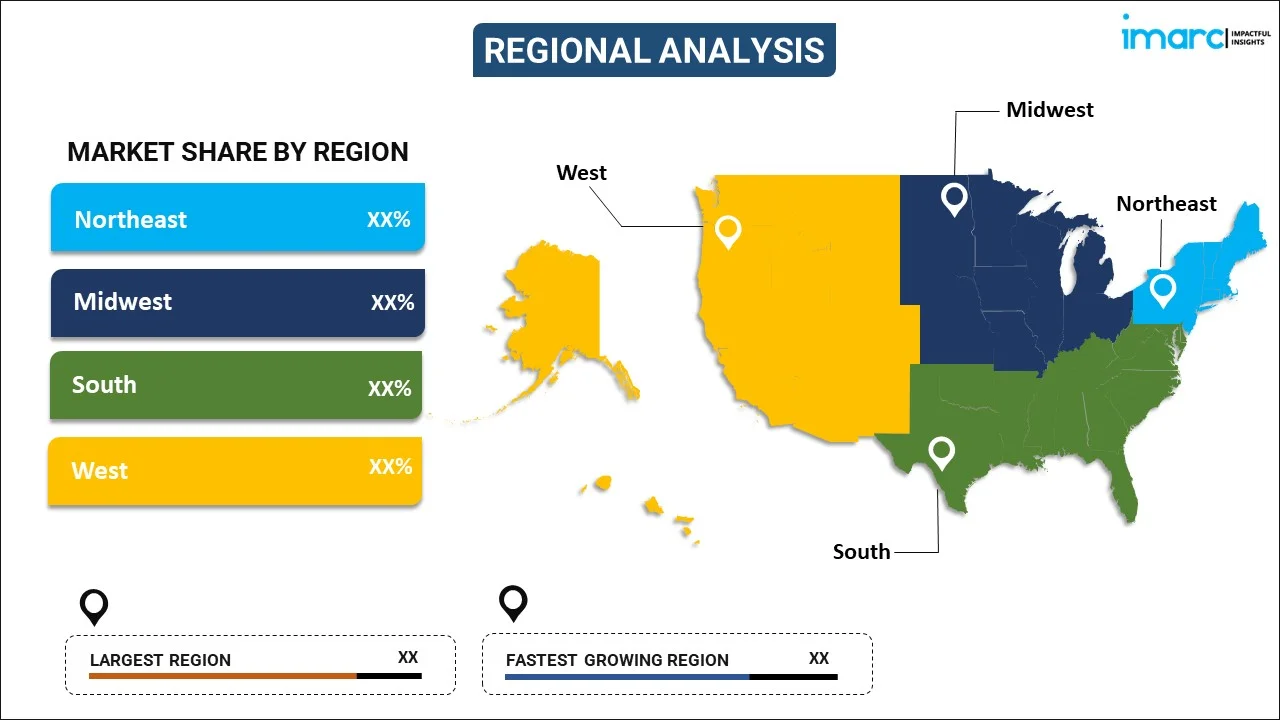

Breakup by Region:

- Northeast

- Midwest

- South

- West

The report has provided a detailed breakup and analysis of the market based on the region. This includes the Northeast, Midwest, South, and West.

The Northeast region is known for its increasing population and advanced healthcare infrastructure, including renowned dental clinics and research institutions. In addition, the escalating demand for dental implants due to rising disposable income, the growing awareness about dental health, and an increasing geriatric population seeking tooth replacement options are contributing to the market growth.

Moreover, the Midwest has a mix of urban and rural areas, with a diverse range of demographics. In addition, urban centers contribute to the demand for dental implants through their population size and rising disposable incomes, rural areas often display a comparatively lower demand. Also, the growing awareness about dental implants, technological advancements, and increasing acceptance of dental implant procedures are propelling market growth.

The South region is driven by the escalating demand for dental implants due to the prevalence of oral health issues, the presence of geriatric populations, and a growing emphasis on aesthetics and oral healthcare. It also benefits from the influx of retirees and a rise in medical tourism, contributing to the market growth. Furthermore, the West region is known for its progressive healthcare infrastructure, high standards of living, and tech-savvy population contributing to a higher acceptance and demand for dental implant procedures. The West region also has a significant number of dental clinics specializing in implant dentistry, leading to propelling market growth.

Competitive Landscape:

Nowadays, key players in the dental implants market are implementing various strategies to strengthen their hold and maintain a competitive edge in the industry. Leading companies in the dental implant market are investing heavily in research and development (R&D) activities to develop innovative products and advanced technologies. These investments aim to improve the success rates, longevity, and aesthetics of dental implants. Moreover, key players are actively pursuing strategic partnerships and acquisitions to expand their product portfolios and market reach by collaborating with other companies, dental implant manufacturers are gaining access to new technologies, and new markets, and strengthening their product offerings. Furthermore, key players are investing in targeted marketing campaigns, and digital marketing strategies, and participating in industry conferences and exhibitions to create brand awareness and showcase their expertise propelling the market growth.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latest News and Developments:

- In April 2025, ZimVie Inc. introduced its Immediate Molar Implant System in the U.S., enhancing its TSX® and T3 PRO® platforms. Designed for immediate molar replacement, the system simplifies post-extraction site preparation with wide-diameter implants for better stability. Featuring DAE surface technology to reduce peri-implantitis risk, it enables faster, more predictable restorations. ZimVie aims to deliver cost-effective, time-saving solutions for molar tooth replacement.

- In March 2025, Dentsply Sirona launched the MIS LYNX all-in-one premium dental implants implant in the U.S., developed by MIS Implants Technologies. Designed for versatility and cost-effectiveness, MIS LYNX supports a broad range of clinical applications. It shares dimensions and prosthetics with MIS C1 implants and offers strong primary stability across various bone types, making it suitable for immediate placement in extraction sites.

United States Dental Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States dental implants market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States dental implants market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental implants market in the United States was valued at USD 1.4 Billion in 2025.

The United States dental implants market is projected to exhibit a CAGR of 5.76% during 2026-2034, reaching a value of USD 2.3 Billion by 2034.

Key factors driving the U.S. dental implants market include an aging population, increasing cases of tooth loss, rising demand for cosmetic dentistry, technological advancements, improved implant materials, growing dental awareness, and higher disposable incomes. Additionally, expanding dental insurance coverage and preference for minimally invasive procedures support market growth.

Titanium dental implants dominate the market due to their excellent biocompatibility, durability, and high success rates. Their ability to osseointegrate effectively with bone promotes long-term stability. Additionally, widespread clinical use, proven safety record, and compatibility with various prosthetic solutions further drive their preference among dental professionals and patients.

Dental clinics hold the majority share in the U.S. dental implants market due to their accessibility, personalized care, and comprehensive treatment options. Increasing patient preference for specialized services, advancements in clinic-based technology, and growing numbers of independent and group practices contribute to their dominant role in implant procedures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)