United States Dental Chain Market Size, Share, Trends and Forecast by Services, and Region, 2025-2033

United States Dental Chain Market Size and Share:

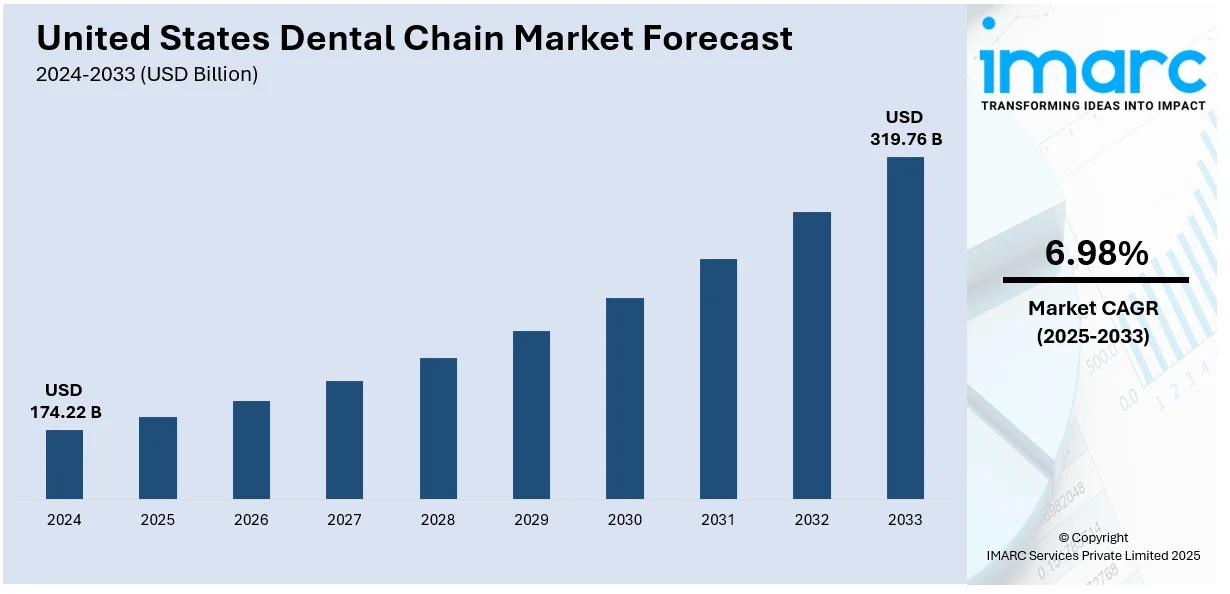

The United States dental chain market size was valued at USD 174.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 319.76 Billion by 2033, exhibiting a CAGR of 6.98% from 2025-2033. The rising demand for affordable care, increasing oral health issues, rapid technological advancements, escalating corporate investments, insurance coverage growth, and emerging cosmetic dentistry trends, are major factors bolstering the United States dental chain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 174.22 Billion |

| Market Forecast in 2033 | USD 319.76 Billion |

| Market Growth Rate (2025-2033) | 6.98% |

In the United States, millions of people either lack dental insurance or struggle to afford routine dental visits. An estimated 67 million Americans, nearly a quarter of the population, lack dental insurance, according to the National Institutes of Health (NIH) report. This number is more than double the 26 million Americans estimated to be without health insurance. More so, traditional private practices often operate on a fee-for-service model that make treatment expensive and out of reach for many. This has created a significant demand for more accessible and affordable dental care options, which is where dental chains step in. Dental chains offer a standardized approach to dental care, often operating on a franchise or corporate-owned model, allowing them to leverage economies of scale. By negotiating bulk discounts on equipment, supplies, and even labor costs, they can provide services at lower prices than independent dentists.

Oral health problems are becoming more common across the country, driving more people to seek dental care and thus leading to the expansion of the United States dental chain market share. Issues like cavities, gum disease, and tooth loss are on the rise due to poor dietary habits, aging populations, and inconsistent oral hygiene routines. The growing consumption of sugary and processed foods is also a major contributor to tooth decay; while smoking and alcohol use continue to increase the risk of gum disease and oral cancers. Complete tooth loss is more than twice as common among older adults who currently smoke (29%) compared to those who have never smoked (12%). As the need for regular check-ups, cleanings, fillings, and more complex procedures like root canals and dental implants increases, the demand for dental services in the country has surged. Dental chains, which are designed to handle high patient volumes, are well-positioned to meet this growing need. They often provide comprehensive care under one roof, meaning patients can receive preventive, restorative, and cosmetic treatments without needing referrals to specialists.

United States Dental Chain Market Trends:

Rising Geriatric Population

A major factor boosting the U.S. dental chains market size is the growing aging population in the country. As baby boomers grow older, they require more dental care, particularly for conditions like periodontitis, which can lead to tooth loss if left untreated. By 2030, all baby boomers will be aged 65 and older, and by 2040, approximately 78.3 million Americans will fall into that age group. Many seniors will need dentures, implants, or other prosthetic solutions, thus increasing the demand for dental services. Unlike traditional solo practices, dental chains have the infrastructure and resources to efficiently cater to this demographic, often offering specialized care for elderly patients.

Corporate Investment and Expansion Strategies

The dental industry has attracted significant corporate investment, leading to the rapid expansion of United States dental chain market demand. In 2023, national dental care expenditures amounted to $174 billion, with private health insurance spending accounting for most of the increase. This influx of capital has enabled dental chains to acquire existing practices and open new locations, increasing their market presence. Aggressive marketing strategies, such as digital advertising and social media campaigns, have significantly strengthened patient acquisition efforts. Franchise models have also facilitated growth, allowing dentists to operate under established brands with corporate support, thereby reducing administrative burdens and focusing on patient care.

Rising Awareness of Oral Health's Impact on Overall Well-being

In recent years, there has been increasing awareness of the link between oral health and overall health, driving the growth of the dental chain market in the United States. Poor oral hygiene has been associated with conditions such as heart disease, diabetes, and even certain cancers. This awareness has led more individuals to prioritize regular dental check-ups and treatments. According to the Centers for Disease Control and Prevention (CDC), as of 2023, 65.5% of adults aged 18 and older had a dental exam or cleaning during the year, reflecting an increased commitment to oral health maintenance. Also, the landscape of dental insurance in the U.S. has seen notable changes. In 2023, national dental care expenditures increased by 2.5% from 2022, with private health insurance spending accounting for most of the increase. This expansion in coverage has made dental services more accessible to a broader segment of the population, encouraging individuals to seek regular care. Dental chains, with their extensive networks, are well-positioned to cater to this growing insured population.

United States Dental Chain Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States dental chain market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on services.

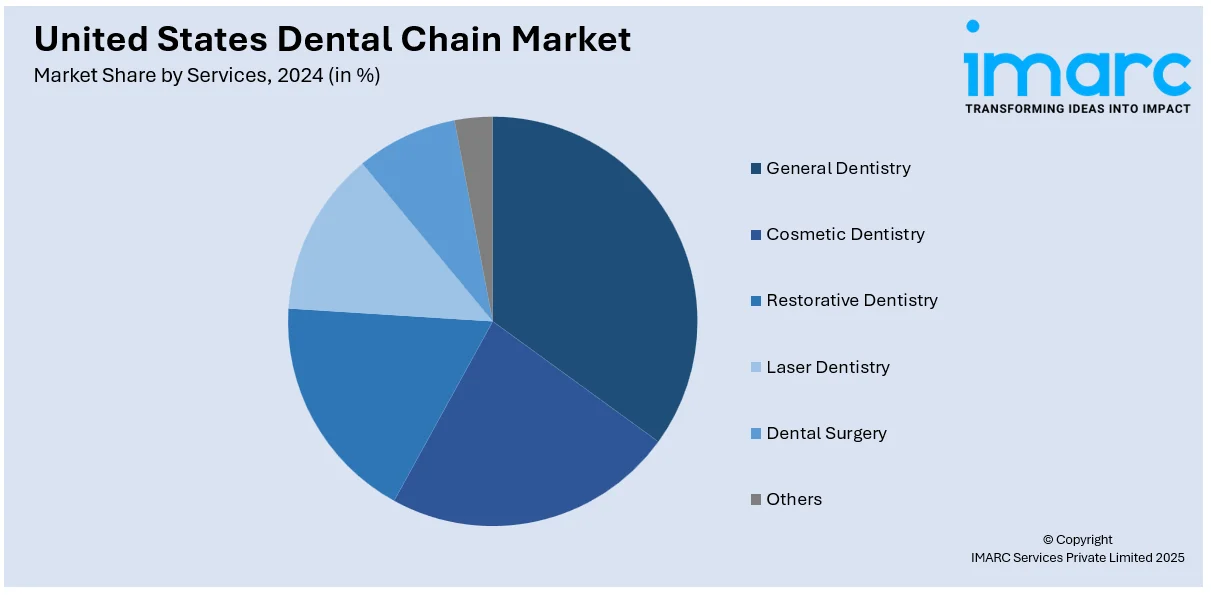

Analysis by Services:

- General Dentistry

- Cosmetic Dentistry

- Restorative Dentistry

- Laser Dentistry

- Dental Surgery

- Others

As per the United States dental chain market trends, General dentistry is one the largest service segments, encompassing routine dental check-ups, cleanings, fluoride treatments, and preventive care. With over 65.5% of U.S. adults visiting a dentist in the year 2023, demand remains high for regular oral health maintenance. Dental chains lead this segment by offering standardized, cost-effective services at scale, catering to insured and uninsured patients alike, and increasing accessibility through retail-based clinics and extended hours.

Cosmetic dentistry is booming with patients for teeth whitening, veneers, and aligners to make their smile more aesthetic. In 2024, 58% of adults went for a regular dental checkup as their focus was on an attractive smile, thus boosting demand for elective treatments. Dental chains utilize technology such as 3D imaging and digital smile design to streamline procedures and offer competitive pricing and financing options, making aesthetic dental care accessible to a larger demographic.

Restorative procedures like fillings, crowns, bridges, and implants are some of the most common treatments for patients who are experiencing tooth decay or damage. With around 13% of adults aged 65 and older having one or more permanent teeth with untreated decay, the demand for restorative services remains high across the country. Chains are able to utilize bulk purchases and digital workflows, such as CAD/CAM technology, which enables efficient and same-day restorations in lower costs and treatment length for patients.

Based on the United States dental chain market forecast, laser dentistry is on the rise as a minimally invasive (MI) treatment option for practices such as gum reshaping, cavity treatment, and periodontal therapy. This treatment is fast becoming popular which is pushing many dental chains to implement laser technology with pain-free and precision-based treatments. By reducing bleeding, discomfort, and healing time, laser dentistry can help alleviate dental anxiety in patients, hence increasing the customer base for chains investing in the latest equipment.

Specialized services in dental surgery include extraction of wisdom teeth, periodontal surgery, and dental implants, which necessitate specialized training. The rising population of the elderly and an increased consciousness regarding the oral implications of systemic diseases lead to more demand for surgical interventions. In-house specialists in dental chains and multi-location surgical centers bring convenience in avoiding outside referrals, streamlined care with the same provider network, and assured quality patient care.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast U.S. dental market is known for its high concentration of urban areas, with major cities leading the demand for dental services. This region typically has a higher population density and more affluent consumers, making it a strong market for advanced dental procedures, cosmetic dentistry, and specialized treatments. A mix of high insurance coverage and a growing focus on preventive dental care also characterizes the Northeast dental landscape. As the region is home to many health-conscious individuals, dental chains often focus on integrating technology and modern treatments to meet the sophisticated needs of the population.

The Midwest dental chain market is marked by a combination of urban and rural populations. While large metropolitan areas drive demand for high-end dental care, a significant portion of the market is also focused on affordable and accessible dental services, catering to smaller communities. Family-oriented care and general dentistry services are prominent here. Midwesterners tend to place high value on convenience and trust, leading to a solid demand for dental chains that emphasize relationship-building and a consistent, quality experience. Additionally, insurance coverage plays a significant role in shaping the purchasing decisions of residents in this region.

As per the United States dental chain market outlook, the South is one of the fastest-growing regions for dental chains, fueled by its large and diverse population, rapid urbanization, and rising incomes. Key cities in this region present a mix of demand for both basic and cosmetic dental services. As many Southern states are known for having higher numbers of uninsured residents, dental chains in this region often offer flexible payment options, such as financing plans or membership programs. Preventive care and family dentistry services also have strong appeal in the South, with many consumers seeking affordable, quality dental care. Furthermore, there is a growing trend of mobile dental clinics and tele-dentistry services to accommodate remote and underserved communities.

The West U.S. dental chain market growth, which includes mostly the big urban centers, is extremely competitive, but very innovative, being a base of top-of-the-line dental technologies. This region offers cutting edge treatments such as digital imaging, laser treatments, and cosmetic dentistry. With a huge population that is more aesthetically conscious, demand for cosmetic dentistry, including whitening of teeth and veneers, is very high. The West is demographically diverse with younger professionals and retirees, thus, needing varied types of dental services. A good insurance cover is dominant here along with an emphasis on holistic and preventive care.

Competitive Landscape:

Key players in the market are increasingly focusing on expanding their geographic reach, integrating advanced technologies, and offering a wide range of services to meet growing demand. Many chains are investing heavily in digital dentistry, using artificial intelligence (AI), here-dimensional (3D) printing, and teledentistry platforms to streamline patient care and improve efficiency. Notable players are also expanding their networks of affiliated practices, capitalizing on economies of scale to reduce costs while maintaining high-quality care. Additionally, these companies are enhancing customer engagement through flexible payment options, loyalty programs, and insurance partnerships, addressing both cost-sensitive and higher-income demographics. Some dental chains are also exploring mergers and acquisitions to increase their market share, particularly in underserved regions. To stay competitive, many are emphasizing preventive care and holistic treatment approaches, tapping into the growing consumer interest in wellness and long-term health outcomes. Overall, players in the market are adapting to changing consumer preferences while optimizing operations for growth and profitability.

The report provides a comprehensive analysis of the competitive landscape in the United States dental chain market with detailed profiles of all major companies, including

- Heartland Dental, LLC

- Smile Brands Group Inc.

- Western Dental Services, Inc.

- Pacific Dental Services, Inc.

- Dental Care Alliance, LLC

- Onsite Dental, LLC

- Affordable Care, LLC

- Great Expressions Dental Centers, Inc.

- Mortenson Family Dental Holdings, Inc.

- North American Dental Management, LLC

Latest News and Developments:

- In January 2025, Torch Dental, the all-in-one dental supply platform, went online nationwide in the US. To better service clients in the South, Mountain, and West coast areas, the company is setting up an office in Austin, Texas. Torch Dental intends to continue its quick growth in 2025, having raised over $17 million in funding from Amex Ventures, Alumni Ventures, and Parameter Ventures, as well as current investors which included Raga Partners, Bessemer Venture Partners, and Health Velocity Capital.

- In January 2025, Dentsply Sirona launched the DS Core Enterprise product, expanding their cloud-based platform. This innovative offering aims to assist dental service organizations (DSOs) in increasing the use of digital workflows by providing their affiliated dental practices with the DS Core platform's ever-expanding feature set, as well as supporting central DSO functions in the administration, monitoring, and analysis of that usage.

- In January 2025, Heartland Dental launched its "Masters and Mentors" brand campaign, emphasizing its commitment to a doctor-led culture and support model. The campaign reflects the philosophy of Founder Dr. Rick Workman, focusing on empowering dental professionals to achieve excellence. It showcases real-life stories from doctors and hygienists, highlighting collaboration, mentorship, and education. The initiative underscores Heartland Dental’s dedication to fostering clinical expertise and leadership in dentistry.

- In April 2024, Pacific Dental Services rebranded as "PDS Health" to reflect its transformation into a comprehensive healthcare support organization. This shift underscores the company's growth from providing dental services to becoming a leader in healthcare innovation. PDS Health aims to revolutionize patient care by integrating dental and medical services.

- In February 2024, Pearl, a global leader in dental AI solutions, and Peak Dental Services, a leading dental service organization (DSO), have partnered to make Pearl their exclusive AI provider. This collaboration will expand Pearl's dental AI suite, including Second Opinion and Practice Intelligence, to more than 50 dental offices across the western United States.

- In December 2023, Smile Brands offered free consultations to patients affected by SmileDirectClub's closure, which left millions without support for their orthodontic treatments. Smile Brands affiliated offices will supervise care, providing regular check-ins and retainers for patients with stable progress. Those with misalignments can restart treatment at a discount of up to $1,000. The initiative aims to help patients safely complete their treatment and achieve the results promised by SDC.

United States Dental Chain Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | General Dentistry, Cosmetic Dentistry, Restorative Dentistry, Laser Dentistry, Dental Surgery, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States dental chain market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States dental chain market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States dental chain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States dental chain market was valued at USD 174.22 Billion in 2024.

Key factors driving the growth of the U.S. dental chain market include increasing consumer demand for affordable and accessible dental care, rapid advancements in dental technology, a growing focus on preventive and cosmetic dentistry, expanding dental insurance coverage, and the rising adoption of teledentistry and digital health solutions.

IMARC Group estimates the market to reach USD 319.76 Billion by 2033, exhibiting a CAGR of 6.98% from 2025-2033.

Some of the major players in the dental chain market include Heartland Dental, LLC, Smile Brands Group Inc., Western Dental Services, Inc., Pacific Dental Services, Inc., Dental Care Alliance, LLC, Onsite Dental, LLC, Affordable Care, LLC, Great Expressions Dental Centers, Inc., Mortenson Family Dental Holdings, Inc., North American Dental Management, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)