United States Contract Lifecycle Management Software Market Report by Deployment Model (Cloud-based, On Premises), CLM Offerings (Licensing and Subscription, Services), Enterprise Size (Large Enterprise, Small and Medium Enterprise), Industry (Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, and Others), and Region 2026-2034

Market Overview:

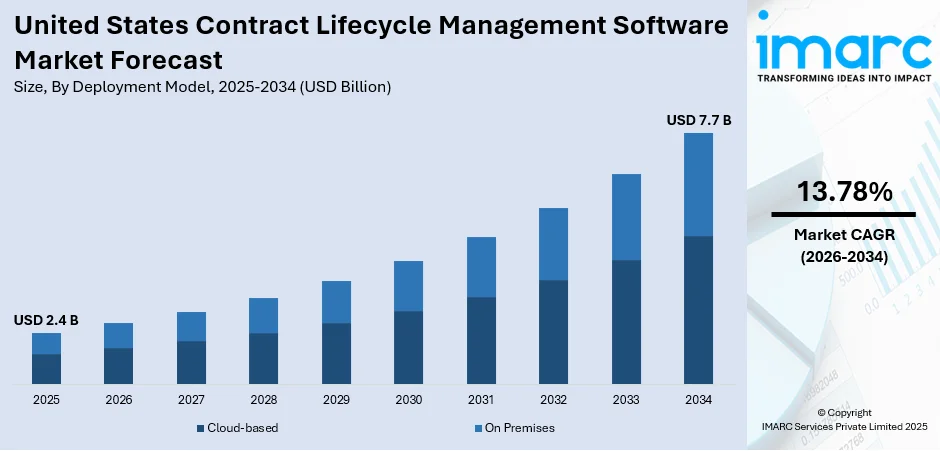

The United States contract lifecycle management software market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.7 Billion by 2034, exhibiting a growth rate (CAGR) of 13.78% during 2026-2034. The need for streamlined contract management processes, enhanced visibility and control over contracts, cost reduction, and operational efficiency, the rise of cloud computing technology, and the integration of AI and machine learning are among the key factors driving the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 7.7 Billion |

| Market Growth Rate 2026-2034 | 13.78% |

Access the full market insights report Request Sample

United States Contract Lifecycle Management Software Market Insights:

- Major Market Drivers: The United States contract lifecycle management software market is dominated by the necessity for contract process simplification, minimizing legal risks, and enhanced compliance. Companies increasingly implement CLM solutions in order to automate processes, minimize errors, and maximize operational efficiency across departments.

- Key Market Trends: AI-based contract analytics, ERP/CRM system integration, and cloud-based CLM platforms are prominent trends. They offer real-time monitoring, data extraction, and performance improvement, which characterizes the market's move toward intelligent, scalable, and collaborative contract management ecosystems.

- Competitive Landscape: The market has a blend of mature enterprise software vendors and nimble startups providing AI-fortified solutions. Vendors compete based on user experience, integration, customization, and automation, creating a dynamic and innovation-fueled landscape that accommodates varied industry needs and compliance needs.

- Challenges and Opportunities: Threats are data privacy issues, integration of legacy systems, and the cost of initial deployment. Opportunities, however, are adoption of AI, increasing demand in regulated segments, and greater emphasis on contract intelligence and analytics to aid strategic decision-making and cost reduction.

To get more information on this market Request Sample

Contract lifecycle management (CLM) software streamlines and automates the entire contract lifecycle, offering numerous benefits for businesses of all sizes. It mainly centralizes contract storage, allowing easy access and retrieval of vital contract documents. CML software facilitates contract creation, negotiation, and approval by providing customizable templates and automated workflows. Furthermore, it offers features like deadline tracking, contract compliance monitoring, and notifications, ensuring timely actions and reducing the risk of missed obligations or penalties. It also enables contract analysis, risk assessment, and performance evaluation, empowering organizations to make informed decisions. With enhanced visibility, efficiency, and control over contracts, CLM software minimizes manual errors, accelerates contract cycles, and improves overall contract management. There are various types of CLM software available, including cloud-based solutions, on-premise deployments, and industry-specific platforms, catering to diverse organizational needs.

The increasing need for organizations to streamline and automate their contract management processes is a major driver accelerating the market growth. The software offers a centralized platform to create, store, and manage contracts, resulting in improved efficiency and reduced manual errors. Moreover, the rising demand for enhanced visibility and control over contract-related activities and obligations has surged the adoption of contract lifecycle management software, thus creating a positive outlook for the market. Organizations seek to optimize contract performance, mitigate risks, and ensure compliance with regulatory requirements. Furthermore, the growing focus on cost reduction and operational efficiency and the widespread adoption of cloud computing technology are supporting the market growth. Besides this, the availability of flexible deployment options and the increasing complexity of contractual relationships are accelerating the market growth.

United States Contract Lifecycle Management Software Market Trends:

Increasing organizational need to streamline and automate contract management processes

Traditional manual methods of contract management are time-consuming, error-prone, and lack efficiency. As organizations deal with a growing volume of contracts, the complexity of managing them becomes a challenge. Contract lifecycle management software provides a centralized platform to create, store, and manage contracts, automating key processes such as contract creation, negotiation, approval, and renewal. This streamlines workflows, reduces manual errors, improves operational efficiency, and saves time and resources. The software also offers features like automated alerts and notifications for important contract dates and obligations, ensuring compliance and reducing risks associated with missed deadlines or overlooked terms. By adopting contract lifecycle management software, organizations can optimize their contract management processes, increase productivity, and focus on strategic initiatives. These benefits are a core focus of the United States contract lifecycle management software market analysis.

Rising demand for enhanced visibility and control over contract-related activities and obligations

Organizations need a comprehensive view of their contracts to effectively monitor and manage their obligations, rights, and performance. Contract lifecycle management software provides real-time visibility into contract status, key terms, milestones, and performance metrics. It enables organizations to track contract milestones, monitor contract compliance, and measure contract performance against predefined metrics and key performance indicators (KPIs). This visibility further allows enterprises to proactively manage risks, identify opportunities for improvement, and make informed decisions. Additionally, the software enables stakeholders to collaborate and communicate effectively throughout the contract lifecycle, ensuring transparency and reducing misunderstandings. With enhanced visibility and control, organizations can optimize contract performance, mitigate risks, ensure regulatory compliance, and drive successful outcomes, further boosting the United States contract lifecycle management software market share.

Growing focus on cost reduction and operational efficiency

Organizations are constantly seeking ways to optimize their processes, reduce expenses, and improve operational efficiency. Manual contract management processes are often time-consuming, resource-intensive, and prone to errors, leading to increased costs. Contract lifecycle management software automates key contract management tasks, streamlines workflows, and eliminates manual errors. It enables organizations to negotiate favorable contract terms, identify cost-saving opportunities, and eliminate unnecessary expenses. The software also facilitates the tracking and management of contract-related financial obligations, such as payment terms, penalties, and incentives, ensuring accurate billing and revenue recognition. Additionally, contract lifecycle management software provides analytics and reporting capabilities, enabling organizations to gain insights into contract performance, identify areas for improvement, and optimize vendor and supplier relationships. These efficiencies are contributing to overall United States contract lifecycle management software market growth.

United States Contract Lifecycle Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States contract lifecycle management software market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on deployment model, CLM offerings, enterprise size and industry.

Breakup by Deployment Model:

- Cloud-based

- On Premises

Cloud-based dominate the market

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and on premises. According to the report, cloud-based represented the largest segment.

Cloud-based refers to the hosting of software applications on remote servers accessed through the internet. In this model, the CLM software is hosted and managed by a third-party vendor, eliminating the need for organizations to invest in infrastructure or perform maintenance tasks. It offers scalability, flexibility, and accessibility, allowing users to access the software from anywhere at any time, facilitating collaboration and remote work. Additionally, cloud-based deployment provides automatic updates, data backup, and high-level security measures, ensuring data integrity and protection.

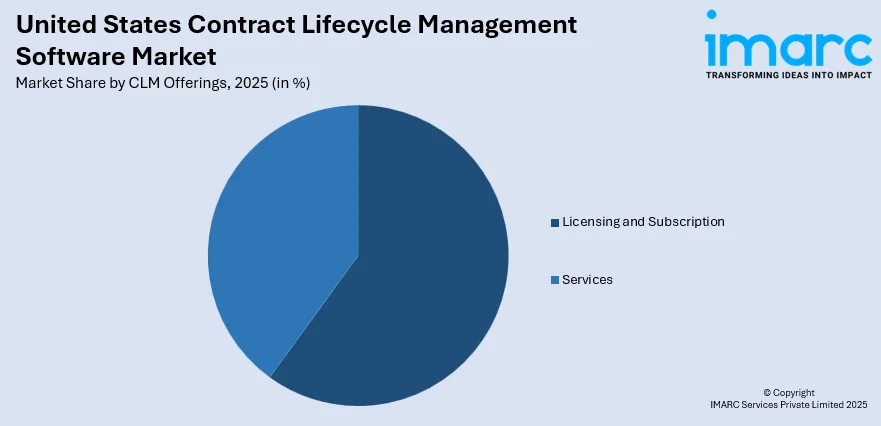

Breakup by CLM Offerings:

To get detailed segment analysis of this market Request Sample

- Licensing and Subscription

- Services

Licensing and subscription hold the largest share in the market

A detailed breakup and analysis of the market based on the CLM offerings has also been provided in the report. This includes licensing and subscription, and services. According to the report, licensing and subscription accounted for the largest market share.

Licensing refers to the legal authorization granted by the owner of a product or software to use, distribute, or modify. It establishes the terms and conditions under which the licensee can utilize the licensed product. Licensing can be in the form of a one-time purchase, where the user pays a fixed fee to obtain perpetual access to the product. On the other hand, a subscription model involves periodic payments, typically monthly or annually, to access the product or service. Subscription-based licensing offers flexibility, regular updates, and often includes additional benefits such as customer support and maintenance.

Breakup by Enterprise Size:

- Large Enterprise

- Small and Medium Enterprise

Small and medium enterprise dominate the market

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large, and small and medium enterprises. According to the report, small and medium enterprise represented the largest segment.

Small and medium enterprises (SMEs) represent a significant portion of the business landscape, encompassing a wide range of industries and sectors. SMEs typically have fewer employees, limited financial resources, and operate on a regional or local scale. When it comes to contract lifecycle management (CLM), SMEs require solutions that are cost-effective, easy to implement, and user-friendly. CLM software for SMEs focuses on providing essential contract management functionalities such as contract creation, storage, and retrieval, along with features like deadline tracking and notification reminders. The emphasis is on simplicity, affordability, and flexibility, allowing SMEs to efficiently manage their contracts, improve compliance, and optimize their overall contract management processes without the need for complex and costly systems.

Breakup by Industry:

- Automotive

- Electrical and Electronics

- Pharmaceutical

- Retail and E-commerce

- Manufacturing

- BFSI

- Others

Pharmaceutical hold the largest share in the market

A detailed breakup and analysis of the market based on the industry has also been provided in the report. This includes automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI, and others. According to the report, pharmaceutical represented the largest segment.

The pharmaceutical industry represents the largest industry vertical for contract management lifecycle software in the United States. The increased complexity in managing pharmaceutical contracts due to global regulatory compliance, multiple stakeholder engagements, complex supply chain systems, and the high cost of contract breaches, all contribute to the significant use of this software in this sector. These platforms provide efficient and reliable means to streamline the contract management process, from initiation and drafting, through negotiation and approval, to execution, analysis, and renewal, reducing errors, saving time, and improving operational efficiencies.

Breakup by Region:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The competitive landscape of the contract lifecycle management software market in the United States is characterized by the presence of numerous players, ranging from established software providers to emerging startups. These companies compete based on factors such as product features, functionality, ease of use, scalability, pricing models, customer support, and industry-specific solutions. Market players strive to differentiate themselves by offering comprehensive solutions that address the diverse needs of organizations across various sectors. They also focus on continuous innovation to stay ahead in the market and cater to the evolving demands of customers. Additionally, strategic partnerships, collaborations, acquisitions, and expansions are common strategies employed by players to strengthen their market presence and expand their customer base. With the increasing demand for contract lifecycle management software, the competitive landscape is expected to witness further intensification as new entrants and existing players vie for market share.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latest News and Developments:

- In June 2024, Conga rolled out a new Contract Lifecycle Management (CLM) AI-powered solution on its Conga Platform, integrating flawlessly with any CRM, ERP, or procurement system. The application automates operations, enhances accuracy, and equips legal and business teams with contract information and automation.

- In February 2024, IntelAgree introduced Saige Assist, a contract management tool powered by generative AI to make contract management easier. Its conversational AI makes redlining, negotiation, and drafting easier while tailoring workflows for legal, sales, and procurement teams to increase efficiency and collaboration throughout the contract lifecycle.

- In January 2024, Evisort launched Document X-Ray™, a generative AI-driven application permitting users to examine contracts using natural language questions. The solution extracts, creates, and organizes important contract information, supporting wiser decision-making and streamlining operational effectiveness for legal, compliance, and procurement teams.

United States Contract Lifecycle Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Models Covered | Cloud-Based, On-Premises |

| CLM Offerings Covered | Licensing and Subscription, Services |

| Enterprises Size Covered | Large Enterprise, Small and Medium Enterprise |

| Industries Covered | Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States contract lifecycle management software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States contract lifecycle management software market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States contract lifecycle management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contract lifecycle management software market in the United States was valued at USD 2.4 Billion in 2025.

The United States contract lifecycle management software market is projected to exhibit a CAGR of 13.78% during 2026-2034, reaching a value of USD 7.7 Billion by 2034.

The market is fueled by growing demand for operational efficiency, compliance with regulations, and risk avoidance. Businesses aim to automate routine tasks to better handle large volumes of contracts. The coupling of AI and analytics provides improved visibility and accuracy, facilitating effective decision-making and collaboration among departments like legal, procurement, and finance.

The pharmaceutical industry holds the largest market share within the United States contract lifecycle management software industry because it has a highly regulated culture and contract-heavy processes. Clinical trials, licensing, and vendor contracts need to be handled with precision and compliance monitoring. CLM software facilitates efficient workflows, enhances audit preparedness, and enforces compliance with intricate regulatory requirements, making it an essential application throughout the pharmaceutical business.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)