United States Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channels, and Region, 2025-2033

United States Contact Lenses Market Size and Share:

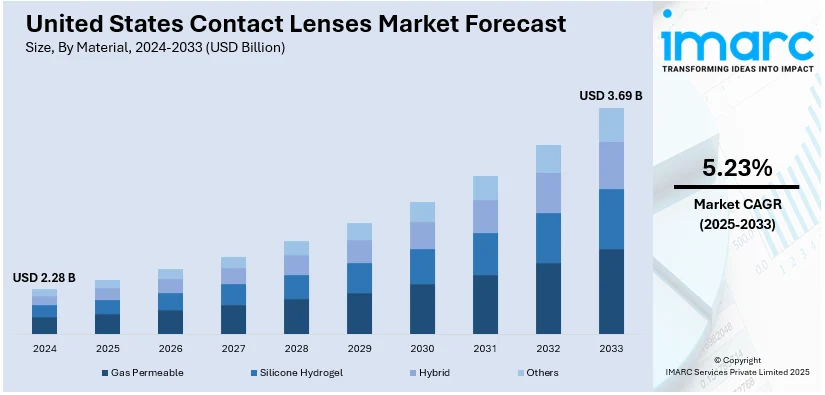

The United States contact lenses market size was valued at USD 2.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.69 Billion by 2033, exhibiting a CAGR of 5.23% from 2025-2033. The market is driven by the rising vision disorders, extended use of screens, and technology growth in lenses. Growing demand for disposable and daily-wear contact lenses due to hygiene advantages also drives growth. Moreover, online shopping convenience and continuous innovations like blue-light blocking and moisture-retaining lenses add to United States contact lenses market share, hence making contact lenses a choice vision correction option.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.28 Billion |

| Market Forecast in 2033 | USD 3.69 Billion |

| Market Growth Rate (2025-2033) | 5.23% |

The growth of the U.S. contact lenses market is primarily influenced by the rising incidence of vision disorders such as myopia, hyperopia, and astigmatism. In the United States, about 12 million individuals aged 40 and older have vision impairment, with one million of them being blind. The WHO estimates that over 2.2 billion individuals worldwide suffer from eye conditions. In the United States, refractive errors are the leading cause, with astigmatism affecting one in three, farsightedness affecting 14.2 million or 8.4% of those over 40, and nearsightedness affecting 34 million or 23.9% of those over 40. With the growing use of digital devices, prolonged screen time has contributed to rising eye strain and vision deterioration, leading to higher demand for corrective lenses. Additionally, advancements in lens technology, such as silicone hydrogel materials and multifocal designs, have enhanced comfort and visual acuity, attracting more consumers. The increasing preference for disposable and daily wear lenses due to their hygiene benefits also fuels United States contact lenses market growth. Furthermore, rising awareness of eye health and routine checkups further supports the demand.

Further, the increasing focus on aesthetic and specialty contact lenses is heavily propelling the market in the U.S. colored and cosmetic lenses have seen increased popularity, especially among youth looking for cosmetic enhancements. Additionally, the rise in orthokeratology (Ortho-K) lenses, which temporarily reshape the cornea to reduce dependence on glasses, has driven demand. The expanding availability of contact lenses through online retail channels, offering convenience and competitive pricing, has further accelerated market growth. Moreover, increasing investments in research and development continue to introduce innovative lens designs, such as blue-light filtering and moisture-retaining lenses, further strengthening the United States contact lenses market outlook. On 3rd May 2024, LensCrafters, a leading North American optical retailer under EssilorLuxottica launched Transitions GEN S™, recognized as the quickest grey lens within the clear-to-dark photochromic segment. The ultra-responsive lenses are available in all LensCrafters stores and online, coming in eight colors, blocking 100% of UVA & UVB rays and filtering up to 85% of blue-violet light when activated. 88% of wearers reported that lenses adapted so fast to changes in light that the wearer could hardly notice.

United States Contact Lenses Market Trends:

Growing Demand for Smart Contact Lenses

The development of smart contact lenses is revolutionizing the market, with major companies investing in wearable technology. These lenses are designed to monitor eye health, track glucose levels for diabetic patients, and even display augmented reality (AR) information. Tech companies and medical device manufacturers are collaborating to bring advanced solutions that integrate health monitoring with vision correction. As consumer interest in wearable health technology grows, the United States contact lenses market demand is rising, offering new opportunities for both healthcare and digital innovation sectors. Research and regulatory approvals will play a key role in determining the adoption rate of these next-generation lenses. On 30th September 2024, Johnson & Johnson widened the TECNIS Odyssey, the company's latest presbyopia-correcting intraocular lens, designed to help patients achieve a continuous full range of vision with an improved minimal need for glasses. Built on the TECNIS platform, the lens represents double the contrast in low light as compared to PanOptix and enables the patient to read 14% smaller print on average. One month after surgery, 93% of patients reported minimum or no halos, glare, or starbursts.

Sustainability and Eco-Friendly Lens Materials

Consumers are becoming increasingly conscious of environmental sustainability, driving demand for eco-friendly contact lens solutions. Manufacturers are developing biodegradable or recyclable lenses to reduce plastic waste, addressing concerns about the environmental impact of disposable lenses. Bausch + Lomb's ONE by ONE and Biotrue Eye Care Recycling initiatives have successfully recycled 65.8 million units, equating to 397,194 pounds, of contact lenses and eye care products—the weight of three commercial airplanes by 2023. The programs recycle waste into products such as benches and picnic tables in nearly 13,000 participating eye doctors' offices. Since 2016, ONE by ONE has collected over 65 million lens-related items, while Biotrue, introduced in 2021, has recycled over 440,000 eye drop units and lens care materials. According to the United States contact lenses market trends & summary, brands are introducing sustainable packaging made from recycled materials, further appealing to environmentally conscious buyers. The shift toward greener alternatives is also influencing consumer purchasing decisions, with more individuals opting for brands that prioritize sustainability. As regulatory bodies push for sustainable practices, companies that invest in eco-friendly innovations are likely to gain a competitive edge in the market.

Expansion of Subscription-Based and Personalized Lens Services

The rise of e-commerce and direct-to-consumer (DTC) brands is leading to the growth of subscription-based contact lens services. These services offer consumers convenience by delivering lenses on a regular basis, reducing the need for frequent store visits. Additionally, advancements in eye care technology allow for more personalized lens options tailored to individual prescriptions, lifestyle needs, and comfort preferences. According to the U.S. contact lenses market forecast, companies are leveraging artificial intelligence (AI) and digital fitting tools to recommend the best lenses for customers, enhancing user experience. Researchers are studying the application of AI in the early detection and prediction of Dry Eye Disease (DED), which afflicts approximately 30% of the world's population. In a paper recently published in Big Data Mining and Analytics, AI is being discussed as capable of analyzing images, risk factors, and patient data to improve the accuracy of detection and to offer personalized treatments. Scientists in ophthalmology and AI-based diagnostics are attempting to make better predictions and offer improved access. The combination of convenience, personalization, and affordability is driving the popularity of subscription-based models in the market.

United States Contact Lenses Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States contact lenses market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, design, usage, application, and distribution channel.

Analysis by Material:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

- Others

Gas permeable (GP) contact lenses, also known as rigid gas permeable (RGP) lenses, offer superior oxygen permeability compared to traditional hard lenses, promoting better eye health. These lenses provide sharper vision correction for individuals with astigmatism and keratoconus, making them a preferred choice for complex prescriptions. Although they require an adaptation period, their durability and long lifespan make them cost-effective over time. Additionally, GP lenses are resistant to protein deposits, reducing the risk of eye infections, which enhances their appeal among specialized user groups.

Silicone hydrogel lenses have become the most popular choice due to their enhanced breathability, allowing more oxygen to reach the cornea. This material reduces dryness and discomfort, making it ideal for extended wear and daily use. The lenses provide improved moisture retention, catering to individuals with dry eye syndrome. As a result, they are widely recommended by eye care professionals for their combination of comfort, safety, and long-term eye health benefits. Continuous advancements in silicone hydrogel technology further drive demand in the contact lenses market in the U.S.

Hybrid contact lenses combine the benefits of soft and gas permeable lenses, featuring a rigid center for sharp vision and a soft outer ring for enhanced comfort. They are particularly beneficial for individuals with irregular corneas, such as those with keratoconus or post-surgical complications. Hybrid lenses offer the stability of GP lenses while maintaining the comfort of soft lenses, making them an appealing alternative for patients who struggle with traditional lens options. Despite their higher cost, their growing adoption highlights a niche but expanding segment in the market.

Analysis by Design:

- Spherical

- Toric

- Multifocal

- Others

Spherical contact lenses are the most commonly used design for correcting refractive errors such as myopia (nearsightedness) and hyperopia (farsightedness). These lenses have a uniform curvature, ensuring even light distribution for clear vision. They are available in daily, bi-weekly, and monthly disposable options, catering to different user preferences. The widespread adoption of spherical lenses is driven by their affordability, ease of fitting, and compatibility with various materials, including silicone hydrogel. As a result, they continue to dominate the market.

Toric contact lenses are uniquely engineered to address astigmatism by integrating varying optical powers across different meridians of the lens. Unlike spherical lenses, toric lenses have a unique orientation that ensures proper alignment of the eye for clear and stable vision. They are available in both soft and gas-permeable materials, providing patients with multiple options for comfort and effectiveness. The increasing prevalence of astigmatism and advancements in lens stabilization technology are key factors driving demand for toric lenses in the U.S. market.

Multifocal contact lenses are specifically designed to address presbyopia, a condition that affects near vision as individuals age. These lenses incorporate multiple prescription strengths in a single lens, allowing users to see clearly at varying distances. They are widely available in both soft and rigid gas-permeable materials, providing flexibility for different preferences. The growing aging population and increasing demand for convenient alternatives to reading glasses are fueling the adoption of multifocal lenses, making them a rapidly expanding segment in the market.

Analysis by Usage:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

Daily disposable contact lenses are designed for single-use, offering maximum convenience and hygiene. Since they are discarded after each wear, they eliminate the need for cleaning solutions and reduce the risk of eye infections. These lenses are particularly popular among individuals with allergies or sensitive eyes, as they minimize the buildup of deposits. The increasing preference for hassle-free and comfortable vision correction has driven the demand for daily disposables, making them one of the fastest-growing segments in the U.S. market.

Disposable contact lenses, typically replaced on a bi-weekly or monthly basis, strike a balance between convenience and cost-effectiveness. They offer better affordability compared to daily disposables while still maintaining hygienic benefits through regular replacement. These lenses are widely used for vision correction across different prescriptions, including spherical, toric, and multifocal designs. The availability of advanced materials such as silicone hydrogel, which enhances comfort and oxygen permeability, has further fueled the popularity of disposable lenses among consumers seeking reliable and affordable options.

Frequent replacement contact lenses are typically changed every one to three months, offering a longer lifespan than daily or bi-weekly disposables. These lenses require regular cleaning and maintenance to ensure eye health and prevent infections. They are often preferred by users who seek a more cost-effective alternative while still benefiting from relatively fresh lenses. Technological advancements in lens coatings and moisture retention have improved their comfort, making them a popular choice for individuals who want extended usability without compromising on eye care.

Traditional contact lenses, also known as conventional or extended-wear lenses, are designed for long-term use, often lasting six months to a year before replacement. Made from durable materials, these lenses require meticulous cleaning and maintenance to ensure eye safety. They are particularly beneficial for individuals with complex prescriptions or specific eye conditions that necessitate customized lenses. Although less common than disposable options, traditional lenses remain relevant for users who prioritize durability and long-term affordability in their vision correction solutions.

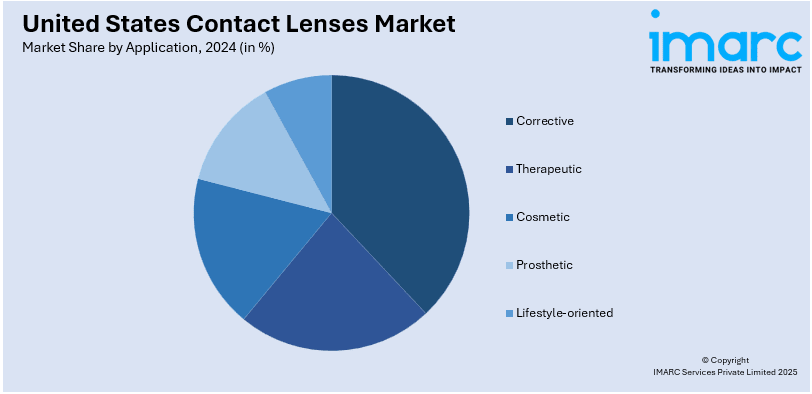

Analysis by Application:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

Corrective contact lenses are the most widely used type, designed to address common refractive errors such as myopia, hyperopia, astigmatism, and presbyopia. These lenses provide an alternative to eyeglasses, offering clear vision with improved aesthetics and convenience. Available in various designs, including spherical, toric, and multifocal, corrective lenses cater to diverse vision needs. The rising prevalence of vision impairments, coupled with technological advancements enhancing comfort and oxygen permeability, continues to drive demand for corrective contact lenses in the U.S. market.

Therapeutic contact lenses, also known as bandage lenses, are used for medical purposes, such as protecting the cornea, promoting healing, and reducing discomfort in patients with eye injuries or disorders. These lenses serve as a protective barrier, shielding the eye from external irritants while maintaining moisture and reducing pain. They are commonly prescribed for conditions including corneal abrasions, dry eye syndrome, and post-surgical recovery. The increasing adoption of therapeutic lenses in ophthalmology highlights their essential role in eye care treatments and rehabilitation.

Cosmetic contact lenses are designed to enhance or alter the appearance of the eyes by changing their color or pattern. They are popular among individuals seeking aesthetic enhancements for everyday wear or special occasions. These lenses come in prescription and non-prescription options, catering to both vision correction and fashion trends. The rising influence of social media, beauty trends, and celebrity endorsements has fueled the demand for cosmetic lenses, making them a growing segment in the market.

Prosthetic contact lenses are customized lenses used to improve the appearance of damaged or disfigured eyes, often resulting from trauma, congenital defects, or medical conditions. These lenses can also enhance vision by reducing light sensitivity or masking irregularities. Ophthalmologists often prescribe them to restore a natural eye appearance and enhance patients’ confidence. Advances in lens customization, including hand-painted and digitally printed designs, have improved the realism and functionality of prosthetic lenses, making them an essential solution for medical and cosmetic needs.

Lifestyle-oriented contact lenses are designed to cater to specific user needs, such as UV protection, blue-light filtering, and enhanced moisture retention. These lenses help protect the eyes from digital strain, harsh lighting, and environmental factors while providing comfort for extended wear. They are especially popular among individuals who spend long hours on digital screens or engage in outdoor activities. As awareness of eye health and preventive care increases, demand for lifestyle-oriented lenses continues to grow, driving innovation in this segment of the U.S. market.

Analysis by Distribution Channel:

- E-commerce

- Eye Care Practitioners

- Retail Stores

The rise of e-commerce has transformed the contact lens market by offering consumers convenience, competitive pricing, and a wide range of options. Online platforms provide easy access to various brands, allowing users to compare products and purchase lenses from the comfort of their homes. Subscription-based models and doorstep delivery services have further fueled online sales. Additionally, advancements in digital eye exams and virtual try-on features have enhanced the online shopping experience, making e-commerce a rapidly growing distribution channel.

Eye care practitioners, including optometrists and ophthalmologists, continue to serve as a safe and trusted channel in which the use of contact lenses is prescribed with the appropriate fit. Instead of going through consumers—who are often skeptical about purchasing lenses directly from the Internet—many eye care providers prefer to buy and recommend them. This channel is critical for specialty lenses such as toric, multifocal, and therapeutic lenses, where fitting must be exact. Moreover, eye care professionals are largely responsible for educating patients on lens maintenance, and proper eye health, which further reiterates the necessity of the market.

Brick-and-mortar retail stores (optical shops, pharmacies, and supermarkets). Unlike other vendors who require shipping delays, these stores are immediately available with lenses to be purchased and worn right away. Some retail chains partner with well-known lens brands to offer exclusive discounts and deals to attract budget shoppers. Moreover, physical stores often offer eye exams and consultations, so customers can be sure to have the proper prescription. While e-commerce is a growing sector in distribution, retail stores remain an important channel in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast, which includes territories including New York, Massachusetts and Pennsylvania, has high need for contact lenses due to its highly dense and urban lifestyle. Availability of prominent healthcare facilities and eye care professionals further drives the growth of the market. In this region, high and premium lens options such as silicone hydrogel and daily disposability are highly favored as they are lifestyle-driven, convenient, and act in the best interests of ocular health. In addition, the growing trend of e-commerce in the vision care market is driving the market which, in turn, assists in the interpretation of the global vision care market.

In the Midwest, with states including Illinois, Ohio and Michigan, the contact lens market is well-established, with a diverse urban population and closer outskirts contributing to a strong population density. Price and availability are important to consumers, and most of them tend to choose cheaper lenses such as bi-weekly and monthly disposables. Well-established players in the form of optical retail shops and eye care clinics spur market penetration. Furthermore, the growing need for treating refractive errors and the rise of specialized lenses further drive the growth of market in this region.

The South, which includes Texas, Florida, and Georgia, is one of the country's largest and fastest-growing contact lens markets due to a demand for breathable and moisture-retaining lenses, enhanced by the region's warm climate and high activity levels. The rising prevalence of urbanization, the aging world's demographics, and increased knowledge regarding vision correction treatments drive the growth of this market. Additionally, the high profile of retail chains and e-shopping preferences resulted in enhancing access to contact lenses, increasing market growth further in this region.

The West, which comprises states such as California, Washington and Colorado, is a hub for technological innovation in contact lenses. This route's consumers have a great desire for unique lens shape designs [blue-light filtration, shaped lenses for lifestyle]. The presence of e-commerce sites and direct-to-consumer companies significantly influences shopping habits. Moreover, the focus on sustainability in the zone has influenced the demand for green and biodegradable lenses, thus impacting the market prospect of the future.

Competitive Landscape:

A significant level of competition marks the current market environment due to a large number of both existing and new brands that are part of the race for dominance. The companies are concentrating on research and development through the release of the latest materials, moisture-retaining technologies as well as blue light blocking functionalities in order to improve user comfort and encourage eye health. The rapid growth of e-commerce and D2C business models are also the reasons behind the fierce competition especially the smaller brands that can also compete with the big fishes in the industry. The main drivers of market positioning are product differentiation, customer loyalty programs, and, price competitiveness. The companies also can leverage strategic partnerships with retailers and eye care practitioners to enhance the distribution channels of their products. Apart from this, the advent of biodegradable lenses and going green in packaging are also positively influencing the market. With the increasing shift in consumer preferences, the industry players' ongoing R&D (Research and Development) activities are moving the market toward more highly advanced and highly personalized contact lenses.

The report provides a comprehensive analysis of the competitive landscape in the United States contact lenses market with detailed profiles of all major companies, including:

- Alcon Vision LLC

- Bausch Health Companies Inc.

- Essilor International SA

- Hoya Corporation

- Johnson & Johnson Vision Care Inc.

- Menicon Co., Ltd.

- SynergEyes Inc.

- The Cooper Companies

- Zeiss Group

Latest News and Developments:

- October 14, 2024: Private equity groups Blackstone and TPG have announced their plans to partner on a bid for Bausch + Lomb, which is worth over USD13 Billion. The action may represent one of the largest private equity buyouts of 2024. Bausch + Lomb, which spun off from Bausch Health in 2022, has seen its share price rise by 10% following reports of discussions about selling stakes.

- September 26, 204: ZEISS Medical Technology launched the MICOR® 700 in the United States, a handheld, ultrasound-free lens removal device with patented NULEX technology designed to enable more gentle cataract surgery with reduced thermal risks and improved procedural efficiency. The FDA-approved, disposable system was unveiled at the AAO conference of October 19-21, 2024. Its disposable and compact design reduces operating room setup time considerably and helps prevent cross-contamination risks.

- July 17, 2024: EssilorLuxottica has acquired streetwear label Supreme from VF Corp. for USD 1.5 billion, further strengthening its lifestyle portfolio that currently includes Ray-Ban and Oakley. The move is in addition to EssilorLuxottica's recent acquisition of a majority stake in Heidelberg Engineering in Germany to strengthen its medical technology business.

- June 24, 2024: Johnson & Johnson, in partnership with the Lions Clubs International Foundation, has provided eye care to over 50 million students across the globe as part of its Sight For Kids program. Under the program, there are vision screenings, treatment, and 515,000 pairs of glasses distributed. The project is also going to cover Atlanta and Hong Kong, and its aim will be to address vision loss affecting 450 million children worldwide out of which 90 million are affected by loss of sight.

United States Contact Lenses Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gas Permeable, Silicone Hydrogel, Hybrid, Others |

| Designs Covered | Spherical, Toric, Multifocal, Others |

| Usages Covered | Daily Disposable, Disposable, Frequently Replacement, Traditional |

| Applications Covered | Corrective, Therapeutic, Cosmetic, Prosthetic, Lifestyle-oriented |

| Distribution Channels Covered | E-commerce, Eye Care Practitioners, Retail Stores |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States contact lenses market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States contact lenses market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States contact lenses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States contact lenses market was valued at USD 2.28 Billion in 2024.

The market growth is driven by the rising prevalence of vision disorders (myopia, hyperopia, and astigmatism), increased screen time leading to eye strain, and advancements in lens technology such as silicone hydrogel and blue-light filtering lenses. Additionally, the demand for daily disposable lenses due to hygiene benefits and the expansion of online retail channels are fueling market expansion.

The United States contact lenses market is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 3.69 Billion by 2033.

Some of the major players in the United States contact lenses market include Alcon Vision LLC, Bausch Health Companies Inc., Essilor International SA, Hoya Corporation, Johnson & Johnson Vision Care Inc., Menicon Co., Ltd., SynergEyes Inc., The Cooper Companies, and Zeiss Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)