United States Commercial Real Estate Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

United States Commercial Real Estate Market Summary:

The United States commercial real estate market size was valued at USD 742.3 Billion in 2025 and is projected to reach USD 995.6 Billion by 2034, growing at a compound annual growth rate of 3.32% from 2026-2034.

The United States commercial real estate market is experiencing steady expansion, propelled by robust demand across industrial and logistics properties, sustained e-commerce growth, and population migration towards economically vibrant regions. Favorable business climates in emerging metropolitan areas, coupled with ongoing infrastructure development and technological advancements in building systems, continue to attract institutional investments. The diversified nature of property types, including offices, retail spaces, warehouses, and multifamily housing, supports resilient performance across economic cycles, strengthening the market share.

Key Takeaways and Insights:

- By Type: Industrial dominates the market with a share of 26.96% in 2025, owing to sustained demand for warehouse and distribution facilities, driven by e-commerce expansion. The segment benefits from supply chain restructuring initiatives and nearshoring trends that require modern logistics infrastructure.

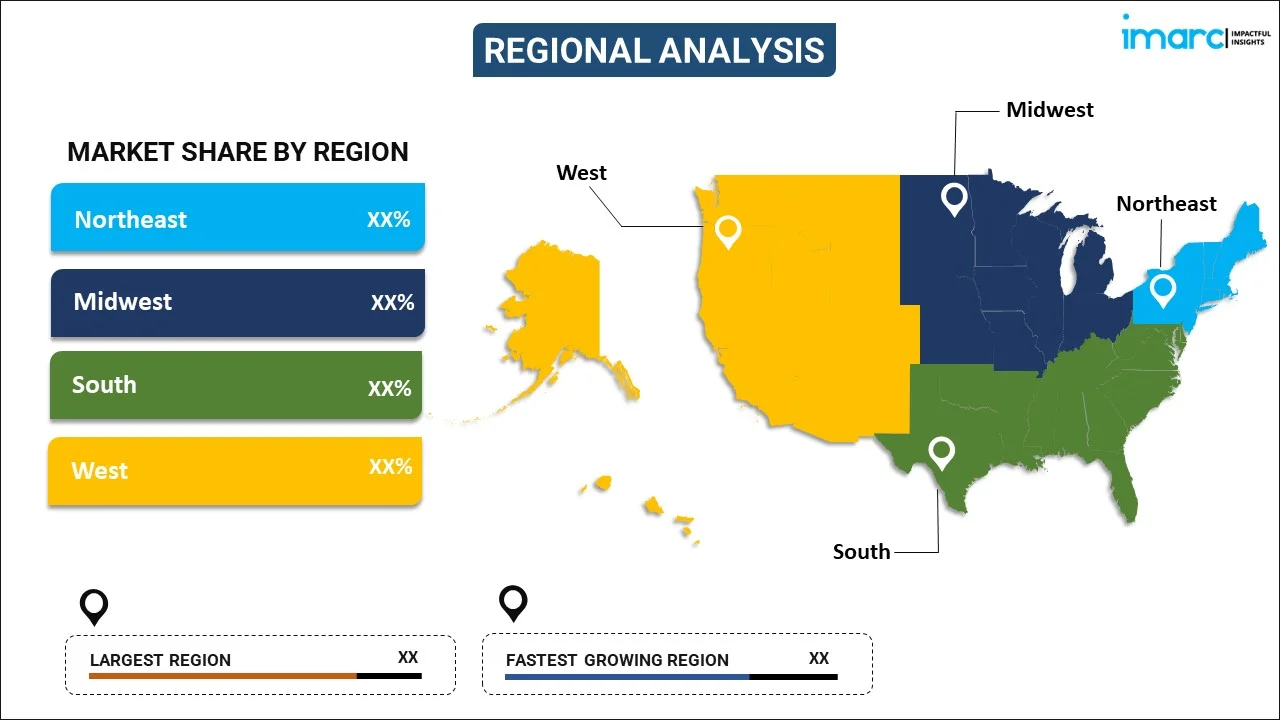

- By Region: South represents the largest region with 29% share in 2025, driven by population influx, favorable business climates, and lower tax environments attracting corporate relocations. States like Texas and Florida continue to experience rapid real estate expansion across residential and industrial segments.

- Key Players: Key players drive the United States commercial real estate market through strategic acquisitions, portfolio diversification, and technological integration. Their investments in sustainable building practices, data-driven asset management, and flexible leasing solutions enhance tenant experiences while strengthening nationwide market presence.

The United States commercial real estate market continues to demonstrate resilience amid evolving economic conditions, supported by strong fundamentals across multiple property sectors. Industrial and logistics properties remain particularly attractive, driven by the persistent growth of online retail sales. The Census Bureau of the Department of Commerce revealed that the projected United States retail e-commerce sales for the third quarter of 2025 reached USD 310.3 Billion, reflecting a rise of 1.9% (±0.4%) from the second quarter of 2025. The market benefits from diversified demand sources, including third-party logistics providers, retail distributors, and manufacturing companies seeking modern warehouse facilities. Population migration towards the Sun Belt states is creating substantial opportunities in emerging metropolitan areas, while gateway cities maintain their appeal for premium office and retail assets. Institutional investors are recalibrating portfolios towards high-quality properties with stable cash flows, prioritizing assets equipped with modern amenities and sustainability features. The flight to quality trend is reshaping tenant preferences across all property types, favoring newly constructed facilities over older buildings.

United States Commercial Real Estate Market Trends:

Flight to Quality Reshaping Property Demand

Commercial real estate occupiers are increasingly prioritizing premium, modern facilities over older properties, creating a pronounced bifurcation in market performance. This trend is particularly evident in the office sector, where prime vacancy rates remain significantly lower than non-prime properties. In Q2 2025, the prime office vacancy rate of 14.5% was 4.8 percentage points lower than the non-prime vacancy rate. Companies are seeking buildings equipped with advanced technological infrastructure, sustainability certifications, and enhanced employee amenities to support hybrid work models and attract talent.

Third-Party Logistics Providers Driving Industrial Demand

Third-party logistics providers are expanding warehousing, distribution, and fulfillment networks to support faster delivery expectations. Growth in e-commerce, omnichannel retailing, and just-in-time inventory models is pushing third-party logistics companies to lease large, strategically located logistics facilities near ports, highways, and major consumer hubs. Their need for scalable, flexible spaces with advanced automation, cold storage, and high ceiling heights is accelerating absorption of modern industrial properties, strengthening overall market demand.

Adaptive Reuse and Mixed-Use Development Gaining Momentum

Adaptive reuse and mixed-use development are gaining momentum in the United States commercial real estate market, as developers repurpose underutilized offices, malls, and industrial assets into flexible, revenue-generating spaces. Converting existing structures into residential, retail, hospitality, and coworking formats lowers development risk while aligning with urban revitalization goals. Mixed-use projects attract consistent foot traffic, diversify income streams, and enhance asset resilience during market cycles. These developments also support walkable communities, sustainability objectives, and changing tenant preferences, strengthening long-term demand across the urban and suburban commercial real estate market.

Market Outlook 2026-2034:

The United States commercial real estate market is positioned for gradual recovery and stabilization throughout the forecast period, supported by improving capital market conditions and firming fundamentals across most property sectors. Economic growth and sustained consumer spending will continue to drive the demand for industrial, retail, and multifamily properties. The market generated a revenue of USD 742.3 Billion in 2025 and is projected to reach a revenue of USD 995.6 Billion by 2034, growing at a compound annual growth rate of 3.32% from 2026-2034. Investment activities are expected to accelerate, as interest rates moderate and property values stabilize, enabling more favorable refinancing conditions. The ongoing digital economy expansion, driven by e-commerce growth and artificial intelligence (AI) adoption, will sustain demand for logistics facilities and data centers.

United States Commercial Real Estate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Industrial |

26.96% |

|

Region |

South |

29% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Offices

- Retail

- Industrial

- Logistics

- Multi-Family

- Hospitality

Industrial dominates with a market share of 26.96% of the total United States commercial real estate market in 2025.

Industrial maintains its position as the leading type within the United States commercial real estate market, driven by sustained demand for warehouse and distribution facilities supporting e-commerce fulfillment operations. Modern Class A industrial warehouses, featuring higher clear heights, extensive dock door configurations, and automation-ready infrastructure, command premium rents and attract creditworthy tenants seeking operational efficiency. The flight to quality is particularly pronounced in this segment, with newly constructed facilities posting positive absorption while older buildings experience negative net absorption.

Supply chain resilience initiatives and nearshoring strategies are reshaping industrial demand patterns, with manufacturing clusters in Texas, Southeast states, and Arizona experiencing heightened development activity. Core industrial markets, including the Inland Empire, Dallas-Fort Worth, Atlanta, Chicago, and the New Jersey/Pennsylvania region, remain leaders in leasing activity due to their strategic positioning and access to major transportation corridors. Continued investments in cold storage, last-mile logistics, and data-driven inventory management further reinforce long-term industrial space demand.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northeast

- Midwest

- South

- West

South leads with a share of 29% of the total United States commercial real estate market in 2025.

South dominates the United States commercial real estate market, benefiting from sustained population influx, favorable business climates, and lower tax environments that attract corporate relocations and investment capital. States, including Texas and Florida, continue to experience rapid real estate expansion across industrial, multifamily, and retail segments, supported by strong employment growth and diversified economic bases. Value fashion and home goods retailer Primark planned to launch its second store in Texas on September 4, 2025. Spanning over 40,000 square feet, the store would feature the retailer's latest collections of clothing, accessories, beauty products, footwear, and a curated selection of home goods.

The region's pro-business regulatory environment and relatively affordable cost of living compared to coastal markets are driving household formation and commercial development. Major metropolitan areas in the South, including Dallas-Fort Worth, Houston, Atlanta, and Miami, are emerging as preferred destinations for institutional investment and corporate expansion. Industrial development remains particularly robust in the region, with logistics facilities benefiting from proximity to manufacturing clusters and cross-border trade corridors with Mexico.

Market Dynamics:

Growth Drivers:

Why is the United States Commercial Real Estate Market Growing?

E-Commerce Expansion Driving Warehouse and Distribution Demand

The sustained growth of e-commerce continues to serve as a primary catalyst for commercial real estate expansion, particularly within the industrial and logistics segment. As per IMARC Group, the United States e-commerce market size reached USD 1,236.5 Billion in 2025. Online retail sales are capturing an increasing share of total consumer spending, necessitating extensive warehouse networks positioned near major population centers to facilitate rapid order fulfillment and delivery services. Retailers are recalibrating their real estate strategies to accommodate omnichannel distribution requirements, investing in both large-scale regional distribution centers and smaller last-mile facilities within urban areas. Consumer expectations for same-day and next-day delivery are compelling retailers to expand their logistics footprints. This structural shift in retail distribution is generating persistent demand for modern warehouse facilities equipped with automation capabilities and efficient loading configurations.

Population Migration to Sun Belt States Fueling Regional Markets

Demographic shifts characterized by sustained population migration towards southern and southwestern states are creating substantial commercial real estate opportunities across multiple property sectors in the United States. Warmer climates, lower state taxes, affordable housing options, and expanding employment opportunities are attracting households and businesses from higher-cost coastal markets. This migration pattern is generating demand for multifamily housing, retail centers, and office space in emerging metropolitan areas while supporting industrial development to serve growing consumer populations. Major corporations across the country are relocating headquarters and expanding operations in states offering favorable business environments, further accelerating commercial real estate development. The resulting job creation stimulates housing demand and supports retail spending, creating a virtuous cycle of economic growth and property market expansion.

Technological Innovations and Digital Infrastructure Requirements

The accelerating adoption of AI, cloud computing, and digital business operations is generating unprecedented demand for data centers and technology-enabled commercial properties. As per IMARC Group, the United States AI market size reached USD 41,532.7 Million in 2025. Hyperscale data center development is moving at a rapid pace to support growing computational needs. Hyperscale facilities are being heavily invested in by technology companies. The commercial real estate sector is making way for smart building technology integration, energy management solutions, and advanced connectivity infrastructure to attract technology-oriented tenants. The digital economy evolution is causing a shift in the needs of tenants for commercial properties of any kind. This has resulted in a focus on buildings which possess advanced technology infrastructure as well as sustainable energy solutions.

Market Restraints:

What Challenges is the United States Commercial Real Estate Market Facing?

Elevated Interest Rates and Financing Constraints

Persistently elevated interest rates continue to constrain commercial real estate financing activities and suppress transaction volumes. Higher borrowing costs increase debt service payments for property owners while compressing returns on leveraged investments. The challenging financing environment is particularly impacting properties requiring refinancing, as owners face significantly higher rates compared to loans originated during the low-rate environment of previous years.

Climate-Related Risks and Insurance Cost Escalation

Increasing frequency and severity of natural disasters are elevating climate-related risks for commercial properties, particularly in coastal and wildfire-prone regions. Insurance premium inflation linked to climate exposure is widening return differentials between coastal and inland assets, influencing investment decisions and portfolio allocation strategies. Property owners face rising operating costs associated with comprehensive insurance coverage and climate resilience investments.

Structural Shifts in Space Utilization and Tenant Demand

Long-term changes in how businesses use commercial space continue to challenge market stability. Remote and hybrid work models are reducing demand for traditional office space, leading to higher vacancy rates and downward pressure on rents in many urban cores. Retail properties face ongoing disruption from e-commerce, requiring landlords to reposition assets or invest in experiential formats. These structural shifts increase capital expenditure needs and prolong lease-up timelines, affecting income predictability and asset valuations.

Competitive Landscape:

The United States commercial real estate market features a diverse competitive landscape, comprising real estate investment trusts, private equity firms, institutional investors, and specialized property developers. Market participants compete through strategic acquisitions, portfolio diversification, and operational excellence while differentiating through specialized sector expertise and geographic focus. Industry leaders are investing in technological capabilities, sustainability initiatives, and tenant experience enhancements to maintain competitive positioning. The market is experiencing increased consolidation as larger players pursue scale advantages and operational synergies through mergers and acquisitions. Competition for high-quality assets remains intense, particularly in sectors demonstrating strong fundamentals, including industrial, multifamily, and data center properties.

Recent Developments:

- In January 2026, SVN Commercial Partners unveiled the resumption of the sale for the Waterfront Property in Fishermen’s Village, Punta Gorda, Florida. The property includes over 97,000 square feet of retail and office areas, five fully leased waterfront eateries, a permitted marina with 142 wet slips and upland development rights, plus 47 roomy two-bedroom, two-bath waterfront hotel apartment suites.

United States Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Offices, Retail, Industrial, Logistics, Multi-Family, Hospitality |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States commercial real estate market size was valued at USD 742.3 Billion in 2025.

The United States commercial real estate market is expected to grow at a compound annual growth rate of 3.32% from 2026-2034 to reach USD 995.6 Billion by 2034.

Industrial dominated the market with a share of 26.96%, driven by sustained demand for warehouse and distribution facilities supporting online retail operations and supply chain resilience initiatives.

Key factors driving the United States commercial real estate market include e-commerce expansion driving warehouse demand, population migration to Sun Belt states, technological innovation requirements, and sustained economic growth supporting tenant demand across property sectors.

Major challenges include elevated interest rates constraining financing activities, substantial commercial real estate debt maturities creating refinancing pressure, climate-related risks increasing insurance costs, and office sector vacancy rates remaining elevated in certain markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)