United States Coiled Tubing Market Size, Share, Trends and Forecast by Application, Location, and Region, 2025-2033

United States Coiled Tubing Market Size and Share:

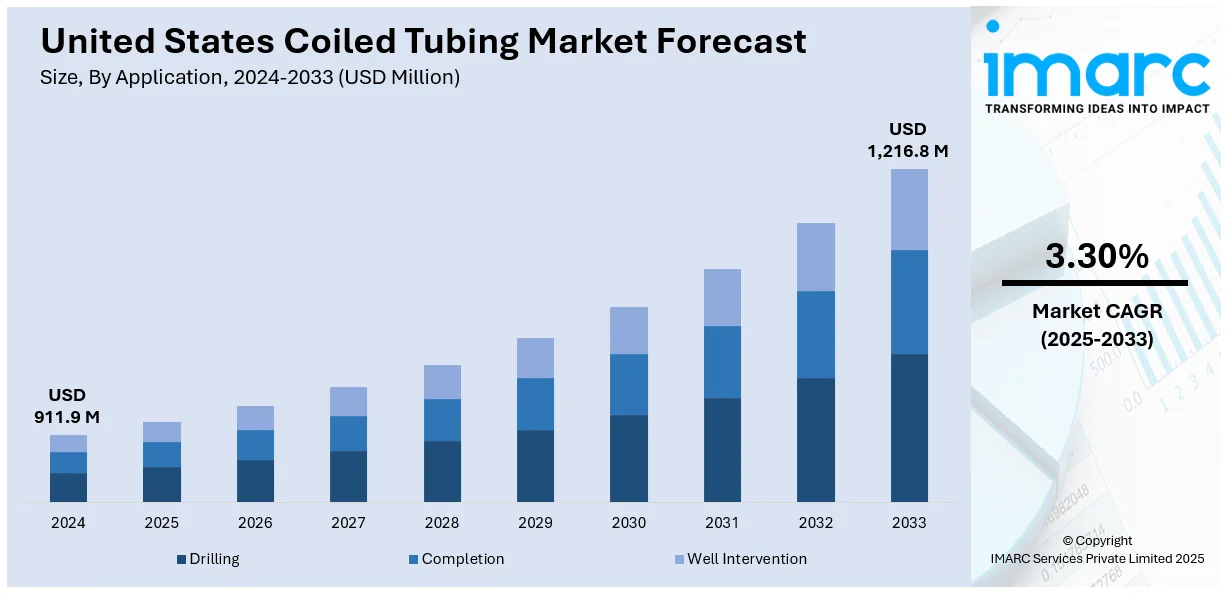

The United States coiled tubing market size was valued at USD 911.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,216.8 Million by 2033, exhibiting a CAGR of 3.30% from 2025-2033. The market is primarily influenced by the magnifying requirement for oil and gas production, especially in shale plays. Innovations in coiled tubing technologies, combined with the elevating demand for drilling services and well intervention, are further bolstering market expansion. Stringent regulatory policies also facilitate the need for dependable and efficient services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 911.9 Million |

| Market Forecast in 2033 | USD 1,216.8 Million |

| Market Growth Rate (2025-2033) | 3.30% |

A major driver of the U.S. coiled tubing market is the growing need for cost-saving, efficient well intervention solutions. As many oil and gas fields reach maturity, operators require reliable solutions to maintain or boost production levels. For instance, as per industry reports, there are around 4 million unattended and unmaintained gas and oil wells across the United States. This will significantly increase demand for coiled tubing that allows for swift, minimal-downtime interventions such as cleanouts, stimulation, and acidizing, which are crucial for extending and maintaining well life. Moreover, the ability to conduct such operations without the need for a drilling rig significantly reduces operational costs and downtime, making coiled tubing an attractive option for operators seeking to optimize their assets in a competitive market.

The continuous improvement in materials, such as high-strength alloys and corrosion-resistant coatings, has expanded the range of applications for coiled tubing in harsh environments like deepwater drilling and unconventional resource extraction, consequently driving the growth for United States coiled tubing market. For instance, in February 2024, Alleima launched SAF 3007, its new alloy of stainless-steel grade developed for tubing applications in offshore oil and gas sector. This product offers exceptional performance in adverse deepwater ecosystem with superior resistance against corrosion. Additionally, significant advancements technologies like real-time monitoring systems, automation, and data analytics have improved operational efficiency and safety, further boosting market adoption. As operators increasingly seek to optimize productivity and minimize risks, the integration of these advanced technologies in coiled tubing operations is expected to continue driving demand and growth within the market.

United States Coiled Tubing Market Trends:

Increasing Demand for Unconventional Resource Development

The increasing focus on unconventional resource development, particularly in shale gas and oil plays, is a significant driver of the U.S. coiled tubing market. Shale formations, such as the Permian Basin and Marcellus Shale, require specialized well intervention techniques, with coiled tubing providing a cost-effective and efficient solution for tasks like hydraulic fracturing, acidizing, and cleanout operations. For instance, according to the U.S. Energy Information Administration, there is an anticipated elevation of 14,000 oil barrels per day from May-June 2024, with average production per new well rising to 1,400 barrels per day in June from 1,386 barrels per day in May. This indicates crucial role of Permian Basin in oil production, thereby utilization of coiled tubing becomes requisite to maintain its operational efficacy. Furthermore, as drilling activities in these plays continue to rise, the need for reliable, efficient, and cost-effective coiled tubing services is expected to grow, contributing to sustained market demand.

Focus on Environmental Sustainability

Environmental sustainability has become a prominent trend influencing the coiled tubing market in the United States. Operators are continuously focusing on employing environmentally friendly practices, including minimizing the environmental impact of well operations and surface waste. For instance, as per industry reports, gas and oil operations in the U.S. are actively releasing more than 6 million tons of methane annually, costing the country USD 10 billion of commercial loss each year. Coiled tubing technology helps address these concerns by enabling more precise, controlled interventions that limit the use of chemicals and reduce environmental disruptions. Additionally, innovations such as nitrogen-assisted coiled tubing and the use of biodegradable fluids are gaining traction, as the industry shifts toward cleaner, more sustainable solutions to meet both regulatory requirements and consumer expectations for eco-friendly operation

Technological Advancements in Coiled Tubing Equipment

United States coiled tubing market forecast indicates that rapid innovations in coiled tubing technology are anticipated to impact the market in upcoming years. Advancements, mainly encompassing improved sensors, real-time monitoring, and automation are significantly improving safety as well as operational efficacy. Such technologies enable enhanced accuracy in well interventions and a substantial deduction in operational expenditure. In addition, enhancements in exceptionally corrosion-resistant, superior-strength materials are augmenting the application of coiled tubing in adverse environments, including ultra corrosive fields and deepwater. The heavy investment in such technological innovations is positioned to further upgrade operations and boost market growth. For instance, in April 2024, BENTELER Steel/Tube Manufacturing Corporation announced its expansion at the Port of Caddo-Bossier, U.S., with the development of new facility using USD 21 million investment. The facility will aim to provider exceptional products for oil and gas sector, including tubing, casing, line pipe, drill pipe, and much more.

United States Coiled Tubing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States coiled tubing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and location.

Analysis by Application:

- Drilling

- Completion

- Well Intervention

The drilling segment plays a pivotal role in expanding US coiled tubing market share by enhancing operational efficiency and reducing costs associated with well construction. Coiled tubing is used extensively in horizontal and directional drilling operations, particularly for wellbore cleaning, fishing, and reaming. Furthermore, the ability to deploy coiled tubing quickly and efficiently during drilling processes helps minimize downtime and optimize drilling performance. With the increasing trend of drilling in challenging environments, coiled tubing offers flexibility and precision, making it a critical tool for modern drilling operations, particularly in shale and deepwater fields.

In the completion segment, coiled tubing is requisite for preparing wells for production as well as finalizing well construction. It is generally leveraged for hydraulic fracturing, wellbore cleanout, and perforating, guaranteeing well performance and demanded flow rates. In addition, coiled tubing facilitates cost-efficiency and effective completion of both reworked and new wells, fostering operations including tubing and casing installation. Moreover, the magnifying need for unconventional oil and gas plays, specifically in shale formations, has supported the elevating utilization of coiled tubing in completion applications significantly, as it offers better operational efficacy and quicker deployment in complicated completion cases.

The well intervention segment is a critical driver for the growth of the U.S. coiled tubing market, as it envelopes a varied range of solutions gravitated at expanding well life and improving production. Coiled tubing is typically leveraged for operations including acidizing, cleaning, and stimulation, which aid in restoring or maintaining well productivity. In addition to this, in mature fields where production is falling, coiled tubing provides an effective service for reservoir optimization, remedial work, and well repairs. Moreover, its capability to access wells without any requirement for rig-based interventions positions coiled tubing as an ideal choice for well intervention, offering a timely and cost-efficient approach to well maintenance.

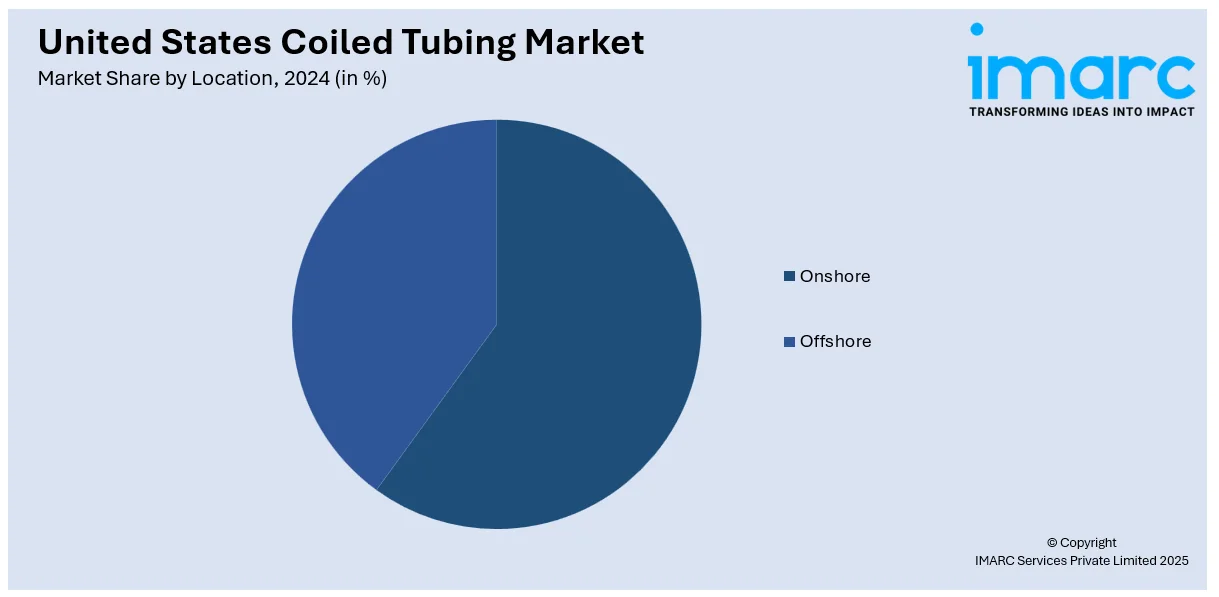

Analysis by Location:

- Onshore

- Offshore

The onshore segment is prominent in the U.S. coiled tubing market, driven by extensive oil and gas production from onshore fields such as the Permian Basin, Bakken, and Marcellus Shale. Onshore operations account for the majority of coiled tubing applications, including well interventions, hydraulic fracturing, acidizing, and reservoir stimulation. Additionally, the need for efficient and cost-effective solutions to enhance well productivity and extend field life propels demand in this segment. Technological advancements, such as automation and real-time monitoring, further support growth, while strong infrastructure and established service networks enhance operational efficiency for onshore applications.

The offshore coiled tubing market in the U.S. is characterized by more specialized and high-value applications, primarily focused on deepwater and subsea well interventions. While smaller in market share compared to onshore, offshore activities require advanced coiled tubing technologies due to the challenging environmental conditions and complex logistical requirements. Coiled tubing is essential for well completion, maintenance, and abandonment in offshore fields, particularly in the Gulf of Mexico. Moreover, the growing emphasis on increasing production from aging offshore assets and the need for advanced safety and efficiency drive further demand for coiled tubing services in this sector.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The United States coiled tubing market graph highlights steady growth of the Northeast region in the coiled tubing market, driven primarily by extensive natural gas production and well maintenance activities. The region’s mature fields, particularly in Pennsylvania’s Marcellus and Utica Shale, require advanced well intervention technologies such as coiled tubing for stimulation and production enhancement. Additionally, the growing demand for efficient hydraulic fracturing and well completion operations further supports market expansion. Key players are increasingly focusing on this region due to its substantial resource base, leading to increased competition and technological innovation.

The Midwest region contributes notably to the U.S. coiled tubing market, bolstered by the development of shale plays and ongoing oil and gas exploration projects. The Bakken formation in North Dakota and other emerging fields in the region create a steady demand for coiled tubing services, particularly for wellbore cleaning, stimulation, and hydraulic fracturing. The rising adoption of smart coiled tubing technologies that enhance operational efficiency and minimize environmental impact is expected to fuel growth. Additionally, the Midwest’s strong infrastructure and pipeline network enable the efficient delivery of coiled tubing services.

The South U.S. region represents a major portion of the coiled tubing market, primarily due to its dominance in oil production, particularly in Texas and Louisiana. The Permian Basin, as a prolific shale formation, drives substantial demand for coiled tubing applications such as well intervention, acidizing, and re-entry operations. Furthermore, as exploration and production activities intensify, there is a growing need for efficient, cost-effective solutions to enhance production rates and extend well life. The region's established oilfield services infrastructure and investment in technological advancements further strengthen its market position.

The West U.S. market for coiled tubing is shaped by both oil and gas production and environmental regulatory considerations. Significant activity in California, Alaska, and other western regions fuels demand for coiled tubing, particularly in maintaining mature fields and enhancing well productivity. The increasing shift toward environmentally responsible practices has led to the adoption of more efficient and sustainable coiled tubing solutions. Additionally, the region’s complex geology and diverse production methods require specialized services, driving the need for advanced coiled tubing technologies that support efficient well intervention and reservoir management.

Competitive Landscape:

The U.S. coiled tubing market is extensively competitive, with leading players dominating the segment by comprehensive operational expertise, implementing leading-edge technologies, and a broad range of solution offerings to sustain their market leadership. In addition, smaller regional firms support the market differentiation by increasingly emphasizing on localized services and niche applications. The market is also represented by steady advancements, with firms actively investing in research and development projects to improve both the efficacy and performance of coiled tubing systems. Moreover, tactical acquisition, partnerships, and mergers further steer the competitive dynamics, targeting to attain a significant share of the amplifying requirement for well intervention solutions. For instance, in November 2024, Azure Holdings, a U.S.-based company, announced a joint venture with Coil Tubing Technology Inc., with a significant investment of USD 14 million. This venture will function on 50/50 profit distribution between the two companies.

The report provides a comprehensive analysis of the competitive landscape in the United States coiled tubing market with detailed profiles of all major companies, including:

- Baker Hughes Co.

- Calfrac Well Services Ltd

- Conquest Completion Services LLC

- Essential Energy Services Ltd

- Halliburton Company

- Key Energy Services LLC

- National-Oilwell Varco Inc.

- Schlumberger Ltd

- STEP Energy Services

- Superior Energy Services

Latest News and Developments:

- In October 2024, EnerMech, a US-based technical solutions company, successfully completed a milestone pre-commissioning project for a leading U.S. energy infrastructure company in the Gulf of Mexico. This project featured the largest nitrogen membrane spread deployed in the region to date, involving the chartering of three light construction vessels, coiled tubing, and the design and fabrication of pig launchers and receivers.

- In June 2024, Baker Hughes, a leading oilfield services company in the U.S., announced receival of a contract from Petrobras, a prominent oil and gas firm, for deploying coiled tubing, wellbore intervention, fishing, and much more in the post-salt and pre-salt fields offshore Brazil. The project is set to initiate in H1 2025.

- In May 2024, Halliburton, a prominent U.S.-based oil service company, announced the deployment a new, largest-ever coiled tubing intervention system at the training facility in Louisiana. This new system includes company's V135HP coiled tubing injector, highly able to handle 36,000 feet of coiled tubing, and a 750 tons capacity of tension lift frame.

United States Coiled Tubing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Drilling, Completion, Well Intervention |

| Locations Covered | Onshore, Offshore |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States coiled tubing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States coiled tubing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States coiled tubing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States coiled tubing market was valued at USD 911.9 Million in 2024.

IMARC estimates the United States coiled tubing market to reach USD 1,216.8 Million by 2033, exhibiting a CAGR of 3.30% during 2025-2033.

Key factors driving the market include increasing oil and gas exploration activities, the growing demand for efficient well intervention solutions, technological advancements in coiled tubing equipment, and the need for cost-effective and environmentally sustainable operations. Additionally, the rise in unconventional resource development and mature field revitalization further contribute to market growth.

Some of the major players in the United States coiled tubing market include Baker Hughes Co., Calfrac Well Services Ltd, Conquest Completion Services LLC, Essential Energy Services Ltd, Halliburton Company, Key Energy Services LLC, National-Oilwell Varco Inc., Schlumberger Ltd, STEP Energy Services, Superior Energy Services, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)