U.S. Cloud Security Market Size, Share, Trends and Forecast by Service Model, Deployment Model, Organization Size, Solution Type, Industry Vertical, and Region, 2025-2033

U.S. Cloud Security Market Size and Share:

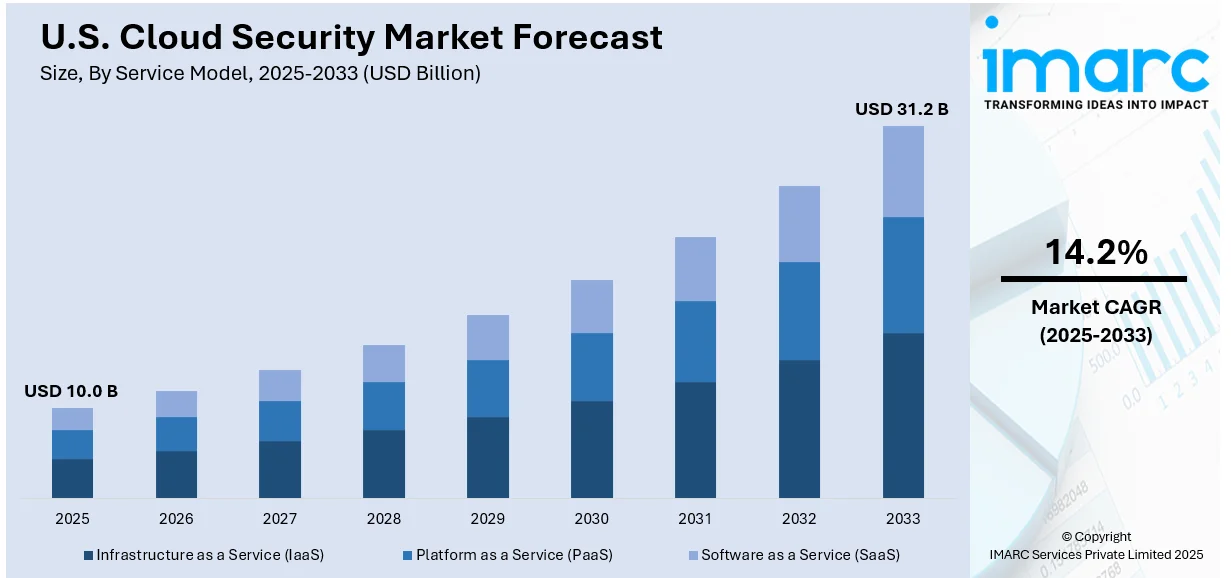

The U.S. cloud security market size is anticipated to reach USD 10.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 31.2 Billion by 2033, exhibiting a CAGR of 14.2% from 2025-2033. The market is driven by increasing cyber threats, including data breaches and ransomware, compelling businesses to adopt advanced security measures. Regulatory requirements such as GDPR and CCPA further fuel demand for compliant security solutions. Additionally, advancements in AI and machine learning enable predictive analytics, enhancing security efficiency and fostering the adoption of scalable, cost-effective cloud protection technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 10.0 Billion |

|

Market Forecast in 2033

|

USD 31.2 Billion |

| Market Growth Rate (2025-2033) | 14.2% |

The rapid adoption of cloud computing across industries is a primary driver of the U.S. cloud security market. As organizations migrate workloads to cloud environments to enhance scalability and efficiency, the need for robust security solutions is increasing. The rise in cyber threats, including data breaches, ransomware, and phishing attacks, has heightened awareness of cloud vulnerabilities, prompting enterprises to prioritize advanced security measures. Additionally, the increasing regulatory pressure from frameworks such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) compels businesses to adopt stringent security protocols, fostering growth in the cloud security market. This regulatory landscape ensures organizations remain compliant while protecting sensitive data from unauthorized access.

The growing demand for zero-trust security models and advanced threat detection technologies is significantly supporting the market. With remote work becoming a norm, fueled by the COVID-19 pandemic, businesses are focusing on securing distributed workforces through cloud-based identity and access management systems. Emerging technologies including artificial intelligence and machine learning are also shaping cloud security by enabling predictive threat intelligence and automated response mechanisms. On 2nd May 2024, Google Cloud announced integrating support for Microsoft Azure and Amazon AWS, enabling enterprises to manage security across multiple cloud platforms with ease. This will ensure that workflows are streamlined, and security is enhanced through a unified approach. Besides this, Google Cloud will tap into AI for better risk management and easier translations of queries by enhancing the security solutions' speed against increasingly threatening data breaches and ransomware. Furthermore, the proliferation of Internet of Things (IoT) devices, coupled with the expansion of 5G networks, increases the attack surface, urging companies to invest in comprehensive cloud security solutions. This trend underscores the vital role of innovation in sustaining the growth of the U.S. cloud security market.

U.S. Cloud Security Market Trends:

Integration of Artificial Intelligence and Machine Learning in Cloud Security

A significant trend shaping the U.S. cloud security market is the integration of machine learning (ML) as well as artificial intelligence (AI) to enhance overall threat detection and response capabilities. AI-driven solutions can analyze vast amounts of data in real time, identifying anomalies and potential threats before they escalate into breaches. On 5th August 2024, IBM introduced generative AI into its Threat Detection and Response Services to advance security operations with its clients. The New IBM Consulting Cybersecurity Assistant aims to expedite the recognition and response processes of any existing threat. Built by IBM's Watsonx AI, it helps reduce AI-blessed automation used across various sectors. Clients thus find IBM's alert times going down by an overall 48% against previously prevalent trends, enhancing their global posture for security. Machine learning models are continuously improving their accuracy by learning from historical data, allowing businesses to stay ahead of changing cyber threats. This trend is especially critical as the complexity of attacks increases, necessitating proactive rather than reactive security measures. Additionally, AI-powered automation streamlines processes such as incident response, reducing manual effort and enhancing overall operational efficiency for organizations managing cloud environments.

Rising Adoption of Multi-Cloud Security Strategies

The growing reliance on multi-cloud environments among U.S. enterprises is driving the demand for integrated cloud security solutions. Companies increasingly use multiple cloud providers to enhance flexibility, avoid vendor lock-in, and optimize costs. This is positively influencing innovation in unified cloud security platforms that offer seamless integration and centralized monitoring across multiple providers. On 3rd December 2024, Elastic advanced its Security platform, building on expanded cloud detection and response (CDR) capabilities directly integrated into the SIEM to simplify and reduce tool fragmentation on the cloud. New capabilities feature agentless ingestion, asset inventory, extended protection, and graph view. Moreover, integration is designed to challenge the issues with old solutions by offering real-time analysis and seamless threat correlation across a unified, AI-driven solution. Additionally, businesses are prioritizing cloud-agnostic solutions that ensure consistent protection regardless of the underlying infrastructure. This trend underscores the need for scalable and customizable security solutions as multi-cloud strategies continue to expand.

Emphasis on Data Privacy and Compliance-Driven Security Solutions

Data privacy concerns and regulatory compliance remain at the forefront of cloud security trends in the United States. New regulations, coupled with the growing consumer awareness, are pushing organizations to adopt robust data protection measures. The emergence of compliance-driven security solutions that provide automated audits, encryption, and access controls is gaining traction among businesses. Additionally, as industries such as healthcare and finance handle sensitive information, compliance with sector-specific standards such as HIPAA and PCI DSS is critical. Companies are increasingly leveraging cloud security solutions to navigate complex regulatory landscapes while ensuring customer trust. On 13th August 2024, NIST at the U.S. Department of Commerce issued three final standards for post-quantum cryptography, developed by IBM researchers, and two co-developed with industry and academic partners: ML-KEM (CRYSTALS-Kyber) and ML-DSA (CRYSTALS-Dilithium). Third is the co-design of SLH-DSA, by an ex-IBM researcher; another selected for further standardization is IBM's FN-DSA FALCON. The algorithms target protection against a cyber-attack using data encrypted on quantum computers. This trend highlights the growing intersection of data privacy, security, and regulatory adherence in shaping the future of the U.S. cloud security market.

U.S. Cloud Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. cloud security market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service model, deployment model, organization size, solution type, and industry verticals.

Analysis by Service Model:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

IaaS provides businesses with scalable and flexible virtualized resources such as servers, storage, and networks. It eliminates the need for physical infrastructure, offering cost-efficiency and enhanced operational agility.

PaaS enables developers to build, test, and deploy applications using pre-configured tools and environments. This service model simplifies development processes and reduces time-to-market for innovative applications.

SaaS delivers software applications through the cloud, accessible via web browsers. It offers convenience, cost savings, and automatic updates, making it ideal for enterprises seeking seamless collaboration and productivity solutions.

Analysis by Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud services are provided by other providers and accessed via the internet. They are scalable, cost-effective, and elastic. They are best suited to organizations with dynamic workloads and constrained IT infrastructure.

The private cloud solution is dedicated to a single organization, which offers higher control, security, and personalization. They are more appropriate for companies dealing with sensitive information or have very strict regulations, ensuring confidentiality of the data and consistency in the operation.

Hybrid cloud combines features from the public and private cloud by making it flexible and scalable. Businesses, for instance, can optimize their cost as they manage sensitive data on private clouds while using public clouds on other non-critical workloads.

Analysis by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Small and medium-sized enterprises (SMEs) are seeking cloud security solutions to ensure sensitive information security while lowering costs. Because of minimal IT infrastructure, SMEs are implementing scalable, pay-as-you-go models to strengthen their cybersecurity. These solutions help SMEs meet changing threats, operational efficiency, and competitiveness in the fast-growing digitization marketplace.

Large enterprises require comprehensive cloud security solutions to manage complex IT infrastructures and vast volumes of data. They prioritize advanced features including real-time threat monitoring and compliance management to mitigate risks. With increasing reliance on multi-cloud environments, large organizations invest heavily in customized, robust security frameworks to ensure operational continuity and regulatory adherence.

Analysis by Solution Type:

- Email and Web Security

- Cloud Identity and Access Management

- Data Loss Prevention

- Intrusion Detection System/Intrusion Prevention System

- Security Information and Event Management

- Others

Email and web security solutions protect businesses from phishing attacks, malware, and ransomware. They help secure communication channels while transmitting data securely and minimize the vulnerability in widely used applications related to emails and the internet.

Cloud Identity and Access Management (IAM) helps cloud Identity and Access Management to handle users' identities and control access to resources containing sensitive information. Enforcing IAM ensures strict authentication protocols with high access security, reducing all unwanted activities and ensuring regulatory compliance for all cloud environments.

DLP solutions detect, monitor, and prevent unauthorized data transfers. DLP solutions protect sensitive information against accidental leaks or malicious breaches in order to avoid noncompliance with data privacy regulations as well as against compromising critical business operations.

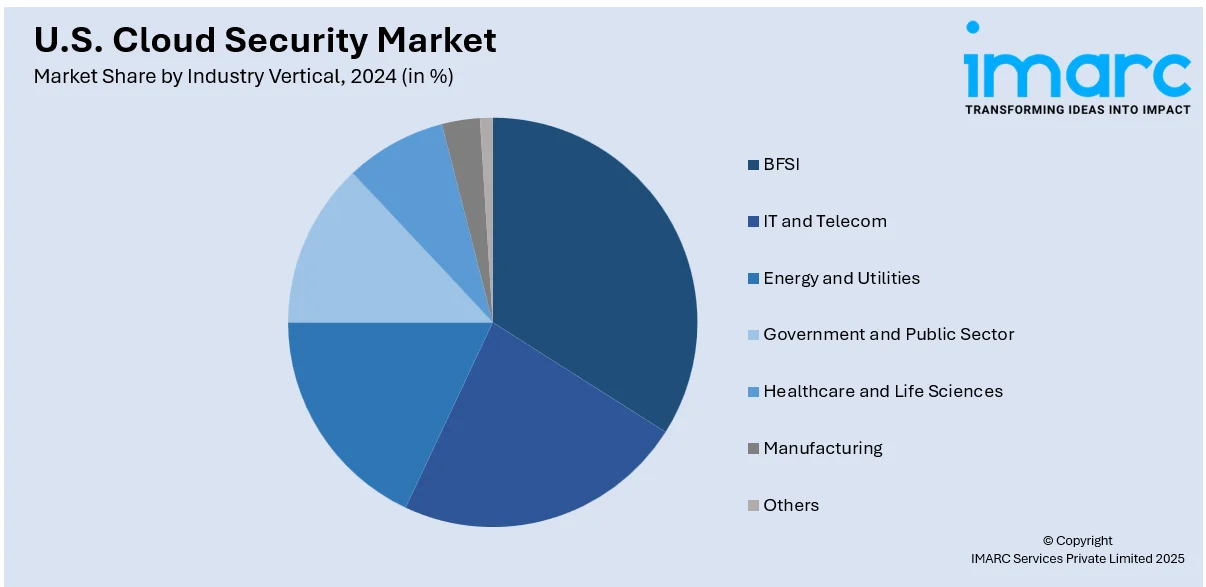

Analysis by Industry Verticals:

- BFSI

- IT and Telecom

- Energy and Utilities

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Others

The BFSI industry focuses on cloud security due to the sensitive financial data and strict regulatory standards they have to meet. This advanced security solution reduces fraud and cyberattacks, ensuring customers' trust and operational resilience in banking, finance, and insurance.

Many cloud security solutions adopt practices for companies in IT and telecommunications firms because they possess much client information and sensitive structures. These solutions address changing cyber threats, enabling secure data exchange, system reliability, and seamless global communication.

Energy and utility sectors are implementing cloud security to secure operational technology as well as protect sensitive data. These solutions mitigate risks that may include cyber-physical attacks, thus ensuring reliable services, regulatory compliance, and the protection of critical national infrastructure.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region drives cloud security adoption due to its concentration of financial institutions and tech firms. Businesses here prioritize robust solutions to protect sensitive data and meet regulatory compliance requirements.

Midwest industries such as manufacturing and healthcare adopt cloud security to safeguard critical infrastructure and sensitive data. The region’s growing digital transformation increases demand for scalable, cost-effective security solutions across diverse sectors.

The South's expanding technology hubs and large enterprises in energy and healthcare sectors fuel cloud security demand. Organizations seek advanced tools to address transforming cyber threats and protect critical business operations.

The West, encompassing numerous tech giants and startups, leads to adopting innovative cloud security solutions. Companies prioritize cutting-edge tools to protect intellectual property and ensure uninterrupted digital operations.

Competitive Landscape:

The US cloud security market is competitive as the major players are innovating to adjust to the latest and emerging cyber threats besides the extension of their offerings. Companies are significantly investing in advanced security technologies such as AI-driven threat detection and zero-trust architectures in order to enhance their platform. Startups and niche players concentrate on specific offerings, such as data loss prevention and identity management, to create differentiations. Strategic partnerships, acquisitions, and new product launches are some of the most popular ways to help companies extend their market presence and make services more integrated. Besides this, compliance-driven solutions that respond to tight regulatory requirements are also witnessing good traction, and vendors focus on end-to-end encryption, automated compliance monitoring, and secure multi-cloud management to meet the needs of diverse enterprises.

The report provides a comprehensive analysis of the competitive landscape in the U.S.cloud security market with detailed profiles of all major companies.

Latest News and Developments:

- September 25, 2024: Accenture Federal Services secured a USD 90 Million contract to help the Cybersecurity and Infrastructure Security Agency, CISA, with data analytics and vulnerability research. The contract further serves to enhance national cybersecurity through the Cybersecurity Division's Vulnerability Management Insights Branch by providing actionable risk mitigation strategies to partners of CISA.

U.S. Cloud Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Models Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Small and Medium-Sized Enterprises (SMEs), Large Enterprises |

| Solution Types Covered | Email and Web Security, Cloud Identity and Access Management, Data Loss Prevention, Intrusion Detection System/Intrusion Prevention System, Security Information and Event Management, Others |

| Industry Verticals Covered | BFSI, IT and Telecom, Energy and Utilities, Government and Public Sector, Healthcare and Life Sciences, Manufacturing, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. cloud security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. cloud security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. cloud security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cloud security refers to a set of practices, technologies, and policies designed to safeguard data, applications, and infrastructure within cloud computing environments. It ensures the protection of sensitive information from cyber threats such as data breaches, unauthorized access, and malware attacks, while maintaining regulatory compliance.

The U.S. cloud security market size is anticipated to reach USD 10.0 Billion in 2025.

IMARC estimates the U.S. cloud security market to exhibit a CAGR of 14.2% during 2025-2033.

The rapid migration to cloud environments, growing cyber threats, and stringent regulatory frameworks like GDPR and CCPA are key drivers. Additionally, the rise in remote work, adoption of zero-trust security models, and advancements in AI and ML technologies are fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)