United States Cloud Professional Services Market Size, Share, Trends and Forecast by Service, Organization Size, Deployment Model, End Use Industry, and Region, 2026-2034

United States Cloud Professional Services Market Overview:

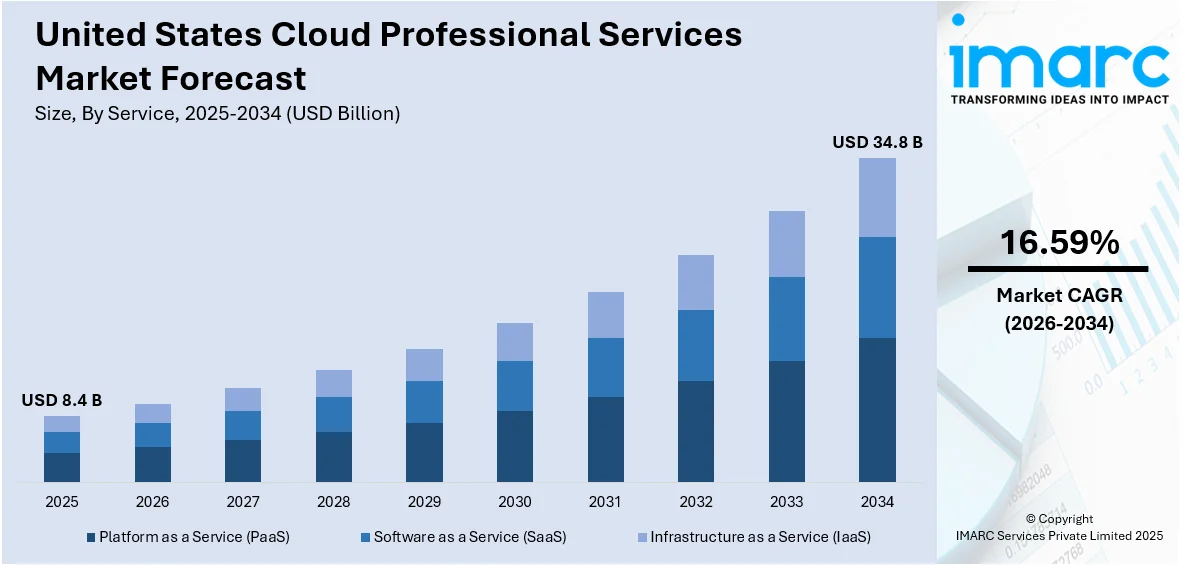

The United States cloud professional services market size was valued at USD 8.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 34.8 Billion by 2034, exhibiting a CAGR of 16.59% during 2026-2034. The increasing prevalence of digital transformation, coupled with the escalating demand for professional services to assist with the migration and integration of cloud solutions, is one of the factors contributing to the United States cloud professional services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.4 Billion |

| Market Forecast in 2034 | USD 34.8 Billion |

| Market Growth Rate 2026-2034 | 16.59% |

The market is expanding due to the accelerated shift of businesses toward cloud-based solutions. Organizations are increasingly adopting hybrid and multi-cloud environments, which require expert support for seamless migration, integration, and management. The demand is further fueled by digital transformation initiatives where companies aim to enhance scalability, improve operational efficiency, and optimize costs. Heightened concerns around data security, compliance with regulations, and governance standards drive enterprises to seek specialized consulting and implementation services. The growing adoption of advanced technologies like AI, machine learning, DevOps, and low-code platforms creates additional complexity, prompting the need for professional expertise. Moreover, the focus on cloud-native applications, automation, and tailored solutions across industries strengthens the United States cloud professional services market growth.

To get more information on this market Request Sample

The acquisition boosts capabilities in cloud, AI, and security, with a sharper focus on customer-driven outcomes. Expertise in AWS services strengthens the ability to deliver tailored solutions across industries. This move reflects growing demand for integrated cloud offerings and advanced AI-driven approaches within the United States market. For instance, in December 2024, CDW acquired Mission Cloud Services Inc., a leading AWS Premier Tier Partner. The acquisition enhances CDW's cloud, AI, and security capabilities, expanding its cloud services and AI solutions. Mission’s expertise will strengthen CDW’s AWS practice and provide more customer-centric outcomes across various industries.

United States Cloud Professional Services Market Trends:

Widespread Cloud Integration in US Enterprises

Cloud-based professional services have become almost universal among US organizations, with 98% now embedding these solutions into their operations, shaping United States cloud professional services market outlook. This widespread adoption reflects a shift toward modernizing IT infrastructure and enhancing scalability to support diverse business needs. Organizations are increasingly blending public and private cloud environments to optimize performance, security, and cost efficiency. The reliance on managed cloud services is growing, especially as companies seek expert support for migration, customization, and ongoing management. The demand for AI-driven cloud solutions and multi-cloud strategies is also rising, allowing businesses to balance workloads and reduce dependency on single vendors. This level of integration is setting the stage for rapid advancements in automation and digital service delivery. For example, an industry report reveals that 98% of US organizations have integrated cloud solutions into at least some of their business operations.

Cost Optimization Driving Cloud Adoption

US enterprises are increasingly shifting to cloud-based professional services to reduce operational expenses. Recent surveys show that organizations report an average savings of 20% in infrastructure costs after migrating workloads to the cloud. This cost advantage is pushing companies to accelerate the replacement of legacy systems with scalable, flexible cloud platforms. Managed services are becoming critical for optimizing resource allocation and ensuring seamless transitions. Businesses are also leveraging automation, containerization, and advanced monitoring tools to maintain cost efficiency while improving performance. The financial benefits are complemented by improved disaster recovery, faster deployment of applications, and the ability to scale operations on demand. As per the United States cloud professional services market forecast, these factors are expected to solidify cloud solutions as a core component of enterprise IT strategies. For instance, a survey found that transitioning to the cloud resulted in an average savings of 20% in infrastructure costs for respondents.

Rising Demand for Digital Transformation Services

Digital transformation efforts in the United States are gaining strong momentum, representing a major share of global initiatives. United States cloud professional services market trends show that businesses are turning to cloud-based solutions to modernize operations and enhance customer experiences. The shift toward hybrid and multi-cloud environments is fueling the need for expert professional services that can manage complex architectures and ensure seamless integration. Industries such as healthcare, retail, and finance are prioritizing modernization to stay competitive, with a growing emphasis on automation, data security, and AI-powered capabilities. Service providers are expanding consulting and implementation services to support organizations in achieving faster digital adoption and building scalable, resilient infrastructures for long-term growth. An industry analysis indicated that US spending on digital transformation represents 35.8% of global expenditure.

United States Cloud Professional Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States cloud professional services market, along with forecasts at the regional, and country levels from 2026-2034. The market has been categorized based on service, organization size, deployment model, and end use industry.

Analysis by Service:

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

Software as a service (SaaS) stood as the largest service in 2025, holding around 47.8% of the market due to its ability to deliver flexible, cost-effective solutions. Organizations are increasingly adopting SaaS applications to replace traditional on-premises systems, reducing infrastructure costs and improving scalability. This shift fuels demand for professional services such as consulting, implementation, integration, and ongoing management to ensure smooth deployment and optimization of SaaS platforms. Enterprises in sectors like healthcare, BFSI, and retail are particularly drawn to SaaS for its quick deployment and subscription-based pricing, which aligns with shifting IT budgets. Furthermore, the rise of remote work and digital transformation initiatives across the US accelerates SaaS adoption, boosting the need for expert services that can handle complex cloud environments and security requirements.

Analysis by Organization Size:

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Large enterprises stood as the largest organization size in 2025, holding around 63.2% of the market as they demand advanced cloud strategies to manage their extensive operations, data, and infrastructure. These organizations are shifting from traditional IT models to cloud-based solutions to enhance flexibility, reduce costs, and improve scalability. Their focus on digital transformation, cybersecurity, and compliance with regulatory standards drives the need for professional services, including cloud consulting, migration, integration, and managed services. Enterprises also prioritize hybrid and multi-cloud environments, requiring expert guidance and technical support. The increasing complexity of their IT ecosystems further fuels demand for specialized providers who can deliver tailored solutions and ongoing optimization. As large enterprises continue investing in cloud technologies, they significantly shape the overall market expansion.

Analysis by Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud led the market with around 70.8% of market share in 2025. Public cloud providers such as AWS, Microsoft Azure, and Google Cloud are rapidly expanding their service portfolios, enabling businesses to access advanced technologies like AI, machine learning, and analytics without heavy infrastructure investments. Enterprises are shifting workloads to public cloud platforms to achieve cost-efficiency, scalability, and faster deployment of applications. This trend is driving the demand for professional services like consulting, migration, integration, and managed services to ensure seamless cloud adoption. Additionally, regulatory compliance requirements and the need for robust security in multi-cloud environments are prompting organizations to seek expert guidance, further fueling the professional services market in the US.

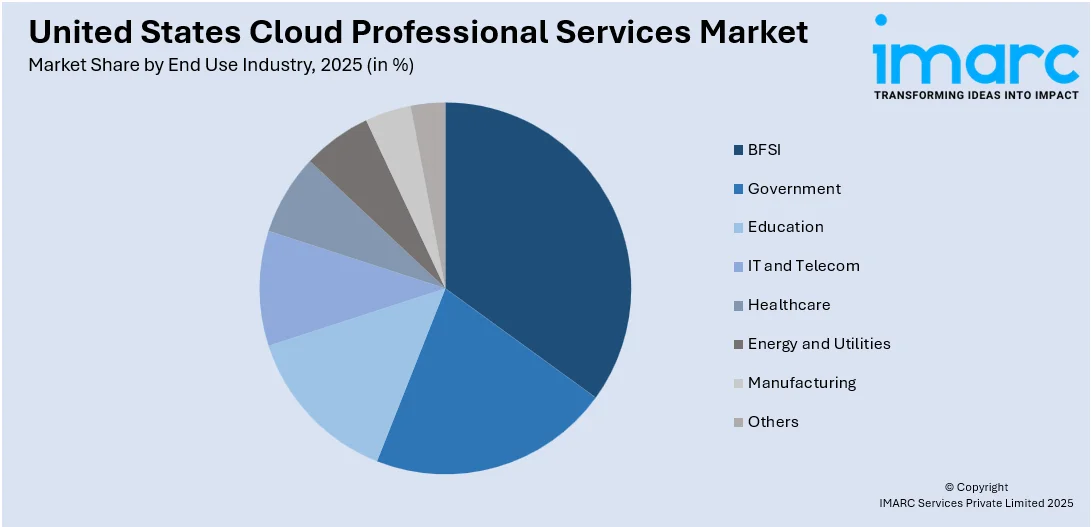

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- BFSI

- Government

- Education

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

IT and telecom led the market with around 25.7% of market share in 2025 due to its rapid digital transformation and growing reliance on cloud-based solutions. Telecom companies are adopting cloud platforms to enhance network efficiency, support 5G infrastructure, and deliver innovative services like IoT and edge computing. Similarly, IT firms are leveraging cloud technologies to improve operational agility, optimize costs, and accelerate software development through DevOps and automation. The increasing complexity of hybrid and multi-cloud environments in this segment is creating high demand for consulting, migration, and managed services to ensure seamless integration and performance. As both IT and telecom sectors expand their digital ecosystems, the need for specialized professional services continues to grow, boosting market momentum.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast, home to major financial and tech hubs like New York and Boston, accelerates adoption due to its strong enterprise IT modernization needs. The Midwest contributes through manufacturing and industrial sectors that are investing in cloud migration and consulting services to improve operational efficiency. The South, with its growing energy, healthcare, and logistics industries, is driving demand for scalable cloud solutions. Meanwhile, the West, led by Silicon Valley and major tech firms, fuels innovation, advanced cloud infrastructure, and cutting-edge professional services. Together, these regions create a nationwide demand surge for cloud consulting, integration, and managed services.

Competitive Landscape:

In the US cloud‑professional‑services sector, companies are partnering with hyperscalers to launch new AI‑enabled advisory and implementation offerings. Government programs like the DoD’s JWCC Next are fueling demand for multi‑cloud migration, engineering, and security services. Research initiatives like NSF’s CloudBank are expanding academic access to commercial cloud platforms. Investors continue backing niche FinOps, governance, and edge/cloud startups. Large consultancies are also teaming up with cloud vendors to create industry‑specific service packages. The dominant trend is collaboration, where hyperscaler‑partner go‑to‑market alliances and co‑developed services lead the scene, with acquisitions of specialized cloud‑services firms a close second.

The report provides a comprehensive analysis of the competitive landscape in the United States cloud professional services market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Rackspace Technology launched OpenStack Flex, an enterprise-grade, on-demand IaaS solution offering secure, scalable, and license-free cloud services. It supports hybrid cloud environments, enhances cost control, alleviates vendor lock-in, and provides 24/7 expert support, enabling businesses to modernize their infrastructure efficiently.

- February 2025: Google Cloud Marketplace launched partner-delivered professional services, allowing customers to seamlessly purchase and manage services from ISVs and systems integrators. This initiative simplifies cloud adoption, offering flexible pricing, streamlined procurement, and enhanced support, accelerating digital transformation and providing new business opportunities for partners.

- January 2025: Deloitte acquired SimplrOps, a SaaS company specializing in automating Workday, SAP, and Oracle operations. This acquisition enhances Deloitte’s Cloud ERP and HCM capabilities, improving system performance, accelerating time to value, and providing real-time insights to help clients maximize their technology investments.

- October 2024: Acumatica launched its Professional Services Edition, a cloud ERP solution designed for small and midsized professional services firms. The solution enhances project management, resource optimization, and financial control, aiming to improve collaboration and operational efficiency for firms in industries like architecture, engineering, and IT.

United States Cloud Professional Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Platform as a Service (PaaS), Software as a Service (SaaS), Infrastructure as a Service (IaaS) |

| Organization Sizes Covered | Small Enterprises, Medium Enterprises, Large Enterprises |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| End Use Industries Covered | BFSI, Government, Education, IT and Telecom, Healthcare, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States cloud professional services market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States cloud professional services market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States cloud professional services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud professional services market in the United States was valued at USD 8.4 Billion in 2025.

The United States cloud professional services market is projected to exhibit a CAGR of 16.59% during 2026-2034, reaching a value of USD 34.8 Billion by 2034.

The United States cloud professional services market is driven by rapid cloud adoption, the growing complexity of hybrid and multi-cloud environments, and enterprises’ push for digital transformation requiring cost optimization, scalability, and compliance. Rising security and regulatory needs, along with the integration of AI, ML, DevOps, and low-code tools, further boost demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)