United States Clinical Nutrition Market Size, Share, Trends and Forecast by Product, Route of Administration, Application, End User, and Region, 2025-2033

United States Clinical Nutrition Market Size and Share:

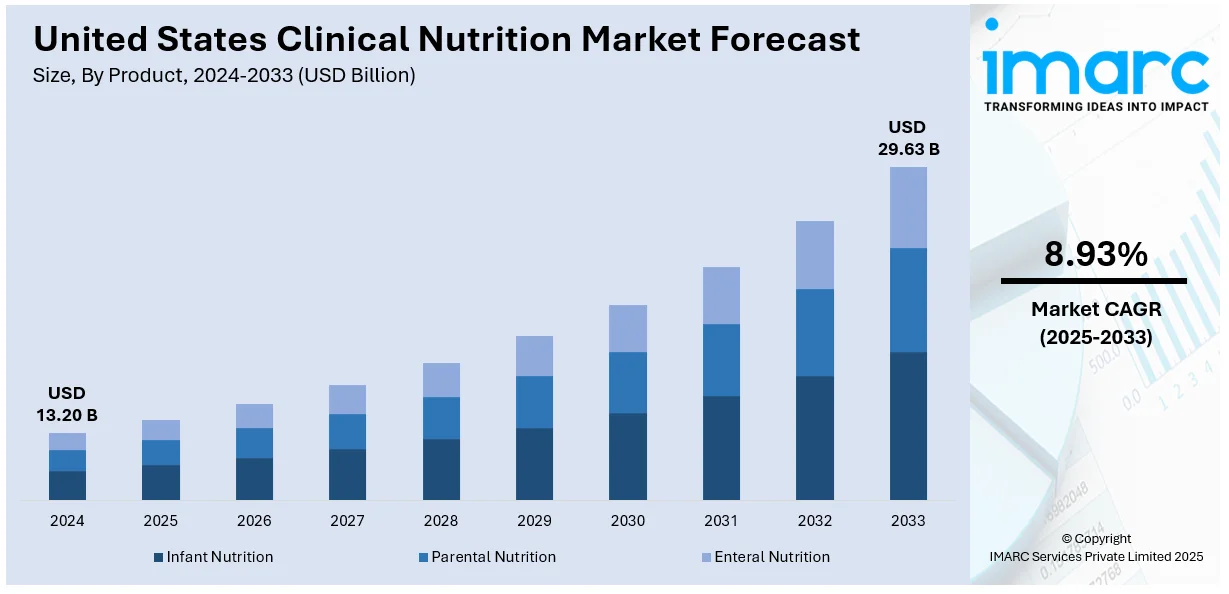

The United States clinical nutrition market size was valued at USD 13.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.63 Billion by 2033, exhibiting a CAGR of 8.93% during 2025-2033. South currently dominates the market, holding a significant market share of around 33.8% in 2024. The market is influenced by the increasing number of chronic conditions like diabetes, cardiovascular diseases, and cancer, which demand expert nutritional care. The aging population and growing concern for the role of nutrition in disease management also contribute significantly to market growth. In addition, improvements in personalized nutrition and a growing trend towards enteral and parenteral nutrition therapy further augment the United States clinical nutrition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.20 Billion |

| Market Forecast in 2033 | USD 29.63 Billion |

| Market Growth Rate (2025-2033) | 8.93% |

United States Clinical Nutrition Market Analysis:

- Major Market Drivers: The high incidence of chronic diseases like diabetes, cardiovascular disease, and cancer fuels specialized nutritional therapies. The rising needs of the aging population and improved healthcare expenditure and insurance coverage generate significant demand for clinical nutrition products across different segments.

- Key Market Trends: Increased realization of preventive healthcare and customized nutrition solutions is transforming consumer habits. Spending on customized nutritional therapy based on genetic predisposition and health status is growing. Technology and artificial intelligence integration to create personalized nutrition plans is a major market shift.

- Competitive Landscape: The market is characterized by high competition among multinational pharmaceutical firms and specialized healthcare providers. Market positioning is driven by innovation in product effectiveness, strategic alliances, and regulatory compliance. Firms are increasingly shifting attention to individualized nutrition solutions to address individualized health intervention needs.

- Challenges and Opportunities: Regulatory conditions and safety norms are challenges that have to be continually faced, while the increasing healthcare infrastructure provides opportunities for alliances. The increasing health awareness among consumers provides scope for market growth, especially in preventive care and the chronic diseases segment.

The market is significantly influenced by the growing incidence of chronic diseases like diabetes, cardiovascular diseases, and cancer, which need specialized nutritional support for improved management and healing. According to industry reports, the number of Americans in the 65 years and above age group is anticipated to increase from 58 million in 2022 to 82 million in 2050, representing a 42% rise. The growing elderly population in the U.S. is generating United States Clinical nutrition market demand, as elderly individuals are more prone to malnutrition and tend to require personalized nutrition interventions. Moreover, growing awareness of the necessity of adequate nutrition in disease prevention and management is fueling the expansion of the clinical nutrition market in the United States. Additionally, advances in medical science have led to more efficient and individualized clinical nutrition solutions that appeal to both healthcare professionals and patients.

To get more information on this market, Request Sample

In line with this, another significant contributor to growth is the increase in healthcare spending, as more funds are provided for healthcare services and health insurance, enabling greater access to clinical nutrition products. Furthermore, the increasing focus on enteral nutrition, particularly for patients with gastrointestinal diseases or those unable to eat orally, is driving market demand. According to industry reports, the prevalence of children and youth in the U.S. with overweight and obesity is estimated to increase to 43.1 million. Among adults, this number is expected to reach 213 million by 2050. The increasing burden of obesity and its associated comorbidities is driving more and more people to consult doctors about controlling their weight through clinical nutrition products. The continuous evolution of new, high-nutrient value formulations for targeted medical conditions is also contributing to United States clinical nutrition market share growth.

United States Clinical Nutrition Market Trends

Growing Awareness Regarding Preventive Healthcare

The growing awareness among individuals about the importance of preventive healthcare and personalized nutrition is a pivotal force driving the market expansion. According to an industry report, in 2023 sales of personalized supplements were expected to reach USD 1.15 Billion by the end of 2024, a 15-fold increase compared to the estimate in 2017. This surge reflects a broader shift in consumer behavior towards more individualized health solutions. The shift towards prevention is creating the need for clinical nutrition that supports immunity, gut health, and overall vitality. Consumers are increasingly aware of the connection between nutrition and health outcomes, and they are seeking personalized nutrition plans to optimize their well-being and prevent disease. Healthcare professionals are also advocating for a proactive approach, incorporating clinical nutrition into wellness programs to mitigate the long-term effects of poor dietary habits.

Investment in Tailored Nutritional Solutions

The market is witnessing an increase in investment in the development of personalized and tailored nutritional solutions, which is creating a positive United States clinical nutrition market outlook. As consumers become more informed about the role of nutrition in disease management and overall well-being, there is a heightened willingness to invest in tailored nutritional solutions. As such, in 2024, The Rockefeller Foundation announced a USD 3.5 Million investment to expand Food is Medicine (FIM) programs across the U.S., aiming to improve health outcomes for patients with chronic diseases, support local farmers, and integrate medically tailored meals and food prescriptions into healthcare. With advancements in genomics, microbiome research, and artificial intelligence, there is a growing trend towards personalized nutrition, where nutritional plans are customized based on an individual's genetic profile, health conditions, and lifestyle factors. This trend is reshaping the clinical nutrition sector as companies invest in innovative solutions that cater to the unique needs of consumers.

Increasing Prevalence of Chronic Diseases

The United States has witnessed a significant rise in the prevalence of chronic diseases such as obesity, diabetes, cardiovascular diseases, and cancer. The CDC reported that between August 2021 and August 2023, 15.8% of U.S. adults were affected by diabetes, with 11.3% having a diagnosed case and 4.5% living with undiagnosed diabetes. These health issues require targeted nutritional treatments. Therefore, the United States clinical nutrition market worth is steadily increasing, with the increase in demand to manage these conditions. Apart from this, healthcare professionals increasingly recommend clinical nutrition supplements and therapeutic diets. The trend also stems from increasing healthcare consciousness among patients who are looking for preventive measures to control chronic diseases through customized nutrition. Additionally, the incorporation of nutrition in medical treatment programs has resulted in the growth of clinical nutrition products as fundamental tools for managing chronic diseases in the country.

United States Clinical Nutrition Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States clinical nutrition market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, route of administration, application, and end user.

Analysis by Product:

- Infant Nutrition

- Parental Nutrition

- Enteral Nutrition

Infant nutrition leads the market with around 42.9% of market share in 2024. The segment is a key aspect of children's health in the early years. Infant nutrition products are formulated for the nutritional benefits of newborns and infants who receive inadequate breast milk. These products include infant formulas, baby food, and specialty nutrition items for infants with medical conditions or special dietary needs. The demand for these products is increasing due to the growing concern for infant health, the rising number of working parent populations, and expanding interest in preventive care. With progress in research, infant clinical nutrition products are increasingly customized to address specific healthcare needs, thereby promoting enhanced results in areas of immunity, growth, and development. As medical professionals remain focused on early-stage nutrition, the infant nutrition segment continues to be a major part in the United States clinical nutrition industry.

Analysis by Route of Administration:

- Oral

- Enteral

- Parenteral

Oral leads the market with around 45.8% of market share in 2024. It constitutes the most common means by which nutritional products are delivered to patients. Oral administration is favored on account of its simplicity, ease of use, and non-invasive character, and it is well suited to both acute and chronic nutritional therapy. Products taken orally include nutritional supplements, therapeutic formulas, and enteral nutrition products that are formulated to provide precise dietary requirements or aid recovery from surgery or illness. Such administration is necessary in patients with health conditions that can be digested and absorbed via the gastrointestinal tract. Oral nutrition is the preferred method in home care patients so that it can be more independent and manageable. With healthcare systems still focusing on cost-saving and patient-focused care, oral nutrition remains an important element in the treatment of a range of diseases, from malnourishment to chronic illnesses.

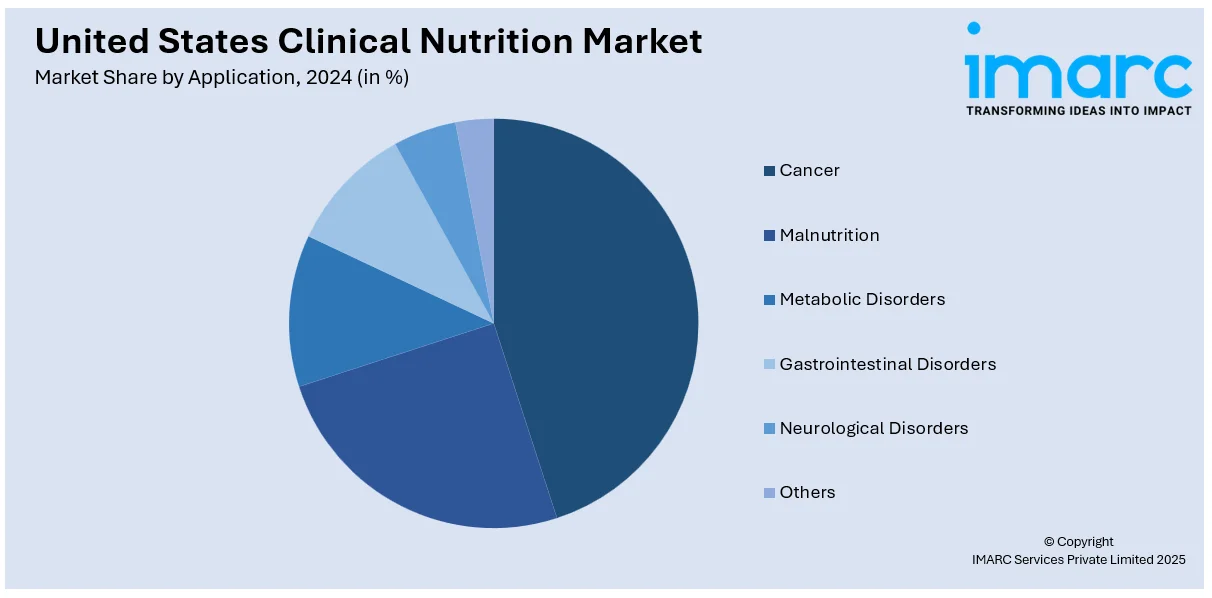

Analysis by Application:

- Cancer

- Malnutrition

- Metabolic Disorders

- Gastrointestinal Disorders

- Neurological Disorders

- Others

Metabolic disorders lead the market with around 34.3% of market share in 2024. Metabolic disorders such as diabetes, obesity, and genetic metabolic disorders impair the body's function to digest nutrients properly, causing a range of health problems. As per United States clinical nutrition market insights, clinical nutrition products play a crucial role in regulating metabolic processes, controlling blood sugar, and managing weight. For example, nutritional treatments for diabetic patients target low glycemic index foods, whereas those for obesity focus on caloric management and balanced nutrient absorption. Specialized diets and supplements assist in keeping patients with inherited metabolic disorders optimally nourished while avoiding interruptions to metabolism. As the occurrence of metabolic disorders increases, fueled by lifestyle choices and inheritances, clinical nutrition remains integral in the management of these conditions, supporting enhanced health outcomes and patient compliance with long-term dietary regimens.

Analysis by End User:

- Pediatric

- Adults

- Geriatric

Pediatrics leads the market with around 53.8% of market share in 2024. The segment plays a key role in driving the United States clinical nutrition market growth, as the nutritional needs of children, particularly infants and toddlers, are critical to their development and overall growth. Pediatric clinical nutrition products, such as infant formulas, specialty medical nutrition, and dietary supplements, are formulated to assist children with particular health issues like prematurity, malnutrition, or genetic disorders. These solutions are vital to promoting appropriate growth, brain development, immune system health, and general well-being. Child nutrition has become an area of growing interest with increasing alarm about child obesity, food allergy, and gastrointestinal disease, prompting demand for customized nutritional interventions. Clinical nutrition interventions under the direction of pediatric health professionals manage conditions such as metabolic disease. As knowledge of children's health gains momentum, the market will grow, with an emphasis on evidence-based, personalized nutrition products aimed at meeting the specific needs of children.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2024, South accounted for the largest market share of around 33.8% due to its size and diversity of population, as well as its specificity of health issues. According to the United States clinical nutrition market analysis, the South region is found to have a high incidence of conditions like obesity, diabetes, and heart disease, which has created a growing demand for clinical nutrition products to manage and prevent such conditions. The Southern states also have a large population of elderly people, who tend to need specialized nutrients for age-related conditions like osteoporosis, malnutrition, and gastrointestinal problems. Clinical nutrition items such as enteral formulas, nutritional supplements, and pediatric nutrition play a crucial role in managing these health issues. Additionally, healthcare providers in the region are placing more emphasis on preventive care and tailored nutrition approaches, promoting market growth. As the Southern U.S. continues to undergo demographic changes and healthcare innovations, its significance in the market remains critical to enhancing population health outcomes.

Competitive Landscape:

The market is highly competitive, with several players ranging from multinational pharmaceuticals to specialized healthcare providers. Competition in the market is largely based on the innovation of products, the effectiveness of the nutritional products, and the capacity to respond to health conditions such as malnutrition and chronic diseases. Strategic alliances, mergers, and acquisitions also significantly contribute to attaining market positions and broadening product offerings. Moreover, firms are shifting their attention to custom nutrition solutions to address the increased demand for personalized health interventions. Apart from this, regulatory requirements and industry standards compliance are important, with product quality and safety being first priority for clinical nutrition. The availability of extensive, well-established healthcare infrastructure also heightens competition with firms competing to partner with hospitals, healthcare professionals, and direct consumers. According to the United States clinical nutrition market forecast, the demand for the products is likely to increase steadily, fueled by a growing population and increased health awareness, leading to a more dynamic competitive environment.

The report provides a comprehensive analysis of the competitive landscape in the United States clinical nutrition market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: The FDA and NIH launched the Nutrition Regulatory Science Program to address diet-related chronic diseases. This joint initiative will research topics like the impact of ultra-processed foods, food additives on metabolic health, and maternal-infant dietary exposures, aiming to develop evidence-based food and nutrition policies for enhanced public health.

- May 2025: Danone acquired a majority stake in Kate Farms, a U.S.-based provider of plant-based, organic nutrition products for both medical and everyday needs. This acquisition enhances Danone's specialized nutrition portfolio, particularly in clinical nutrition. The deal aims to expand access to high-quality nutrition for individuals with health needs across the United States.

- May 2025: Everwell Health acquired American River Nutrition (ARN) from Designs for Health. The acquisition brings plant-based ingredients like DeltaGold and GG-Gold, supporting clinical nutrition in areas such as metabolic, cardiovascular, and men's health.

- April 2025: Arla Foods Ingredients launched Lacprodan MicelPure Medical, a micellar casein isolate (MCI) solution targeting medical nutrition. This innovation addresses malnutrition, with enhanced protein content, neutral taste, and improved texture, aiding compliance. The MCI solutions are ideal for oral and tube feeding, supporting patient recovery and quality of life.

- November 2024: NationsBenefits, a U.S. fintech and healthcare benefits platform, acquired Good Measures, a Boston-based company specializing in personalized nutrition solutions. Good Measures utilizes clinical coaching, advanced technology, and customized food plans to enhance health outcomes by offering food-as-medicine solutions.

- June 2024: Nestlé Health Science launched a comprehensive GLP-1 nutrition support platform in the U.S. to aid individuals on weight loss medications like Ozempic and Wegovy. The platform offers personalized nutritional solutions, including muscle preservation, gut health, micronutrient intake, and weight rebound control, supported by expert guidance.

United States Clinical Nutrition Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Infant Nutrition, Parental Nutrition, Enteral Nutrition |

| Route of Administrations Covered | Oral, Enteral, Parenteral |

| Applications Covered | Cancer, Malnutrition, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Others |

| End Users Covered | Pediatric, Adults, Geriatric |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States clinical nutrition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States clinical nutrition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States clinical nutrition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clinical nutrition market in United States was valued at USD 13.20 Billion in 2024.

The growth of the United States clinical nutrition market is driven by increasing healthcare awareness, the rising prevalence of chronic diseases, an aging population, and advancements in medical nutrition therapy. Moreover, growing demand for specialized nutrition solutions in hospitals, home care, and long-term care facilities contributes significantly to market expansion.

The clinical nutrition market in United States is projected to exhibit a CAGR of 8.93% during 2025-2033, reaching a value of USD 29.63 Billion by 2033.

Infant nutrition account for the largest share of the United States clinical nutrition market product. This segment's dominance is driven by the rising number of premature births, growing awareness about the importance of infant nutrition, and increased parental focus on providing optimal nutrition to support healthy growth and development in early life.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)