United States Ceramic Ball Bearings Market Size, Share, Trends and Forecast by Raw Material, Product Type, Application, and Region, 2025-2033

United States Ceramic Ball Bearings Market Size and Share:

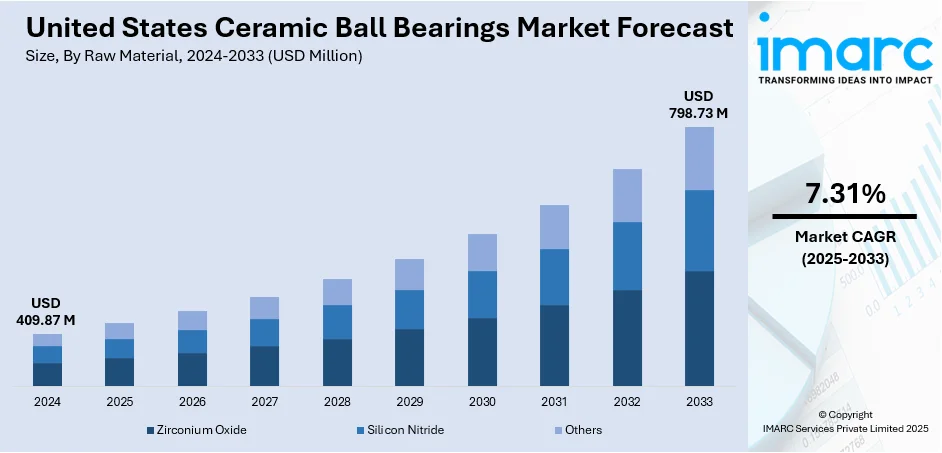

The United States ceramic ball bearings market size was valued at USD 409.87 Million in 2024. Looking forward, the market is expected to reach USD 798.73 Million by 2033, exhibiting a CAGR of 7.31% during 2025-2033. Midwest currently dominates the market, holding a significant market share in 2024. The market is witnessing steady growth due to rising demand across the aerospace, automotive, and medical industries. Their superior durability, high-temperature resistance, and reduced friction make them ideal for precision applications. Increasing adoption of electric vehicles and advanced manufacturing also fuels expansion, supporting the United States ceramic ball bearings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 409.87 Million |

|

Market Forecast in 2033

|

USD 798.73 Million |

| Market Growth Rate 2025-2033 | 7.31% |

The market is expanding steadily, driven by a combination of performance advantages, industrial demand, and environmental considerations. Ceramic ball bearings offer exceptional hardness, low friction, high heat resistance, and corrosion protection, making them ideal for aerospace, automotive, medical, and semiconductor applications. Their ability to function under extreme conditions ensures reliability and durability in environments where traditional steel bearings underperform. Technological advancements in material engineering, such as silicon nitride and zirconia composites, have significantly improved performance, life cycle, and affordability. These innovations enable broader industrial adoption and support miniaturization trends in electronics and medical devices.

To get more information on this market, Request Sample

The United States ceramic ball bearings market growth is also fueled by the increased use in electric vehicles (EVs) and high-speed machinery. A report by Experian Automotive reveals that in 2024, around 4,092,200 electric vehicles, roughly 1.4% of the 292.3 million cars and trucks in the US, were on the road. This marks a steady rise from 2 million EVs in 2022 and 1.3 million in 2021. Looking ahead, the National Renewable Energy Laboratory estimates that by 2030, the number of electric vehicles in the US could reach between 30 million and 42 million. Ceramic bearings enhance energy efficiency, reduce wear, and require less maintenance, aligning with industry goals to cut operational costs and increase productivity. Their lightweight structure further improves fuel efficiency in the aerospace and automotive sectors.

United States Ceramic Ball Bearings Market Trends:

Resurgence in Motor Vehicle Production

The United States is experiencing a rebound in motor vehicle production, creating increased demand for high-performance components like ceramic ball bearings. These bearings offer advantages such as durability, heat resistance, and low friction, making them essential for electric drivetrains and precision automotive applications. According to reports, the forecast for light vehicle production in 2025 has been updated with a 1.2% increase, bringing the anticipated output to approximately 14.18 million units. This uptick in manufacturing directly boosts the need for efficient, long-lasting bearing solutions, especially as automakers seek advanced materials to improve fuel efficiency and performance. As automotive innovation continues, ceramic ball bearings are expected to play a vital role in supporting mechanical reliability and operational excellence, which is creating a positive United States ceramic ball bearings market outlook.

Expansion of Wind Energy Infrastructure

Ceramic ball bearings are increasingly critical in renewable energy applications, particularly wind turbines, due to their superior wear resistance and ability to withstand harsh operating conditions. The US wind energy market is gaining momentum, offering significant long-term growth opportunities for ceramic bearing manufacturers. From 2025 through 2029, developers in the US are expected to install 33 GW of new onshore wind capacity, 6.6 GW of offshore capacity, and 5.5 GW in repowering projects. As turbines operate at high speeds and require minimal maintenance, ceramic bearings are preferred for their longevity and efficiency. The sector's focus on sustainability and reduced operational costs further reinforces their adoption in this evolving energy landscape.

Growth in Aerospace and Precision Applications

The US aerospace industry continues to be a major contributor to the ceramic ball bearings market, driven by the need for high-precision, lightweight components in engines, satellites, and avionics. According to the United States ceramic ball bearings market trends, these bearings perform exceptionally in extreme conditions and high-speed rotations, making them indispensable in aerospace engineering. According to the Aerospace Industries Association, the US aerospace industry generated USD 545.2 Billion in total output in 2024, including USD 306.9 Billion in aerospace products. Additionally, rising demand in sectors like electric motors and laboratory equipment further supports market growth. As these industries emphasize performance, durability, and reliability, ceramic ball bearings remain essential to enhancing operational capabilities and minimizing maintenance demands.

United States Ceramic Ball Bearings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States ceramic ball bearings market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on raw material, product type, and application.

Analysis by Raw Material:

- Zirconium Oxide

- Silicon Nitride

- Others

Zirconium oxide leads the market with 48.5% of market share in 2024 due to its exceptional toughness, corrosion resistance, and smooth surface finish. It is especially suitable for applications requiring high wear resistance and low thermal conductivity, such as in dental drills, medical instruments, and precision machinery. Its biocompatibility also makes it ideal for medical and laboratory environments. Compared to other ceramics, zirconium oxide provides better shock resistance and reduced brittleness, making it a preferred choice for low-load, high-precision uses. According to the United States ceramic ball bearings market forecast, these performance characteristics, along with increasing demand in healthcare and precision equipment sectors, contribute to its dominant position in the market.

Analysis by Product Type:

- Hybrid Ceramic Ball Bearings

- Full Ceramic Ball Bearings

Hybrid ceramic ball bearings lead the market with 65.2% of market share in 2024 due to their optimal balance of performance and cost. These bearings use ceramic balls—typically silicon nitride—combined with steel races, offering advantages such as reduced weight, lower friction, and extended lifespan compared to traditional steel bearings. They are widely adopted in electric motors, machine tools, aerospace, and medical equipment for their ability to operate at higher speeds and temperatures. Additionally, their resistance to corrosion and minimal lubrication needs contribute to lower maintenance costs. As industries increasingly prioritize efficiency, speed, and durability, the demand for hybrid bearings continues to rise across multiple high-performance sectors.

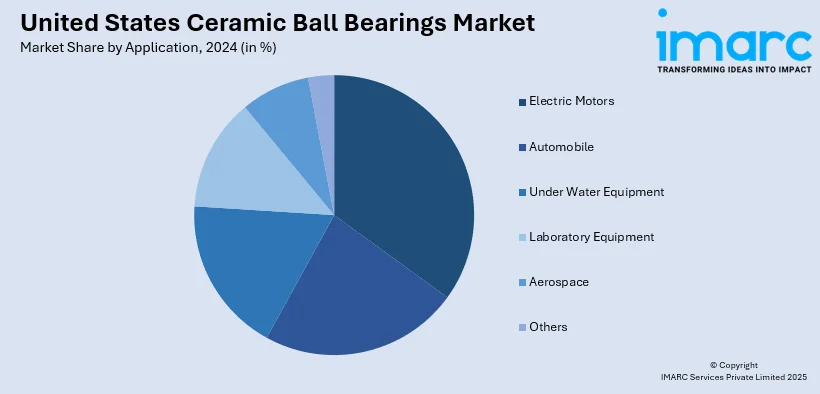

Analysis by Application:

- Electric Motors

- Automobile

- Under Water Equipment

- Laboratory Equipment

- Aerospace

- Others

Electric motors lead the market with 37.6% of share due to the increasing demand for high-speed, energy-efficient performance. Ceramic bearings, especially hybrids, reduce friction, heat generation, and energy loss, enabling motors to operate more efficiently and with less wear. They also extend maintenance intervals due to their durability and reduced need for lubrication. With the rapid expansion of electric vehicles, industrial automation, and HVAC systems, electric motors are becoming more sophisticated and performance driven. The rise in smart manufacturing and energy-saving mandates across the US is further accelerating the integration of ceramic ball bearings in motors to enhance output and operational reliability.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Midwest holds the leading position in the market, holding a significant market share. The Midwest’s strong manufacturing base and automotive production hubs, particularly in Michigan, Ohio, and Indiana, are escalating the United States ceramic ball bearings market demand. The region’s transition toward electric vehicle (EV) manufacturing amplifies the need for durable, high-speed components that improve motor efficiency and extend service life. Additionally, the Midwest is a center for industrial automation and robotics, where ceramic bearings are favored for their ability to operate at high speeds with low maintenance. Agricultural equipment manufacturers also use ceramic bearings to boost operational life under harsh, abrasive conditions. The push for energy-efficient and precision-based machinery supports ceramic bearing growth in this region’s evolving industrial landscape.

Competitive Landscape:

The United States ceramic ball bearings market is characterized by intense competition, driven by technological innovation, performance differentiation, and growing demand across high-precision industries. Key players such as SKF, Timken, CeramTec, CoorsTek, and Boca Bearings dominate the landscape, offering advanced hybrid and full ceramic solutions tailored to sectors like aerospace, automotive, medical, and energy. These companies focus on material innovation, particularly in silicon nitride and zirconium oxide, to enhance durability, speed, and corrosion resistance. Strategic partnerships, joint ventures, and investments in research and development (R&D) are common, aiming to expand product portfolios and address niche applications. Additionally, international players are increasing their US presence, intensifying market rivalry, and driving rapid advancements in ceramic bearing technology and applications.

The report provides a comprehensive analysis of the competitive landscape in the United States ceramic ball bearings market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Boca Bearings expanded its full ceramic bearing line, enhancing its offerings with products like deep groove radial and angular contact bearings. Utilizing materials such as Silicon Nitride and Silicon Carbide, the company reinforced its leadership in high-performance, corrosion-resistant, and temperature-tolerant bearing solutions for advanced industrial applications.

- April 2025: The American Gear Manufacturers Association (AGMA) and the American Bearing Manufacturers Association (ABMA) officially merged, following approval from both memberships. This consolidation has resulted in the creation of the Motion and Power Manufacturers Alliance (MPMA), a unified organization. The new structure became effective starting May 1, 2025. Both AGMA and ABMA retained their names, as their 108-year-old and 107-year-old brands held significant historical value for their members. The MPMA aimed to provide increased value through continued standards development under the AGMA and ABMA brands, enhanced educational and workforce programs, stronger supply chain connections via in-person events, two industry publications, and advocacy at the federal level.

United States Ceramic Ball Bearings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Zirconium Oxide, Silicon Nitride, Others |

| Products Covered | Hybrid Ceramic Ball Bearings, Full Ceramic Ball Bearings |

| Applications Covered | Electric Motors, Automobile, Under Water Equipment, Laboratory Equipment, Aerospace, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States ceramic ball bearings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States ceramic ball bearings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States ceramic ball bearings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceramic ball bearings market in the United States was valued at USD 409.87 Billion in 2024.

The United States ceramic ball bearings market is projected to exhibit a CAGR of 7.31% during 2025-2033, reaching a value of USD 798.73 Billion by 2033.

The United States ceramic ball bearings market is driven by rising demand in electric vehicles, aerospace, and renewable energy sectors. Their superior durability, high-speed performance, and resistance to heat and corrosion make them ideal for precision applications. The growing industrial automation and investment in advanced manufacturing further fuel market expansion.

Midwest currently dominates the United States ceramic ball bearings market due to industrial resurgence in the Midwest, particularly in automotive and aerospace manufacturing, along with growing demand for high-performance, energy-efficient ceramic bearings, and continuous technological innovation in ceramics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)