United States Carpet Market Size, Share, Trends and Forecast by Material, Price Point, Sales Channel, End User, and Region, 2025-2033

United States Carpet Market Size and Share:

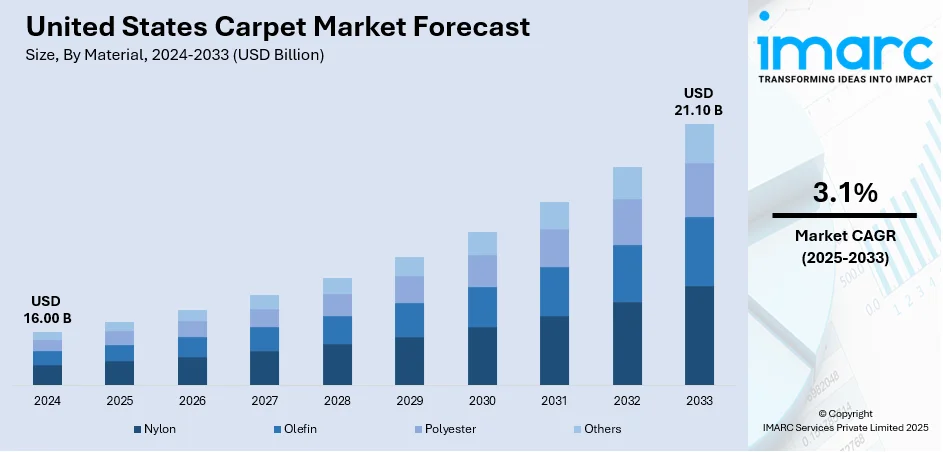

The United States carpet market size was valued at USD 16.00 Billion in 2024. The market is projected to reach USD 21.10 Billion by 2033, exhibiting a CAGR of 3.1% from 2025-2033. South United States is currently dominating the market with a share of 36.6% owing to the growth in residential construction and demand for affordable, multi-purpose flooring, along with changing consumer tastes that center on comfort and interior design, drives market. Materials innovation, most notably with nylon, and the growing popularity of eco-friendly carpet choices drive purchase behavior. Rise in specialty channels increases accessibility and customer interaction. High demand from the Southern region also strengthens market expansion, contributing to ongoing growth and resilience of the United States carpet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.00 Billion |

| Market Forecast in 2033 | USD 21.10 Billion |

| Market Growth Rate 2025-2033 | 3.1% |

Heightened need for multifunctional and appearance-adaptable flooring products is a major influence on the United States carpet market. As customers search for interior design solutions that are both expressive of individual style and functional, carpets are being perceived as highly versatile elements in domestic and public arenas. Moreover, to standard applications, carpets are now utilized to divide open-plan spaces into clearly defined areas, aid in room sound suppression, and contribute to thermal comfort. Modular carpet tiles and the possibility of customizing designs and layouts give the user more liberty to experiment with layout and design. This flexibility answers to changing tastes of design-oriented consumers who value both aesthetics and functionality in their residence or office space. Additionally, the power of dominant interior design fashions through electronic media channels is driving interest in statement rugs and color-coordinated carpets. As per the sources, in January 2025, Ruggable and Architectural Digest introduced a collection of 10 machine-washable, stain-resistant rugs in Archaic, Industrial, and Art Deco designs based on 2025 trends for interior design. Furthermore, as such tastes resonate, demand for carpets that play both functional and aesthetic purposes is bound to boost, underwriting continuous market expansion.

To get more information on this market, Request Sample

Another major force behind the United States carpet market outlook is the increasing dominance of commercial and institutional renovation. Office buildings, schools, and hospitality establishments are being refurbished to meet contemporary design aesthetics and comfort expectations, and carpeting is at the forefront of this process. Carpets minimize ambient noise, generate warm and welcoming environments, and contribute safety attributes through slip resistance, making them ideal for heavy-traffic zones. Their flexibility to choose from an extensive variety of textures, colors, and performance attributes persuades their application in lobbies, corridors, conference spaces, and guest rooms. For instance, in February 2025, Engineered Floors added 30+ new styles to its DreamWeaver and Pentz lines of carpets leveraging High-Def PureColor technology, signaling resurgent demand for colorful, resilient carpets in the residential market.In addition, heightened focus on employees' well-being and aesthetics of the workspace within organizations is further boosting demand for premium carpets with ergonomic and acoustic value. Renovation cycles across public buildings and private businesses alike are increasingly becoming more common, creating a stable, long-term base for demand. This commercial focus extends the carpet market beyond the residential segment, sustaining overall United States carpet market growth.

United States Carpet Market Trends:

Residential Construction and Renovation-Driven Growth

The United States carpet industry is underpinned by steady growth in the construction industry, particularly in residential construction. The rise in housing completions and starts, complemented by continuous home repairs, maintains carpet demand. Home construction projects tend to need carpeting because of its insulating nature, beauty, and comfort. According to the United States Census Bureau, construction spending for the period between January and April 2025 totaled USD 660.2 billion, a consistent increase from the previous year. As new homeowners invest in interior decor and the current ones invest in property enhancement, carpeting continues to be a popular flooring option. As well, more disposable income encourages consumers to select high-end carpets that suit upscale living standards. These forces put carpets as an attractive and fashionable flooring option, making a significant contribution to market growth. The United States carpet market trends remain driven by residential sector expansion, supporting overall carpet market performance.

Sustainability and Eco-Conscious Consumer Preferences

Environmental consciousness is transforming carpet buying in the United States. More and more consumers opt for 'green' carpets produced from natural fibers or recycled materials, which have a smaller ecological footprint. These eco-friendly carpets, which release fewer volatile organic compounds (VOCs), are popular for enhancing indoor air quality and supporting sustainable living objectives. Response from manufacturers has been the introduction of eco-friendly ranges, with plant-based fibers, biodegradable elements, and recyclable content being integrated into manufacturing processes. This change complements wider consumer demands for ethically and responsibly produced goods across all home furnishing sectors. The market is also seeing an increase in certifications and green labels that confirm sustainable claims, driving purchasing decisions. As environmental health and climate change concerns continue to develop, the need for sustainable carpets will probably build steadily. This trend serves both individual tastes and fits into national initiatives to drive greener building practices. The overall growth of the United States Carpet Market is favorably influenced by this environmental focus.

Innovation and Digital Sales Redefine Consumer Experience

Materials innovation, functionality, and retail channel innovation are leading to the transformation of the United States carpet market landscape. Advances in technology for carpet design have enabled the creation of stain-resistance, moisture-resistance, and durability, improving the convenience of use and product life for users. Carpets today incorporate advanced features without affecting their looks, thus becoming interesting to fashion-savvy customers. Simultaneously, the rise of e-commerce has revolutionized the way carpets are sold and bought. Customers increasingly use digital platforms for variety, price comparison, and home delivery, thus widening the reach of brands across geographical limits. Virtual room visualizers, AR-based previews, and customization tools further enhance the shopping experience on the web. These developments are drawing in younger consumer groups and technologically advanced purchasers. Additionally, companies are focusing on R&D to launch more value-added products that cater to changing lifestyle requirements. With growing residential completions and changing tastes, these trends reflect major United States Carpet Market developments. The market share is therefore experiencing consistent and varied growth across the country.

United States Carpet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States carpet market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, price point, sales channel, and end user

Analysis by Material:

- Nylon

- Olefin

- Polyester

- Others

Nylon accounted for 44.3% of the United States carpet market forecast in 2024, because of its better performance features and general consumer popularity. Nylon carpets are known for their excellent durability, resistance to stains, and resilience, and are therefore suitable for heavy-traffic commercial and residential spaces. This material maintains its texture and color for a long time, even with constant wear, which improves its value proposition. Nylon also responds well to various dyeing techniques, offering vibrant, long-lasting color options that appeal to design-conscious buyers. As manufacturers integrate nylon with advanced treatments like soil resistance and antimicrobial coatings, the material becomes even more competitive. Its versatility in texture, from plush to looped styles, allows it to suit diverse interior design preferences. Nylon’s cost-effectiveness over time, given its longevity and low maintenance needs, further strengthens its appeal. These qualities continue to maintain its leading share in the U.S. carpet material market.

Analysis by Price Point:

- Economy

- Luxury

With a 57.6% share in 2024, the economy price segment dominated the United States carpet market, fueled by high demand from cost-conscious homeowners and volume buyers like rental property managers. This segment has carpets that provide simple functional value, usually made from man-made fibers and available in neutral colors appropriate to mass marketability. Price continues to be a primary consideration in buying, especially for starter homes, temporary housing, and high-density home projects where cost-effectiveness is paramount. Economic instability and volatile consumer confidence have also underscored value-based purchase behavior, ensuring this segment's dominance. Furthermore, advancements in production processes enable manufacturers to provide affordable carpets with satisfactory quality and decent durability. Consequently, the economy segment reconciles cost with functionality and is a steady option in most income groups. Its popularity in most suburban and rural markets further establishes itself as the go-to pricing segment in the U.S. carpet market.

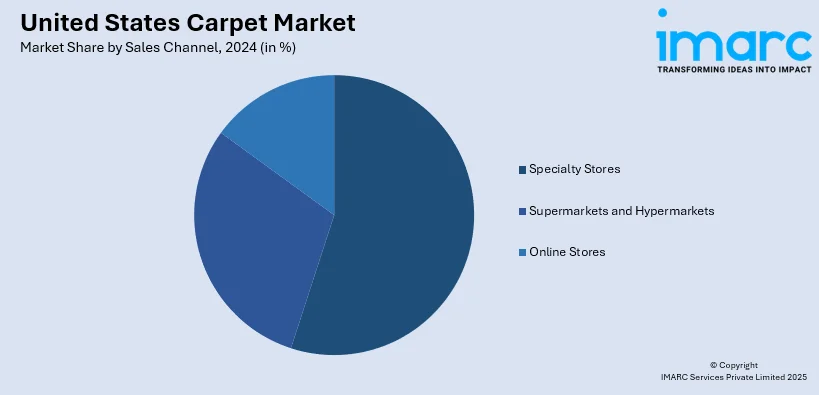

Analysis by Sales Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

Specialty stores dominated carpet distribution in the United States with a 41.7% market share in 2024, providing shoppers with a dedicated, high-service setting for flooring shopping. These stores offer detailed product expertise, one-on-one advice, and exposure to more extensive customization choices, enabling consumers to make well-informed choices based on their lifestyle, design intentions, and budget. Specialty stores tend to feature a wide range of premium, green, and technologically advanced carpet types not easily accessible at mass-market stores. Their capacity to serve particular project demands, whether home remodeling or office interior design, further enhances their popularity. In addition, post-sales assistance and professional installation provided by most specialty stores help reassure customers and ensure loyalty. With consumers still valuing quality and consultative shopping experiences, this channel enjoys repeat business and word-of-mouth referrals. The resultant trust and knowledge involved in these outlets make them a leading force in the U.S. market for carpet sales.

Analysis by End User:

- Residential

- Commercial

In 2024, the residential category represented 73.8% of the United States carpet market, confirming its leading position as the sole end-use category. Homeowners always prefer carpeting for living rooms, bedrooms, and basements because of the comfort, warmth, and acoustical benefits it offers. Carpet's capacity for interior softness and visual enhancement makes it an American household staple, especially for colder climates, where thermal insulation advantages are appreciated. The popularity of wall-to-wall carpeting and the recent popularity of stacking rugs on top of hard surfaces have maintained high consumer demand. As a result, single-family homeownership has increased, and renovation activity has been on the rise, all for sustained demand. Homebuilders and interior designers continue to specify carpet solutions for new and remodeled projects, augmenting residential consumption. Advances in terms of hypoallergenic fibers and pet-friendly materials also serve contemporary household requirements. Complementing a strong emotional and functional tie to comfort, the residential market continues to dominate nationwide consumption.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The US South region had a dominant 36.6% market share in 2024, owing to its large residential base and consistent new construction. The South states, including Texas, Georgia, and Florida, have witnessed strong housing development, driven by population growth and encouraging economic conditions. The comfort and affordability of carpet render it a desirable flooring option for single-family residences, apartments, and rentals in both urban and suburban settings. The climate of the region, which is humid to temperate, also favors carpet usage for its ability to help regulate temperatures. Cultural tastes and interior designs favoring warm, inviting interiors also factor into this regional demand. The Southern market is also supported by a well-developed network of retail and specialty flooring stores with broad product options that meet local tastes. With high homeownership rates, the South is still grounding national carpet consumption patterns.

Competitive Landscape:

The United States carpet market has a fragmented and dynamic competitive environment with a combination of domestic producers, regional players, and international players selling a variety of carpet products. Design variety, price, technological advancements, and sustainability are the markets' competition issues on which the players vie for consumer attention in residential, commercial, and institutional segments. Product differentiation by way of customization, extension of color palette, and blend of fibers is a primary focus, with certain companies underscoring performance-oriented carpets and others emphasizing traditional craftsmanship or environmental sustainability. Distribution channels also assume significant importance, with producers utilizing physical distribution networks along with direct-to-consumer digital platforms for widening reach. Tie-ups with interior designers, home improvement stores, and real estate developers also enhance market strength. As lifestyles and consumer tastes move towards luxury and functionality, players are going all out in branding and marketing to make their presence felt. Such a highly competitive yet fragmented marketplace promotes ongoing innovation and sensitivity to arising trends in design and lifestyle.

The report provides a comprehensive analysis of the competitive landscape in the United States carpet market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Interface Inc., headquartered in Atlanta, launched the Dressed Lines global collection of carpet tiles. The range, which takes its inspiration from post-war modernism, continues the company's tradition of pioneering craftsmanship by providing a holistic design experience and a fresh take on enduring designs through creative patterns, constructions, and manufacturing methods.

- May 2025: Carpet Planet unveiled its standalone USA website to offer its unique blend of trustworthy, budget-friendly, and sophisticated carpets to customers all over the United States. It is a major milestone towards the brand's vision to become a household name in upscale carpeting solutions in the United States.

- February 2025: Interface, Inc. has introduced two new lines of carpet tiles to the market, the Material Impressions and the Open Road. These lines expand the i2TM portfolio of the company and mark the 25th anniversary of the launch of this revolutionary design philosophy.

- January 2025: Multinational flooring firm Tarkett recently introduced the Preserved Treasures carpet collection. Developed with life-plan communities in mind, the collection provides a refined style of design that will be a source of exceptional performance and durability for years to come.

United States Carpet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Nylon, Olefin, Polyester, Others |

| Price Points Covered | Economy, Luxury |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States carpet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States carpet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carpet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carpet market in the United States was valued at USD 16.00 Billion in 2024

The United States carpet market is projected to exhibit a CAGR of 3.1% during 2025-2033, reaching a value of USD 21.10 Billion by 2033

Key drivers are the growth in demand for multifunctional and design-focused flooring, higher residential construction and renovation, and the rising popularity of cost-effective carpet alternatives. Increased product innovation, consumer demand for comfort and look, and the broadening of specialty retail channels also contribute to maintained growth in both residential and commercial use in United States carpeting market

The South constitutes the biggest market share of the United States carpet sector at 36.6% in 2024. Its dominance is motivated by strong housing activity, population expansion, and cultural inclinations toward carpeted floors. The South's beneficial construction tendencies and ubiquity of affordable flooring options continue to sustain its leadership role in domestic carpet usage

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)