United States Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

United States Carbon Black Market Size and Share:

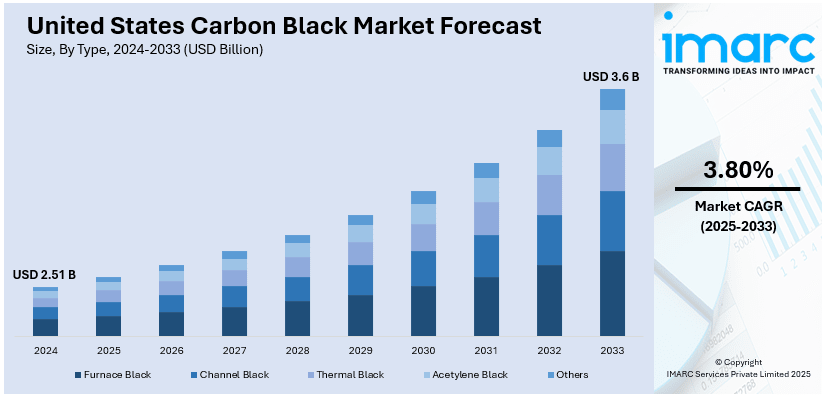

The United States carbon black market size was valued at USD 2.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.6 Billion by 2033, exhibiting a CAGR of 3.80% from 2025-2033. The market is influenced by its extensive use in tire manufacturing, industrial rubber products and plastics. Key players drive innovation to meet regulatory requirements while environmental concerns continue to shape industry dynamics and future opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.51 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Market Growth Rate (2025-2033) | 3.80% |

The key United States carbon black market trends include the widespread application in the automotive sector for tire manufacturing and rubber reinforcement. An increase in vehicle production along with the growing demand for durable and high-performance tires drives the need for carbon black. According to industry reports, in Q4 2024, the U.S. automakers witnessed strong sales driven by electric vehicle demand. General Motors led with a 21% sales rise and over 44,000 E.V.s sold. Ford's sales increase nearly 9%. Overall, E.V.s accounted for 8% of new vehicle purchases in 2024. Its role in enhancing the physical properties of rubber, such as tensile strength and abrasion resistance, that makes it indispensable in producing industrial rubber goods, further driving market growth.

Another major driver is the increasing demand of carbon black in paints, coatings, and plastics industries. Carbon black provides UV protection and color stability to plastic products and also helps in intensifying the pigmentation of coatings. The growing focus on sustainable manufacturing processes has introduced innovation in recovered carbon black that will be greener and address the environmental concerns of the leading industries. For instance, in June 2024, CSRC announced partnership with SHEICO's Eco Infinic to establish North America's largest ecofriendly carbon black plant at the Continental Carbon Company (CCC) Phenix site slated to begin production in 2026. The facility aims to produce 30,000 tons of recovered carbon black annually supporting sustainable tire materials and carbon neutrality goals.

United States Carbon Black Market Trends:

Shift Towards Sustainable Solutions

With increasing environmental concerns and stricter regulations, industries are shifting toward adopting sustainable practices, and this has led to a demand for recovered and sustainable carbon black (rCB). Being a recycled material rCB offers a lower environmental footprint by reducing greenhouse gas emissions and waste from end-of-life tires. The automotive and plastics industries are increasingly using rCB to meet sustainability goals without sacrificing performance. This trend has been bolstered by efforts to standardize and improve the adoption of recovered carbon black in industrial applications. For instance, in July 2024, ASTM International's recovered carbon black committee announced its plans to develop a standard to determine storage duration and effects on material quality. This guideline intends to prevent unnecessary disposal of recovered carbon black from end-of-life tires promoting responsible usage in various industries and supporting sustainability initiatives. This is an indication of growing industry efforts to align with circular economy principles and address environmental and resource challenges, which, in turn, is intensifying the United States carbon black market demand.

Rising Infrastructure Activities

The rise in construction activities across the United States considerably increases the demand for carbon black especially in asphalt, paints and coatings. Carbon black improves the strength, UV resistance and color retention of these products making it quintessential in infrastructure construction projects like roads, bridges and commercial buildings. As governments continue to invest in infrastructure modernization and urban development the use of carbon black in bitumen for paving applications and protective coatings for structural components continues to rise. For instance, in June 2024, the Biden-Harris Administration announced $1.8 billion in Rebuilding American Infrastructure with Sustainability and Equity (RAISE) grants for 148 infrastructure projects across all 50 states totaling over $7.2 billion since 2021.

Expansion of Automotive Sector

Increased demand for carbon black is emerging due to the rapidly expanding automotive industry especially with electric vehicles (EVs) as they have high requirements for lightweight and highly durable rubber parts. According to a report from the International Energy Agency, U.S. vehicle sales during the first quarter of 2024 totaled approximately 350,000 representing an increase of nearly 15% compared to the previous year. Notably, sales of plug-in hybrid electric vehicles (PHEVs) experienced a remarkable surge of 50%. Carbon black is a vital additive in tire manufacturing which helps to increase the strength, durability and wear resistance of the tire. As EVs require high-performance tires capable of handling unique torque and weight distribution characteristics the need for advanced rubber products is growing. Carbon black is used in automotive seals, hoses and gaskets further fueling the demand. This trend emphasizes the role carbon black plays in meeting the growing performance needs of the increasing EV industry. This, in turn, is contributing to the United States carbon black market growth.

United States Carbon Black Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States carbon black market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, grade and application.

Analysis by Type:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

Furnace black is expected to hold a significant United States carbon black market share. It is produced by the incomplete combustion of hydrocarbons. It is available in a variety of particle sizes and structures. It is used in the production of tires, rubber reinforcement and industrial applications. It is also used in coatings, inks and plastics industry. The demand for high-performance tires in the automotive industry and the construction industry's demand for durable materials are the main drivers of its usage. Its cost-effectiveness and large-scale production make it a key type in the market.

Channel black has a fine particle size and high surface area. It is thus suitable for applications that require intense pigmentation and durability. Its primary applications are in coatings, plastics and inks. Channel black gives deep black coloration and enhances the life of the material. However, environmental concerns and limited production methods have reduced its availability. Nonetheless, it remains important for niche applications where high purity and performance are critical.

Thermal black has low surface area and larger particle size which is produced through thermal decomposition. The material is generally used in the applications where the low reinforcement properties are required such as in gaskets, hoses and seals. Its high resilience and cost-efficient production support its use in non-tire rubber goods and some specialty polymers.

Acetylene Black Acetylene black is derived from the pyrolysis of acetylene gas. It has a high purity level and excellent electrical conductivity. It is used in batteries, conductive plastics and cables. Its thermal stability and ability to enhance conductivity make it a crucial material for the electronics industry. Growing demand for high-end battery technologies especially in renewable energy systems will further drive its market.

Analysis by Grade:

- Standard Grade

- Specialty Grade

Standard grade carbon black is the most widely used grade in the United States primarily in the tire and rubber industries. Its main applications include enhancing durability, wear resistance and mechanical strength in tires, conveyor belts and other industrial rubber goods. The growing demand for automotive tires driven by an expanding vehicle fleet supports the dominance of this grade.

Specialty grade carbon black is developed for high-performance applications with superior properties like high purity, fine particle size and enhanced coloration. It is used in large volumes in plastics, coatings, inks and advanced electronics. This grade is critical to industries that require specific performance characteristics such as UV protection and electrical conductivity. Its market growth is further contributed by increasing adoption in renewable energy solutions including solar panel production and battery technologies.

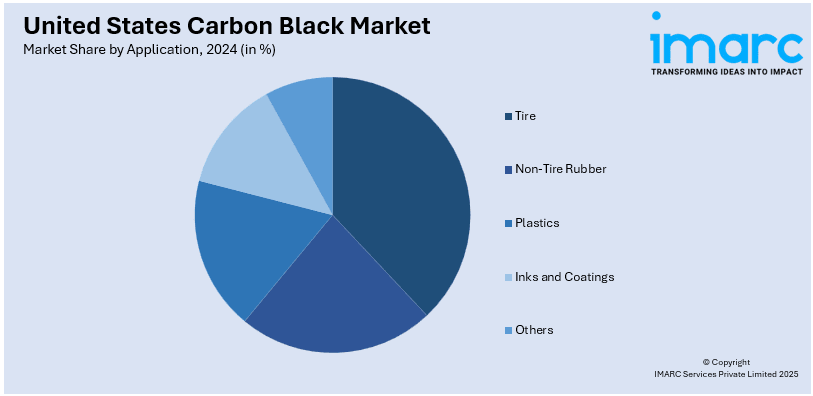

Analysis by Application:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

The tire industry is the largest application for carbon black in the U.S. market. Carbon black is a primary reinforcing agent that enhances the durability, wear resistance and performance of tires. Carbon black improves tensile strength which in turn extends the tire lifespan under heavy use. With increasing vehicle production and replacement tire demand especially in the automotive and commercial sectors tire manufacturing continues to drive carbon black consumption. Increased adoption of electric vehicles drives the need for new innovations in tire formulations thus promoting the market growth.

Non-tire rubber applications comprising seals, hoses, belts and gaskets form a significant segment of the carbon black market. Carbon black acts as a reinforcing filler which enhances the mechanical strength, elasticity and resistance of such products to wear and environmental effects. Industrial applications in machinery, construction and automotive components heavily rely on non-tire rubber products. The expansion of infrastructure projects and the growing demand for durable industrial goods contribute to sustained growth in this segment.

Carbon black in the plastics industry serves as a pigment, UV stabilizer and conductive additive. It gives plastic products an improved durability and appearance along with thermal properties. Its uses include packaging materials, automotive parts, electrical devices and building materials. In the automotive and infrastructure development fields the increased demand for lighter and more environment-friendly materials makes carbon black indispensable in plastics because it improves the performance of the polymer under demanding conditions.

Carbon black is an essential ingredient in inks and coatings that provide excellent pigmentation, tinting strength and opacity. This product is used mainly in printing inks, industrial coatings and decorative paints. Its consumption is promoted by the growth of high-performance coatings in automotive and construction segments. It also plays a key role in giving a good aesthetic appeal and enhancing durability hence its use is critical in packaging and commercial printing. The steady innovation in specialty inks and advanced coatings continues to fuel growth of carbon black in this application.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast U.S. carbon black market benefits from its established industrial base and proximity to major automotive and manufacturing hubs. The region's demand is driven by tire production, non-tire rubber application and industrial coatings. The high density of urban areas and infrastructure development supports the use of carbon black in plastics and construction materials. Growth in renewable energy initiatives such as solar panel production is also contributing to the demand for specialty-grade carbon black.

The Midwest is a key market for carbon black due to its concentration of automotive and industrial manufacturing facilities. The region's strong demand for carbon black in tire production is fueled by the automotive industry's presence especially in states like Michigan and Ohio. The agriculture and machinery sectors drive the need for non-tire rubber goods and durable plastics. Infrastructure upgrades and construction projects further boost the market particularly for coatings and specialty grade products.

The South U.S. region leads in carbon black consumption due to its robust automotive, petrochemical and manufacturing industries. States such as Texas and Louisiana house major production facilities ensuring a steady supply for tire and non-tire rubber applications. The region’s growth in construction and infrastructure projects supports increased demand for plastics and coatings. The expanding energy sector including renewable energy initiatives drives the use of specialty carbon black in advanced technologies.

The Western U.S. market for carbon black is driven by the region's focus on sustainability and technological innovation. California with its significant automotive and renewable energy sectors plays a leading role. Demand for specialty-grade carbon black is high for applications in battery technologies electronics and advanced coatings. The region’s construction and infrastructure projects also contribute to the demand for carbon black in plastics and coatings. Emphasis on green energy and electric vehicles further supports market growth.

Competitive Landscape:

The United States carbon black market is characterized by the presence of established global and regional manufacturers. Key players are dominating with extensive production capacities and diversified product portfolios. Competition is driven by innovation in specialty grades catering to advanced applications like batteries and electronics. Strategic initiatives such as capacity expansions, mergers and partnerships are prevalent to strengthen market positions. Environmental regulations and sustainability trends encourage investments in eco-friendly production processes. Smaller players focus on niche markets leveraging localized demand. The automotive, construction and renewable energy sectors significantly influence competitive dynamics with companies prioritizing technological advancements to meet evolving industry needs and maintain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the United States carbon black market with detailed profiles of all major companies, including:

- Birla Carbon Thailand Public Co. Ltd.

- Cabot Corporation

- Orion Engineered Carbons SA

- Phillips Carbon Black Limited

- CSRC Group

- Omsk Carbon Group

- OCI COMPANY Ltd.

- Himadri Speciality Chemicals Ltd.

- Longxing Chemical Industry Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

Latest News and Developments:

- In December 2024, Cabot Corporation announced a global price increase for its carbon black products effective. The decision follows rising inflation impacting labor and manufacturing costs, as well as supply chain issues. The adjustments aim to maintain product quality and ensure reliable service while supporting sustainability goals.

- In March 2024, Cabot Corporation launched its new PROPEL® E8 engineered reinforcing carbon black enhancing tire tread durability and reducing rolling resistance for electric vehicles. This innovative product addresses the increased wear due to EV weight and torque supporting more efficient and longer-lasting tires contributing to sustainability in the automotive industry.

United States Carbon Black Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States carbon black market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States carbon black market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States carbon black market was valued at USD 2.51 Billion in 2024.

The United States carbon black market is driven by the rising demand in tire manufacturing, industrial rubber products, and plastics, fueled by growth in the automotive and construction sectors. Increasing focus on sustainable production methods and advancements in specialty grades further support market expansion while addressing environmental concerns. These factors, collectively, are creating a positive United States carbon black market outlook.

IMARC estimates the United States carbon black market to reach USD 3.6 Billion by 2033, exhibiting a CAGR of 3.80% during 2025-2033.

Some of the major key players include, Birla Carbon Thailand Public Co. Ltd., Cabot Corporation, Orion Engineered Carbons SA, Phillips Carbon Black Limited, CSRC Group, Omsk Carbon Group, OCI COMPANY Ltd., Himadri Speciality Chemicals Ltd., Longxing Chemical Industry Co., Ltd., Mitsubishi Chemical Holdings Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)