United States Calcium Chloride Market Size, Share, Trends and Forecast by Application, Product Type, Raw Material, Grade, and Region, 2025-2033

United States Calcium Chloride Market Size and Share:

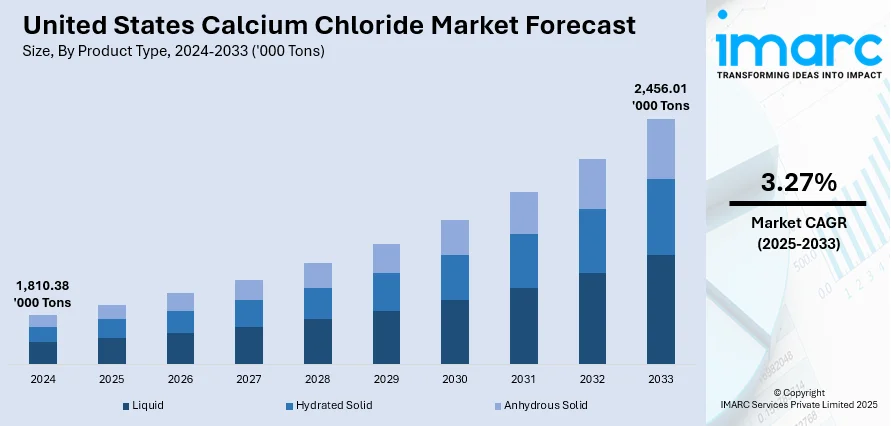

The United States calcium chloride market size reached 1,810.38 Thousand Tons in 2024. Looking forward, IMARC Group estimates the market to reach 2,456.01 Thousand Tons by 2033, exhibiting a CAGR of 3.27% during 2025-2033. Widespread use as a de-icing agent on roads during winter, especially in the Midwest, is one of the factors contributing to the United States calcium chloride market share. Other key drivers include its use in the oil and gas industry for drilling fluids, dust control and road stabilization in construction, and as a food preservative and firming agent.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1,810.38 Thousand Tons |

|

Market Forecast in 2033

|

2,456.01 Thousand Tons |

| Market Growth Rate 2025-2033 | 3.27% |

The market is primarily driven by its widespread use in de-icing and dust control, especially in colder regions and on unpaved roads. The compound is also essential in the oil and gas industry, where it is used in drilling fluids to stabilize shale formations. Infrastructure development and road maintenance projects continue to increase demand. Calcium chloride’s hygroscopic properties make it effective for moisture control in construction and packaging. It's also used in food processing, refrigeration brines, and wastewater treatment due to its chemical stability and cost efficiency. Domestic availability of limestone and hydrochloric acid, key raw materials, further supports production. Additionally, the agricultural sector uses it to improve soil quality and crop yield. These combined United States calcium chloride market trends are boosting both consumption and manufacturing across multiple industries.

To get more information on this market, Request Sample

The market for calcium chloride is broadening beyond its traditional uses. A notable shift is occurring with the adoption of innovative solutions to treat water from oil and gas operations. Additionally, the substance is increasingly being integrated into new, sustainable energy technologies, highlighting a significant move toward environmental applications and energy transition initiatives in the United States. For instance, in March 2025, TETRA Technologies collaborated with EOG Resources in the United States on a pilot project using its Oasis TDS solution to treat produced water from oil and gas wells. The company also continued supplying calcium chloride for diverse applications while expanding its presence in sustainable energy solutions.

United States Calcium Chloride Market Trends:

Seasonal Volatility in Demand

The demand for certain de-icing agents is significantly influenced by seasonal weather patterns, shaping the United States calcium chloride market outlook. A substantial volume of de-icing operations is performed annually at major transportation hubs, with the total number of applications fluctuating based on the severity of winter conditions. This demonstrates a strong link between cold-weather events and consumption, as a greater number of icy days directly correlates with higher demand for materials used to ensure safe travel. This sensitivity to climate highlights a key driver for the demand side of this particular commodity, creating a variable and reactive consumption pattern that shifts from one winter to the next. For example, it has been reported that at Chicago O'Hare International Airport (ORD), aircraft are deiced approximately 6,000 to 10,000 times per winter season, depending on weather conditions.

Proliferation of Quick-Service Dining

Driven by consumer demand for convenience and affordability, the quick-service restaurant (QSR) sector in the United States continues to expand its physical footprint. This growth reflects a broader societal shift toward on-the-go lifestyles and a preference for readily available meal options. A notable example of this market's vitality is the substantial presence of a major hamburger chain, which has steadily increased its number of outlets across the nation. This significant network of establishments highlights the company's aggressive growth strategy and its strong position within a competitive landscape. The widespread opening of these kinds of food service outlets is a clear indication of a robust and expanding market, catering to consumers' desire for readily accessible dining options. For instance, there are 13,647 McDonalds restaurants in the United States as of June 30, 2025. The product is considered generally recognized as safe (GRAS) by the United States Food and Drug Administration (USFDA), which, in turn, supports the United States calcium chloride market growth.

Construction Sector Expansion Fueling Chemical Demand

The US construction industry is poised for continued expansion, with total spending projected to be significant in 2025. This robust activity, driven by both residential and non-residential projects, is creating a positive market environment for construction materials and additives. A notable beneficiary of this growth is calcium chloride, which is widely utilized to enhance concrete performance, especially in colder climates. It acts as an accelerator, speeding up the curing process and improving early strength, which helps to maintain project schedules. As per the United States calcium chloride market forecast, the overall dynamism in the building and infrastructure sectors is directly correlated to a heightened requirement for chemical compounds that are expected to improve efficiency and durability in construction applications. According to research, in 2025, the US construction industry is expected to reach an estimated USD 2.15 Trillion in total spending.

United States Calcium Chloride Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States calcium chloride market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, product type, raw material, and grade.

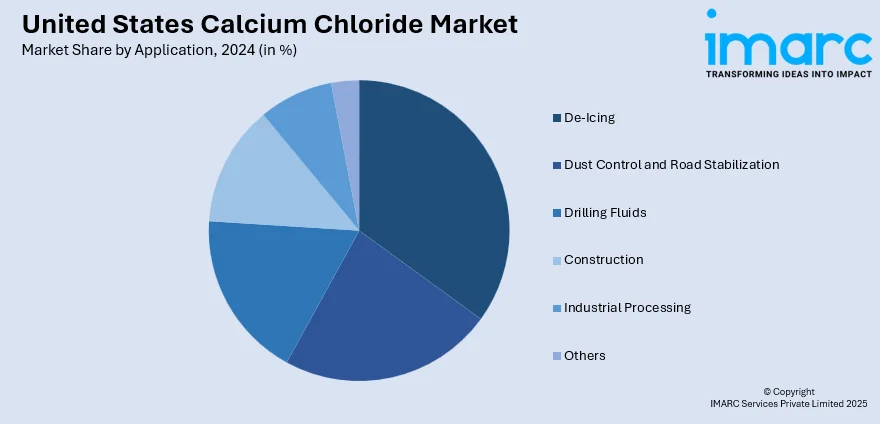

Analysis by Application:

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

De-icing stood as the largest application in 2024. The country's extensive road network and harsh winter conditions across northern and central states create a strong need for effective snow and ice management. Calcium chloride performs well in low temperatures, melting ice faster than alternatives like sodium chloride. This makes it the preferred choice for municipalities, state DOTs, and private contractors responsible for maintaining safe roadways. Its ability to absorb moisture also helps reduce dust and improve traction, further supporting safety during freezing conditions. Seasonal stocking ahead of winter and repeat purchasing by transportation departments significantly support volume growth. The recurring and weather-dependent nature of de-icing ensures calcium chloride remains a consistent and essential product in the US market, sustaining demand across both public and commercial sectors.

Analysis by Product Type:

- Liquid

- Hydrated Solid

- Anhydrous Solid

Hydrated solid led the market in 2024 due to its versatility, cost-effectiveness, and ease of handling. Hydrated solid forms like flake and pellet are widely used for de-icing, dust control, and concrete acceleration. These products are easier to store, transport, and apply compared to liquid forms, making them attractive for municipalities, road maintenance crews, and construction firms. Their extended shelf life also appeals to buyers managing long-term inventory or operating in regions with seasonal demand. In construction, hydrated calcium chloride speeds up curing in cold weather, improving work schedules. For dust control, it offers effective moisture retention on unpaved roads. The solid form’s lower risk of spillage and compatibility with standard spreading equipment further support its growing adoption across industrial and public applications.

Analysis by Raw Material:

- Natural Brine

- Solvay Process (by-Product)

- Limestone and HCL

- Others

Natural brine led the market in 2024 due to its cost-efficiency, abundance, and suitability for large-scale production. Sourced primarily from brine wells and salt lakes, natural brine offers a steady, low-cost raw material for manufacturers. It enables high-volume calcium chloride output without the energy-intensive processes required for synthetic alternatives. This appeals to producers aiming to meet growing demand from sectors like road de-icing, oil and gas, and dust suppression. In oilfield applications, calcium chloride derived from brine is used in drilling fluids and completion operations. States like Michigan and Utah have well-established brine operations, ensuring a consistent supply and regional competitiveness. The ability to scale operations using natural sources without heavy environmental disruption further strengthens the segment’s role in driving market growth.

Analysis by Grade:

- Food Grade

- Industrial Grade

Industrial grade led the market in 2024, owing to its wide use across key industries such as oil and gas, construction, mining, and wastewater treatment. In oilfield operations, industrial-grade calcium chloride is essential for drilling fluids, completion brines, and cementing applications, supporting wellbore stability and improving drilling efficiency. In construction, it accelerates concrete setting in cold weather, allowing year-round building activity. Mining operations use it for dust control and moisture retention on haul roads. Industrial-grade calcium chloride is also applied in water treatment processes to remove impurities and adjust hardness levels. Its high concentration, performance reliability, and relatively lower cost make it suitable for large-scale, repeat-use applications. The steady demand from these sectors keeps the industrial grade segment central to overall market growth in the United States.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The United States calcium chloride market's drivers vary significantly by region. In the Northeast and Midwest, demand is primarily seasonal, driven by the need for de-icing agents to ensure safe roads during harsh winters. Here, calcium chloride's effectiveness at lower temperatures and its quick-melting properties are key. In the South and West, however, the market is driven by different, more year-round applications. The robust oil and gas industries in these regions use calcium chloride extensively in drilling and well completion fluids. Additionally, the construction sector, particularly in the growing urban areas of the South and West, relies on calcium chloride as a concrete accelerator to speed up the setting process. Across all four regions, there is also a consistent demand for calcium chloride for dust control on unpaved roads and construction sites, a use that capitalizes on its hygroscopic nature.

Competitive Landscape:

The US calcium chloride market is seeing steady activity through product development, supply chain collaborations, and application-specific innovations. Companies are focusing on expanding their distribution networks, optimizing production capabilities, and forming partnerships to serve industries like de-icing, oil and gas, and agriculture. Private-sector agreements and joint ventures are more common than public initiatives. While government involvement and funding are minimal, research and development is continuing, mostly within corporate labs to explore new formulations and broader use cases. Among all these, partnerships and supply agreements stand out as the most common strategies currently, driven by demand for consistent supply and regional availability. Most developments are aimed at strengthening the domestic supply and targeting niche industrial uses.

The report provides a comprehensive analysis of the competitive landscape in the United States calcium chloride market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: HigherGov announced a government contract opportunity for calcium chloride for the 2025–26 winter season in Davenport, Iowa. The procurement highlighted the United States' preparations for winter road safety and de-icing operations.

- April 2025: TETRA Technologies expanded its Evergreen Unit in the United States' Smackover Formation, where new test wells revealed rich volumes of lithium, bromine, and critical minerals. The company also continued supplying calcium chloride for various applications while advancing resource development and extraction technologies.

- May 2025: The Franklin Regional Council in Massachusetts released an RFP for calcium chloride tank and system procurement for FY 2026. The initiative aimed to enhance road maintenance efforts and included potential sourcing connections with the United States suppliers of calcium chloride solutions.

- February 2025: Berrien County in Michigan issued a tender for two liquid calcium chloride road-spread applications scheduled for May and August 2025. The initiative aimed to enhance dust control and road stabilization efforts in the United States.

United States Calcium Chloride Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | De-Icing, Dust Control and Road Stabilization, Drilling Fluids, Construction, Industrial Processing, Others |

| Product Types Covered | Liquid, Hydrated Solid, Anhydrous Solid |

| Raw Materials Covered | Natural Brine, Solvay Process (by-Product), Limestone and HCL, Others |

| Grades Covered | Food Grade, Industrial Grade |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States calcium chloride market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States calcium chloride market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States calcium chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The calcium chloride market in the United States reached 1,810.38 Thousand Tons in 2024.

The United States calcium chloride market is projected to exhibit a CAGR of 3.27% during 2025-2033, reaching 2,456.01 Thousand Tons by 2033

Key drivers of the US calcium chloride market include demand from de-icing and dust control, growth in oil and gas drilling, rising infrastructure activity, and use in food processing and wastewater treatment. Availability of raw materials and cost-effective production also support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)