United States Blueberry Market Size, Share, Trends and Forecast by Application, Distribution Channel, Packaging Type, and Region, 2025-2033

United States Blueberry Market Size and Share:

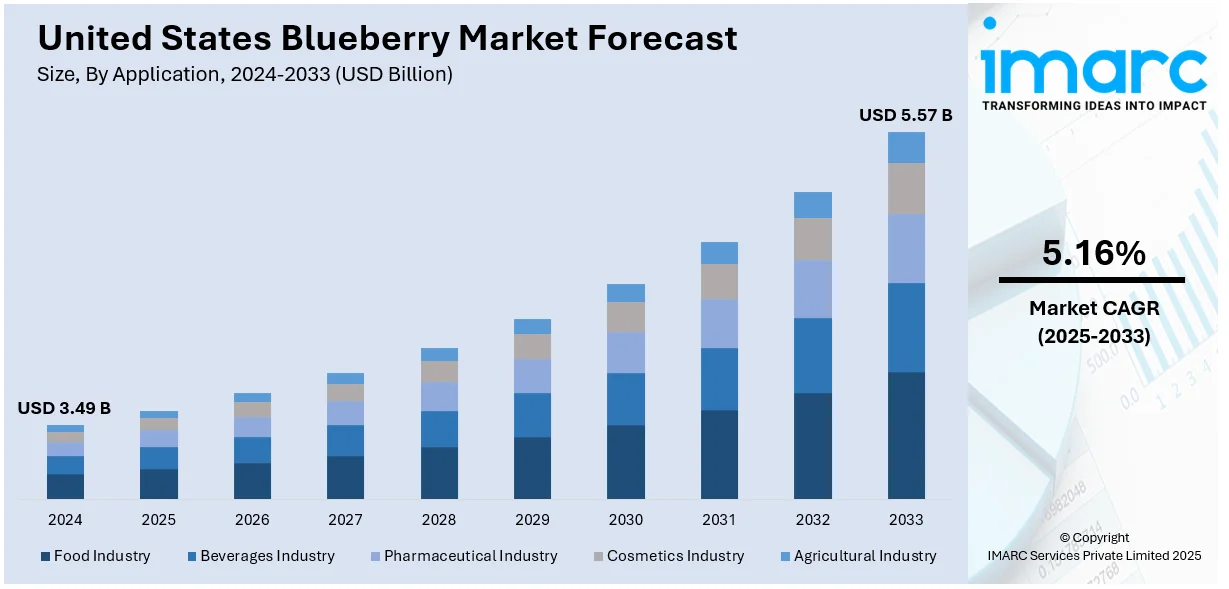

The United States blueberry market size was valued at USD 3.49 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.57 Billion by 2033, exhibiting a CAGR of 5.16% from 2025-2033. The market is fueled by the rising demand for healthy foods, expanding processed and packaged blueberry products, growth in domestic production, increasing online and direct-to-consumer sales, and adoption of sustainable farming practices, ensuring year-round supply, market expansion, and consumer accessibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.49 Billion |

| Market Forecast in 2033 | USD 5.57 Billion |

| Market Growth Rate (2025-2033) | 5.16% |

Expanding blueberry cultivation in California, Oregon, Washington, Georgia, and Florida ensures year-round supply. Innovations in precision agriculture, irrigation, and sustainable farming enhance productivity while reducing costs. Improved cold chain logistics, packaging solutions, and transportation networks support wider distribution across retail and foodservice channels. Government-backed research and cooperative farming initiatives strengthen market efficiency, ensuring consistent quality and pricing stability. Increasing organic production and regenerative farming practices further expand consumer access to premium-quality blueberries. An enhanced focus on packaging is also driving the market toward growth significantly. For instance, in July 2024, Pearl Sort launched the Blue Pearl, a cutting-edge Blueberry Category Sorter designed specifically for the new market. The Blue Pearl is prepared to transform the blueberry packaging sector following five years of intense study, development, and testing.

E-commerce and DTC sales channels are transforming blueberry distribution through Amazon Fresh, Walmart+, and Instacart, allowing consumers to purchase fresh and frozen blueberries conveniently. Farm-to-table subscription services promote organic and specialty blueberry varieties, catering to premium markets. Meal kit services and digital grocery platforms enhance accessibility. Online retailers use data-driven marketing, influencer collaborations, and personalized promotions to increase consumer engagement. The shift toward contactless shopping and home delivery services is further accelerating blueberry sales growth. For instance, in May 2024, The US Highbush Blueberry Council (USHBC) started a consumer and shopper marketing campaign to boost the volume of fresh and frozen blueberries sold in retail stores.

United States Blueberry Market Trends:

Expansion of Processed and Packaged Blueberry Products

The growing use of blueberries in processed foods is driving market growth, with demand surging in bakery, dairy, confectionery, and beverages. Blueberries are widely used in breakfast cereals, protein bars, energy drinks, and flavored waters. Food manufacturers develop freeze-dried, powdered, and puree forms to enhance product versatility. The rise of RTD (ready-to-drink) beverages and functional snacks supports increased blueberry integration. Additionally, expanding private-label offerings and premium product lines in supermarkets encourages greater consumer adoption of blueberry-based packaged goods, reinforcing the fruit’s role in the processed food industry. For instance, in July 2024, the notable dried fruit snack company Sun-Maid Growers of California launched Blueberry & Vanilla Yogurt Covered Raisins. This new flavor was created with the assistance of the Sun-Maid Board of Imagination, a group of imaginative children aged 6 to 12 who collaborated with Sun-Maid executives to explore new concepts.

Growth in Domestic Production and Supply Chain Efficiency

The U.S. blueberry industry has expanded cultivation in California, Oregon, Washington, Georgia, and Florida, ensuring a year-round supply. Advancements in precision farming, irrigation systems, and controlled-environment agriculture optimize yields while reducing environmental impact. Enhanced cold chain logistics, packaging innovation, and extended shelf-life technologies support greater blueberry distribution nationwide. Investments in sustainable farming and organic certification drive market penetration, while government-backed research encourages further production efficiency. Strong cooperative networks among growers ensure price stability and consistent supply, strengthening blueberries' presence in retail, foodservice, and export markets. For instance, in May 2023, the U.S. Highbush Blueberry Council (USHBC) announced the launch of the BerrySmart Insights platform for fresh blueberries, a voluntary, automated production and historical price database that provides a weekly report on supply, demand, inventory, and shipments and more precise production, inventory, and pricing measurements.

Expanding Online and Direct-to-Consumer (DTC) Sales

E-commerce and direct-to-consumer (DTC) sales channels are transforming the U.S. blueberry market. Online grocery platforms like Amazon Fresh, Walmart+, and Instacart facilitate home delivery of fresh and frozen blueberries, meeting the demand for convenient and subscription-based fresh produce. Meal kit services and farm-to-table initiatives promote organic and specialty blueberry varieties, driving consumer preference for premium-quality berries. Digital marketing strategies, including health-focused branding, influencer partnerships, and personalized promotions, strengthen online blueberry sales. As consumers shift toward contactless shopping and farm-direct purchases, the online blueberry market continues to expand rapidly. For instance, in November 2024, The Department of Commerce's Census Bureau reported that the estimated $300.1 billion in U.S. retail e-commerce sales for the third quarter of 2024, adjusted for seasonal fluctuation but not price adjustments, represented a 2.6 percent (±0.4) increase over the second quarter of 2024. The third quarter of 2024 was expected to have total retail sales of $1,849.9 billion, up 1.3 percent (±0.2) from the second quarter.

United States Blueberry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States blueberry market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, distribution channel, and packaging type.

Analysis by Application:

- Food Industry

- Beverages Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Agricultural Industry

The food industry dominates the U.S. blueberry market due to rising demand for processed and frozen blueberries in bakery, confectionery, cereals, and snack foods. Blueberries serve as excellent additions to baked goods because they contain natural sweetness along with antioxidants and their vibrant color attributes increase their appeal in muffins, granola bars and sauces and jams. Due to rising consumer focus on clean-label products with functional properties, the market has increased its demand for organic and minimally processed blueberries. Companies in the food manufacturing sector use blueberry products in their health-oriented products to support steady market expansion. As customers select natural substances over manufactured additives their consumption of blueberries drives these fruits deeper into mass-produced ready-to-eat and packaged foods.

The beverages industry is expanding blueberry utilization due to rising demand for functional and plant-based drinks. Blueberries' high anthocyanin and vitamin C content drive their inclusion in smoothies, flavored waters, sports drinks, and herbal teas. The marketplace for blueberry extracts, concentrates, and cold-pressed juices increases because consumers choose natural fruit-based drinks instead of sugar-filled carbonated beverages. Manufacturers of alcoholic beverages integrate blueberry flavors into both craft beers and ciders as well as flavored spirit products. The market for RTD (ready-to-drink) blueberry formulations is experiencing growing momentum because consumers want natural antioxidant and immune-boosting beverages from premium health-focused segments.

The pharmaceutical sector adopts blueberry-derived active compounds for developing nutraceuticals and dietary supplements as well as medicinal products. Consumers can find blueberry-based supplements in various formats such as capsules, tablets and liquids because these agents deliver polyphenols, anthocyanins, and flavonoids that promote cognitive health along with cardiovascular benefits as well as anti-inflammatory properties. The market need for natural antioxidant alternatives promotes research to develop blueberry extracts as chronic disease treatment solutions. Functional medicine and preventive healthcare developments support pharmaceutical companies to use blueberry extracts in anti-aging and vision-support supplements as well as gut health products, which enhances their market presence in the health and wellness industry.

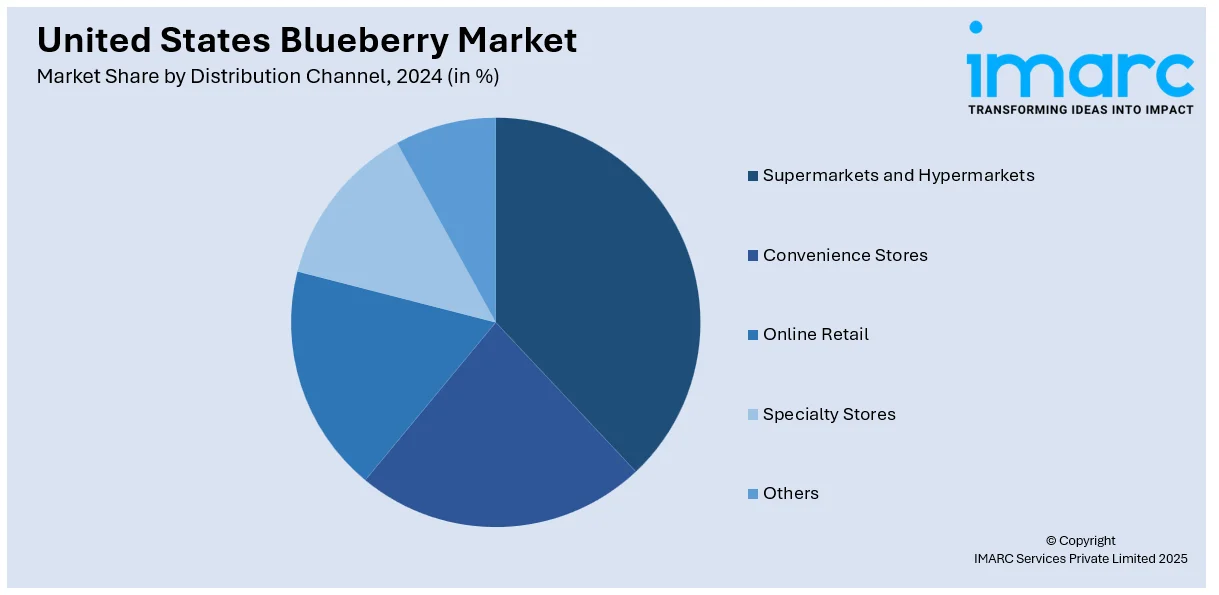

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

Supermarkets and hypermarkets are expected to hold the U.S. blueberry market because of the high footfall of consumers, wide variety of products, and bulk purchasing. The leading chains include Walmart, Kroger, and Costco, which sell fresh, frozen, and organic blueberries at competitive prices. Consumers prefer supermarkets for one-stop shopping and premium brands. Promotional strategies such as discounts, loyalty programs, and in-store sampling further enhance sales. Organic and health-conscious food aisles expansion supports an increasing demand for blueberry-based products. With proper cold chain logistics and high penetration in major cities, supermarkets continue to be the most important means through which fresh and packaged blueberries reach Americans.

Convenience stores hold a significant share of the U.S. blueberry market due to on-the-go snacking trends and rising demand for grab-and-go healthy options. Retailers like 7-Eleven, Wawa, and Sheetz stock fresh blueberries, yogurt parfaits, and blueberry-infused snacks, catering to health-conscious urban consumers. Smaller store footprints and quick checkout experiences attract customers seeking pre-packaged and ready-to-eat fruit products. The rise of single-serve portions in convenience stores supports impulse buying behavior. With extended operating hours and strategic locations in high-traffic areas, convenience stores continue to drive steady sales of blueberry-based products and fresh fruit packs.

Online retail is gaining a substantial share in the U.S. blueberry market, driven by e-commerce growth, direct-to-consumer (DTC) models, and subscription-based fresh produce services. Platforms like Amazon Fresh, Walmart+, and Instacart provide home delivery and bulk ordering options, meeting the needs of health-conscious and busy consumers. Online retailers offer organic and specialty blueberry varieties that may not be available in physical stores. Direct farm-to-consumer sales and meal kit services featuring blueberries further boost digital sales. The increasing preference for contactless shopping, personalized product recommendations, and subscription-based fresh fruit deliveries strengthens online retail’s position in the blueberry market.

Analysis by Packaging Type:

- Cans

- Cartons

- Bags

- Plastic Containers

- Cups

- Tubs

Canned blueberries hold a significant United States blueberry market share due to their long shelf life, year-round availability, and convenience. Food manufacturers and consumers prefer canned blueberries for baking, desserts, and preserves. They retain nutritional value and flavor, making them popular in pie fillings, jams, and sauces. The foodservice industry also drives demand for bulk canned blueberries in restaurants and bakeries. Advances in BPA-free can linings and sustainable packaging support growth. With rising demand for processed and preserved fruit products, canned blueberries continue to be a stable and cost-effective alternative to fresh or frozen options.

Carton packaging dominates the fresh blueberry segment due to its eco-friendly appeal, lightweight structure, and breathability, which helps maintain fruit freshness and quality. Major retailers and organic brands prefer recyclable and biodegradable cartons to meet sustainability goals. Clamshell cartons and fiber-based containers enhance convenience and protection, reducing spoilage and damage during transport. Demand is increasing in supermarkets, hypermarkets, and online grocery platforms, where pre-portioned and resealable cartons cater to consumer preference for snackable and ready-to-eat blueberries. The growing shift toward plastic-free packaging solutions further strengthens the role of cartons in the U.S. blueberry market.

Bags hold a large share in the U.S. frozen blueberry market, driven by consumer preference for resealable, portion-controlled, and easy-to-store packaging. Frozen blueberries in resealable pouches are popular for smoothies, baking, and meal prep, ensuring year-round consumption. The rise in foodservice and bulk purchasing also boosts demand for large frozen blueberry bags in club stores. Sustainable packaging innovations, such as compostable and recyclable bag materials, contribute to the United States blueberry market growth. With the increasing popularity of frozen fruits in health-conscious diets, flexible stand-up pouches and vacuum-sealed bags remain key packaging formats for long-term blueberry storage.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast drives the U.S. blueberry market due to strong consumer demand for fresh and organic blueberries in cities like New York, Boston, and Philadelphia. Retail chains and farmers' markets promote local sourcing from New Jersey, the "Blueberry Capital of the World". Health-conscious consumers fuel demand for functional foods and antioxidant-rich products. The region’s well-established food processing industry supports sales of blueberry-based snacks, bakery items, and beverages, while cold storage infrastructure ensures year-round supply.

The Midwest market is driven by rising health-conscious consumer trends and strong food manufacturing demand. Michigan, the largest Midwestern blueberry producer, supplies fresh and frozen berries to supermarkets, food processors, and juice manufacturers. Growing interest in immune-boosting superfoods fuels demand for blueberry-infused functional beverages and dietary supplements. Expanding organic farming initiatives align with consumer preferences for clean-label products, while regional logistics hubs and food distribution networks enhance accessibility across urban and rural areas.

The Southern U.S. market benefits from year-round blueberry production in Florida and Georgia, supplying both domestic and export markets. Rising demand for fresh and frozen blueberries in bakery, dairy, and beverage industries strengthens market expansion. Large retail chains and convenience stores promote grab-and-go blueberry snacks. Southern consumers prioritize functional foods, smoothies, and natural health products, increasing demand for blueberry-based nutraceuticals and meal replacements. Government support for precision agriculture and sustainable farming further drives production efficiency.

The West leads in blueberry production (California, Oregon, and Washington), driven by high consumer demand for organic and sustainably grown fruit. Urban centers like Los Angeles, San Francisco, and Seattle support the demand for fresh blueberries in premium retail stores and farmers’ markets. Expanding plant-based and clean-label food trends fuel growth in blueberry-infused products, including non-dairy yogurts and functional beverages. Exports to Asia and Canada also boost the market, while investments in climate-resilient farming ensure long-term supply stability

Competitive Landscape:

The U.S. blueberry market is dominated by Driscoll’s, Naturipe Farms, Hortifrut, Rainier Fruit, and Wish Farms, competing on fresh, frozen, and organic blueberry production. Driscoll’s leads in premium fresh blueberries, while Naturipe and Hortifrut specialize in vertically integrated supply chains and year-round availability. Rainier Fruit and Wish Farms focus on sustainable and organic blueberry cultivation. Growth is driven by expanding acreage, controlled-environment farming, and demand for organic produce. Companies invest in breeding programs, precision agriculture, and improved cold chain logistics. Private-label brands and direct-to-consumer sales are increasing, intensifying competition. Retail partnerships and e-commerce distribution are key market differentiators.

Latest News and Developments:

- In June 2024, Naturipe Farms announced that they are launching a new variety of blueberries in its Sweet Selections line. The product is of premium quality and is said to be infused with exceptional flavor.

- In July 2024, AC Foods announced that launch of their brand of organic-certified, regenerative blueberries called Betterful. Rebuilding functional landscapes and recovering natural resources are the main goals of the methods used to grow betterful blueberries.

United States Blueberry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Food Industry, Beverages Industry, Pharmaceutical Industry, Cosmetics Industry, Agricultural Industry |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others |

| Packaging Types Covered | Cans, Cartons, Bags, Plastic Containers, Cups, Tubs |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States blueberry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States blueberry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States blueberry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blueberry market in the United States was valued at USD 3.49 Billion in 2024.

The market is driven by rising consumer demand for healthy and functional foods, expanding processed and packaged blueberry products, growth in domestic production and supply chain efficiency, increasing online and direct-to-consumer sales, and adoption of sustainable and organic farming practices, ensuring year-round availability, market expansion, and premium product accessibility. The factors, collectively, are creating the United States blueberry market outlook across the country.

The United States blueberry market is projected to exhibit a CAGR of 5.16% during 2025-2033, reaching a value of USD 5.57 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)