United States Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

United States Bioplastics Market Size and Share:

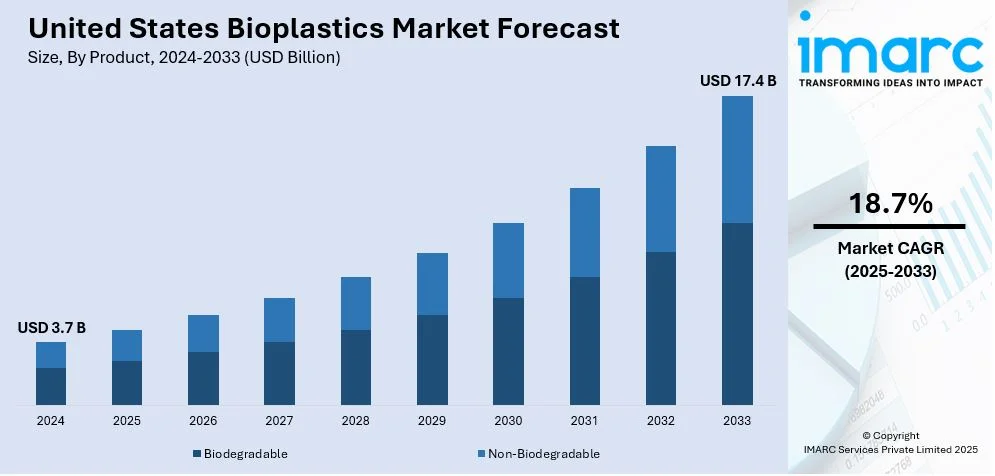

The United States bioplastics market size was valued at USD 3.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.4 Billion by 2033, exhibiting a CAGR of 18.7% from 2025-2033. The market in the United States is driven by the heightened environmental concerns among the masses, enhanced adoption of regulatory measures to support sustainable practices, and an increasing use of eco-friendly plastic alternatives in packaging production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 17.4 Billion |

| Market Growth Rate (2025-2033) | 18.7% |

The United States bioplastics market is driven by a convergence of environmental awareness, technological advancements, and shifting preferences. Companies and policymakers in the country are seeing that people are gradually becoming knowledgeable about the benefits of using bioplastics instead of conventional plastics. This is why they are focusing on minimizing the overall footprint of plastic productions and instead investing in bioplastic manufacturing plants. Bioplastics, either bio-based, biodegradable, or both, are drawing interest as an innovative solution for the growing concerns surrounding plastic pollution and fossil fuel dependency. Government regulations and steps play a crucial role in charting the course of the bioplastics industry. Federal and state-level policies continually introduce stringent measures to curtail single-use plastics and promote sustainable materials, driving companies to invest in eco-friendly packaging solutions.

In recent times technological advancements are continuously improving the performance, cost-effectiveness, and scalability of bioplastics, which enables their widespread adoption. Innovations in raw material sourcing, such as the use of agricultural by-products, algae, and waste feedstocks, are diversifying the production processes and reducing reliance on food crops. Researchers and manufacturers continue to discover new types of bioplastics like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-based polyethylene, which are said to have equal properties as common plastics. These innovations address specific issues - durability, heat resistance, and cost of production which had been raised against certain applications of bioplastics.

United States Bioplastics Market Trends:

Environmental Regulations and Policies

Environmental regulations and policies are supporting the United States bioplastics market’s growth. Government initiatives toward reducing plastic waste and encouraging the use of biodegradable and sustainable materials are promoting the growth of bioplastics. Many federal and state-level measures are establishing bas on single-use plastics, limitations on non-biodegradable packaging, and mandates for compostable or recyclable options. The resulting set of regulations is increasingly pushing this toward a regulatory environment where more bioplastics are becoming a desirable solution for manufacturers and consumers in various scenarios. For example, as from 2024, California put its alterations to the earlier proposed regulation implementing the Plastic Pollution Prevention and Packaging Producer Responsibility Act. The regulations and strategies further stretched California’s producer responsibility packaging scheme. This policy is encouraging various companies to add bioplastics in their supply chains to adhere to the new regulatory norms. Product launches recently also share the same timeframe of new regulatory norms. Such advancements enable companies to anticipate the changes in compliance norms and continue to serve environmentally responsible consumers.

Technological Advancements and Innovation

Technological aspects play a vital role as they enhance the overall manufacturing process of bioplastics in the Unites States. Research activities continuously develop superior bioplastics that overcome the challenge of durability, heat resistance, and cost factor. Some raw material acquisition innovations including agricultural waste, non-food biomass, and algae were seen to reduce the costs of production of bioplastics and increase its scalability. These developments are also facilitating bioplastics to mirror the characteristics of traditional, petroleum-based plastics, such that they can be more widely applied. In the recent days, numerous product launches highlighted the contribution of technological developments. Among them, in November 2023, a Dallas-based bioplastics company PlantSwitch relocated its headquarters to Sanford, NC, while beginning a new manufacturing facility there as well. The newly built facility converted thirty million pounds of agricultural waste into 50 million pounds of bioplastic pellets. Such innovations are proving bioplastics versatile and applicable to replace conventional plastics in demanding applications, hence popularizing the technology across diverse sectors.

Heightened Demand for Sustainability

The high awareness and demand for sustainability are transforming the United States bioplastics market. Modern consumers, especially the younger generation, have increasingly become conscious of eco-friendly products and seek brands that match their values. This change in preferences is making businesses adopt sustainable practices, such as incorporating bioplastics into their product lines. Companies are employing bioplastics to improve brand image, attract environmentally conscious individuals, and establish a niche position in extremely competitive markets. A significant amount of research is also undertaken in developing biodegradable bioplastics that are suitable for making packaging products. In the year 2024, researchers at Northeastern University created an advanced bioplastic that would dissolve in water, thus offering a suitable substitute for conventional plastics. It is especially best suited to applications such as detergent pods, electronics packaging, and any other commodity.

United States Bioplastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States bioplastics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, application, and distribution channel.

Analysis by Product:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The biodegradable (polylactic acid, starch blends, polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS), and others) bioplastics segment is propelled by rising environmental awareness and strict regulatory policies. Biodegradable plastics are engineered to break down into natural substances under particular conditions, making them appealing for lowering plastic waste in landfills and oceans. Polylactic acid (PLA), a highly utilized biodegradable plastic, is commonly employed in food packaging, single-use cutlery, and healthcare applications because of its ability to decompose and affordability. In a similar vein, starch mixtures sourced from renewable agricultural materials are being utilized more frequently in the creation of packaging films, bags, and agricultural mulch films, meeting both sustainability and functional needs.

The use of non-biodegradable (polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate, and others) bioplastics has been steadily rising in the United States due to their ability to closely resemble traditional plastics in terms of durability and performance while presenting a smaller carbon footprint. These bioplastics are derived from renewable sources such as sugarcane, corn, and biomass. The most commonly utilized product in this category is Bio-based polyethylene, primarily employed for producing bottles, films, and rigid containers for food and beverage, personal care, and automotive sectors. In a similar vein, bio-based polyethylene terephthalate is becoming popular in the packaging sector, with uses that encompass beverage bottles, cosmetic containers, and textile fibers.

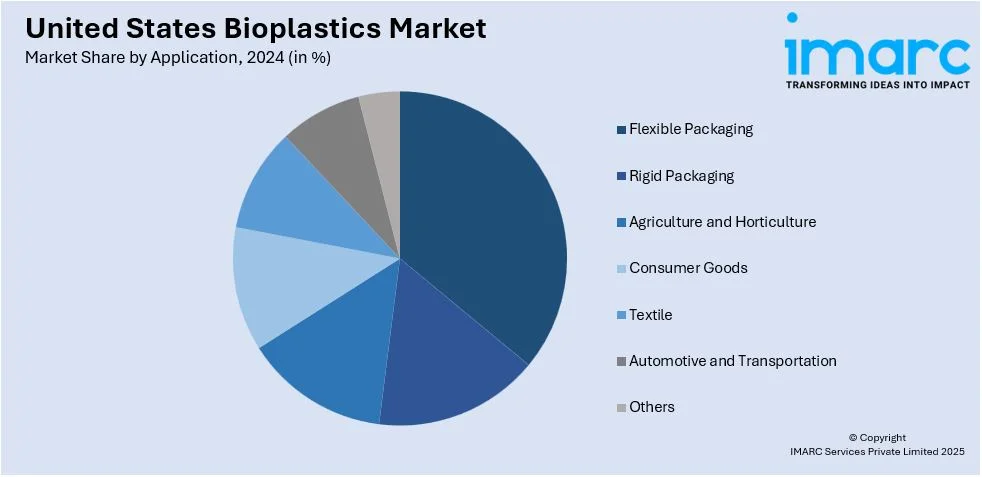

Analysis by Application:

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

Flexible packaging stands out as the leading application area for bioplastics, mainly due to the growing need for lightweight, resilient, and eco-friendly packaging solutions. Sectors implementing adaptable bioplastic packaging for items such as pouches, wraps, and sachets encompass food and beverage, personal care, and pharmaceuticals. Additional significant trends in these materials consist of biodegradable substances, like polylactic acid (PLA) and starch blends, that provide compostable alternatives adhering to regulatory standards and addressing consumer preferences for eco-friendly options.

A major application for bioplastics is in rigid packaging, including the food and beverage, cosmetics, and household products industries. Bio-PET is widely used due to its excellent transparency, durability, and recyclability in the production of bottles, jars, and containers. The use of materials such as PLA has started to be on the rise in this category, especially for thermoformed containers and single-use rigid products like clamshells and trays. Rigid bioplastic packaging is in increasing demand because it provides the same performance as conventional plastics but with the benefit of being environment friendly.

Bioplastics are finding a big market in the agriculture and horticulture sector, primarily mulch films, plant pots, and seed coatings. Natural decomposition in soil is found in biodegradable bioplastics such as polylactic acid (PLA), polybutylene succinate (PBS), and starch blends, reducing plastic waste and minimizing impact on the environment. Mulch films made from bioplastics gain more and more popularity because they avoid removal and disposal after use, which lowers labor costs and supports sustainable farming practices.

Bioplastics are increasingly being utilized in the production of durable and disposable consumer goods, ranging from kitchenware and toys to electronics and personal care products. Biodegradable materials such as PLA and polyhydroxyalkanoates (PHA) are commonly used for items like disposable cutlery, plates, and storage containers, catering to eco-conscious consumers. Non-biodegradable bioplastics like bio-based polyethylene (Bio-PE) and bio-based polypropylene (Bio-PP) are being adopted for durable goods such as casings for electronics and household items due to their mechanical strength and versatility.

Bioplastics are being increasingly utilized for fibers, fabrics, and nonwovens by the textile industry. Bioplastic materials such as polylactic acid (PLA) and polytrimethylene terephthalate (PTT) gain popularity because of biodegradable properties, lightweightness, and performance equivalent to conventional synthetic fibers. The adoption rate in apparel, carpets, upholstery, and technical textiles is going to rise in anticipation of the growing consumer demand for sustainable fashion and home textiles.

Analysis by Distribution Channel:

- Online

- Offline

The online channel of distribution is growing rapidly within the US bioplastics market, fueled by increased use of e-commerce and online marketplaces. The channel allows manufacturers and suppliers direct access to the global marketplace to sell their bioplastic products including raw materials, packaging solutions, and finished goods to an entire array of industries. Customers can conveniently compare products, review technical specifications, and even place orders with the help of online platforms, making procurement processes for B2B and B2C buyers much smoother.

Offline is a very essential part of the United States bioplastics market for industries requiring large-scale procurements and customized solutions. Traditional distribution networks, which include wholesalers, distributors, and direct sales teams, are necessary to cater to businesses in agriculture, automotive, and packaging, where face-to-face consultations and tailored solutions are required. The off-line channels are more useful for bulk and long-term contracts because they help the suppliers build the relationship with the clients.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is a significant market for bioplastics in the United States, driven by stringent environmental regulations and a strong emphasis on sustainability initiatives. States like New York, Massachusetts, and Vermont have implemented comprehensive bans on single-use plastics and mandates for compostable and recyclable materials, creating favorable conditions for the adoption of bioplastics. The region’s dense urban centers and well-developed waste management infrastructure support the growth of biodegradable bioplastics for packaging and food service applications.

The Midwest is emerging as a key hub for bioplastics production, largely due to its abundant agricultural resources and proximity to renewable feedstocks like corn and soybeans. States such as Iowa, Illinois, and Minnesota are home to major bioplastics manufacturers and research facilities, leveraging the region’s agricultural by-products to produce bio-based plastics like polylactic acid (PLA) and polyhydroxyalkanoates (PHA). The strong presence of the agriculture and automotive industries in the Midwest is driving the adoption of bioplastics for mulch films, seed coatings, and lightweight automotive components.

The South region is witnessing a growing adoption of bioplastics, driven by increasing industrial activity, urbanization, and regulatory measures aimed at reducing plastic waste. States like Texas, Florida, and Georgia are seeing a surge in the use of bio-based polyethylene (Bio-PE) and biodegradable plastics for flexible and rigid packaging in industries such as food and beverage, retail, and healthcare. The region’s extensive agriculture sector is also encouraging the use of bioplastics for applications like agricultural mulch films and plant pots.

The West region represents one of the largest and most dynamic markets for bioplastics in the United States, primarily due to progressive environmental policies and a strong culture of sustainability. California, in particular, has been a frontrunner in promoting the adoption of bioplastics through initiatives such as statewide bans on single-use plastics and financial incentives for sustainable materials.

Competitive Landscape:

Leading companies in the bioplastics market are heavily investing in R&D to enhance the performance, functionality, and cost-effectiveness of their products. These efforts include developing advanced bioplastics with improved durability, heat resistance, and mechanical properties, enabling their use in diverse applications such as automotive components, electronics, and packaging. To meet the rising demand for bioplastics across industries, key players are scaling up their production capacities and establishing new manufacturing facilities. Collaborations with research institutions, raw material suppliers, and downstream industries are becoming a core focus for bioplastics companies. Strategic partnerships enable knowledge sharing, cost-sharing in R&D projects, and improved access to supply chains. Product innovation remains a key strategy for market players looking to differentiate themselves in the competitive bioplastics industry. Companies are introducing bioplastics that cater to specific industry needs, such as high-performance biodegradable materials for packaging, durable bio-based alternatives for automotive components, and compostable bioplastics for agriculture. For instance, in December 2024, Lactips, a France-based brand prioritizing the production and commercialization of 100 percent biobased natural water soluble and biodegradable polymers raised EUR 16 million to expand its operations in the American and Japanese markets.

The report provides a comprehensive analysis of the competitive landscape in the United States bioplastics market with detailed profiles of all major companies.

Latest News and Developments:

- November 2023: AgroRenew LLC stated its plans of building a $83 million bioplastics plant to create 250 jobs. The entire 2,00,000 sq foot facility is employed to convert food waste from cantaloupe, watermelon, and pumpkin farms in the US into bioplastics.

- February 2024: The American Chemistry Council’s Plastic division (ACC) released a set of principles and definitions to promote regulation supporting responsible commercialization of bio-based plastic production.

United States Bioplastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States bioplastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States bioplastics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States bioplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bioplastics are plastics derived from renewable biological sources such as corn, sugarcane, and agricultural by-products. They are either bio-based, biodegradable, or both, making them a sustainable alternative to conventional plastics. Applications include packaging, consumer goods, agriculture, textiles, and automotive industries.

The United States bioplastics market was valued at USD 3.7 Billion in 2024.

IMARC estimates the United States bioplastics market to exhibit a CAGR of 18.7% during 2025-2033.

Key drivers include heightened environmental awareness, stringent regulatory measures promoting sustainable practices, technological advancements improving bioplastic performance, and growing consumer demand for eco-friendly alternatives in packaging and other sectors.

On a regional level, the market has been classified into Northeast, Midwest, South, and West.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)