United States Biodiesel Market Report by Feedstock (Vegetable Oils, Animal Fats, and Others), Application (Fuel, Power Generation, and Others), Type (B100, B20, B10, B5), Production Technology (Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating), and Region 2025-2033

Market Overview:

The United States biodiesel market size reached USD 15.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The annual production capacity of biodiesel exceeded 23.8 billion gallons in 2023, marking a growth of 1.7 billion gallons as compared to 2022. A significant increase in imports, along with strategic investments and collaborations among key players, are significantly driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 23.7 Billion |

| Market Growth Rate (2025-2033) | 4.81% |

Biodiesel is a renewable, bio-based fuel that is engineered to work effectively in diesel engines, emitting fewer pollutants and providing a more sustainable alternative to conventional diesel. Derived primarily from plant oils, animal fats, and used cooking oils, biodiesel can directly replace or blend with petroleum diesel in many applications, without significant modifications to the engines. It exhibits superior lubricity, biodegradability, and substantially lower emission profile, which makes it an ideal option for the transportation sector, agriculture, as well as various industrial applications.

With a growing commitment to reducing greenhouse gas emissions, the United States is experiencing a significant shift in its energy market. Stricter environmental regulations have accelerated the adoption of biodiesel nationwide. In 2023, biodiesel consumption soared to over 1,939 million gallons, surpassing the production volume of 1,699 million gallons, according to the Department of Energy’s Alternative Fuels Data Center. To bridge this gap, biodiesel imports doubled compared to the previous year, reaching 1.4 million gallons per day. This surge continued into 2024, driven by low prices in Europe, as reported by the U.S. Energy Information Administration. Moreover, the country's biofuel production capacity expanded to 23.8 billion gallons per year (BGPY) in 2023—a growth of over 1.7 billion gallons compared to 2022, according to IEA Bioenergy.

The market in the United States is primarily driven by the increasing emphasis on reducing greenhouse gas emissions. This can be attributed to the rapid utilization of biodiesel due to the growing stringency in environmental regulations. In line with this, a considerable rise in the usage of renewable energy sources by corporate entities and government bodies is stimulating the growth of the market. Besides this, the rising adoption of biodiesel in the transportation and industrial sectors due to its sustainable and eco-friendly nature is creating lucrative opportunities in the market. In addition to this, continual advancements in biofuel conversion technologies, such as enzymatic hydrolysis, fermentation, pyrolysis, gasification, genetic engineering and metabolic engineering techniques, are fueling the market. Furthermore, the easy availability of supporting infrastructure throughout the country is resulting in a higher uptake of biodiesel.

United States Biodiesel Market Trends/Drivers:

Increasing Domestic Production of Biodiesel

One of the most significant drivers of the U.S. biodiesel market is the increased domestic production of various biodiesel feedstocks, including soybean oil, recycled cooking oil, and animal fats. As these key ingredients become more abundantly available domestically, the resulting ease of access and reduced costs have provided a substantial boost to biodiesel production, in turn catalyzing overall market growth in the United States. Additionally, the influence of federal biofuel policies such as the Renewable Fuel Standard (RFS) and the Biomass-Based Diesel Volume Obligation play pivotal roles in promoting the biodiesel industry. By mandating a minimum volume of biofuels to be included in transportation fuel, they create a favorable regulatory environment that encourages both the increased production and wider consumption of biodiesel throughout the country.

Strategic Investments and Collaborations in the Biodiesel Industry

The market is further propelled by the influx of strategic investments and the establishment of beneficial partnerships within the sector. Major stakeholders spanning the energy value chain, from technology innovators to manufacturers and oil corporations, are demonstrating active engagement in enhancing biodiesel production facilities. Their investments in research underscore their commitment to advancing the efficiency and sustainability of biodiesel. The landscape of the market is further transformed by collaborations that facilitate technology exchange, infrastructure development, and market enlargement. These concerted efforts, fostering synergistic relationships among diverse entities in the biodiesel domain, are consolidating the strength of the market and catalyzing its sustained upward trajectory. This momentum is anticipated to continue, further supporting future growth and expansion of the sector in the United States.

United States Biodiesel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States biodiesel market report, along with forecasts at the country levels from 2025-2033. Our report has categorized the market based on feedstock, application, type and production technology.

Breakup by Feedstock:

- Vegetable Oils

- Animal Fats

- Others

Vegetable oils represent the most widely used feedstock

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes vegetable oils, animal fats and others. According to the report, vegetable oils represented the largest segment.

Vegetable oils are the primary feedstocks for biodiesel production due to their high oil content and easy availability. Increasing demand for eco-friendly fuels, along with government initiatives supporting the usage of biofuels, is propelling the market. Furthermore, technological advancements have improved the conversion efficiency of vegetable oils to biodiesel, thereby driving their use.

On the other hand, animal fats represent a low-cost, widely available biodiesel feedstock. The drive to utilize waste products for energy generation, coupled with the need for sustainable fuels, is accelerating their usage. Additionally, animal fats offer a high energy content, further strengthening their application in biodiesel production.

Breakup by Application:

- Fuel

- Power Generation

- Others

Fuel accounts for the majority of the market share

A detailed breakup and analysis of the market based on the application has been provided in the report. This includes fuel, power generation and others. According to the report, fuel accounted for the largest market share.

The role of biodiesel as a drop-in fuel solution, compatible with existing diesel engines, is a key market driver. Its higher cetane number improves engine performance and fuel efficiency. Moreover, the tightening environmental regulations around fossil fuels are prompting a shift towards biodiesel.

On the other hand, with the increasing demand for sustainable and clean energy sources, biodiesel is witnessing growing usage in power generation. Its lower greenhouse gas emissions, combined with its renewable nature, makes it a viable alternative to fossil fuels in power plants. Also, the increasing investments in renewable energy infrastructure supports the growth of this segment.

Breakup by Type:

- B100

- B20

- B10

- B5

B20 holds the largest share in the market

A detailed breakup and analysis of the market has been provided based on type. This includes B100, B20, B10 and B5. According to the report, B20 accounted for the largest market share.

B20 is popular for its optimal balance between environmental benefits and performance. It can be used in many diesel engines without modifications, encouraging its adoption. Moreover, B20's lower emissions compared to conventional diesel fuel enhance its market appeal, thereby driving the segment.

On the other hand, the B100 segment is gaining traction due to its maximum reduction in greenhouse gas emissions compared to other blends. Its suitability for use in most diesel engines, especially in warmer temperatures, drives its demand. The increasing focus on achieving carbon neutrality also contributes to the growth of this segment.

Besides this, B10 offers a more moderate blend for engines not fully optimized for higher biodiesel content. Its compatibility with a wide range of diesel engines and its lower emissions compared to standard diesel fuel contributes to the market growth. It also offers a viable transition fuel for fleets gradually shifting towards higher biodiesel blends which is propelling the segment growth.

On the other hand, B5 is primarily driven by its compatibility with all diesel engines, which makes it an easy entry point for biodiesel usage. Its reduced emissions and improved lubricity over standard diesel fuel also stimulate its market demand. B5's affordability and ready availability are additional contributing factors.

Breakup by Production Technology:

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

Conventional Alcohol Trans-esterification holds the largest share in the market

A detailed breakup and analysis of the market has also been provided based on production technology. This includes conventional alcohol trans-esterification, pyrolysis and hydro heating. According to the report, conventional alcohol trans-esterification accounted for the largest market share.

Conventional alcohol trans-esterification is the most common method for biodiesel production due to its high conversion efficiency and cost-effectiveness. The process's scalability and compatibility with multiple feedstocks drive its use. Additionally, advancements in catalyst technology are improving this process's efficiency, further propelling its market growth.

On the other hand, pyrolysis allows for the conversion of a wider range of feedstocks into biodiesel, including biomass and waste materials, which is a major market driver. The production of valuable byproducts like biochar also adds to its appeal. The process's potential to convert waste into energy aligns with the circular economy principles, promoting its use.

Furthermore, hydro heating, or hydrothermal liquefaction, can convert wet biomass into biodiesel, eliminating the need for drying, which is a key market driver. It's a promising technology for utilizing waste materials and algae, supporting the trend towards waste valorization. Also, it produces a higher energy yield compared to other methods, enhancing its market potential.

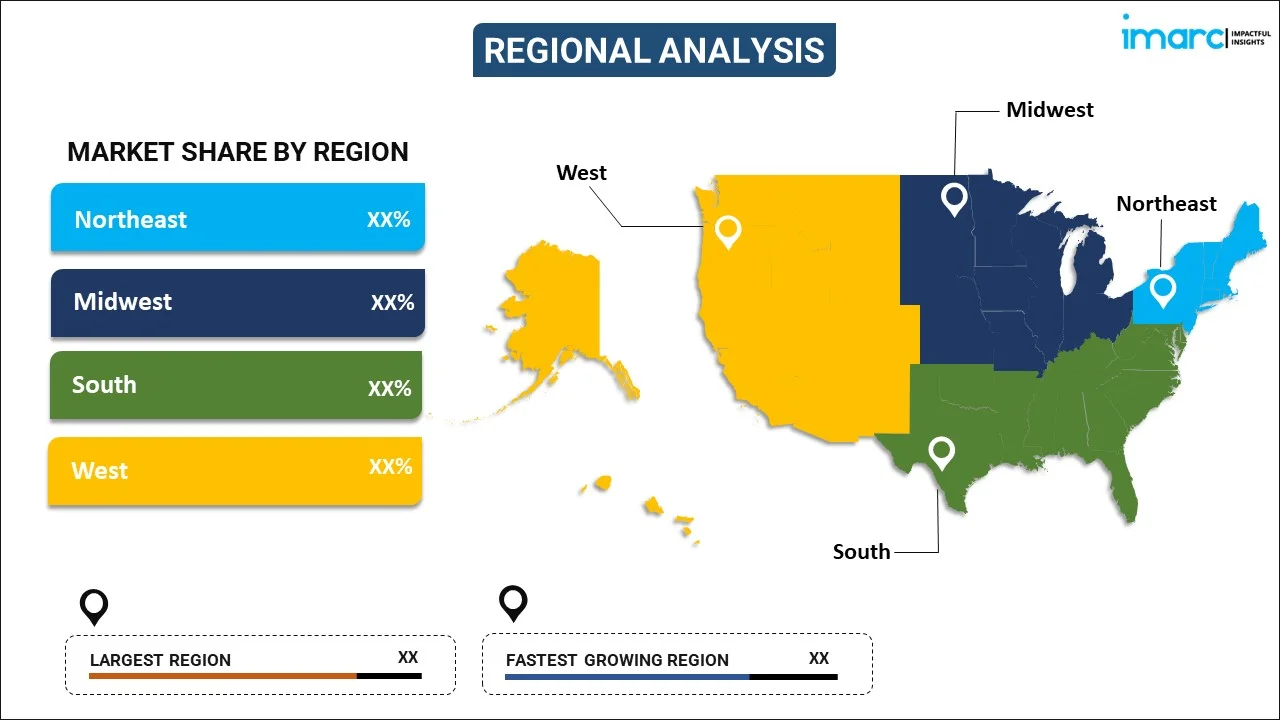

Breakup by Region:

- Northeast

- Midwest

- South

- West

West region exhibits a clear dominance, accounting for the largest biodiesel market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West. According to the report, the West was the largest market for paper cups.

The western region of the United States held the biggest market share since the region has a strong agricultural sector, which provides ample feedstock for biodiesel production, including soybean oil and animal fats. In line with this, stringent environmental regulations in various states such as California, which has implemented Low Carbon Fuel Standards (LCFS), incentivize the use of cleaner fuels including biodiesel.

Additionally, the region has progressive renewable energy policies, that are promoting the use and production of biodiesel. Also, tech-savvy states in the West are leading in technology advancements and R&D in biofuels, fostering innovation in biodiesel production techniques.

Furthermore, the presence of a robust transportation sector in the region, with a significant number of commercial and public fleets, provides a ready market for biodiesel. These factors collectively contribute to the steady growth of the biodiesel market in the Western United States.

Competitive Landscape:

Th top players in the market are investing heavily in research and development (R&D) to innovate and improve biodiesel production processes, enhance fuel quality, and develop advanced biofuels. Major companies are expanding and upgrading their existing production capacities as well as constructing new facilities for increasing the overall production volume. To leverage collective strengths, top players are also forming strategic partnerships and collaborations, which involves sharing of technologies, joint research projects, and marketing initiatives. Additionally, they are focusing on making their production processes more sustainable, and implementing waste reduction measures. Furthermore, the key players in the market are also advocating for supportive biofuel policies and incentives, and providing industry inputs for regulatory decisions to create a favorable regulatory environment in the country.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

United States Biodiesel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Feedstocks Covered | Vegetable Oils, Animal Fats, Others |

| Applications Covered | Fuel, Power Generation, Others |

| Types Covered | B100, B20, B10, B5 |

| Production Technologies Covered | Conventional Alcohol Trans-Esterification, Pyrolysis, Hydro Heating |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States biodiesel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States biodiesel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States biodiesel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States biodiesel market was valued at USD 15.2 Billion in 2024.

We expect the United States biodiesel market to exhibit a CAGR of 4.81% during 2025-2033.

The rising environmental consciousness, coupled with the growing demand for biodiesel as an eco-friendly alternative to conventional fuels, is primarily driving the United States biodiesel market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous end-use industries for biodiesel.

Based on the feedstock, the United States biodiesel market has been divided into vegetable oils, animal fats, and others. Among these, vegetable oils currently exhibit a clear dominance in the market.

Based on the application, the United States biodiesel market can be categorized into fuel, power generation, and others. Currently, fuel accounts for the majority of the total market share.

Based on the type, the United States biodiesel market has been segregated into B100, B20, B10, and B5, where B20 currently holds the largest market share.

Based on the production technology, the United States biodiesel market can be bifurcated into conventional alcohol trans-esterification, pyrolysis, and hydro heating. Currently, conventional alcohol trans-esterification exhibits a clear dominance in the market.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where West currently dominates the United States biodiesel market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)