United States Battery Management System Market Size, Share, Trends and Forecast by Battery Type, Type, Topology, Application, and Region, 2025-2033

United States Battery Management System Market Size and Share:

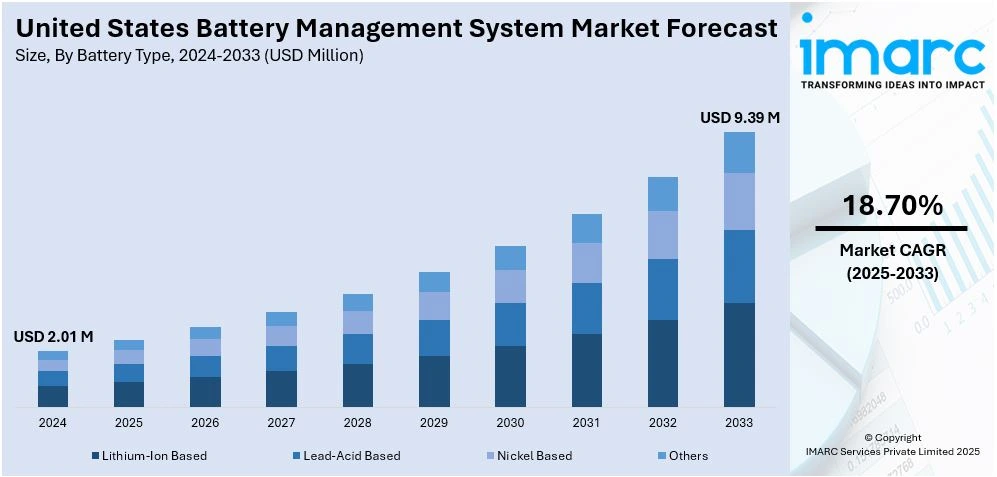

The United States battery management system market size was valued at USD 2.01 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.39 Million by 2033, exhibiting a CAGR of 18.70% from 2025-2033. The United States battery management system market share is propelled by the growing uses of renewable sources of energy like solar and wind power, an increasing demand for consumer electronics products that require reliable and long-lasting battery systems, and the rapidly growing trend toward smart grid and smart home technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.01 Million |

| Market Forecast in 2033 | USD 9.39 Million |

| Market Growth Rate (2025-2033) | 18.70% |

The United States battery management system market growth is increasing due to the tremendous growth of the electric vehicle market. Governments of the United States are enacting strict policies regarding emission reduction and providing generous incentives to promote electric vehicle adoption. In the United States, electric car sales are expected to grow by 20% in 2024 from the previous year, according to the International Energy Agency. This trend is indicative of the growing dependency on advanced BMS solutions that ensure battery safety, efficiency, and extended lifespan in EVs. As auto manufacturers are investing heavily in next-generation EVs with high-capacity batteries, the demand for sophisticated BMS is expected to accelerate further. The evolution of battery technologies, including solid-state and fast-charging batteries, also necessitates cutting-edge BMS to manage temperature, voltage, and current levels effectively. It further highlights the increasing need for electrifying public transport and heavy-duty vehicles as one of the important challenges in managing large-scale battery packs.

Apart from the EV market, the United States battery management system demand is also fueled by the growth in the renewable energy market. Solar and wind energy plants are increasingly deploying energy storage systems to manage fluctuating power generation. These systems require advanced BMS to optimize energy usage, monitor battery health, and prevent potential failures. With rising global investments in renewable energy projects, the need for robust BMS solutions has intensified. Additionally, the integration of IoT and AI in BMS technologies enables real-time monitoring, predictive maintenance, and enhanced energy efficiency, making these systems indispensable for modern energy management. The demand for decentralized energy grids and residential battery storage further drives the growth of the BMS market. Coupled with innovations in portable electronics and industrial automation, these developments underline the expanding scope and importance of BMS across diverse sectors, positioning it as a cornerstone technology in the global transition to sustainable energy solutions.

United States Battery Management System Market Trends:

Increasing electric vehicle adoption

The United State battery management system market trend is heavily influenced by the fast-paced adoption of electric vehicles (EVs). With government incentives such as federal tax credits, along with state-level programs promoting EV adoption, the demand for efficient battery management solutions has surged. According to the U.S. Department of Energy, there are more than 181,000 public charging ports, including Level 2 and direct current fast chargers, at more than 66,000 station locations throughout the country. This robust charging infrastructure supports the growing EV ecosystem, necessitating advanced BMS technologies to enhance battery safety, longevity, and performance. Leading automakers such as Tesla, Ford, and GM are integrating cutting-edge BMS in their EVs to accommodate high-capacity batteries and fast-charging capabilities. In addition, such innovations as solid-state batteries and wireless BMS are changing the view of the face of EVs. As electric buses and other heavy-duty truck electrification within the U.S. continue expanding, the increase in demand is expected for trustworthy and efficient solutions for BMS, which drives further market extension and sustainable mobility.

Energy storage expansion and grid integration

Growth in renewable sources of energy which includes solar, and wind, is focusing more attention on having an energy storage system in America. Advanced management of batteries makes its adoption on a large basis for efficient integration of renewables in the grid supply. A notable development in this area is the California Energy Commission's approval of a $42 Million grant to build a long-duration energy storage project. It shows that investment in sustainable energy solutions is increasing. Projects like these point out the critical role BMS plays in monitoring and optimizing battery performance for reliability and safety. Utilities and energy companies are deploying high-capacity battery storage to complement renewable energy and reduce dependence on fossil fuels. BMS technologies play a significant role in making possible real-time monitoring, predictive analytics, and balancing energy loads for smooth integration into the grid. As the country continues to witness growth in energy storage projects, from California to Texas, the need for sophisticated BMS solutions is bound to increase, providing a solid underpinning to the transition toward a more sustainable energy ecosystem.

Advancements in Technology for Battery Systems

The market for BMS in the United States is being driven forward by continuous advancement in battery technology. Companies are exploring next-generation technologies such as lithium-sulfur and solid-state batteries, requiring more advanced BMS to remain safe and efficient. The recently introduced wireless BMS is witnessing growing popularity in the market for its ability to reduce wiring complexity and enhance scalability. Texas Instruments and Analog Devices are among the major players who have developed cutting-edge BMS solutions with integrated AI and machine learning capabilities for real-time monitoring and predictive analytics. These developments are particularly useful for the EV and energy storage sectors, where precise battery management is critical. The demand for portable consumer electronics and industrial automation equipment is also driving innovation in compact and energy-efficient BMS designs. BMS becomes of higher importance, both from the power supply reliability point and the viewpoint of increased efficiency for all operations during and after this revolutionary period that started with Industry 4.0 technology for American industries.

United States Battery Management System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States battery management system market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on battery type, type, topology, and application.

Analysis by Battery Type:

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Others

Lead-acid holds the leading position with a market share of 50.2% as they are used extensively for stationary applications such as backup power systems and grid storage due to their affordability and recyclability. Lithium-ion batteries have a significant market due to their superior energy density, longer lifecycle, and lower self-discharge rates, which makes them preferred for electric vehicles (EVs), renewable energy storage, and portable electronics. These batteries are lightweight, efficient, and increasingly cost-competitive, driving adoption across various industries. The US Department of Energy recently issued over $3 Billion in funding for 25 selected projects spread across 14 states to improve the domestic production of advanced batteries and battery materials, furthering the U.S. position in the lithium-ion market. Nickel-based batteries, such as nickel-metal hydride (NiMH) and nickel-cadmium (NiCd), are also well known for durability and good performance in extreme conditions. These batteries have been applied for industrial, aerospace, and military purposes.

Analysis by Type:

- Motive Battery

- Stationary Battery

Motive batteries are applied in vehicles and other mobility applications, such as EVs, electric bikes, and forklifts. These batteries require efficient battery management systems to ensure safety, longevity, and optimal energy utilization. The rapid growth of the global EV market has been a significant driver for the motive battery segment, leading to continuous advancements in battery technologies and management systems. Stationary batteries are utilized in non-mobility applications like renewable energy storage, grid stabilization, and backup power systems. According to the National Renewable Energy Laboratory, renewable energy generation has increased for years, accounting for 22% of U.S. electricity in 2024. Stationary batteries play a significant role in ensuring continuous power supply for telecommunication, healthcare facilities, and data centers. The increasing trend of renewable energy integration and energy storage solutions is further expected to augment the demand for advanced stationary batteries.

Analysis by Topology:

- Centralized

- Distributed

- Modular

Centralized systems account for the major market share of 44.7% as they are widely used in large-scale applications, where all the batteries are stored and managed at one place such as power plants or large energy storage facilities. These systems are highly space and cost-efficient for large deployments. Distributed systems are used in applications such as decentralized applications, where the storage of batteries is distributed across various locations due to the requirement of flexibility and scalability. Distributed systems are often preferred for renewable energy applications and microgrids to increase energy security and resilience. Modular systems offer both. They provide flexibility in deployment and can easily be maintained and upgraded. The U.S. Department of Energy stated that battery deployment in the U.S. may rise by six times between 2024 and 2035, further establishing the increased need for all three topologies in supporting renewable energy and energy storage systems. Battery management systems (BMS) are essential for managing the efficiency, performance, and safety of all these topologies, ensuring optimal functioning and lifespan of the batteries.

Analysis by Application:

.webp)

- Automotive

- Electric Vehicles

- E-Bikes

- Golf Carts

- Military and Defense

- Healthcare

- Consumer Electronics

- Telecommunications

- Renewable Energy Systems

- Others

Consumer electronics represents the largest market with a share of 43.2% due to the rising demand for portable devices, efficient energy usage, advancement in battery technology, and growing adoption of IoT-enabled smart devices. In the automotive sector, battery management systems (BMS) play a critical role in optimizing the performance, safety, and longevity of electric vehicles (EVs). With the increasing adoption of EVs, there is great growth in the development of battery technologies, and BMS has become a must to handle energy efficiency. Under the Biden-Harris Administration, the private sector has invested $120 Billion into America's critical EV supply chain, enhancing American energy security and economic competitiveness, as per the US Department of Energy. This program is critical in accelerating the transition to cleaner energy sources, further enhancing the demand for BMS solutions in automotive applications. In military and defense, BMS ensures the efficient operation of batteries used in various defense systems, while in healthcare, it supports medical devices and backup power systems. Telecommunications and renewable energy systems mainly require BMS for energy storage and grid stabilization, ensuring reliable delivery of power in critical infrastructure applications.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The South leads the market with a share of 33.5% due to the fast-growing EV market and large-scale renewable energy projects, with Texas and Florida taking center stage in battery manufacturing and energy storage, which further drives the demand for BMS. The Northeast is leading the charge with robust clean energy policies, such as government initiatives in electric vehicles and renewable energy systems, which fuel demand for BMS solutions. States like New York and Massachusetts are advancing grid modernization, further boosting the need for energy storage solutions. The U.S. Department of Energy has also allocated $22 Million in grants for projects that strengthen and modernize New York's electric grid, further highlighting the state's commitment to clean energy and propelling the demand for BMS. In the Midwest, states like Michigan and Illinois are positioning themselves as automotive hubs, given the rise of electric vehicle production and the integration of renewable energy into the grid. The strong industrial sector of the region is also driving the adoption of BMS for energy storage and efficiency. The West, led by California, has been the leader in sustainability, with aggressive climate policies and a growing focus on EVs and energy storage, creating significant opportunities for the BMS market. Market players in the U.S. battery management system (BMS) industry are actively advancing battery technologies to meet the growing demand for electric vehicles (EVs) and energy storage systems.

Competitive Landscape:

Manufacturers are emphasizing the improvement of BMS capabilities toward enhancing the performance, safety, and energy efficiency of the battery. There is a strong need to optimize battery life, speed up charging processes, and ensure the reliability of energy storage solutions. As the adoption of renewable energy sources intensifies, the quest for efficient means of energy storage has brought about a spate of innovations in BMS to cater to grid modernization efforts. Other new trends found are wireless BMS systems and integrating AI into BMS for predictive maintenance, including real-time monitoring and minimizing downtime. These developments are supporting the widespread use of BMS across various applications, from automotive to telecommunications and renewable energy systems.

The report provides a comprehensive analysis of the competitive landscape in the United States battery management system market with detailed profiles of all major companies, including:

- Eberspaecher Vecture Inc.

- BorgWarner Inc.

- Texas Instruments Incorporated

- Nuvation Energy

- Sensata Technologies Inc.

- Romeo Power Inc. (Nikola Corporation)

- Maxwell Energy Systems (Endurance Technologies Ltd.)

- Ewert Energy Systems Inc.

- Schneider Electric SE

- NXP Semiconductors NV

- Infineon Technologies AG

Latest News and Developments:

- On October 2024, Ford filed for a new battery monitoring system patent for electric vehicles in the US. It targets off-road and track enthusiasts and uses adaptive prediction to improve range estimation. This innovation may make EVs easier to use when racing or off-roading.

- On September 2024, FlexGen recently launched a U.S.-based battery management system (BMS) to tackle some of the most critical challenges in the energy storage industry: cybersecurity risks, supply chain uncertainty, and performance limitations. The new BMS provides improved security, robust site-level control, and optimized performance, ensuring that large-scale energy storage systems will be more reliable and efficient.

United States Battery Management System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Based, Lead-Acid Based, Nickel Based, Others |

| Types Covered | Motive Battery, Stationary Battery |

| Topologies Covered | Centralized, Distributed, Modular |

| Applications Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States battery management system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States battery management system market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States battery management system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States battery management system market was valued at USD 2.01 Million in 2024.

IMARC estimates the United States battery management system market to exhibit a CAGR of 18.70% during 2025-2033.

The market is driven by the growing uses of renewable sources of energy like solar and wind power, an increasing demand for consumer electronics products that require reliable and long-lasting battery systems, and the rapidly growing trend toward smart grid and smart home technology.

South leads the market with a share of 33.5% due to the fast-growing EV market and large-scale renewable energy projects, with Texas and Florida taking center stage in battery manufacturing and energy storage, which further drives the demand for BMS.

Some of the major players in the United States battery management system market market include Eberspaecher Vecture Inc., BorgWarner Inc., Texas Instruments Incorporated, Nuvation Energy, Sensata Technologies Inc., Romeo Power Inc. (Nikola Corporation), Maxwell Energy Systems (Endurance Technologies Ltd.), Ewert Energy Systems Inc., Schneider Electric SE, NXP Semiconductors NV, and Infineon Technologies AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)