United States Bancassurance Market Size, Share, Trends and Forecast by Report by Product Type, Model Type, and Region, 2026-2034

United States Bancassurance Market Size and Share:

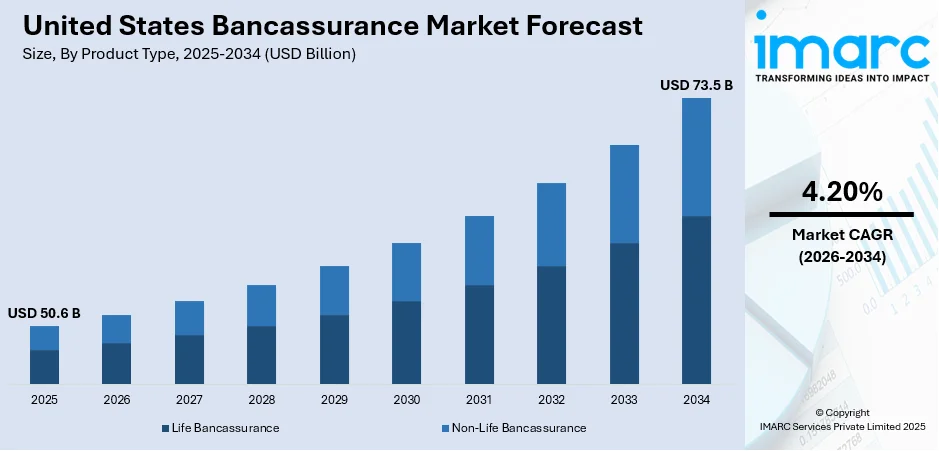

The United States bancassurance market size was valued at USD 50.6 Billion in 2025. Looking forward, the market is projected to reach USD 73.5 Billion by 2034, exhibiting a CAGR of 4.20% during 2026-2034. The market is fueled by increased collaboration between banks and insurance providers to diversify revenue streams and improve customer retention. Besides that, regulatory shifts enabling bancassurance operations and the rising demand for integrated financial services have further accelerated adoption. In addition, advancements in digital platforms have streamlined the cross-selling of insurance products through banking channels, thereby further augmenting the United States bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 50.6 Billion |

|

Market Forecast in 2034

|

USD 73.5 Billion |

| Market Growth Rate 2026-2034 | 4.20% |

Access the full market insights report Request Sample

The market is propelled by the growing preference among consumers for integrated financial services, which is prompting both banks and insurance companies to collaborate more actively. Moreover, the rising awareness of financial planning and wealth protection has also led to higher demand for bundled insurance products offered at banking touchpoints. At the beginning of 2025, the United States had approximately 322 Million internet users, reflecting an online penetration rate of 93.1%. This extensive connectivity has profoundly transformed the way financial services are accessed and delivered. It has accelerated digital transformation across the financial sector, prompting banks to adopt app-based platforms for distributing insurance products. With support from data analytics and automation, these platforms enable real-time customization, simplified policy management, and broader reach.

To get more information on this market Request Sample

In addition to this, the aging population and their increased need for retirement and life insurance products have pushed banks to expand their insurance offerings. Besides, one of the emerging United States bancassurance market trends is that financial institutions see bancassurance to diversify revenue streams amid pressure on traditional lending margins. The increasing presence of tech-savvy millennials seeking convenience and personalized solutions is encouraging innovation in bancassurance models. Furthermore, the movement of nearly USD 800 Billion in reserves to offshore affiliates by U.S. life insurers between 2019 and 2024 reflects rising reliance on complex private credit strategies. This has increased the need for transparent, bank-integrated distribution models to manage capital, regulatory pressure, and risk exposure. As a result, bancassurance is gaining traction as a channel that supports insurers in diversifying risk while leveraging banks' regulatory compliance infrastructure and customer networks. Apart from this, intensified competition in both banking and insurance sectors is pushing firms to adopt bancassurance to retain customers and increase their share of wallet through value-added services.

United States Bancassurance Market Trends:

Widespread Consolidation in the Banking Sector

The market in the United States (US) is primarily driven by the widespread consolidation in the banking sector. As per industry, the number of US banks has fallen 75% in the past 40 years amid a strong push for consolidation. Mergers and acquisitions among regional and national banks are often driven by the need to scale operations, improve operational efficiency, and meet rising regulatory and technological costs. This consolidation enables banks to negotiate more favorable terms with insurance partners and offer a wider portfolio of insurance products to a larger, more diverse customer base. Moreover, larger institutions are also more likely to invest in advanced customer relationship management (CRM) systems, allowing for more effective targeting and cross-selling of insurance solutions. These mergers reduce overlap in branch networks, optimizing distribution points for both banking and insurance services. At the same time, consolidation may limit smaller insurers’ access to bancassurance partnerships, giving larger insurance companies an advantage. This trend continues to influence partnership dynamics, product design, and customer engagement strategies across the market.

Rise in the Geriatric Population

The increasing proportion of elderly individuals in the country is significantly influencing the United States bancassurance market growth, particularly in the life, health, and retirement insurance segments. According to an industry report, the number of individuals aged 65 years and older in the United States reached 58 Million in 2022, accounting for 17% of the total population of the country. This number is expected to reach 82 Million by 2050, representing a growth of 47% and accounting for 23% of the total population. As people age, their demand for financial protection and post-retirement security grows, creating opportunities for banks and insurers to develop specialized products. Banks, as custodians of financial planning for many seniors, serve as effective channels for distributing long-term care insurance, annuities, and supplemental health policies. Insurance companies are working closely with banks to tailor policies that cater to age-related concerns, including chronic illness coverage and estate planning tools. In addition, many seniors prefer familiar institutions for financial decisions, making banks trusted intermediaries for insurance purchases. This demographic shift also places emphasis on transparency, simplified policy language, and assisted onboarding, prompting insurers and banks to redesign their user experience to address evolving senior expectations.

Widespread Digital Transformation

Digital transformation across the financial sector is reshaping how insurance products are marketed and sold. This trend is creating a positive United States bancassurance market outlook. With rising customer preference for online and mobile banking, financial institutions are integrating insurance offerings into digital platforms, allowing seamless access, comparison, and purchase of policies. According to an industry survey in November 2024, mobile apps have become the leading method for US consumers to manage their bank accounts. The findings reveal that 55% of respondents now rely primarily on mobile devices to handle their banking needs. An additional 22% reported that they most frequently accessed their accounts through online banking on a desktop or laptop over the past year. The data highlights a continued shift toward digital platforms for everyday financial transactions. Moreover, advanced analytics and customer profiling tools enable banks to recommend personalized insurance solutions, increasing the likelihood of uptake. This digital shift is also expanding the reach of bancassurance beyond traditional branch customers, capturing younger demographics who seldom visit physical locations. Insurers are investing in APIs and cloud infrastructure to support real-time integration with banking systems, ensuring consistent and secure customer experiences.

United States Bancassurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States bancassurance market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and model type.

Analysis by Product Type:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance leads the market in 2025. Life bancassurance plays a crucial role by combining the reach of banks with the stability and long-term value of life insurance products. The insurance products are sold directly by banks through their branches and online platforms, utilizing established customer relationships to cross-sell. Insurers benefit from wider access and reduced acquisition costs, while banks achieve fee-based income without assuming underwriting risk. For consumers, it is convenient and trustworthy since they can buy life insurance from known financial institutions. In a financially aware but underpenetrated life insurance take-up country, particularly beyond employer-sponsored schemes, bancassurance bridges the protection gap. Regulatory clarity and the push towards more digitalization have also fueled its expansion. U.S. banks are increasingly combining these products with wealth and retirement planning services to position life insurance as a component of a long-term financial plan.

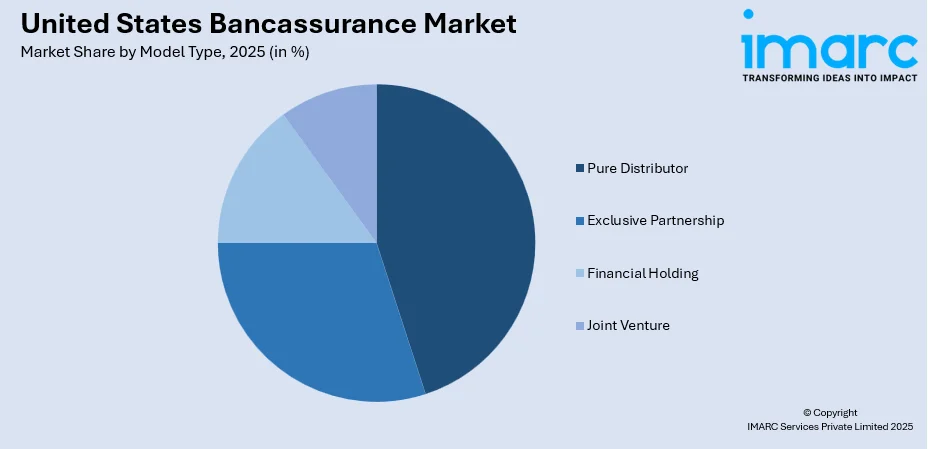

Analysis by Model Type:

To get detailed segment analysis of this market Request Sample

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Pure distributor leads the market in 2025. The segment is characterized by a distinct separation between banking and insurance activities. With this arrangement, the bank is only a distributor, providing insurance products of one or more insurers without taking on any responsibility for underwriting or partaking in any risk. This model is attractive to US banks as it enables them to earn non-interest income from commissions while remaining committed to their core financial service. It also allows insurers to increase their customer base without having to establish their own retail networks. The structure is usually regulated by licensing and regulatory arrangements that preserve a clear delineation between insurance selling and financial advice. The majority of US banks selling insurance products, mainly life and annuities, utilize this structure. It reduces the complexities of compliance and harmonizes nicely with the risk-averse stance of most American banks, so it is the most common bancassurance model in the United States.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast has a significant position in the market due to its high population density, high financial literacy level, and the presence of large financial institutions. New York and Massachusetts have headquarters of large numbers of banks and insurance carriers, and hence, the region is a place for bancassurance collaborations. The developed financial market facilitates cross-selling of annuity, health, and life products through well-established banking networks. Regulatory comfort and consumer confidence with their long-established banks underpin high penetration of insurance products. The region tends to establish trends in financial services distribution that spill over to the rest of the nation.

The Midwest has a strong presence in the market, led by regional and community banks that have established loyal customer segments over many decades. Customers in Illinois, Ohio, and Michigan tend to favor one-stop financial services, which makes banks efficient carriers for insurance products. The area experiences steady demand for life and property insurance products in suburban and rural communities. The Pure Distributor model is the most popular model across the region. Bancassurance here emphasizes relationship-based selling, with branch personnel taking a central role in cross-selling insurance products to retail and small business customers.

The South is among the fastest-growing areas for bancassurance in the United States, fueled by population growth, expanding financial inclusion, and increasing income levels. Texas, Florida, and Georgia are among the states where banks increasingly are teaming up with insurers to serve underserved or newly banked populations. The South has a high concentration of regional banks and credit unions, which have started to offer simple insurance products. Bancassurance business in the South tends to emphasize convenience and price, targeting middle-class households with combined financial products such as insurance, savings, and loans.

The West region provides a distinctive bancassurance environment, with innovation and demographic mix. California and Washington are among the top states for online banking adoption, aligning with increasing demand for online insurance products. Banks within this region tend to bundle insurance products with mobile and online products, targeting tech-savvy younger customers. The market also indicates diverse insurance demands, with earthquake, wildfire, and health insurance being in greater demand compared to other areas. Western bancassurance models stand a greater chance of utilizing digital collaborations and fintech alliances, moving beyond the confines of physical bank branches to provide insurance in more flexible ways.

Competitive Landscape:

The market is highly competitive, driven by changing consumer needs, digitalization, and shifting distribution patterns. Banks that have extensive retail networks leverage their customer relationships to sell insurance products along with traditional financial products, opening the door for product bundling and greater customer retention. Conventional insurers, on the other hand, aim to enhance distribution by partnering with banking institutions that enjoy extensive reach among customers. In addition, competition is propelled by the capacity to embed digital tools, for example, automated underwriting, AI-driven advice, and mobile platforms, which enhance the selling process and the overall customer experience. Additionally, regulatory compliance, particularly product suitability and disclosure, also contributes to the way in which market players conduct their business and compete. Furthermore, smaller institutions rely on niche products, whereas larger players target scale and operating efficiency. According to the United States bancassurance market forecast, rising consumer awareness and growing preference for simplified, all-in-one financial solutions will continue to push market growth, intensifying competition among market participants.

The report provides a comprehensive analysis of the competitive landscape in the United States bancassurance market with detailed profiles of all major companies.

Latest News and Developments:

- January 2024: Kyndryl, a provider of IT infrastructure solutions based in New York, and the Bank of the Philippine Islands (BPI), a prominent provider of various financial solutions such as investment banking and bancassurance, recently commemorated ten years of their partnership. With its extensive nationwide network of 752 branches, BPI has significantly expanded its technical expertise through its partnership with Kyndryl.

- November 2024: One Inc, a payments platform focused on the insurance sector, has partnered with U.S. Bank to offer a seamless payment experience for Property & Casualty (P&C) and Life insurance providers. This collaboration integrates U.S. Bank’s sophisticated banking and money movement services with One Inc’s ClaimsPay and PremiumPay technologies, enhancing the efficiency of claims disbursements and premium collections for insurers and their policyholders.

United States Bancassurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States bancassurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States bancassurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bancassurance in United States as valued at USD 50.6 Billion in 2025.

The United States bancassurance market is projected to exhibit a CAGR of 4.20% during 2026-2034, reaching a value of USD 73.5 Billion by 2034.

The market is driven by growing consumer preference for bundled financial services, cross-selling opportunities leveraged by banks, and the trust customers place in their existing banking relationships. Increased penetration of life and health insurance through established bank networks, improved digital integration between banks and insurers, and rising awareness of financial planning are also fueling the market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)