United States B2B Payments Market Size, Share, Trends and Forecast by Payment Type, Payment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033

United States B2B Payments Market Size and Share:

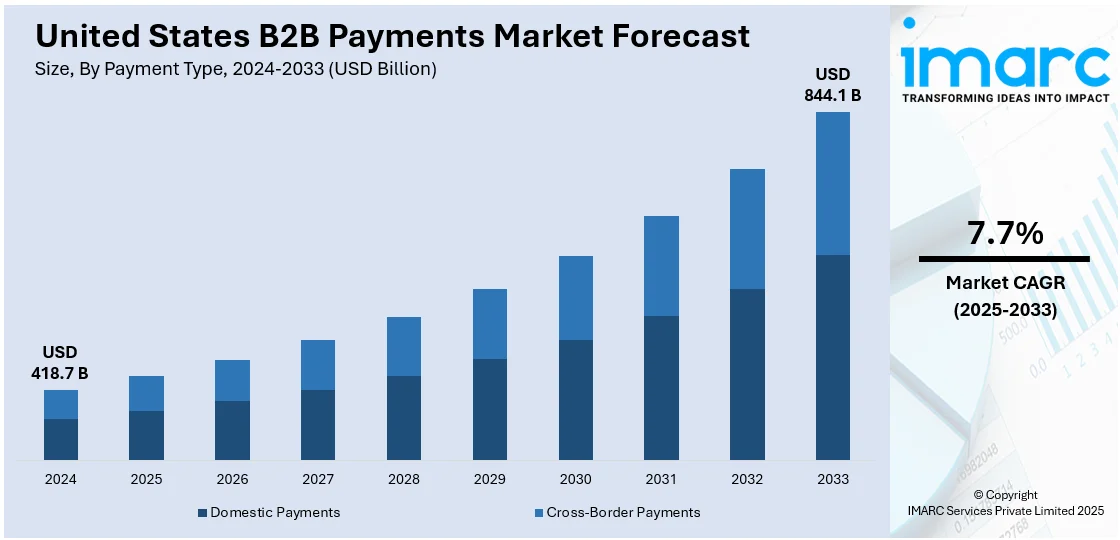

The United States B2B payments market size was valued at USD 418.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 844.1 Billion by 2033, exhibiting a CAGR of 7.7% from 2025-2033. The market is driven by digital transformation, the widespread adoption of automation, the rising demand for secure and faster payment solutions, and the expansion of cross-border trade. Growth in industries like BFSI, manufacturing, and IT, coupled with the shift toward cloud-based platforms, further propels the market’s development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 418.7 Billion |

| Market Forecast in 2033 | USD 844.1 Billion |

| Market Growth Rate (2025-2033) | 7.7% |

The United States B2B payments market is propelled by the widespread adoption of digital payment solutions across industries. Businesses are increasingly shifting from traditional methods like checks and manual processing to digital platforms, which offer speed, transparency, and efficiency. The integration of technologies, such as blockchain, artificial intelligence (AI), and machine learning, enhances payment security and reduces processing errors, thereby further driving adoption. Furthermore, the widespread use of mobile payment apps and cloud-based payment systems enables companies to handle transactions more effectively, enhancing cash flow and overall operational effectiveness. The demand for seamless, automated payment processes continues to fuel market growth. For instance, in October 2024, Bank of America launched Virtual Payables Direct for B2B payments. This tool enables businesses to pay suppliers through a card transaction or direct bank transfer.

The growth of international trade and cross-border transactions is another significant factor driving the market. The adoption of advanced B2B payment systems is fueled by businesses' need for safe and affordable payment solutions to handle international payments. The need for effective payment mechanisms is also increased by the growth of e-commerce, especially in wholesale and supply chain businesses. In order to manage high transaction volumes and maintain compliance and business continuity, sectors like BFSI, manufacturing, and IT significantly depend on scalable, secure payment platforms. For instance, in January 2024, the digital payment platform Balance unveiled a new line of products that cover the whole B2B transaction lifecycle. Distributors, platforms, and B2B brands selling online have instant potential to increase margins and spur growth due to the advantages of AI-powered net terms evaluation and financing, payment cost optimization, and AR automation. Furthermore, government initiatives supporting digital infrastructure development and regulatory compliance requirements enhance trust in digital payment platforms, contributing significantly to the U.S. B2B payments market expansion.

United States B2B Payments Market Trends:

Rising Digital Transformation

Businesses are embracing digital payment solutions for their efficiency, speed, and transparency. Technologies, such as AI, blockchain, and cloud-based platforms, enable automated payment processing, reducing errors, and improving cash flow. For instance, in May 2024, the industry leader in private permissioned blockchain-based real-time settlement solutions, Tassat Group, Inc., announced a strategic collaboration with Glasstower Digital Inc., a financial technology firm facilitating cross-border, blockchain-based, business-to-business remittances. The partnership gives Glasstower a cutting-edge, turnkey technology solution for quick, safe, and affordable digital cross-border payments and speeds up international digital payments for multinational corporate entities. The collaboration facilitates global digital payments for multi-national corporate institutions and permits Glasstower with a turnkey technology solution for immediate, secure, and cost-effective digital cross-border payments.The shift from traditional payment methods like checks to digital platforms is significantly driving the U.S. B2B payments market growth.

Cross-Border Trade Expansion

As globalization accelerates, companies are increasingly engaged in international trade, requiring secure and cost-effective cross-border payment solutions. Advanced systems streamline currency conversions and transaction processing, supporting the growth of global commerce and fueling the B2B payments market. For instance, in November 2024, Mastercard’s Multi-Token Network announced its collaboration with J.P. Morgan’s Kinexys Digital Payments to rationalize cross-border B2B transactions. Leveraging blockchain for better payments is pivotal for B2B firms operating internationally. For businesses with 24/7 supply chains, the partnership's ability to transfer value in real-time minimizes settlement delays and time zone friction. Kinexys is a blockchain-based payment network that transfers value in real time using commercial bank funds, and MTN is a set of blockchain-based tools and standards that support creative business models. By integrating these two systems, mutual clients can settle transactions more quickly and effectively via a single API, which lessens the time limits and complexity that are frequently connected to cross-border payments.

Industry Growth and Automation

Industries like BFSI, manufacturing, and IT demand scalable and secure payment platforms to manage high transaction volumes which are contributing to the market growth. The broad use of B2B payment solutions in various industries is fueled by automation, which lowers administrative costs, boosts productivity, and guarantees adherence to financial standards. For instance, in January 2024, TreviPay, announced the launch of its Universal Acceptance solution to develop supplier access to and faster operation of TreviPay’s payments and invoicing technology, in collaboration with Mastercard. Mastercard cardholders, especially suppliers, will be able to offer net terms, trade credit financing, and SKU-level invoicing to business buyers through TreviPay's Universal Acceptance platform, leveraging Mastercard’s commercial card payment solutions.

United States B2B Payments Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States B2B payments market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on payment type, payment mode, enterprise size, and industry vertical.

Analysis by Payment Type:

- Domestic Payments

- Cross-Border Payments

Domestic B2B payments are expected to hold a large share of the U.S. market due to the high volume of transactions between businesses within the country. Efficient domestic payment solutions, such as ACH transfers, wire payments, and virtual cards, are crucial for managing routine expenses, payroll, and vendor payments. The demand for faster, secure, and automated domestic payments continues to grow, making them a key segment in the B2B payments market, particularly in large enterprises and SMEs.

Cross-border B2B payments are also expected to account for a sizeable portion of the market as businesses are becoming more and more globalized. Businesses involved in international trade require effective, reasonably priced payment methods to manage transactions across multiple currencies and financial systems. The advancement of digital payment solutions, blockchain technology, and fintech technologies has made cross-border payments faster, safer, and less costly. This helps U.S. companies that are involved in international trade and adds to their expanding market share.

Analysis by Payment Mode:

- Traditional

- Digital

Traditional B2B payment methods such as checks, wire transfers, and ACH continue to dominate the U.S. market due to their established infrastructure and reliability. These approaches are still preferred by many companies due to their familiarity, security, and regulatory compliance, particularly in industries like manufacturing and construction. Despite the growing trend toward digital solutions, traditional payment methods still account for a sizable percentage of the market since they are ingrained in corporate processes.

Digital B2B payment solutions, including virtual cards, e-wallets, and cloud-based platforms, are rapidly gaining market share due to their speed, efficiency, and cost-effectiveness. The need for automation, real-time transaction tracking, and better cash flow management is what is driving the move to digital payments. Digital payments are growing in the U.S. B2B payments sector because of businesses using digital solutions more frequently to improve transaction security, expedite invoicing, and minimize manual interaction.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises drive the market due to their high transaction volumes, complex supply chains, and need for secure, automated payment solutions. They require scalable systems to manage vendor relationships, process international payments, and adhere to financial standards. Large enterprises are already major players in the B2B payments market, optimizing cash flow and enhancing operational efficiency using cutting-edge technologies like blockchain and artificial intelligence (AI) for quicker, more transparent, and more affordable transactions.

SMEs are using digital B2B payment solutions more frequently to improve cash flow management, cut down on administrative expenses, and streamline operations. SMEs gain from automation, quicker payments, and less reliance on manual procedures thanks to the availability of user-friendly, reasonably priced payment platforms. SMEs play a major role in the B2B payments sector in the US because of the growing requirement for safe and effective payment solutions as these companies grow and expand internationally.

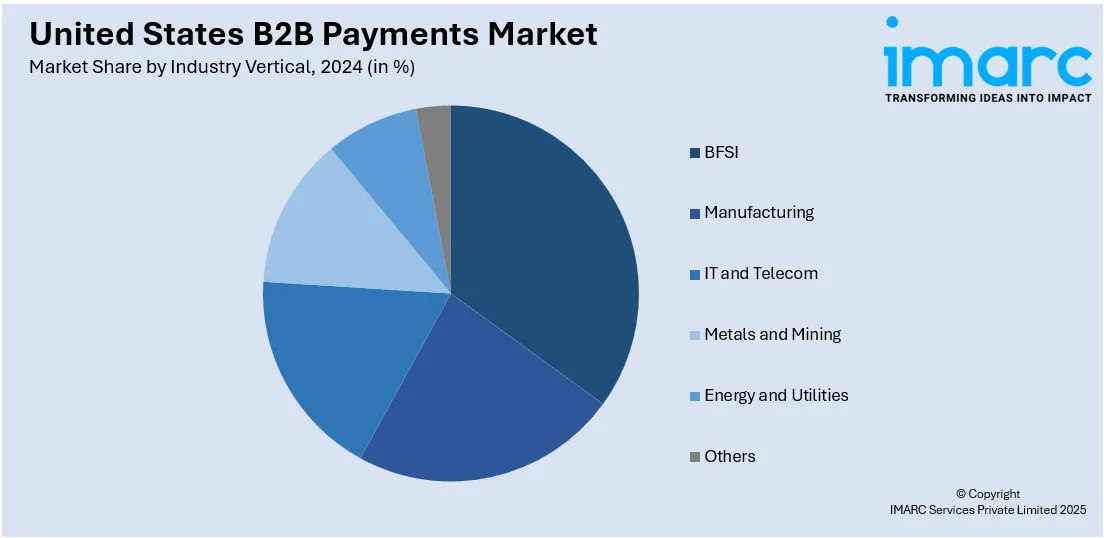

Analysis by Industry Vertical:

- BFSI

- Manufacturing

- IT and Telecom

- Metals and Mining

- Energy and Utilities

- Others

The BFSI sector is integral to the B2B payments market due to its role in handling large volumes of financial transactions. As digital payments, secure payment gateways, and automated financial procedures become more widely used, banks and other financial institutions are promoting more effective business-to-business payment solutions. Additionally, the BFSI sector is a significant player in the market due to the demand for secure and dependable systems being driven by compliance and regulatory regulations.

The manufacturing sector, a cornerstone of the U.S. economy, is increasingly adopting digital B2B payment systems to streamline procurement, supply chain, and vendor payments. Electronic payments like ACH and virtual cards are becoming indispensable as the industry seeks to enhance payment processes and maximize cash flow. With high transaction volumes and frequent business-to-business exchanges, manufacturing is a major driver in the B2B payments market due to the requirement for safe, traceable, and efficient transactions.

The IT and telecom sectors are driving B2B payment growth due to their reliance on technology for fast, seamless transactions. Businesses in this industry need sophisticated payment solutions to handle invoicing, subscriptions, and international services because of the huge numbers of recurring payments, cross-border transactions, and automation trends. Additionally, the demand for digital wallets, cloud-based platforms, and mobile payment solutions encourages the use of effective B2B payment systems, guaranteeing the industry's quick expansion.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast U.S. is a hub for financial services, with New York City as a global finance center. The region's strong technological infrastructure, significant concentration of big businesses, and use of digital solutions fuel the need for effective business-to-business payments. As the region's B2B payments sector expands, local financial institutions and fintech firms are also promoting innovation by improving the automation, security, and speed of payment processing.

A robust manufacturing base in the Midwest contributes to significant business-to-business transaction volumes. Digital payments, especially ACH and virtual cards, are becoming more and more popular as businesses seek to simplify their payment procedures. Businesses are embracing automation more and more to boost productivity, cut down on mistakes, and control cash flow, which is driving an increase in business-to-business payments in areas like Ohio, Michigan, and Illinois.

The South's growing economy, diverse industries (including tech, healthcare, and energy), and increasing adoption of digital technologies are driving the B2B payments market. Businesses are moving to digital solutions in states like Florida and Texas to improve cash flow management and transaction visibility. The necessity for safe and efficient B2B payment solutions is further fueled by the region's business-friendly atmosphere and quick economic growth.

The West, with its focus on technology and innovation, leads in adopting cutting-edge payment solutions. Fintech is expanding rapidly in Silicon Valley and places like Los Angeles, which is helping cloud-based B2B payment platforms become more widely used. Due to the region's emphasis on automation and artificial intelligence, as well as the increased need for cross-border transactions and quicker, safer payment options, the West is a major driver of the U.S. B2B payments market.

Competitive Landscape:

The market in the United States is highly competitive, with major players including PayPal, Visa, MasterCard, American Express, and Square, alongside specialized fintech firms like Bill.com and Brex. These companies serve a range of company needs by providing a range of digital payment solutions, such as virtual cards and ACH transactions. The increasing use of cloud-based platforms, automation powered by AI, and blockchain technology enabling safer, quicker transactions are some of the major trends. The market is becoming more competitive as new players concentrate on specialized services like cross-border payments and customized invoicing solutions, while established financial institutions are collaborating with startups to innovate and enhance user experiences. For instance, in April 2024, the key players in blockchain-enabled business-to-business payments, Paystand, announced the acquisition of Teampay, a market-leading spend management program. The deal establishes a B2B payments powerhouse with the ongoing mission to transform payments by growing the biggest, fastest, and most economical B2B payments network.

Latest News and Developments:

- In September 2024, Stripe and Capchase collaborated to provide a business-to-business (B2B) purchase now, pay later (BNPL) payment option in the US. Through this collaboration, Stripe's corporate financial infrastructure platform now offers Capchase's B2B BNPL for Software-as-a-Service (SaaS) companies.

- In October 2024, Allianz Trade, the world leader in trade credit insurance, and TreviPay, the most reliable B2B payments and invoicing network, established a new strategic alliance. Through this partnership, TreviPay's trade credit and invoicing solutions will have the opportunity to incorporate Allianz Trade's credit insurance, improving risk management and allowing funding capabilities for companies globally.

United States B2B Payments Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Types Covered | Domestic Payments, Cross-Border Payments |

| Payment Modes Covered | Traditional, Digital |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Manufacturing, IT and Telecom, Metals and Mining, Energy and Utilities, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States B2B payments market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States B2B payments market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States B2B payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

B2B (business-to-business) payments refer to financial transactions conducted between two businesses, typically for goods or services. These payments can include various methods such as wire transfers, ACH (Automated Clearing House), credit cards, or digital wallets, and are essential for streamlining business operations, managing cash flow, and maintaining supplier relationships.

The United States B2B payments market was valued at USD 418.7 Billion in 2024.

IMARC estimates the United States B2B payments market to exhibit a CAGR of 7.7% during 2025-2033.

The key factors driving the United States B2B payments market include the rise of digital payment solutions, increased adoption of automation and AI for efficient transactions, growing demand for secure, faster payments, and the shift towards cloud-based financial systems. Additionally, regulatory compliance and the need for seamless cross-border transactions are influencing market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)