United States Assisted Reproductive Technology Market Size, Share, Trends and Forecast by Product, Type, End Use, and Region, 2025-2033

United States Assisted Reproductive Technology Market Size and Share:

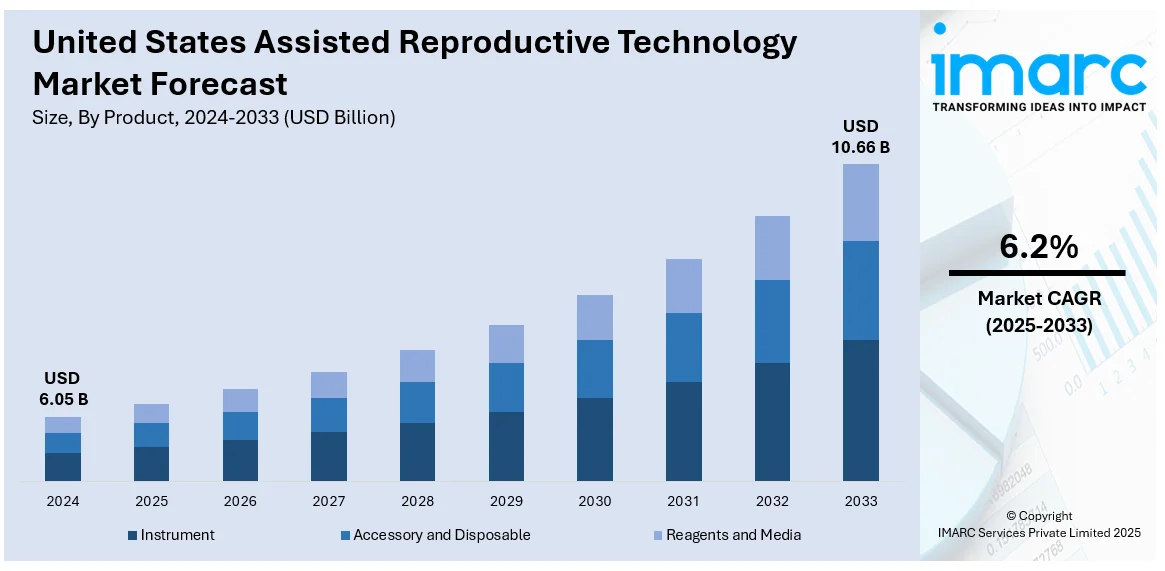

The United States assisted reproductive technology market size was valued at USD 6.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.66 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033. The easy accessibility to improved healthcare facilities, along with the rising prevalence of delayed pregnancies, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.05 Billion |

| Market Forecast in 2033 | USD 10.66 Billion |

| Market Growth Rate (2025-2033) | 6.2% |

The increasing awareness and acceptance of various fertility treatments among individuals is propelling the market growth. Governing agencies and non-governmental agencies are organizing campaigns that benefit in generating awareness among individuals about the wide availability of treatment options available, which is bolstering the market growth. These campaigns often use media, social platforms, and community outreach to disseminate information about the causes of infertility and the benefits of early intervention.

Besides this, publicized instances involving celebrities who candidly talk about their infertility issues and usage of IVF, surrogacy, or egg freezing help to lessen the stigma attached to these procedures. Furthermore, major companies in the market are engaging in partnerships and collaborations with major players to expand their services and market reach. For instance, in October 2024, The American Society for Reproductive Medicine (ASRM) announced the launch of the ASRM Clinical Embryology Learning Laboratory (“CELL”), an embryology school co-developed with the Society for Reproductive Biologists and Technologists (SRBT).

United States Assisted Reproductive Technology Market Trends:

Increased Adoption of Egg Freezing and Fertility Preservation

Egg freezing has received massive popularity in the United States because women opt to delay their childbearing due to professional, personal, or medical reasons. Advances in the field of vitrification have improved egg survival rates both during freezing and thawing, thereby raising IVF success rates in the future. Many large employers such as Google, Apple, and Facebook are now offering benefits with regard to egg freezing within their healthcare packages. Further, increasing awareness of the declining rate of fertility with age has led women to consider egg freezing proactively, especially those in their late 20s to early 30s. Fertility clinics are also aggressively marketing preservation options as a type of "reproductive insurance," running campaigns focused on empowering women to take charge of their fertility timelines. This trend reflects the evolution of societal norms and technological advancements in reproductive technology, which are expanding choices for women planning for future parenthood.

Rising Use of Genetic Testing and PGT (Preimplantation Genetic Testing)

Preimplantation Genetic Testing (PGT) is being integrated into assisted reproductive technology to enhance the outcome of IVF procedures and prevent genetic disorders. The Next-Generation Sequencing technology provides more sensitive and specific detection of chromosomal abnormalities, and, thus, assists in choosing the healthiest embryo to be transferred for a pregnancy. PGT-A (Aneuploidy testing) is being more frequently chosen by older patients or those who had repeated IVF failure attempts as this procedure raises chances for implantation success. This trend thus reflects a growing preference towards precision medicine, allowing a patient to make informed decisions and improve live birth rates.

Technological Advancements in AI and Automation for IVF

Improvements in the efficiency and accuracy of IVF procedures transform the ART market using Artificial Intelligence (AI) and automation. AI-based instruments like EmbryoScope time-lapse imaging systems will facilitate continuous monitoring of the embryos. This results in more proper selection and higher success rates. Companies like Alife Health and TMRW Life Sciences are promoting innovations with automated lab solutions that reduce manual errors, thereby optimizing embryo storage management. Additionally, AI algorithms analyzing patient data pave the way for personalized treatment protocols that improve patient outcomes while streamlining clinic workflows.

United States Assisted Reproductive Technology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States assisted reproductive technology market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, type,and end use

Analysis by Product:

- Instrument

- Sperm Separation System

- Cryosystem

- Incubator

- Imaging System

- Ovum Aspiration Pump

- Cabinet

- Micromanipulator

- Laser Systems

- Others

- Accessory and Disposable

- Reagents and Media

- Cryopreservation Media

- Semen Processing Media

- Ovum Processing Media

- Embryo Culture Media

The instrument segment is driving the ART market as advancements in technology like incubators, time-lapse imaging systems, and micromanipulators are enhancing the monitoring, handling, and success rates of embryos. Increased adoption of automation systems and AI-powered instruments in fertility clinics has enhanced the precision and efficiency of ART procedures.

The accessory and disposable segment growth is increasing because of the growing demand for products such as culture dishes, pipettes, catheters, and needles, all of which are important in ART procedures. This relates to the growth in IVF cycles and fertility preservation as these cost-effective single-use products are often recommended to ensure safety from contamination.

Reagents and media constitute a vital aspect of ART procedures because of ever-increasing demands for high-quality culture media, cryopreservation solutions, and sperm/egg processing reagents. Innovations in formulation and emphasis on the improvement of embryo viability and laboratory outcomes are increasingly leading to the adoption of specialized media and reagents within fertility clinics and laboratories.

Analysis by Type:

- In-Vitro Fertilization (IVF)

- Fresh Donor

- Frozen Donor

- Fresh Non-Donor

- Frozen Non-Donor

- Artificial Insemination

- Intrauterine Insemination

- Intracervical Insemination

- Intravaginal Insemination

- Intratubal Insemination

In vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI) is beneficial in cases of severe male infertility, where traditional IVF methods might not be as effective. It is used to maximize the chances of fertilization among individuals. The growing demand for effective treatments like IVF with ICSI, as people are seeking assisted reproductive technologies (ART) to overcome infertility, is offering a favorable growth outlook for the market.

Artificial insemination is commonly recommended for couples experiencing unexplained infertility, mild male factor infertility, or certain ovulation disorders. Some common artificial insemination methods are intrauterine, intracervical, intravaginal, and intratubal. It is a relatively simple and non-invasive procedure and can be performed using sperm from the woman's male partner or a donor.

Analysis by End Use:

- Fertility Clinics and Other Facilities

- Hospitals and Others

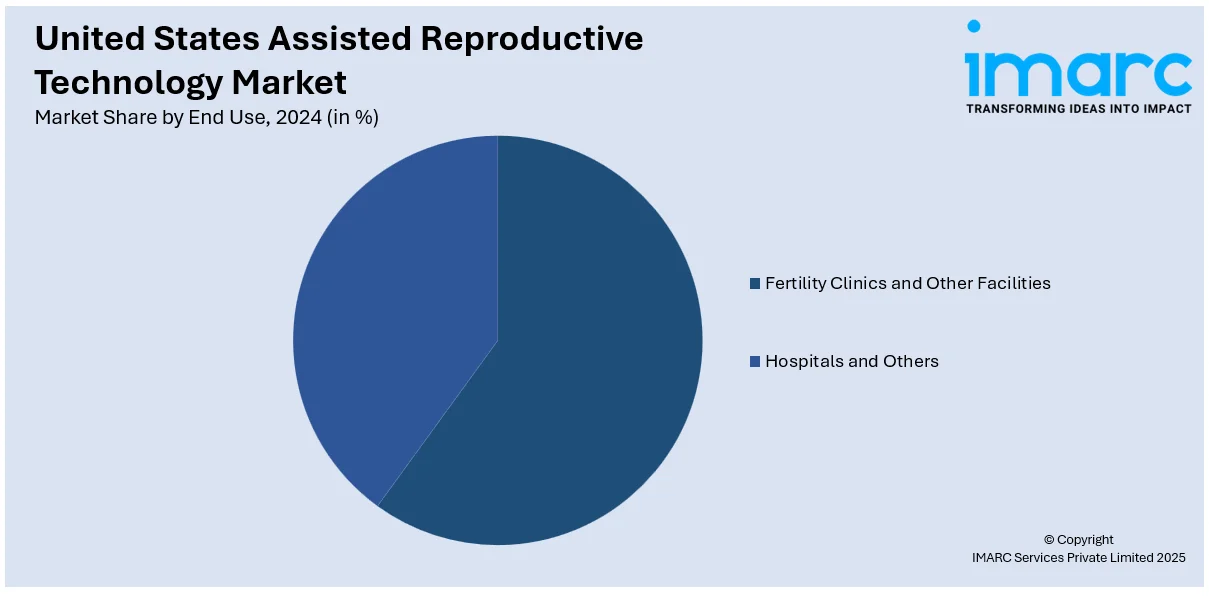

Fertility clinics are specialized in the advanced provision of fertility treatments such as IVF, egg freezing, and genetic testing. With state-of-the-art technologies now being integrated into personalized treatment plans and expert care, such facilities have become the first choice of patients for reproductive services.

Hospitals provide the complete spectrum of fertility services alongside other areas of medical care, particularly those patients who would receive some form of integrated treatment for infertility or other associated medical conditions.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is the hub for state-of-the-art ART institutes offering advanced treatments and research in the fields of reproductive medicine. Centers like Boston and New York have premier fertility clinics and academic institutions for patients to visit. All these are being driven by innovative and up-scale care research in its various regions that draw national as well as international patients into the Northeast. In addition, research cooperation between academic institutions and fertility centers within the Northeast promotes ART advancement and enhances patient success rates.

The Midwest is developing in terms of availability and affordability of ART services, thereby making it a potential destination for patients who want to access quality services at lower cost. States such as Illinois, Michigan, and Ohio have well-established centers for fertility, which afford expertise with affordable treatment options. The low cost of living in the Midwest, as compared to other regions, attracts patients from surrounding states for cost-effective solutions pertaining to IVF, egg freezing, and surrogacy. Engaging research universities has also propelled advancement in the area of reproductive technology toward improving ART success rates using innovative, patient-centered care strategies.

The South has become the prime location for assisted reproductive technology, balancing low-priced treatments with superior care levels. Fertility clinics, in addition to surrogacy programs, are slowly flourishing in places like Texas, Florida, and Georgia. Its warm climate, supporting communities, and strong appreciation of family have made the region a preferable destination among many couples in search of ART treatments.

The West region, primarily California, Washington, and Oregon, is at the epicenter of innovation in ART. Proximity to Silicon Valley encourages the use of advanced technologies such as AI and automation in ART services, resulting in higher success rates and efficiency in clinics. In urban centers, fertility clinics offer the latest treatments, which include embryo monitoring systems, genetic testing, and fertility plans tailored to the specific needs of each individual.

Competitive Landscape:

Key players in the market are expanding their range of services to include not just basic fertility treatments but also advanced technologies like preimplantation genetic testing (PGT), fertility preservation (egg or sperm freezing), and third-party reproduction (egg or sperm donation and surrogacy). They are also expanding their footprint by opening new fertility clinics in emerging markets. Furthermore, companies are engaging in strategic partnerships and acquisitions to strengthen their market presence.

The report provides a comprehensive analysis of the competitive landscape in the United States assisted reproductive technology market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Ivy Fertility announced the acquisition of the Northern California Fertility Medical Center. This strategic move is aimed at expanding Ivy’s presence in the West Coast fertility sector and expanding access to advanced assisted reproductive technology services.

United States Assisted Reproductive Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered |

|

| End Uses Covered | Fertility Clinics and Other Facilities, Hospitals and Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States assisted reproductive technology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States assisted reproductive technology market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States assisted reproductive technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Assisted reproductive technology (ART) stands as a transformative field within the realm of reproductive medicine, offering hope and solutions to individuals and couples facing challenges in conceiving naturally. In the contemporary landscape of family planning, ART encompasses a diverse range of medical procedures and interventions designed to assist individuals in achieving pregnancy. From in vitro fertilization (IVF) to intrauterine insemination (IUI), assisted reproductive technology leverages advanced scientific and medical techniques to overcome various fertility issues.

The United States assisted reproductive technology market was valued at USD 6.05 Billion in 2024.

IMARC estimates the United States assisted reproductive technology market to exhibit a CAGR of 6.2% during 2025-2033.

The key factors driving the United States assisted reproductive technology market include increasing infertility rates due to lifestyle changes, delayed pregnancies, and rising awareness of fertility preservation options such as egg freezing. Additionally, advancements in ART technologies, growing acceptance of genetic testing (PGT), and favorable insurance coverage for fertility treatments are contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)