United States Aromatherapy Market Size, Share, Trends and Forecast by Product, Mode of Delivery, Application, End Use, Distribution Channel, and Region, 2025-2033

United States Aromatherapy Market Size and Share:

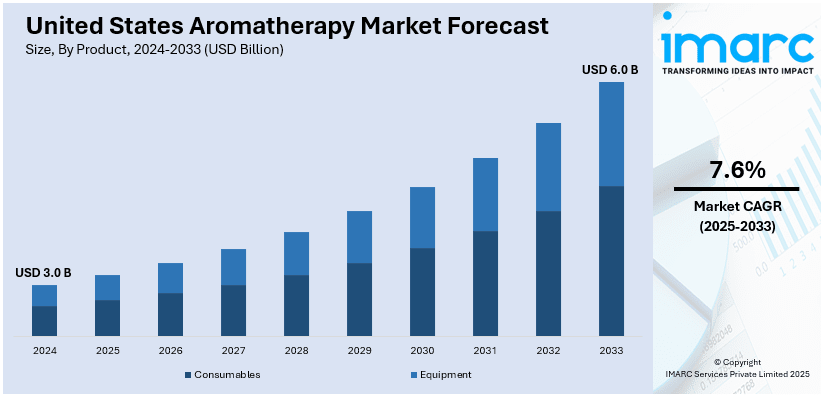

The United States aromatherapy market size was valued at USD 3.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.0 Billion by 2033, exhibiting a CAGR of 7.6% from 2025-2033. The market is witnessing significant growth due to the increasing awareness of natural remedies for health and wellness and the rising popularity of aromatherapy in various sectors. Additionally, the expansion of product offerings, growing demand for sustainable and organic products, and focus on health and wellness benefits are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate (2025-2033) | 7.6% |

The heightening adoption as well as awareness of natural remedies for wellness and health purposes are bolstering the requirement for aromatherapy products in the U.S.. Consumers are increasingly turning to alternative healing methods, such as aromatherapy, to address various health concerns, including stress, anxiety, and insomnia. Consequently, the rising prevalence of such disorders is positively impacting the market for aromatherapy. This shift is driven by the desire for holistic, non-invasive approaches to health management. For instance, according to the University of St. Augustine for Health Sciences, around 57.8 million U.S. adults are living with some kind of mental disorder, including anxiety illness.

Secondly, the rising popularity of aromatherapy in various sectors like spas, wellness centers, and vehicles is also contributing to the market growth. Many health and wellness professionals are incorporating essential oils and aromatherapy techniques into their practice to enhance the overall experience for their clients. This growing demand from professionals in the healthcare and wellness industry is expected to drive the market for aromatherapy products in the United States. For instance, in December 2024, AERON Lifestyle Technology received U.S. utility patent No. 11980702 for its ScentWow Aromatherapy 12V Vehicle Diffuser, a breakthrough in enhancing driving experiences with soothing scents. This product highlights the rising popularity of aromatherapy, not only in traditional settings like spas and wellness centers but also in unconventional environments such as vehicles. The ability to enhance driving experiences with soothing scents reflects the growing consumer desire to integrate aromatherapy into daily life, promoting relaxation and stress relief even on the go.

United States Aromatherapy Market Trends:

Expansion of Product Offerings

One of the major trends of the US market is that consumers currently have easy access to diversified aromatherapy products. From basic to essential oils, the products spectrum of aromatherapy companies nowadays extends to various forms of diffusers, candles, lotions, and several other personal care products. For example, in 2024, Aera partnered with Apartment Therapy to release two limited-edition mini diffusers and unveil 3 new exclusive scents, combining style and functionality for a unique aromatherapy experience. This product line expansion appeals to consumers who want to infuse aromatherapy into their day-to-day life. By offering a wide variety of products, companies are in a position to cater to a larger audience and grab a bigger share of the market.

Growing Demand for Sustainable and Organic Products

Another noteworthy trend in the United States aromatherapy market is that consumer awareness of sustainability and organic products is on the rise. Conscious of the fact that their purchasing decisions have an environmental effect, they are looking for products that will be produced using sustainable practices and all-natural ingredients. Consequently, this is driving companies to source ethical and eco-friendly ingredients as well as to use environmentally responsible packaging. For example, in May 2024, AERON Lifestyle Technology introduced Belle Aroma No-Mess Fragrance Tarts, long-lasting and safer resin melts that come in resealable recyclable pouches, further expanding its line of unique aroma diffusers, infused resins, and organic essential oils. By being able to operate according to consumer values in offering sustainable products, differentiation in the market and even attracting loyal customers can then be achieved by companies

Focus on Health and Wellness Benefits

The United States aromatherapy market is also shifting to health and wellness benefits of aromatherapy. With the rise in popularity of holistic healing practices, consumers are resorting to aromatherapy as a natural way of dealing with stress, sleep improvement, and mood elevation. Companies are responding to this trend by advertising the therapeutic effects of their products and offering educational material to inform consumers how aromatherapy can aid them in general wellness. For example, as part of the annual convention of dōTERRA in September 2024, 4 new products for wellness were launched consisting of a nutrient drink and an omega-3 supplement besides Frankincense oil products. A limited-time trio for essential oil was also launched. The emphasis on health and wellness by aromatherapy companies enables them to market their products as integral to a holistic self-care routine and attract health-conscious consumers.

United States Aromatherapy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States aromatherapy market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, mode of delivery, application, end-use, and distribution channel.

Analysis by Product:

- Consumables

- Equipment

In the product category, consumables are products generally used up in the aromatherapy process, including essential oils, scented candles, and refill cartridges. These products are crucial to the U.S. aromatherapy market as they drive repeat purchases, enhance customer engagement, and support sustained growth by catering to diverse consumer preferences.

Equipment refers to devices like essential oil diffusers, nebulizers, and ultrasonic humidifiers that are used for dispersing fragrances. This product category is essential to the U.S. aromatherapy market, providing innovative, user-friendly tools that allow for the effective distribution of scents. Equipment contributes to the overall aromatherapy experience, creating demand and fueling growth as consumers seek convenience and functionality.

Analysis by Mode of Delivery:

- Topical Application

- Direct Inhalation

- Aerial Diffusion

Topical application under the mode of delivery covers the direct application of the essential oils or aromatherapy-infused products onto the skin in the form of creams, balms, and lotions. Such a method caters to the U.S. market for aromatherapy. This is because the primary therapeutic benefits offered include relaxation, pain relief, and nourishment of the skin. This aspect attracts health-conscious consumers for natural, effective solutions blended into their personal care habits.

Direct inhalation in the mode of delivery segment refers to inhaling essential oil vapors directly from a bottle, diffuser, or inhaler device. This approach meets the needs of the U.S. aromatherapy market for a fast-acting method of respite to remove stressful factors, improve mood, and include respiratory support, etc. It is particularly in vogue among well-placed, healthy-conscious people who do not have many spare moments to hang about.

Aerial diffusion in the mode of delivery segment involves sprinkling essential oils into the air using devices like diffusers or humidifiers. This method serves the U.S. aromatherapy market by creating ambient environments that promote relaxation, mood enhancement, and air purification. Its ability to cater to diverse spaces and preferences makes it a cornerstone of modern aromatherapy practices.

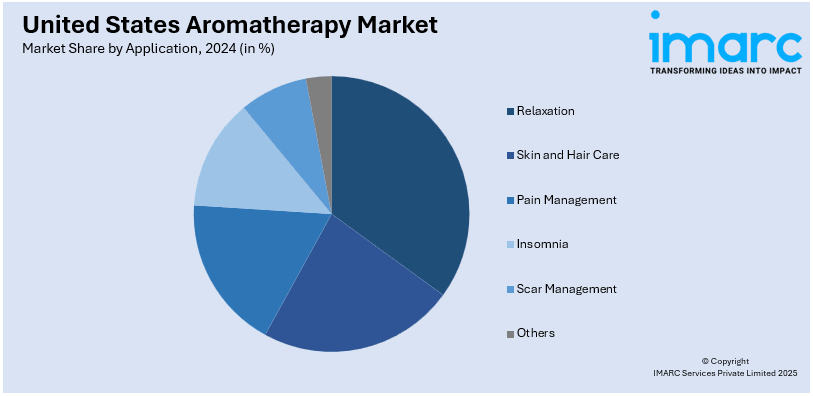

Analysis by Application:

- Relaxation

- Skin and Hair Care

- Pain Management

- Insomnia

- Scar Management

- Others

Relaxation in the application segment applies aromatherapy products, including essential oils, diffusers, and candles, to reduce stress and improve emotional well-being. This segment caters to the U.S. aromatherapy market because of the growing demand for natural solutions for stress management and anxiety. It is attractive to consumers who prefer holistic wellness practices, making the market grow and drive innovation in the product.

Skin and hair care within the application segment utilizes aromatic-infused products, for example, essential oils, serums, shampoos, and conditioners, to improve skin health and hair vitality. This segment caters to the U.S. aromatherapy market by fulfilling its demand for natural, therapeutic beauty solutions. It has appealed to consumers who desire effective, chemical-free solutions for personal care, creating a drive for market innovation and growth.

In the application segment, pain management is achieved through the use of aromatherapy products, including essential oils, balms, and compresses. The product is focused on the U.S. aromatherapy market, offering natural, non-invasive alternatives for chronic pain, muscle soreness, and inflammation. This focuses health-conscious consumers in growing and innovating therapeutic product offerings.

Insomnia in the application segment focuses on the use of aromatherapy products, for example, soothing essential oils, diffusers, and sprays, to enhance the quality of sleep and to cure sleep disorders. This segment caters to the U.S. aromatherapy market by responding to the growing demand for natural sleep aids. It appeals to consumers who look for effective, non-pharmaceutical solutions for relaxation and better nighttime rest.

Scar management within the application segment includes products from aromatherapy that help to reduce the appearance of scars and promote healing within the skin. This is the segment that caters to the U.S. market for aromatherapy products as a response to consumers' demands for natural, efficient skincare products. It fuels growth in the market by providing consumers with alternative treatments that are free from chemicals, thus appealing to health-conscious individuals.

Analysis by End Use:

- Hospitals and Clinics

- Home Use

- Spa and Wellness Centers

- Yoga and Meditation Centers

- Others

Hospitals and clinics in the end-use segment utilize aromatherapy as a complementary approach to enhance patient care, including stress reduction, pain management, and emotional support. This segment serves the U.S. aromatherapy market by integrating therapeutic practices into healthcare settings, addressing growing demand for holistic treatments. Its adoption promotes market expansion and underscores the credibility of aromatherapy within medical environments.

Home use in the end-use segment involves employing aromatherapy products, such as diffusers, essential oils, and candles, to create a soothing and personalized environment. This segment serves the U.S. aromatherapy market by catering to individuals seeking wellness and relaxation at home. Its accessibility and versatility drive consumer demand, fostering market growth and innovation in home-based aromatherapy solutions.

Spa and wellness centers in the end-use segment incorporate aromatherapy into treatments, such as massages, facials, and relaxation therapies, to enhance client experiences. This segment serves the U.S. aromatherapy market by driving demand for premium essential oils and diffusers. Its focus on holistic well-being aligns with consumer preferences, supporting market growth and elevating the therapeutic value of spa services.

Yoga and meditation centers in the end-use segment utilize aromatherapy products, such as diffusers and essential oils, to create calming environments and enhance focus during sessions. This segment serves the U.S. aromatherapy market by aligning with the growing wellness trend. It supports market growth by integrating natural solutions into practices that promote mental clarity, relaxation, and spiritual well-being.

Application by Distribution Channel:

- DTC (Direct-to-Consumer)

- B2B

DTC (Direct-to-Consumer) in the distribution channel segment refers to the direct sale of aromatherapy products through company-owned websites or online platforms. This model serves the U.S. aromatherapy market by offering convenience, competitive pricing, and personalized shopping experiences. It enables companies to build stronger customer relationships, gather valuable data, and drive market growth through targeted marketing and efficient delivery systems.

B2B (Business-to-Business) in the distribution channel segment involves the sale of aromatherapy products to businesses such as spas, wellness centers, retailers, and healthcare facilities. This model serves the U.S. aromatherapy market by expanding product reach, fostering collaborations, and supporting bulk purchasing. It strengthens market penetration and sustains growth by catering to institutional buyers seeking high-quality, reliable aromatherapy solutions.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region serves the U.S. aromatherapy market as a key hub, driven by its densely populated urban centers and high consumer awareness of wellness trends. The region's affluent and health-conscious demographic supports strong demand for premium aromatherapy products. Additionally, the presence of specialized retailers and wellness centers fosters market growth and product accessibility in this area.

The Midwest serves the U.S. aromatherapy market by leveraging its growing wellness-focused consumer base and expanding retail networks. With an increasing number of health-conscious individuals, the region drives demand for affordable and versatile aromatherapy products. Additionally, the presence of spa services, wellness centers, and online retail adoption supports the market's growth and accessibility across urban and suburban areas.

The South serves the U.S. aromatherapy market by capitalizing on its expanding population, growing interest in holistic wellness, and the rise of spas and wellness centers. The region's diverse consumer base drives demand for affordable and premium aromatherapy products alike. Additionally, increasing e-commerce adoption enhances product accessibility, supporting steady market growth across both metropolitan and rural areas.

The West serves the U.S. aromatherapy market through its strong wellness culture, high disposable income, and trendsetting urban centers. The region fosters demand for premium and innovative aromatherapy products, supported by eco-conscious consumer preferences. A robust presence of wellness retreats, spas, and yoga studios further drives market growth, making the West a significant contributor to industry expansion.

Competitive Landscape:

The United States aromatherapy market features a highly competitive landscape, with key players competing on the basis of product quality, pricing, distribution channels, and marketing strategies. The market is also characterized by the presence of numerous emerging players offering niche products targeted at specific customer segments. Additionally, the market has been witnessing increasing adoption of online sales channels by both established brands and emerging firms, further intensifying competition in the industry. For instance, in July 2024, Young Living marks its 30th anniversary at the YL30 International Grand Convention, unveiling new products like Legacy 30 oil, Lavender Legacy Collection, DeepSpectra infusions, AromaConnect Diffusers, and more.

The report provides a comprehensive analysis of the competitive landscape in the United States aromatherapy market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, AERON Lifestyle Technology, Inc., creator of Belle Aroma and Drive Time fragrance diffusers, introduced a nitrile cup designed to simplify the removal of scented waxes and resins from wax warmers. This innovative solution enhances convenience and usability, reflecting the company’s commitment to improving the functionality of fragrance products.

United States Aromatherapy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Consumables, Equipment |

| Modes of Delivery Covered | Topical Application, Direct Inhalation, Aerial Diffusion |

| Applications Covered | Relaxation, Skin and Hair Care, Pain Management, Insomnia, Scar Management, Others |

| End Uses Covered | Hospitals and Clinics, Home Use, Spa and Wellness Centers, Yoga and Meditation Centers, Others |

| Distribution Channels Covered | DTC (Direct-to-Consumer), B2B |

| Regions Covered | Northeast, Midwest, South, and West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States aromatherapy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States aromatherapy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States aromatherapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aromatherapy is a holistic practice that uses natural plant extracts, primarily essential oils, to promote physical and emotional well-being. It involves methods like inhalation, topical application, and diffusion to alleviate stress, enhance mood, and support health. Widely used in wellness, healthcare, and personal care, it emphasizes natural, therapeutic benefits.

The United States aromatherapy market was valued at USD 3.0 Billion in 2024.

IMARC estimates the United States aromatherapy market to exhibit a CAGR of 7.6% during 2025-2033.

Main factors that propel the market growth are increasing consumer demand for natural wellness solutions, an increased awareness of holistic health practices, and growth in adoption within healthcare, spas, and personal care. Product innovations, e-commerce development, and integration into the daily lives of individuals have been key drivers in increasing market size.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)