United States Anime Market Size, Share, Trends and Forecast by Revenue Source and Region, 2025-2033

United States Anime Market Size and Share:

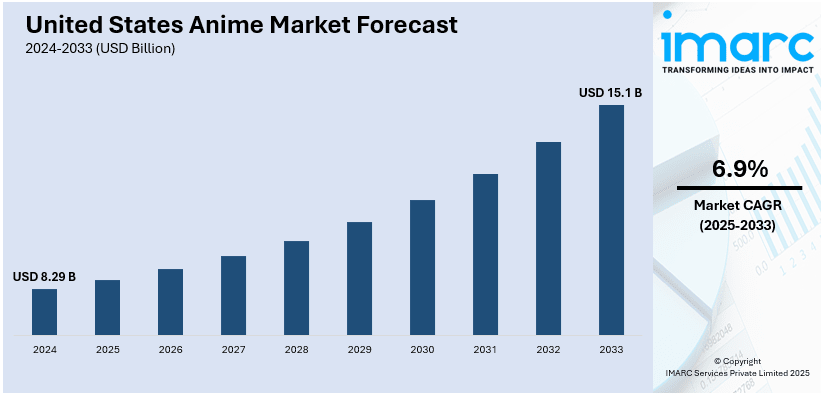

The United States anime market size was valued at USD 8.29 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.1 Billion by 2033, exhibiting a CAGR of 6.9% from 2025-2033. The market growth is driven by streaming platforms, which expand access and engagement. Besides this, the United States anime market share is influenced by increased localization and dubbing, making anime more accessible to mainstream audiences. Strong social media influence and fandoms create buzz and drive fan participation, which further strengthens the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.29 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Market Growth Rate (2025-2033) | 6.9% |

The strong influence of social media and fandoms is driving the market for anime in United States. Social media platforms create spaces for fans to connect and share content. Anime-related discussions, memes, fan art, and cosplay posts generate organic buzz and promote anime culture. Hashtags and trending topics related to specific anime series encourage increased fan engagement and visibility. Influencers and content creators help promote anime to wider audiences. Social media-driven viral trends, such as challenges or fan theories, spark curiosity and attract new viewers. Online communities and fan groups offer recommendations and insights, fueling interest in niche anime genres. Fandoms host virtual and in-person events, creating a sense of belonging and shared experiences. Fans actively support their favorite anime series by purchasing merchandise and attending conventions, which propels the growth of the market.

The United States anime market demand is driven by increased localization and dubbing of content. As anime content becomes more accessible through English dubs and subtitles, it appeals to a wider audience. The expansion of dubbed anime on streaming platforms makes series more approachable. High-quality English dubbing and translation make anime more relatable to American viewers, improving engagement. This localization allows anime to reach mainstream audiences who may not read subtitles, expanding its market. Additionally, dubbed versions are often released simultaneously with Japanese broadcasts, reducing the gap between releases. Increased investment in localization enhances the overall viewing experience, enhancing the attractiveness of anime content. Dubbing studios hire well-known voice actors, which adds credibility and appeal to anime titles. Major streaming companies specialize in dubbing and distributing anime for US audiences, fueling market growth.

United States Anime Market Trends:

Growing demand for anime merchandise

Fans are increasingly purchasing collectibles, figures, clothing, and accessories featuring their favorite anime characters. Limited-edition merchandise from conventions and online stores is creating exclusivity and enhancing sales in the United States. Streaming platforms and social media are enhancing anime visibility, increasing demand for related products. Popular franchises are dominating the merchandise market in the US retail stores, expanding anime product lines to attract buyers. In August 2024, Manga Plus by Shueisha launched its first online store in America, offering exclusive anime and manga merchandise. The store features a variety of collectibles, apparel, and limited-edition items from popular series like One Piece, Naruto, and Jujutsu Kaisen. This initiative aims to expand its fanbase and provide North American fans with easier access to authentic products tied to their favorite manga and anime. Moreover, collaborations between anime studios and fashion brands are bringing anime-inspired clothing to mainstream fans. Fans are actively supporting their favorite series by purchasing officially licensed merchandise from various retailers. Customization options, including personalized anime-themed accessories, are further enhancing engagement with the fan community.

Expansion of e-commerce platforms

Online marketplaces provide a vast variety of anime products, increasing accessibility. Dedicated anime retailers provide a focused shopping experience for fans in the United States. E-commerce enables fans to purchase exclusive merchandise, including figures, clothing, and accessories, worldwide. Online platforms also allow for the easy distribution of anime films and series, increasing viewership. Global shipping options ensure that US fans have access to international merchandise and collectibles. In January 2025, VIZ Media launched a new online store, VIZ Shop, catering to North American anime and manga fans. It offers exclusive products from over 20 popular series like Sailor Moon, RWBY, and Bleach. This platform provides US fans access to officially licensed merchandise previously unavailable outside Japan, enhancing the fan experience. With a range of products including apparel and collectibles, VIZ Shop showcases classics and new favorites like Jujutsu Kaisen, while highlighting special items like Sailor Moon Monopoly set. The rise of user-generated content and reviews on e-commerce sites encourages more purchases and engagement. Social media portals are driving traffic to e-commerce sites, thereby expanding brand reach. Special promotions, discounts, and limited-edition releases on e-commerce platforms generate increased demand for anime-related products. Secure payment methods and convenient delivery options make online shopping a preferred choice for customers, thereby strengthening market growth.

Rising number of esports and cosplay events

Cosplay events allow fans to embody their favorite anime characters, strengthening their emotional connection with franchises. Major conventions in the United States provide platforms for cosplay competitions and anime-themed showcases. For instance, HoYoverse's Zenless Zone Zero launched its first pop-up event, "Hollow Sighting," in New York on July 12-13, 2024. The event offers fans an interactive experience inspired by the game, featuring themed activities, collectibles, and in-game rewards. Visitors can explore a real-life Hollow environment, complete mini-games, and meet cosplayers portraying characters. Increased participation in cosplay drives demand for costumes, props, and accessories, accelerating growth the anime merchandise industry. Social media platforms amplify cosplay events, inspiring more people to engage with anime culture. Esports and cosplay communities create passionate fanbases that actively support anime series through various forms. Sponsorship deals between gaming companies and anime studios further promote anime’s visibility in mainstream entertainment. Esports tournaments featuring anime-inspired games attract massive audiences, increasing interest in anime franchises and characters.

United States Anime Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States anime market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on revenue source.

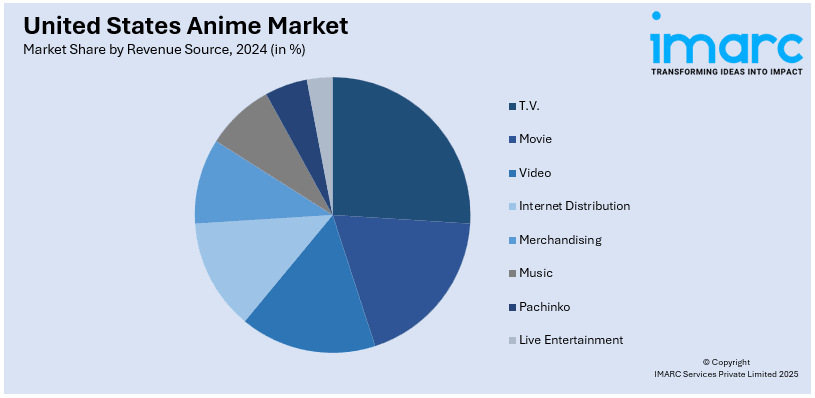

Analysis by Revenue Source:

- T.V.

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

T.V. remains a primary revenue source as major networks broadcast anime to mass audiences. Advertising revenue from commercials aired during anime programming significantly contributes to financial growth. Licensing deals with global broadcasters ensure anime reaches international markets, increasing monetization opportunities. Long-running series generate continuous income through syndication and reruns. Cable and satellite channels specializing in anime cater to dedicated fanbases, driving consistent demand.

Theatrical anime films generate substantial revenue through box office sales, both domestically and internationally. Blockbuster films proving anime's cinematic profitability. Collaborations between anime studios and major theater chains ensure wide distribution and accessibility. Exclusive screenings and limited-edition collectibles attract dedicated fans, influencing overall revenue generation.

Physical media sales remain an important revenue stream for anime studios and distributors. Limited-edition box sets with exclusive content appeal to collectors, encouraging premium purchases. DVD and Blu-ray sales provide long-term revenue beyond the initial broadcast or theatrical release. International distribution of physical media allows fans worldwide to legally own and support anime. Home video releases often include director’s cuts and bonus features, increasing their market value.

Streaming platforms generate significant revenue through subscription fees and advertisements. Simulcasting allows fans to watch new episodes immediately, increasing global engagement and reducing piracy. Exclusive licensing agreements with streaming services secure consistent income for anime production companies. Digital downloads and on-demand purchases provide additional monetization beyond subscription-based models. Global accessibility via streaming platforms expands anime’s audience, ensuring continuous revenue growth.

Anime merchandise, including figures, apparel, and accessories, generates billions in global sales annually. Popular franchises dominate the merchandise-driven revenue streams. Exclusive and limited-edition products create high demand, driving fan purchases and long-term engagement. Collaborations with major retailers like ensure widespread merchandise availability. The rise of online marketplaces allows international fans to purchase anime-themed products easily.

Anime theme songs and soundtracks generate revenue through digital streaming, CD sales, and concert performances. Opening and ending themes are becoming iconic, increasing demand for official music releases and live performances. Major record labels collaborate with anime studios to produce hit songs that gain mainstream popularity. Anime music concerts and events attract large audiences, driving ticket sales and merchandise purchases. Music streaming platforms enable global streaming, ensuring continuous revenue from digital plays.

Pachinko machines featuring anime themes generate significant revenue in Japan, benefiting anime production companies. Popular series have dedicated pachinko machines attracting dedicated players. Gaming centers and pachinko parlors capitalize on anime's popularity, creating additional revenue streams. Licensing agreements with pachinko manufacturers provide studios with a steady flow of royalties. Pachinko machines often feature exclusive animations and story elements, increasing fan engagement.

Anime-related stage plays, concerts, and theme parks contribute to the market’s revenue through ticket sales. Live-action adaptations and theatrical performances based on anime series attract dedicated fan interest. Anime conventions like Anime Expo and Japan Expo generate revenue from sponsorships, merchandise, and attendance fees. Virtual concerts featuring vocaloid characters demonstrate the growing demand for anime-themed entertainment. Themed café experiences and interactive exhibitions drive fan engagement while generating substantial revenue.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region including cities like New York and Boston, has a strong anime fanbase due to cultural diversity. Major conventions attract large audiences, propelling regional anime market growth. High population density and access to international media make anime easily accessible through streaming and retail stores. Universities and academic institutions in the region offer anime and manga studies, fostering deeper interest. Specialty stores and theaters frequently host anime screenings and merchandise sales, increasing regional revenue.

The Midwest region including Chicago and Detroit, has a steadily growing anime market driven by fan conventions and events. Cities like Chicago host major anime conventions attracting attendees from across the country. Expanding access to streaming services is increasing anime’s demand, despite fewer specialty stores compared to coastal regions. Colleges and universities in the Midwest have strong presence of anime clubs and communities that drive engagement. Anime is gaining traction among young audiences due to growing interest in esports and gaming culture.

The South including Texas and Florida, has emerged as a major hub for anime culture and industry growth. Dallas, home to major streaming platforms plays a significant role in anime distribution and localization. Anime conventions in Texas and Florida attract massive crowds, enhancing market expansion. The region’s growing population and strong youth demographic contribute to increasing anime demand. Retail chains and independent stores in the South are expanding anime merchandise availability, enhancing accessibility.

The West, particularly California, is the epicenter of the United States anime industry, hosting major companies and events. Los Angeles is home to the largest anime convention in North America, attracting global audiences. Many anime licensing and distribution companies are headquartered in this region, which further strengthens the market growth. Hollywood's collaboration with anime studios has led to increased mainstream acceptance and exposure of anime content. The West Coast’s proximity to Japan facilitates strong industry connections, ensuring early access to new releases and trends.

Competitive Landscape:

Key players are expanding anime libraries, making content easily accessible in the United States. These platforms are securing exclusive licensing deals, ensuring a steady supply of high-quality anime series. Anime studios are producing globally popular series, increasing international engagement. Production companies are investing in high-budget anime films and series, elevating animation quality and storytelling standards. Merchandising giants are capitalizing on anime’s popularity through toys, apparel, and collectibles. For example, in May 2024, Aniplex of America announced to expand the Demon Slayer franchise in the US with new products, licensing deals, and partnerships. This includes collaborations with Adidas, Team Liquid, and Steve Aoki’s DIM MAK for apparel and accessories. Bandai Namco and McFarlane Toys are releasing new figures, while Funko expands its Pop! line. The company is also hosting a Demon Slayer convention in Daytona Beach and participating in Licensing Expo 2024. Retail stores are expanding anime product lines to meet rising demand. Hollywood studios are collaborating with anime creators, producing live-action adaptations and anime-inspired films. Esports and gaming companies are integrating anime content into their games, attracting wider audiences and engagement. Major conventions provide platforms for key players to showcase and promote anime content.

The report provides a comprehensive analysis of the competitive landscape in the United States anime market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Yu-Gi-Oh! Go Rush!! debuted in the United States on Disney XD. This series marks the first English release since its 2022 premiere in Japan. As with previous installments, fans can expect it to likely stream on Hulu post-airing. This series features Rush Duel, a simplified version of the traditional Yu-Gi-Oh! card game, tailored for children, using different cards and mechanics than the mainline games.

- March 2024: GKIDS acquired the North American distribution rights for several films by Mamoru Hosoda, including Summer Wars, The Girl Who Leapt Through Time, The Boy and the Beast, and Wolf Children. The company plans to release these films in theaters and on home video starting in 2025. This partnership marks a significant expansion of GKIDS' catalog, showcasing Hosoda's celebrated work in animation.

- October 2024: The anime film The Colors Within announced its release date in the United States for January 24, 2025. The film is produced by Science SARU and directed by Naoko Yamada. It explores the life of Totsuki Higurashi, a high school girl with the ability to see the emotions of others through colors.

United States Anime Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Sources Covered | T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, United States anime market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States anime market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States anime industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anime market in the United was valued at USD 8.29 Billion in 2024.

The United States anime market growth is driven by increasing access through streaming platforms, improved localization and dubbing, which makes anime more appealing to a wider audience. Strong social media influence and active fandoms increase engagement and visibility, fostering a sense of community. Expanding e-commerce platforms provide easy access to merchandise, fueling the market growth.

The United States anime market is projected to exhibit a CAGR of 6.9% during 2025-2033, reaching a value of USD 15.1 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)