United States Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

United States Animal Feed Market Size, Share & Analysis:

The United States animal feed market size was valued at USD 114.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 164.95 Billion by 2033, exhibiting a CAGR of 3.95% from 2025-2033. The United States animal feed market share is expanding, driven by the transition towards intensive farming systems for meat, dairy, and egg production, escalating demand for superior quality animal protein, advances in feed technology and delivery systems, and new developments in nutritional science and biotechnology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.30 Billion |

| Market Forecast in 2033 | USD 164.95 Billion |

| Market Growth Rate 2025-2033 | 3.95% |

United States Animal Feed Market Analysis:

- Growth Drivers: Growth in livestock production, growing demand for quality meat, technology in feed, and encouraging government policies drive United States animal feed market analysis growth in various segments.

- Market trends: Movement towards organic and personalized feed, precision livestock farming, inclusion of probiotics and enzymes, and digital monitoring systems are changing the way animal feed is produced and operated.

- Market Opportunities: Growth in aquaculture, increasing pet food industry, increasing export opportunities, and need for sustainable, plant-based feed ingredients offer strong prospects for market penetration and innovation in new animal classes.

- Market Challenges: Unstable raw material prices, strict regulatory policies, environmental issues due to feed production, and competition from other protein sources are major challenges for market participants and sustainable growth.

The United States animal feed industry is witnessing consistent growth due to a rise in the demand for high-quality protein ingredients and the expansion of the livestock sector. Manufacturers are concentrating on optimizing feed efficiency by utilizing superior nutritional solution and additives, such as amino acids, probiotics, and enzymes. The sector is also observing a shift towards organic and non-genetically modified organisms (GMO) feed due to the ongoing preference for sustainably produced animal products. Moreover, businesses are making investments in research and development (R&D) to create specialized feed for various animal species, enhancing overall animal productivity and health.

To get more information on this market, Request Sample

Precision feeding technologies are increasingly being adopted, which allows for more precise formulation and minimizes feed wastage. Additionally, regulatory support for the production of safe feed and high-quality standards is encouraging manufacturers to implement innovative manufacturing practices. The market is also witnessing a heightened focus on feed safety and traceability, especially due to concerns about foodborne illnesses and supply chain disruptions. Consequently, firms are adopting stricter quality control measures and digital surveillance systems. Additionally, the convergence of data analytics and Internet of Things (IoT) into feed management systems is enabling producers to track animal nutrition in real-time.

United States Animal Feed Market Trends:

Industrialization of Livestock Production

Livestock production industrialization is driving the demand for animal feed in the United States. With a transition towards intensive farming systems for meat, dairy, and egg production, the requirement for formulated and nutritionally balanced feed is on a rise. Mass production depends on effective feed solutions to drive productivity, enhance animal well-being, and maintain a consistent yield. This is most evident in poultry, pig, and dairy industries, wherein feed optimized to control cost containment and growth rates is of prime importance. The application of compound feed, which is reinforced by vitamins, minerals, amino acids, and other additives, is growing to address the individual nutritional requirements of various animal groups. Consolidation of farms and new integrated supply chains are also making feed buying and production simpler. With the growing scale and sophistication among farms, feed producers are creating commodity-specific products suited for intensive farming techniques, thereby supporting the United States animal feed market growth. The IMARC Group predicts that the United States meat market is expected to reach USD 480 Billion by 2033. This will further increase the requirements for animal feed.

Rising Demand for High-Quality Animal Protein

The escalating demand for superior quality animal protein is contributing to the United States animal feed market demand in the US. Increased incomes and a change in consumption habits, particularly toward protein-heavy foodstuffs, are making people consume more meat, milk, and eggs. According to a report by Choban, in 2024, 85% of Americans are interested in increasing their protein intake. This exerts pressure on cattle and other farm animals to provide improved yield as well as sustain the level of quality, leading to heightened need for better nutritional content feed. Shoppers are more interested than ever in the origins of their food, whether that means how animals are raised or what they eat. It is encouraging feed makers to use higher-quality ingredients and to include feed additives that ensure animal health and enhance product quality. Feed that optimizes growth, immunity, and nutrient uptake is now an industry standard among commercial farms. Moreover, the shift towards antibiotic-free and organic livestock products is rising the popularity of other types of feed additives like probiotics and enzymes that are helping manufacturers to address changing norms while ensuring productivity.

Technological Advancements in Feed Formulation and Delivery

Advances in feed technology and delivery systems are revolutionizing the market in the United States. Precision nutrition, data-driven feeding management, and intelligent farming applications are allowing producers to optimize feed formulation for various animal species, ages, and health statuses. New developments in nutritional science and biotechnology are enabling feed producers to design products with better digestibility and bioavailability, resulting in improved feed conversion ratios and lower overall feed prices. In addition, computer-controlled feeding systems are enabling farmers to manage portions, track animal consumption, and minimize waste. All these technologies are helping to improve livestock performance and make feed management more sustainable. The application of real-time data analysis and sensors is further fine-tuning the process, such that animals get the right nutrients at the right times. In 2024, Elanco Animal Health Incorporated declared the U.S. Food and Drug Administration (FDA) finished its extensive, multi-year review of Bovaer® (3-NOP), a first-in-class feed ingredient to reduce methane, and concluded the product is safe and effective for use in lactating dairy cows.

United States Animal Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States animal feed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form, animal type and ingredient.

Analysis by Form:

- Pellets

- Crumbles

- Mash

- Others

Pellets hold 67.8% of the market share. Pelletized animal feed has a considerable market share in the United States because it has great efficiency when it comes to feeding and nutrient supply. Pellets involve processing mixed ingredients of feed into a solid, compact shape through compressing. This shape is excellent in poultry, swine, and dairy farming because it enhances feed conversion and digestion. Pelleting also enhances shelf life and lowers the risk of contamination, and hence it is a choice of preference for large-scale and commercial farming. Its uniform size and composition make automated feeding systems easy, further contributing to its use in intensive farming practices.

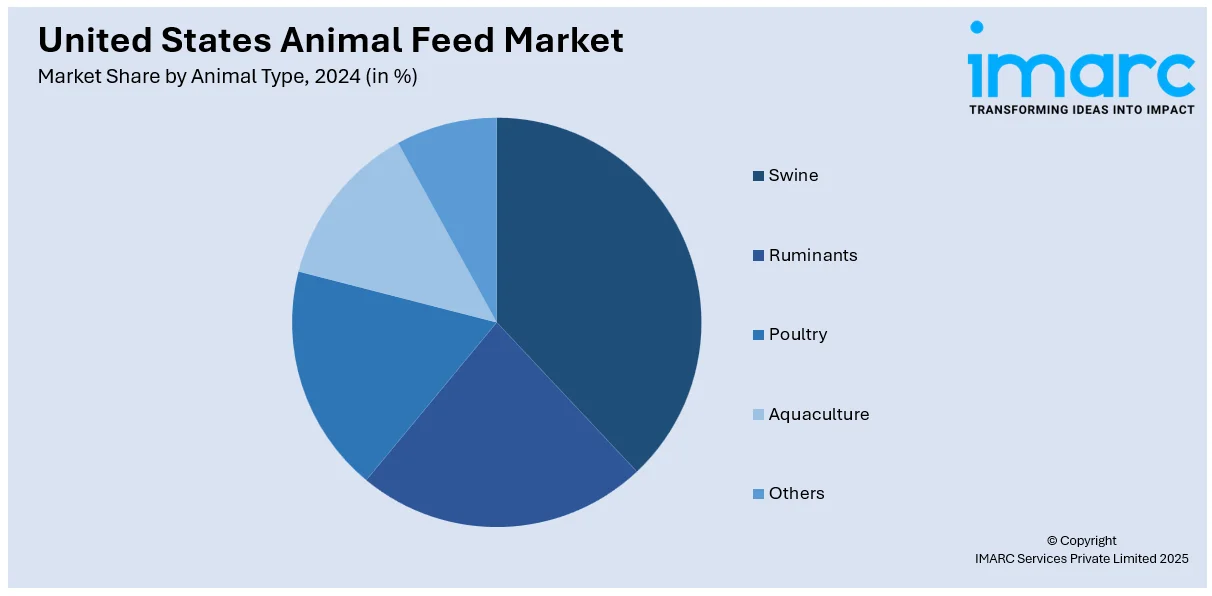

Analysis by Animal Type:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackerel

- Milkfish

- Mollusks

- Salmon

- Others

- Others

Poultry (broilers, layers, turkeys, and others) holds 46.8% of the market share. Poultry feed is amongst the most popular category, being propelled by huge demand for eggs and poultry meat. Broiler feed is formulated for quick growth and feed conversion efficiency, often available in terms of phases such as starter, grower, and finisher. Layer feed is formulated to support maximum egg production, hen health, and shell strength. Moreover, turkey feed has to be capable of handling the larger size and longer growth phase of the birds and must provide higher energy and protein levels.

Analysis by Ingredient:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereals hold the biggest market share. Cereals form the backbone of most animal feed formulations due to their high carbohydrate content and cost-effectiveness. Corn, wheat, barley, and sorghum are commonly used cereals in the market, providing the primary source of energy for livestock and poultry. Their digestibility and availability make them ideal for supporting rapid growth and energy requirements in intensive farming operations. Corn is particularly dominant in poultry and swine diets, while barley and sorghum see more use in ruminant feeds. The demand for non-genetically modified organisms (GMO) and organic cereal variants is also rising, driven by consumer preferences for clean-label and sustainably sourced animal products.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region, though smaller in terms of agricultural output compared to other parts of the country, maintains a steady demand for animal feed, particularly for dairy and poultry operations. States such as New York and Pennsylvania are known for their dairy farms, which require a consistent supply of high-quality ruminant feed. Additionally, the rise of organic and small-scale farming in this region supports the use of specialized feed products, including non-GMO and organic options. Urban proximity also drives demand for locally sourced animal products, encouraging farmers to adopt premium feed solutions that align with consumer expectations for quality and sustainability.

The Midwest stands as the leading region in the market due to its dominance in corn and soybean production, which are critical feed ingredients. States like Iowa, Illinois, and Minnesota are major centers for livestock and poultry farming, including large-scale swine and cattle operations. The abundance of raw materials in the region supports cost-effective feed manufacturing and distribution. Moreover, the region's established infrastructure, along with access to grain processing facilities and feed mills, strengthens its position in both domestic supply and export. The Midwest continues to benefit from innovation in feed technology and precision agriculture, enhancing feed efficiency and animal productivity.

The Southern United States has a diverse agricultural landscape that supports a wide range of animal farming, including poultry, cattle, and aquaculture. States such as Georgia, Texas, and Arkansas are major poultry producers, creating significant demand for broiler and layer feed. Additionally, the presence of beef cattle ranching across Texas and surrounding areas contributes to the high consumption of ruminant feed. Aquaculture is also expanding in the Gulf Coast states, generating demand for specialized aquatic feed. The region benefits from a warm climate and extends growing season, supporting year-round feed production and consumption. Regional feed manufacturers often tailor products to local farming practices and climatic conditions.

The Western region, including states like California, Washington, and Idaho, plays a key role in the animal feed market, particularly through its large-scale dairy and beef cattle operations. California, as one of the nation’s top dairy producers, requires vast quantities of nutritionally dense ruminant feed to maintain high milk output. The region also shows growing interest in sustainable farming, leading to a rise in demand for organic and environmentally friendly feed ingredients. In addition to traditional livestock, the West supports a niche aquaculture sector and specialty animal farming, contributing to varied feed requirements. Water availability and environmental regulations influence feed practices in this region, prompting innovation in resource-efficient feeding solutions.

Competitive Landscape:

Key market players in the United States animal feed market are investing in advanced feed formulations to improve livestock health and productivity. They are incorporating probiotics, enzymes, and organic ingredients to meet the growing demand for sustainable and high-performance feed. Companies are expanding production capacities and upgrading processing facilities to boost efficiency. They are partnering with local farmers and cooperatives to strengthen supply chains and ensure quality raw materials. Firms are conducting research on alternative protein sources like insect meal and algae. They are leveraging digital tools to track feed performance and optimize nutrition delivery. Regulatory compliance and traceability systems are being enhanced to build trust. Players are also increasing marketing efforts to promote customized feed solutions for different livestock categories.

The report provides a comprehensive analysis of the competitive landscape in the United States animal feed market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: CubicFarms’ US subsidiary HydroGreen launched its first Feed-as-a-Service (FaaS) facility in Wakeeney, Kansas, in collaboration with Plainview Beef. The facility provides nutrient-rich sprouted feed aimed at improving cattle health and meat quality.

- September 2024: Cargill acquired two feed mills in Denver, Colorado and Kansas City, Kansas from Compana Pet Brands, aiming to strengthen its animal and pet nutrition operations. The move aligns with Cargill’s broader strategy to grow its animal nutrition footprint.

- September 2024: Novus International, Inc. and Ginkgo Bioworks announced a strategic partnership to develop advanced feed additives for the animal agriculture industry. Leveraging Ginkgo’s Enzyme Services, NOVUS aims to create cost-effective and efficient enzymes that enhance livestock performance.

- August 2024: 4Roots and SeaWorld Orlando partnered to supply nutrient-rich, locally grown lettuce to feed rescued manatees at SeaWorld’s Orlando Rescue Center. Manatees, herbivores native to Florida, rely heavily on leafy greens for survival, consuming about 8% of their body weight daily.

- May 2024: Elanco Animal Health announced that the FDA completed its multi-year review of Bovaer®, confirming its safety and efficacy for use in US dairy cattle. Bovaer is the first methane-reducing feed ingredient of its kind, aimed at supporting climate-neutral dairy farming.

United States Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States animal feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States animal feed market in the region was valued at USD 114.30 Billion in 2024.

The market is growing due to the shift toward intensive livestock farming, rising demand for high-quality animal protein, ongoing innovations in feed formulations, increased adoption of precision feeding technologies, and a growing preference for sustainable and organic feed products.

The United States animal feed market is projected to exhibit a CAGR of 3.95% during 2025-2033, reaching a value of USD 164.95 Billion by 2033.

Pellets accounted for the largest market share at 67.8%, due to their efficiency in feeding, improved digestion, and compatibility with automated systems, especially in poultry, swine, and dairy farming sectors.

Poultry feed held the largest share at 46.8%, driven by high demand for poultry meat and eggs. Broilers and layers dominate this segment with formulations enhancing growth, immunity, and productivity.

Cereals led the market, forming the backbone of feed formulations due to their high energy content and digestibility. Corn, wheat, and barley are widely used, particularly in poultry and swine diets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)