United States Agricultural Biologicals Market Size, Share, Trends, and Forecast by Type, Source, Mode of Application, Application, and Region, 2025-2033

United States Agricultural Biologicals Market Size and Share:

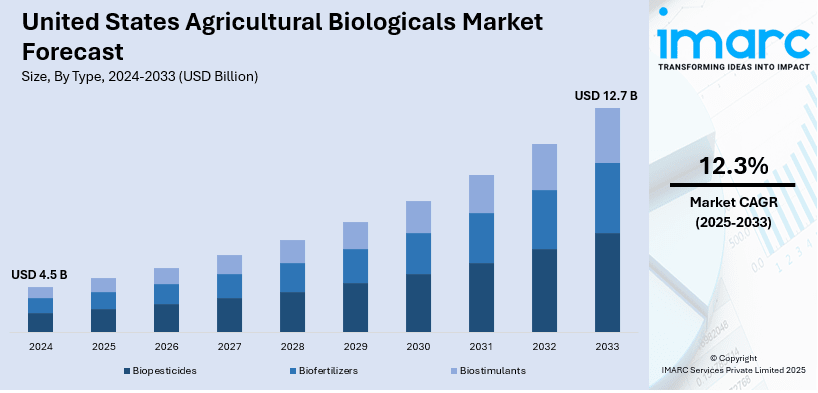

The United States agricultural biologicals market size was valued at USD 4.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.7 Billion by 2033, exhibiting a CAGR of 12.3% from 2025-2033. The rising demand for organic produce, growing environmental awareness, the increasing need for sustainable farming practices, regulatory support, advancements in biotechnologies, and the increasing need for pest resistance are some of the major factors propelling the market growth across the United States.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.7 Billion |

| Market Growth Rate (2025-2033) | 12.3% |

One of the primary factors driving the market is the increasing demand for sustainable farming practices. With growing concerns over the environmental impact of conventional chemical pesticides and fertilizers, farmers are turning to agricultural biologicals, which offer eco-friendly alternatives. These biological products, including biopesticides, biofertilizers, and biological seed treatments, reduce the reliance on synthetic chemicals and help improve soil health, biodiversity, and crop yield without harming the environment. For instance, in July 2024, Syngenta Crop Protection, a leader in agricultural innovation, and Ginkgo Bioworks, which is building the leading platform for cell programming and biosecurity, announced a new cooperation aimed at accelerating the launch of a new biological solution. The two companies have previously collaborated on next-generation seed technology.

Another major factor is the growing recognition of food safety and demand for organic products. People are now conscious about the chemicals involved in the making of food and therefore the farmers are opting to use biological solutions within organic farming standards. Some advanced technologies and new inventions in developing agricultural biologicals are also contributing to the market growth. Novel formulations, improved efficacy, and targeting capabilities of specific pests or diseases make biologicals more appealing. Moreover, the increase in research and development (R&D) investments by the key players in the industry, which makes the availability of much better and more affordable biological solutions, is another driving force of the market growth. For instance, in October 2024, AgroSpheres, a biotechnology leader in sustainable crop protection and crop health, and BASF, a global leader in agricultural solutions, announced their strategic partnership on a category-defining novel bioinsecticide. This collaboration marks a significant step forward in sustainable agriculture solutions aimed at enhancing crop protection.

United States Agricultural Biologicals Market Trends:

Increasing Demand for Organic Produce

The growing consumer demand for organic and sustainably produced food is a major driver in the market across the United States. According to industry reports, in 2023, the category grew by 2.6 percent to $20.5 billion. Organic produce now accounts for more than 15 percent of total U.S. fruit and vegetable sales. Top sellers in the organic produce section were avocadoes, berries, apples, carrots, and packaged salads, and organic bananas saw stronger growth in 2023 than non-organic bananas. Consumers are increasingly becoming health-conscious and seek produce free from synthetic chemicals and pesticides, pushing farmers to adopt biological solutions. As awareness of environmental impact rises, the demand for organic agriculture further boosts the adoption of biologicals across the industry. According to updated research conducted by Stratovation Group, over that time, awareness of biologicals among row-crop farmers increased to 87%, from 83% in 2022. Awareness of specific subcategories, biostimulants, and biofertilizers, were both up 14 percentage points.

Rising Environmental and Regulatory Pressure

Strict environmental regulations and government initiatives to reduce chemical usage in agriculture propel the demand for biologicals. According to the United States agricultural biologicals market overview, many federal and state policies have allocated funds for marketing such sustainable practices. They also invest funds in the development and dissemination of these alternatives. Often, regulatory agencies shorten the approval process for biologicals, thus making them more readily accessible to farmers. The environmental concerns have increased interest in soil health, water quality, and biodiversity loss; therefore, regulatory pressure is expected to increase sustainability shifts toward biologicals. For instance, in December 2023, The U.S. Environmental Protection Agency (EPA) registered Greenlight Biosciences' biopesticide products containing the new active ingredient Ledprona for three years, a timeframe that is consistent with EPA’s approach to other novel biopesticide products. Ledprona is a new type of pesticide that relies on a natural mechanism--called RNA interference (RNAi)--used by plants and animals to protect against disease. EPA supports advancements in novel pesticide technology because this technology replaces more toxic chemical-based pesticides, provides an additional tool for farmers to address challenges of climate change and aids in resistance management.

Technological Advancements in Biologics

Technological innovations in biopesticides, biofertilizers, and biostimulants fuel market growth by enhancing the effectiveness and usability of biological products. For instance, in November 2024, Yara North America launched the YaraAmplix biostimulant portfolio in the United States and Canada, marking a significant milestone in the company’s commitment to advancing a sustainable, resilient food system. Backed by over five years of global and regional research and development, the YaraAmplix portfolio is designed to enhance crop resilience, nutrient uptake, and overall crop quality while promoting healthier soils and better adaptability to environmental stressors. Advances in genomics, microbial formulations, and delivery mechanisms help develop biologicals that work more consistently across varying environmental conditions. According to the United States agricultural biologicals market forecast, improved shelf life, application techniques, and product stability increase farmer confidence, driving broader adoption. As precision agriculture and biotechnology improve, biologicals become more practical, offering farmers efficient, targeted solutions to boost crop health and yield.

United States Agricultural Biologicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States agricultural biologicals market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, source, mode of application, and application.

Analysis by Type:

- Biopesticides

- Biofertilizers

- Biostimulants

Biopesticides are expected to hold a significant share in the market as they offer effective, eco-friendly alternatives to synthetic pesticides. They target specific pests without harming beneficial organisms or polluting the environment. With rising regulatory restrictions on chemical pesticides, biopesticides have gained popularity among farmers seeking safe pest management solutions. Advances in microbial and botanical formulations further boost their reliability, making them a preferred choice across conventional and organic farming practices in the U.S.

Biofertilizers are increasingly popular due to their role in enhancing soil fertility and nutrient availability without depleting soil health. They promote plant growth by fostering beneficial microbial activity, which helps fix nitrogen and solubilize phosphorus naturally. As farmers seek sustainable fertilization methods, biofertilizers provide a viable alternative to chemical fertilizers. With consumer demand for organic produce and growing awareness of soil preservation, biofertilizers are expected to maintain a strong market position.

Biostimulants are projected to dominate the largest United States agricultural biologicals market share as they improve plant resilience, nutrient uptake, and yield potential. They help crops withstand stress from drought, salinity, and extreme temperatures, which is increasingly important with changing climate conditions. By enhancing root growth and boosting overall plant health, biostimulants enable farmers to achieve better productivity. Rising focus on sustainable farming practices and resource efficiency makes biostimulants a favored choice in agriculture.

Analysis by Source:

- Microbials

- Macrobials

- Biochemicals

- Others

Microbials are projected to dominate the market due to their versatility and effectiveness in improving soil health, nutrient absorption, and pest management. These products, derived from beneficial bacteria, fungi, and other microorganisms, enhance plant resilience while minimizing environmental harm. Microbial solutions address diverse agricultural needs, from fertilization to pest control, appealing to farmers aiming for sustainable, eco-friendly practices. Ongoing research and advancements further boost their efficacy, driving strong market demand.

Macrobials like beneficial insects or nematodes do much in natural pest management that helps farmers, reducing the dependency on synthetic pesticides. They are specialized-action biological agents that attack only the damaging ones without making a difference to beneficial species and support eco-friendly crop management. The trend of IPM gaining ground among farmers would therefore be welcomed in macrobials as their sustainable solution to pest control in large-scale farming. They have proven successful in reducing resistance build-up, and promoting biodiversity, and so have high recommendation value for both conventional and organic systems.

Biochemicals are expected to capture significant market share due to their targeted pest control and plant enhancement properties. Derived from natural compounds, biochemicals like pheromones and plant extracts disrupt pest behavior without toxicity to the environment or humans. As regulations on synthetic pesticides tighten, biochemicals offer effective, eco-friendly alternatives. Their compatibility with other biologicals in integrated pest management systems further increases their appeal to U.S. farmers prioritizing sustainability.

Analysis by Mode of Application:

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Post-harvest

Foliar sprays are widely used for their quick absorption, delivering nutrients and pest control directly to plant leaves for rapid effects. This method improves efficiency and reduces waste, making it ideal for targeted applications. As farmers prioritize resource-efficient solutions, foliar sprays are favored for their ease of use, especially in high-value crops where quick response is essential.

Soil treatments are popular due to their role in enhancing soil health, promoting beneficial microbial activity, and improving nutrient availability. By directly enriching the soil, they support robust root development and plant resilience. As sustainable agriculture gains traction, soil treatments are preferred for their long-term benefits, making them essential in organic and regenerative farming practices.

Seed treatments protect crops at their earliest stage, enhancing germination, disease resistance, and pest protection right from planting. This targeted approach minimizes chemical use while maximizing growth potential. With increasing demand for efficient, eco-friendly crop protection, seed treatments are favored for their cost-effectiveness and ability to enhance yields by boosting plant health from the start.

Post-harvest treatments reduce spoilage, extend shelf life, and preserve crop quality, critical for food supply chains. Biological post-harvest solutions prevent decay and microbial growth, appealing to organic and conventional markets alike. As waste reduction becomes a priority, post-harvest treatments gain popularity, helping meet consumer demand for fresh, high-quality produce with minimal environmental impact.

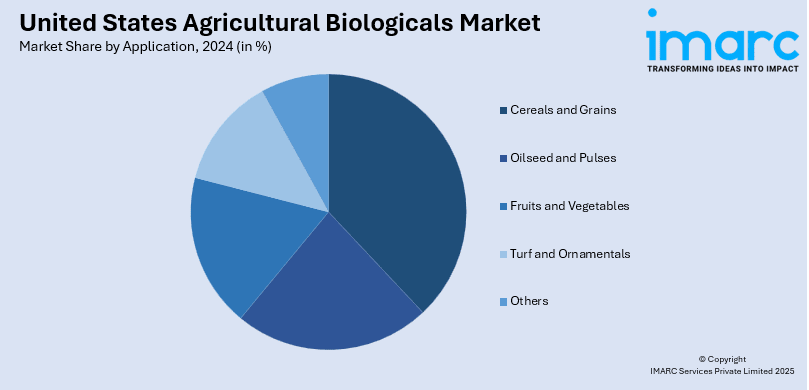

Analysis by Application:

- Cereals and Grains

- Oilseed and Pulses

- Fruits and Vegetables

- Turf and Ornamentals

- Others

Cereals and grains hold a significant market share due to their vast acreage and essential role in the U.S. food supply. Farmers increasingly turn to biologicals for sustainable pest control and nutrient management in these crops which is driving the United States agricultural biologicals market demand. With rising demand for healthier, chemical-free grain products, biological solutions offer effective, eco-friendly alternatives that maintain yield and soil health, aligning with consumer and regulatory pressure for sustainable large-scale farming practices.

Oilseeds and pulses benefit from biologicals that enhance nitrogen fixation and pest resistance, critical for these nutrient-demanding crops. Farmers prioritize soil health and yield optimization in these high-value crops, making biologicals a popular choice. As demand grows for sustainable plant-based proteins and oils, biologicals support the effective, eco-friendly production of oilseeds and pulses, meeting consumer interest in organic and sustainable agricultural practices.

Fruits and vegetables drive biological demand due to their sensitivity to pests and chemicals, as well as consumer preference for pesticide-free produce. Biologicals support pest control, growth enhancement, and shelf-life extension, essential for quality and marketability. With increasing demand for organic and fresh produce, biological treatments provide sustainable solutions that maintain crop quality and meet strict residue standards, making them highly popular in these high-value crops.

Turf and ornamentals adopt biologicals to enhance growth, aesthetic appeal, and resilience to pests while minimizing chemical input. Used widely in landscaping, sports fields, and nurseries, these sectors prioritize eco-friendly practices and safe, non-toxic products. Biologicals meet these needs, offering effective pest control and growth support without harmful residues, making them ideal for maintaining high-quality turf and ornamental plants in environmentally sensitive areas.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast holds a significant share due to its emphasis on sustainable agriculture, particularly in organic farming. The region’s diverse crop production, including fruits, vegetables, and dairy, benefits from biologicals like biopesticides and biofertilizers. The demand for environmentally friendly solutions is high, driven by consumer preferences for organic products and strict regulatory standards promoting eco-conscious farming practices.

The Midwest, with its large-scale crop production, especially corn, soybeans, and wheat, is a major user of agricultural biologicals. The region's focus on high-yield, sustainable farming practices makes biologicals appealing for pest management, soil health, and nutrient optimization. As farmers seek ways to reduce chemical inputs and improve crop resilience, the Midwest’s agricultural diversity and scale drive significant market adoption of biological products.

The South’s agriculture is diverse, with cotton, tobacco, and citrus among the key crops, creating substantial demand for biologicals. High temperatures and pest pressure make biopesticides, biostimulants, and biofertilizers popular choices which are facilitating the United States agricultural biologicals market growth. The region's focus on reducing pesticide usage and environmental impact, along with a growing interest in sustainable farming methods, positions the South as a major market for agricultural biologicals.

The West, with its large-scale production of fruits, vegetables, and nuts, increasingly relies on biologicals to meet sustainability goals and consumer demand for pesticide-free produce. The region's dry climate makes soil health and water conservation critical, driving demand for biological solutions that improve nutrient uptake and plant resilience. Regulatory pressure and consumer preferences for organic produce further enhance the West's adoption of agricultural biologicals.

Competitive Landscape:

The market is competitive, with key players including Bayer AG, Syngenta, BASF, and Corteva Agriscience leading through extensive product lines and R&D investments. Numerous startups and specialized companies, such as Marrone Bio Innovations and Valent BioSciences, focus on niche biopesticides and biofertilizers, intensifying competition. The United States agricultural biologicals market companies drive innovation as they respond to the rising demand for sustainable, effective, and accessible biological alternatives to traditional agricultural chemicals. Moreover, strategic mergers, acquisitions, and partnerships help larger companies expand portfolios and enter new segments. For instance, in October 2024, Bridgepoint, a leading private asset growth investor, announced its partnership with Meristem, a leader in the agricultural solutions market. Meristem's innovative and patent-protected technology accelerates farmers' access to new biologicals, lacking in the US market. Bridgepoint's new partnership with Meristem builds on the firm's strong track record of backing companies in the agricultural solutions sector, including SunWorld, an innovative global fruit genetics platform, and Rovensa, a global leader in R&D-led biological solutions for growers.

Latest News and Developments:

- In March 2024, MBFi (Microbial Biological Fertilizers International), long-established agricultural biologicals technology developer and manufacturer announced its entry into the North America marketplace with its SaxSym biologicals technology. The company's key focus is to provide growers with effective, sustainable crop inputs.

- In July 2024, Syngenta Biologicals, a leader in cutting-edge agricultural biological solutions and Intrinsyx Bio, a Silicon Valley biotech company that promotes sustainable agriculture, announced a collaboration to bring a novel biological solution to agricultural markets globally. The collaboration will boost farmers’ access to a custom selection of Intrinsyx Bio’s proprietary endophyte formulations.

- In February 2024, Locus Agriculture (Locus AG) announced the introduction of six new biological treatments to its Rhizolizer® Duo product line in a major advancement for row crop farming. Available immediately for in-furrow, and upstream and downstream seed applications, the biologicals meet the evolving needs of row crop farmers, seed treatment companies, agricultural retailers, and distributors. The launch is a strategic response to the industry’s need for cost-effective, sustainable biologicals amidst rising input costs, which are identified as the primary threat to farm profitability.

United States Agricultural Biologicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biopesticides, Biofertilizers, Biostimulants |

| Sources Covered | Microbials, Macrobials, Biochemicals, Others |

| Mode of Applications Covered | Foliar Spray, Soil Treatment, Seed Treatment, Post-harvest |

| Applications Covered | Cereals and Grains, Oilseed and Pulses, Fruits and Vegetables, Turf and Ornamentals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States agricultural biologicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States agricultural biologicals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States agricultural biologicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agricultural biologicals are natural or biologically-derived products used in farming to enhance crop production and protect against pests and diseases. These include biopesticides, biofertilizers, biostimulants, and biological seed treatments. They promote sustainable farming by improving soil health, increasing yield, and reducing the reliance on synthetic chemicals.

The United States agricultural biologicals market was valued at USD 4.5 Billion in 2024.

IMARC estimates the United States agricultural biologicals market to exhibit a CAGR of 12.3% during 2025-2033.

The key factors driving the market are the increasing demand for sustainable farming, growing consumer preference for organic products, and environmental concerns over synthetic chemicals. Technological advancements, regulatory support, and the need for cost-effective, eco-friendly solutions further accelerate the adoption of biopesticides, biofertilizers, and other biological products in agriculture.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)