United Kingdom Facility Management Market Report by Type (Inhouse, Outsourced), Offering (Hard FM, Soft FM), End User (Commercial, Institutional, Public/Infrastructure, Industrial, and Others), and Region 2026-2034

United Kingdom Facility Management Market Overview:

The United Kingdom facility management market size reached USD 2,939.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,276.3 Million by 2034, exhibiting a growth rate (CAGR) of 12.19% during 2026-2034. The market is witnessing significant growth due to rising urbanization and commercial development, the growing focus on employee experience and workplace wellness, and the increasing demand for integrated solutions enhancing operational efficiency across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,939.7 Million |

|

Market Forecast in 2034

|

USD 8,276.3 Million |

| Market Growth Rate 2026-2034 | 12.19% |

Access the full market insights report Request Sample

United Kingdom Facility Management Market Trends:

Rise in Urbanization and Commercial Development:

The United Kingdom market and lifestyle are changing due to rapid urbanization, which is driving the demand for facility management (FM) services. Additionally, the demand for effective management of commercial and residential areas is driving market expansion as cities expand to accommodate growing populations. For instance, as per the Office for National Statistics, the population of the United Kingdom reached 67.6 million by mid-2022, a 6.8% increase from 2011. Besides this, in 2019, urban areas were home to 56.3 million individuals, comprising 82.9% of England's population, while rural areas accommodated 9.6 million people, constituting 17.1% of the total population. This increase highlights the need for all-encompassing facilities management (FM) solutions to meet the growing needs of cities. Moreover, the growing need for FM services to maintain and maximize these facilities throughout the region is due to the requirement for sophisticated infrastructure in urban areas to support expanding populations is contributing to the market growth. As a result, professional facility management is becoming necessary as cities and commercial infrastructure increase due to the concentration of enterprises, residential complexes, and public amenities needed for smooth operation in these places across the region.

Growing Focus on Employee Experience and Workplace Wellness:

Workplace health initiatives and an increased focus on employee experience are driving substantial growth in the facility management (FM) business in the United Kingdom. Additionally, businesses are realizing that employee productivity, satisfaction, and retention are directly correlated with a positive, nurturing work environment. For instance, in January 2023, Sodexo's corporate services division focused on maximizing workplace utilization won a five-year contract to provide integrated facilities management (FM) for a prestigious global bank's London offices. The initiative involves implementing state-of-the-art vital spaces, which are intended to improve employee experience and boost productivity. Sodexo provided a range of services meant to improve worker engagement and satisfaction as part of the £2 million yearly contract. These services include guest services, cleaning, reception, cuisine, hospitality, technical assistance, and maintenance of the on-site gym. Therefore, the need for FM services specifically designed to create welcoming work environments is growing as companies place a higher priority on employee well-being.

United Kingdom Facility Management Market News:

- March 2024: FM provider Atlas acquired Tudor Group, a provider of cleaning and support services. Tudor has offices in Bristol and Cardiff in addition to its headquarters in Eccles, Greater Manchester. In total, the company oversees operations at more than 250 locations. Tudor provides construction and technical services to offices, stadiums, hotels, and window cleaning services to numerous clients in different industries across the region.

- May 2024: Mitsubishi Electric introduced a novel control platform MELCloud commercial aimed at offering enhanced monitoring and reporting capabilities, providing building operators and facilities managers with immediate access to a greater volume of data, and improving overall functionality. Additionally, the platform facilitates the configuration, monitoring, and proactive maintenance of HVAC systems. It is tailored for commercial settings such as offices, hospitals, retail stores, and hotels where efficient cooling, heating, and ventilation are critical, the platform addresses the evolving needs of modern buildings and enhances building management for organizations of all kinds.

United Kingdom Facility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, offering, and end user.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Inhouse

- Outsourced

- Single FM

- Bundled FM

- Integrated FM

The report has provided a detailed breakup and analysis of the market based on the type. This includes inhouse and outsourced (single FM, bundled FM, and integrated FM).

Offering Insights:

- Hard FM

- Soft FM

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hard FM and soft FM.

End User Insights:

- Commercial

- Institutional

- Public/Infrastructure

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, institutional, public/infrastructure, industrial and others.

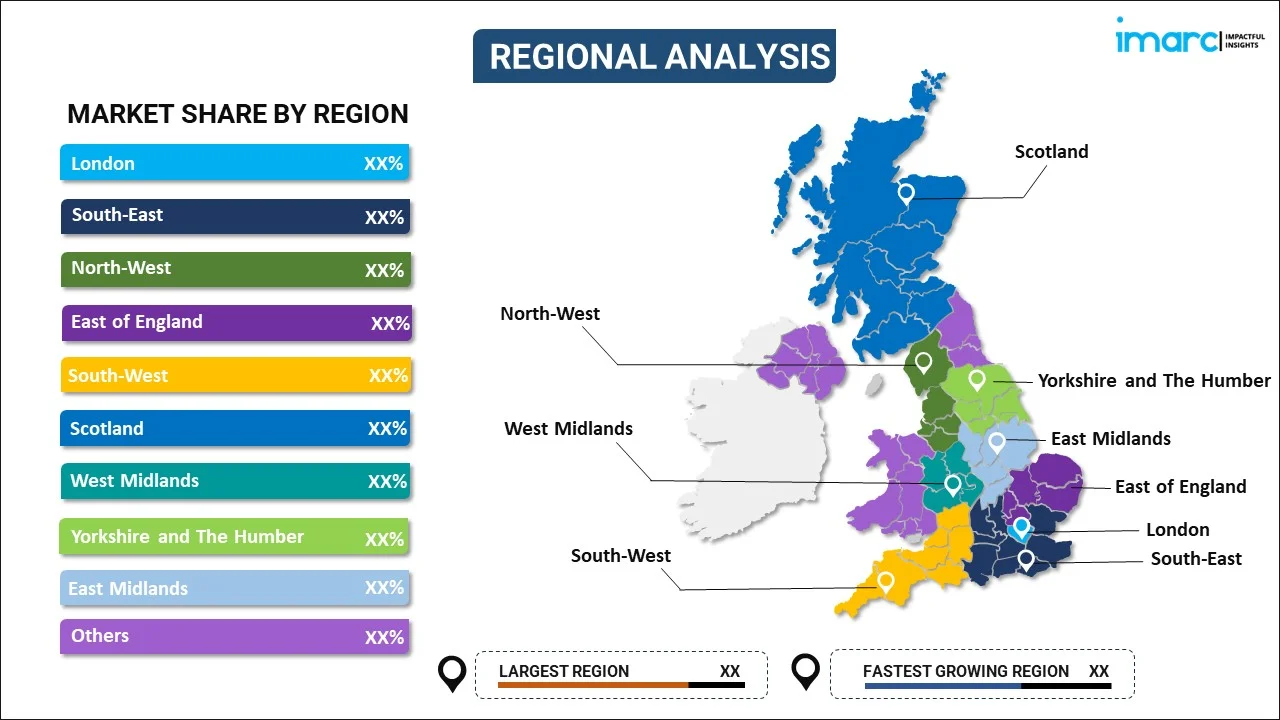

Region Insights:

To get detailed regional analysis of this market Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United Kingdom Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Offerings Covered | Hard FM, Soft FM |

| End Users Covered | Commercial, Institutional, Public/Infrastructure, Industrial, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United Kingdom facility management market performed so far and how will it perform in the coming years?

- What is the breakup of the United Kingdom facility management market on the basis of type?

- What is the breakup of the United Kingdom facility management market on the basis of offering?

- What is the breakup of the United Kingdom facility management market on the basis of end user?

- What are the various stages in the value chain of the United Kingdom facility management market?

- What are the key driving factors and challenges in the United Kingdom facility management?

- What is the structure of the United Kingdom facility management market and who are the key players?

- What is the degree of competition in the United Kingdom facility management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United Kingdom facility management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United Kingdom facility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United Kingdom facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)