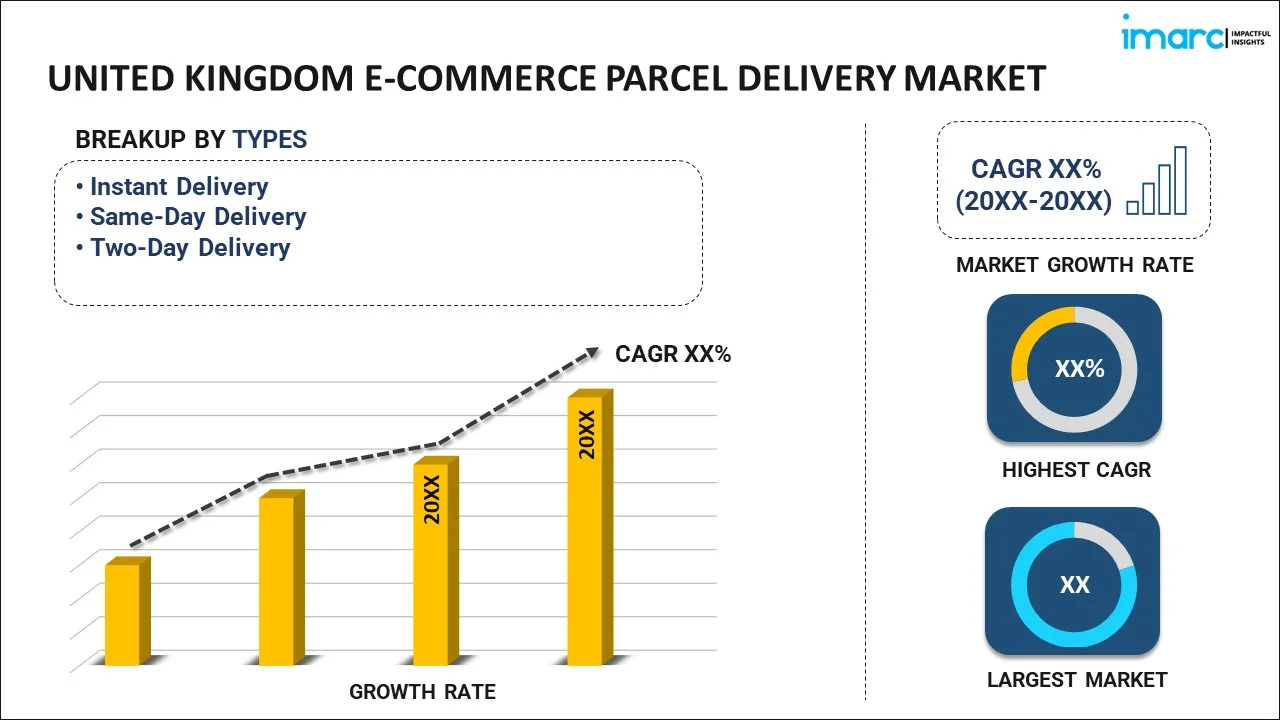

United Kingdom E-Commerce Parcel Delivery Market Report by Type (Instant Delivery, Same-Day Delivery, Two-Day Delivery), Business Size (Small, Medium, Large), Destination (Domestic, International), Industry (Apparel and Accessories, Consumer Packaged Goods, Consumer Electronics, Manufacturing and Construction, Healthcare, and Others), and Region 2026-2034

United Kingdom E-Commerce Parcel Delivery Market Overview:

The United Kingdom e-commerce parcel delivery market size reached USD 11,412.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 73,132.1 Million by 2034, exhibiting a growth rate (CAGR) of 22.92% during 2026-2034. The rise in online shopping, increasing consumer expectations for fast and flexible delivery, significant technological advancements in logistics, growing retailer competition, and the shifting focus on sustainable delivery practices are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 11,412.8 Million |

|

Market Forecast in 2034

|

USD 73,132.1 Million |

| Market Growth Rate 2026-2034 | 22.92% |

Access the full market insights report Request Sample

United Kingdom E-Commerce Parcel Delivery Market Trends:

Rise in Online Shopping

The continuous growth of e-commerce, driven by the COVID-19 pandemic, is leading to a significant increase in parcel volumes as consumers increasingly prefer online shopping over traditional retail. According to the International Trade Administration, eCommerce revenues in the UK are expected to have an annual average growth rate of 12.6% by 2025. The UK has the third largest e-commerce market in the world after China, and the U.S. Consumer e-commerce now accounts for 36.3% of the total retail market in the UK (as of Jan 2021), with e-commerce revenue projected to increase to $285.60 billion by 2025. In 2022, UK online sales saw its highest annual growth since 2007 with sales increasing by 36%.

Significant Technological Advancements

The increasing innovations in logistics technology, including automated sorting systems, real-time tracking, and last-mile delivery solutions, have helped enhance efficiency, reduce delivery times, and improve overall customer satisfaction, which, in turn, is fueling the market growth. For instance, in November 2023, Guernsey Post completed the installation of automated parcel sorting equipment. The post office implemented the£1.8m parcel sorter at its Envoy House headquarters. The sorter is believed to handle all mail formats up to 20 kg, and optical character recognition which can read handwritten addresses. Similarly, in November 2023, Nigerian last-mile delivery startup, Fez Delivery launched its UK-Nigeria Shipping service, marking a significant milestone in the company's expansion. This move comes as part of Fez's strategy to refine its operations and enhance its delivery services in the UK market.

United Kingdom E-Commerce Parcel Delivery Market News:

- In February 2023, Maersk announced a new multi-year partnership with ASOS, the global fashion e-commerce destination headquartered in the UK. ASOS appointed Maersk as its strategic logistic partners for supply chain management (SCM), supporting the growth of the FTSE 250-listed company. ASOS solved over 26 million active customers in over 200 markets. These customers can shop a curated edit of nearly 70,000 products, sourced from nearly 900 of the best global and local partner brands and its mix of fashion-led own-brand labels.

- In May 2024, after an extensive due diligence process, the Cardinal Partnership, Davies Turner, and Woodland Group formed a holding company and acquired the UK-based freight software firm Forward Computers Ltd from the Freight Software Group. The joint venture is called Forward Computers Alliance Limited and is the vehicle through which the three leading independent freight forwarding and supply chain management companies now jointly own Forward Computers Limited, which trades as Forward Solutions.

United Kingdom E-Commerce Parcel Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, business size, destination, and industry.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Instant Delivery

- Same-Day Delivery

- Two-Day Delivery

The report has provided a detailed breakup and analysis of the market based on the type. This includes instant delivery, same-day delivery, and two-day delivery.

Business Size Insights:

- Small

- Medium

- Large

A detailed breakup and analysis of the market based on the business size have also been provided in the report. This includes small, medium, and large.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

Industry Insights:

- Apparel and Accessories

- Consumer Packaged Goods

- Consumer Electronics

- Manufacturing and Construction

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes apparel and accessories, consumer packaged goods, consumer electronics, manufacturing and construction, healthcare, and others.

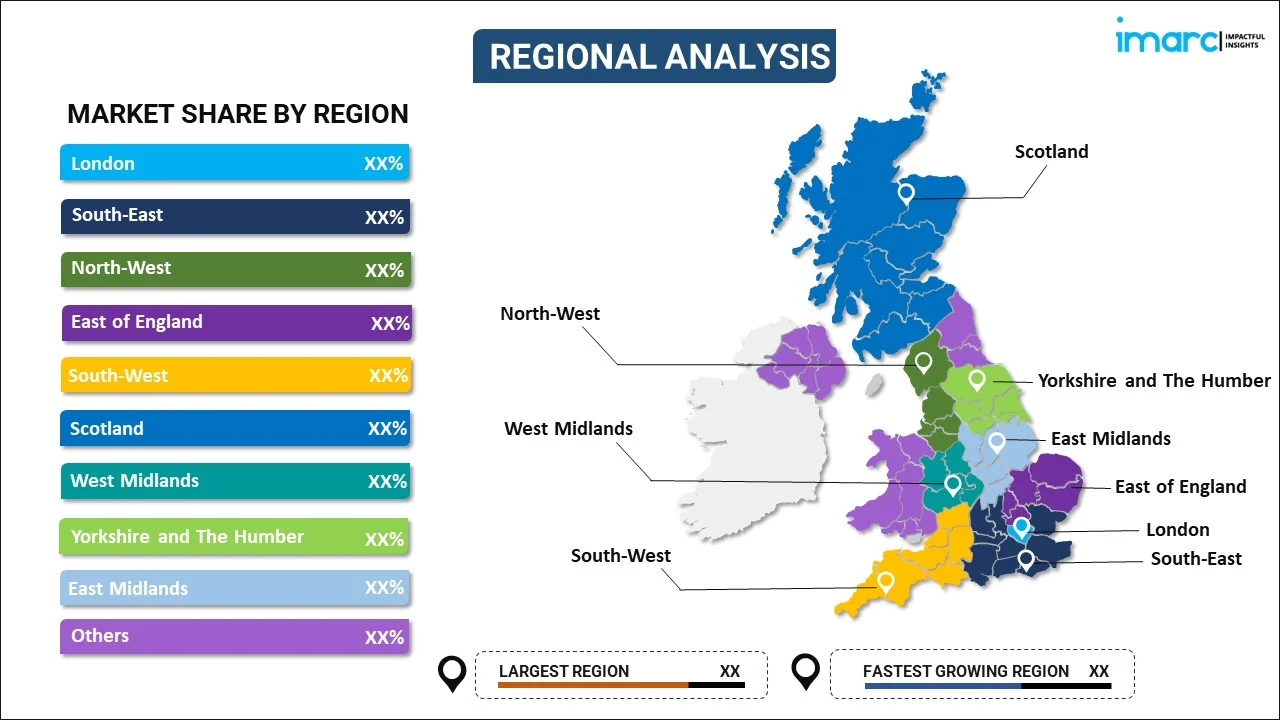

Region Insights:

To get detailed regional analysis of this market Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United Kingdom E-Commerce Parcel Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Instant Delivery, Same-Day Delivery, Two-Day Delivery |

| Business Sizes Covered | Small, Medium, Large |

| Destinations Covered | Domestic, International |

| Industries Covered | Apparel and Accessories, Consumer Packaged Goods, Consumer Electronics, Manufacturing and Construction, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United Kingdom e-commerce parcel delivery market performed so far and how will it perform in the coming years?

- What is the breakup of the United Kingdom e-commerce parcel delivery market on the basis of type?

- What is the breakup of the United Kingdom e-commerce parcel delivery market on the basis of business size?

- What is the breakup of the United Kingdom e-commerce parcel delivery market on the basis of destination?

- What is the breakup of the United Kingdom e-commerce parcel delivery market on the basis of industry?

- What are the various stages in the value chain of the United Kingdom e-commerce parcel delivery market?

- What are the key driving factors and challenges in the United Kingdom e-commerce parcel delivery?

- What is the structure of the United Kingdom e-commerce parcel delivery market and who are the key players?

- What is the degree of competition in the United Kingdom e-commerce parcel delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United Kingdom e-commerce parcel delivery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United Kingdom e-commerce parcel delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United Kingdom e-commerce parcel delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)