United Kingdom Carbon Dioxide Market Report by Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, and Others), Production (Biological, Combustion), End Use (Food and Beverages, Oil and Gas, Medical, Rubber, Metal Fabrication, and Others), and Region 2025-2033

Market Overview:

United Kingdom carbon dioxide market size reached 8.4 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 12.8 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The expanding industries like food and beverage, chemicals, and manufacturing, which use carbon dioxide for various processes, such as carbonation in beverages, chemical production, and refrigeration, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

8.4 Million Tons |

|

Market Forecast in 2033

|

12.8 Million Tons |

| Market Growth Rate 2025-2033 | 4.7% |

Carbon dioxide (CO2) is a colorless, odorless gas composed of one carbon atom and two oxygen atoms. It is a crucial component of Earth's atmosphere, playing a significant role in the carbon cycle. CO2 is released through natural processes like respiration and volcanic activity, but human activities, particularly the burning of fossil fuels and deforestation, have significantly increased its concentration in the atmosphere. This heightened presence contributes to the greenhouse effect, trapping heat and leading to global warming. As a major greenhouse gas, CO2 is a key driver of climate change, impacting weather patterns, sea levels, and ecosystems. Efforts to mitigate climate change often involve reducing CO2 emissions and exploring technologies for carbon capture and storage to curb its environmental impact.

United Kingdom Carbon Dioxide Market Trends:

The carbon dioxide market in the United Kingdom is propelled by various factors, with a prominent driver being the regional commitment to mitigate climate change. Governments have initiated stringent regulations and policies to curb greenhouse gas emissions, creating a demand for carbon dioxide reduction solutions. Moreover, the increasing awareness of the environmental impact of industrial activities has prompted businesses to adopt sustainable practices, thereby fostering the growth of the carbon dioxide market. Furthermore, the rise in renewable energy projects and the transition towards cleaner technologies contribute significantly to the market dynamics. As industries seek to minimize their carbon footprint, the demand for carbon capture and storage technologies intensifies, driving the market forward. Additionally, economic considerations play a pivotal role in shaping the carbon dioxide market landscape. The pursuit of economic efficiency and cost-effectiveness has led industries to explore carbon dioxide utilization technologies, transforming a potential environmental liability into a valuable resource. In essence, the carbon dioxide market in the United Kingdom is intricately linked to a complex web of environmental, economic, and regulatory factors that collectively steer its trajectory toward a more sustainable and low-carbon future.

United Kingdom Carbon Dioxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source, production, and end use.

Source Insights:

- Hydrogen

- Ethyl Alcohol

- Ethylene Oxide

- Substitute Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes hydrogen, ethyl alcohol, ethylene oxide, substitute natural gas, and others.

Production Insights:

- Biological

- Combustion

A detailed breakup and analysis of the market based on the production have also been provided in the report. This includes biological and combustion.

End Use Insights:

- Food and Beverages

- Oil and Gas

- Medical

- Rubber

- Metal Fabrication

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food and beverages, oil and gas, medical, rubber, metal fabrication, and others.

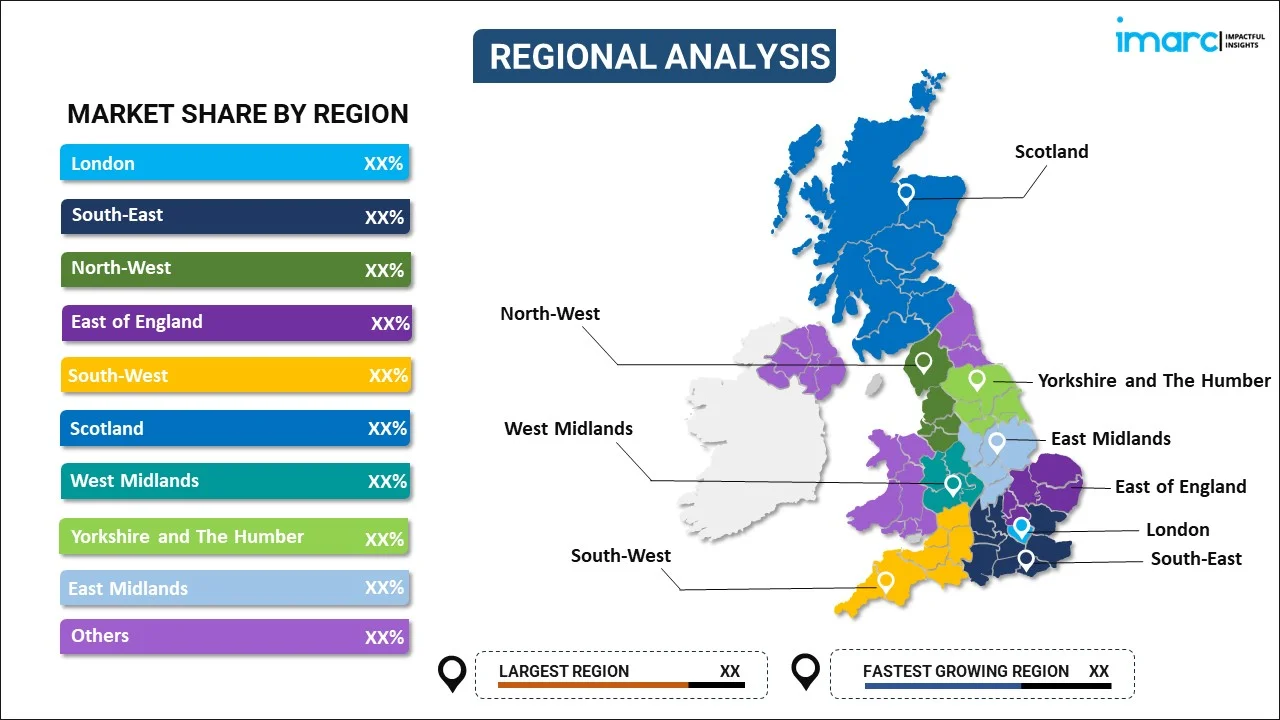

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United Kingdom Carbon Dioxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, Others |

| Productions Covered | Biological, Combustion |

| End Uses Covered | Food and Beverages, Oil and Gas, Medical, Rubber, Metal Fabrication, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United Kingdom carbon dioxide market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United Kingdom carbon dioxide market?

- What is the breakup of the United Kingdom carbon dioxide market on the basis of source?

- What is the breakup of the United Kingdom carbon dioxide market on the basis of production?

- What is the breakup of the United Kingdom carbon dioxide market on the basis of end use?

- What are the various stages in the value chain of the United Kingdom carbon dioxide market?

- What are the key driving factors and challenges in the United Kingdom carbon dioxide?

- What is the structure of the United Kingdom carbon dioxide market and who are the key players?

- What is the degree of competition in the United Kingdom carbon dioxide market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United Kingdom carbon dioxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United Kingdom carbon dioxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United Kingdom carbon dioxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)