Underwater Drone Market Size, Share, Trends and Forecast by Type, Product Type, Propulsion System, Application, and Region, 2025-2033

Underwater Drone Market Size and Share:

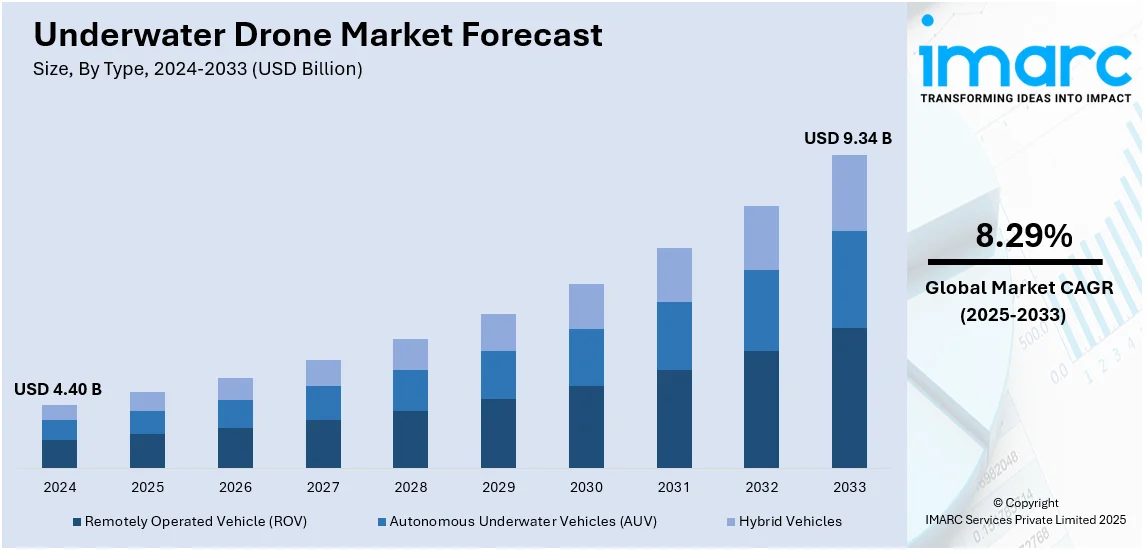

The global underwater drone market size was valued at USD 4.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.34 Billion by 2033, exhibiting a CAGR of 8.29% from 2025-2033. North America currently dominates the market, holding a market share of over 32.3% in 2024. The underwater drone market share is expanding, driven by the rising applications in marine research, defense, and commercial sectors, rapid technological advancements, and the increasing demand for underwater exploration, surveillance, and environmental monitoring.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.40 Billion |

| Market Forecast in 2033 | USD 9.34 Billion |

| Market Growth Rate (2025-2033) | 8.29% |

The increasing demand for ocean exploration and marine research is fueling the market growth. Industries, such as oil and gas, are using underwater drones for inspecting pipelines, mapping seabeds, and monitoring underwater structures. Besides this, the defense sector is adopting underwater drones for surveillance, mine detection, and rescue missions, enhancing safety and operational efficiency. Additionally, advancements in sensors, navigation systems, and remote control technologies are improving drone performance, expanding their applications. Apart from this, the rising focus on marine conservation and environmental monitoring is encouraging their use in tracking aquatic ecosystems. Aquaculture farms are also employing underwater drones for fish monitoring and water quality checks.

To get more information on this market, Request Sample

The United States has emerged as a major region in the underwater drone market owing to many factors. The increasing investments in maritime security, naval defense, and offshore energy exploration are offering a favorable underwater drone market outlook. The US Navy is adopting these drones for surveillance, underwater reconnaissance, and mine detection, improving defense capabilities. Underwater drones are becoming necessary to monitor pipelines and underwater infrastructure due to the increased demand for offshore oil and gas inspection. Additionally, their use in ocean mapping and ecosystem monitoring is rising due to the increasing expenditure associated with marine research and environmental conservation. In December 2024, The US Department of Energy declared an investment exceeding USD 18 Million in 27 research and development (R&D) activities via the Marine Energy University Foundational R&D funding initiative.

Underwater Drone Market Trends:

Increasing Use in Marine Research and Exploration

Underwater drones are critical to the marine research and exploration process. For example, in 2022, ocean-related sectors created USD 2.5 Trillion in worldwide economic value and sustained nearly 3 Billion people’s livelihoods across industries like seafood, port development, and coastal tourism. Government agencies and firms are collaborating to invest in sea probe activities. In 2024, the National Oceanic and Atmospheric Administration (NOAA) teamed up with the nonprofit Ocean Discovery League (ODL) to accelerate deep-ocean exploration by developing affordable tools and technologies like underwater cameras and drones, enabling the public and countless additional scientists to investigate the ocean. The underwater drones allow scientists and researchers to examine more information about the ocean ecosystem, the behavior of marine animals, and the numerology of the ocean. These drones assist in conducting studies that were never possible before. These drones are built with sensors and imaging systems, offering data that is valuable to the understanding of the ocean, the biodiversity of the ocean, and how human activities affect the marine environment.

Rising Demand in Defense and Security Applications

The rising product demand across military and defense agencies to undertake military-related trends and maritime border surveillance missions is one of the primary factors positively influencing the market. According to the European Council, between 2021 and 2024, the total defense spending of EU member countries increased by over 30%. In 2024, it attained an estimated sum of USD 345 Billion. Underwater drones are largely used for performing various tasks in military operations, such as underwater mine detection and maritime border surveillance. Drones provide a cost-effective and efficient solution to monitoring waterways, coastal regions, and maritime boundaries of strategic importance. Advancements in sensor technology and communication systems are propelling the underwater drone market growth. Underwater drones play a crucial role in safeguarding maritime assets, protecting national interests, and ensuring maritime domain awareness in both peacetime and conflict scenarios.

Growing Adoption for Offshore Operations

Underwater drones are employed for various offshore-related operations in the commercial sector, such as oil and gas exploration, complex underwater pipeline inspection, and marine salvage tasks. For instance, in 2023, foreign investors held 45% of total commercial property transactions in Dubai. Underwater drones allow companies to develop a better understanding of the deep-sea environment quickly and effectively, within less time and at a lower risk as compared with human diving and various other traditional drones. With high-resolution camera systems and sensors mounted within drones, companies can explore potential oil and gas reserves, deploy maintenance on pipelines, and assess their structural integrity underwater. As part of the commercial sector, utilizing underwater drones significantly lowers the costs associated with using human divers, decreases operational risks, and guarantees operational compliance with regulations.

Underwater Drone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global underwater drone market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product type, propulsion system, and application.

Analysis by Type:

- Remotely Operated Vehicle (ROV)

- Autonomous Underwater Vehicles (AUV)

- Hybrid Vehicles

Remotely operated vehicle (ROV) held 54.5% of the market share in 2024. It offers precise control, real-time monitoring, and enhanced safety in deep-water operations. ROV is widely used in offshore oil and gas industries for pipeline inspection, maintenance, and underwater repairs due to its ability to operate at significant depths with minimal risk to human divers. Its advanced navigation systems, cameras, and sensors make it ideal for scientific research, underwater mapping, and search and rescue missions. Additionally, ROV is employed in military applications for mine detection, surveillance, and reconnaissance tasks. Its capability to perform complex underwater tasks with high accuracy makes it the preferred option over an autonomous underwater vehicle (AUV) in scenarios that demand human control and decision-making. The growing investments in offshore energy projects, underwater infrastructure, and marine research are further driving the demand for ROVs. The development of improved communication systems, power efficiency, and payload capacity also contributes to the high adoption of ROVs in various industries.

Analysis by Product Type:

- Micro

- Small and Medium

- Light Work-Class

- Heavy Work-Class

Light work-class accounts for 32.9% of the market share. It offers a balance between operational capability and cost-efficiency. Light work-class drone is designed for moderate-depth tasks, making it ideal for industries like offshore oil and gas, marine research, and aquaculture. Its compact size and lighter weight allow easier deployment and maneuverability in confined underwater spaces. Light work-class drone is equipped with cameras, sensors, and manipulators, enabling it to perform inspections, maintenance, and data collection with precision. Its versatility makes it suitable for tasks, such as pipeline inspection, underwater cable maintenance, and ship hull examination. Additionally, its reduced power requirements and simpler control systems make it cost-effective compared to heavy work-class drones, attracting more end users. As offshore wind farm development, marine conservation efforts, and underwater infrastructure projects expand, the demand for these drones is growing.

Analysis by Propulsion System:

- Electric System

- Mechanical System

- Hybrid System

Electric system holds 79.7% of the market share. It provides efficient, quiet, and environment-friendly propulsion. It offers better energy efficiency compared to hydraulic or mechanical alternatives, allowing drones to operate for longer durations with minimal maintenance. The electric propulsion system is also lightweight and compact, making it suitable for various drone sizes, especially smaller models used in marine research, environmental monitoring, and underwater exploration. Its quieter operation minimizes disturbance to marine life, making it ideal for scientific and ecological studies. Additionally, the electric system is easier to control and integrate with advanced technologies like autonomous navigation and remote control, improving overall performance. As the demand for sustainable solutions is increasing, the electric system aligns with worldwide efforts to reduce emissions and minimize environmental impact. With ongoing innovations in battery technology and power management systems, the electric propulsion system continues to gain preference across sectors, such as defense, oil and gas, and underwater archaeology, positioning its dominance in the market.

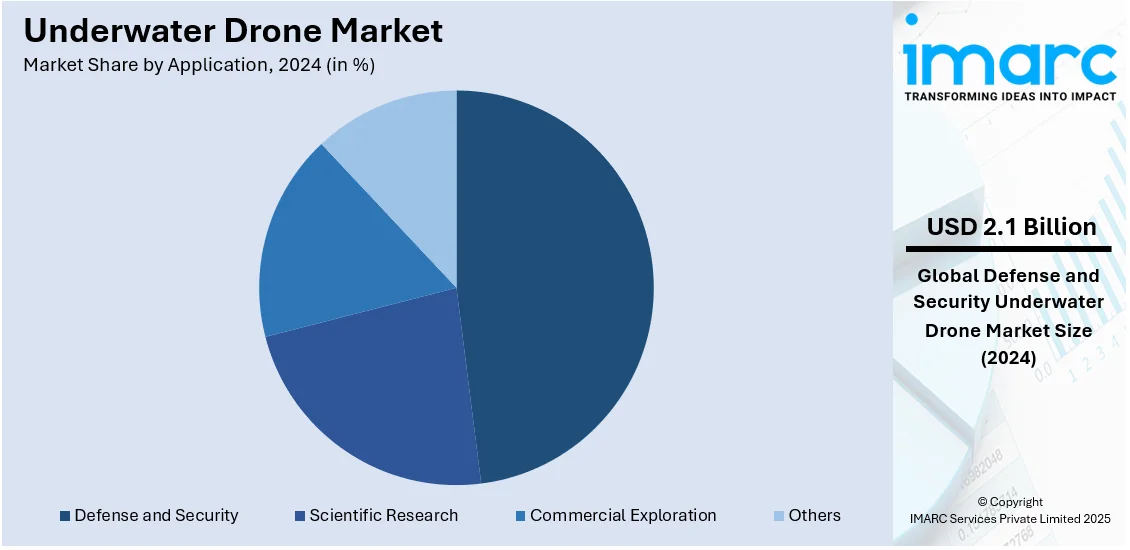

Analysis by Application:

- Defense and Security

- Scientific Research

- Commercial Exploration

- Others

Defense and security accounts for 47.7% of the market share. These sectors heavily rely on advanced surveillance, reconnaissance, and inspection capabilities for maritime operations. Underwater drones are widely used for detecting and neutralizing underwater mines, monitoring hostile activities, and securing naval borders. Their ability to operate discreetly in challenging environments makes them valuable for intelligence gathering and threat detection. Defense agencies are investing in underwater drones to enhance security strategies, improve data collection, and conduct deep-sea patrols with minimal risk to human divers. These drones are also employed to inspect submarine cables, detect submerged explosives, and support search and rescue missions. With rising geopolitical tensions and maritime disputes, government agencies are actively strengthening their underwater defense systems, further driving the demand. Ongoing advancements in sonar imaging, artificial intelligence (AI)-based navigation, and refines battery life also enhance drone reliability, reinforcing their adoption in defense and security applications as a preferred solution for underwater monitoring and protection.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 32.3%, enjoys the leading position in the market. The region is recognized for well-established defense agencies, marine research organizations, and offshore energy companies that actively adopt advanced underwater technologies. The United States Navy is heavily investing in underwater drones for surveillance, reconnaissance, and security operations, driving significant demand. The rising interest in marine exploration and environmental monitoring is further supporting the market growth. Additionally, the burgeoning offshore oil and gas industry in the United States relies on underwater drones for pipeline inspection, maintenance, and exploration. According to the IMARC Group, the US oil and gas market is set to reach USD 339.5 Billion by 2033, showing a CAGR of 3.26% from 2025-2033. The presence of leading underwater drone manufacturers and technology firms ensures continuous innovation and improved product performance, strengthening regional dominance. Moreover, the increasing expenditure on research institutions and partnerships with private firms is enabling the development of drones with advanced imaging, navigation, and data collection capabilities.

Key Regional Takeaways:

United States Underwater Drone Market Analysis

The United States holds 87.80% of the market share in North America. The United States is witnessing an increase in underwater drone deployment, driven by the growing investments in defense and security. According to industry reports, the US defense expenditure rose by USD 55 Billion from 2022 to 2023. The high need for advanced surveillance and reconnaissance capabilities has accelerated the procurement of unmanned underwater vehicles for naval operations. The ongoing emphasis on enhancing maritime domain awareness among the masses is leading to increased funding for underwater drone R&D. Defense and security initiatives are prioritizing underwater drones for anti-submarine warfare, intelligence gathering, and mine countermeasures. The integration of autonomous underwater systems is strengthening naval fleets, ensuring effective threat detection and response. As military forces continue to modernize, the spending on underwater drone technologies is rising. The increasing demand for real-time situational awareness and underwater threat detection is fostering innovations in sonar and imaging systems. With defense and security strategies focusing on underwater superiority, autonomous and remotely operated underwater drones are becoming indispensable assets. The continuous advancements in underwater propulsion, endurance, and sensor technologies are further reinforcing the adoption of these systems.

Europe Underwater Drone Market Analysis

Europe is experiencing significant underwater drone deployment owing to the increasing underwater tourism activities. According to reports, in 2024, the expected number of nights stayed at tourist lodging facilities in the EU hit 2.99 Billion, surpassing 2023 by 53.4 Million, or 2%. The growing interest in exploring underwater environments is driving the demand for advanced underwater drone solutions. The rise of underwater tourism is fostering technological advancements in imaging, navigation, and communication systems. The need for high-resolution underwater exploration is leading to the integration of autonomous and remotely operated underwater drones. The development of underwater attractions and marine parks is further amplifying the use of underwater drones for guided exploration. The increasing underwater tourism activities are encouraging the creation of compact and user-friendly underwater drone models.

Asia-Pacific Underwater Drone Market Analysis

The Asia-Pacific region is witnessing an expansion in underwater drone utilization because of the presence of large coastal area and the need to safeguard critical maritime assets, such as ports, offshore installations, and naval vessels. For instance, in 2024, India possessed a total coastline of 7516.6 km, comprising 2094 km of island areas and 5422 km of mainland coast. With an extensive coastline, monitoring vast oceanic regions has become a priority, necessitating efficient underwater drone operations. Maritime security initiatives are focusing on deploying advanced underwater surveillance systems to ensure the protection of vital assets. Safeguarding offshore installations and naval vessels is a key concern, leading to the integration of underwater drones into security frameworks. The presence of major shipping lanes is creating the need for underwater inspection and monitoring technologies. As the large coastal area presents unique surveillance challenges, the employment of autonomous underwater systems is gaining traction.

Latin America Underwater Drone Market Analysis

Latin America is experiencing an increasing use of underwater drones due to the expanding naval operations and commercial shipping routes. For instance, the ranking of ports and container terminals in Latin America accounted for 84% of the total cargo handled in the region in 2022. Broadening maritime activities are driving the demand for unmanned underwater vehicles to enhance operational efficiency. As naval operations intensify, the requirement for underwater drones in surveillance and reconnaissance is increasing. The monitoring of commercial shipping routes is encouraging the deployment of autonomous underwater systems for inspection and maintenance. The need for cost-effective underwater exploration and asset monitoring is fostering innovations in remotely operated underwater drones.

Middle East and Africa Underwater Drone Market Analysis

In the Middle East and Africa region, underwater drones are increasingly used for various offshore-related operations in the commercial sector, such as oil and gas exploration and oil and gas projects. According to reports, during the period 2024-2028, a sum of 668 oil and gas projects were set to start operations in the Middle East. The growing demand for efficient subsea inspections is enabling the adoption of autonomous underwater vehicles. The expansion of offshore infrastructure is creating the need for advanced underwater monitoring solutions. Oil and gas exploration activities are fostering technological advancements in underwater navigation and imaging systems.

Competitive Landscape:

Key players are working to develop modern devices to meet the high underwater drone market demand. Companies are investing in advanced technologies, such as improved battery life, high-resolution imaging systems, and enhanced navigation features to meet industry demands. They are also expanding their product portfolios to cater to various sectors, including defense, marine research, and offshore energy. Strategic collaborations with government agencies and research institutions are helping key players to create specialized drones for surveillance, exploration, and environmental monitoring. Additionally, manufacturers are offering customized solutions to fulfill specific industry requirements, boosting adoption across commercial and military sectors. By focusing on R&D activities, improving product performance, and broadening global distribution networks, key players are actively supporting the market growth. For instance, in January 2024, the Royal Netherlands Institute for Sea Research (NIOZ) was acquired by Teledyne Marine for a new Gavia Osprey AUV. NIOZ is the National Oceanographic Institute of the Netherlands, performing multidisciplinary applied marine research to tackle significant scientific inquiries regarding oceans and seas. NIOZ obtained the Teledyne Gavia Osprey AUV to broaden its rapidly growing fleet for scientific initiatives, such as investigating the considerable effects of climate change on seas and oceans, including rising temperatures and acidification.

The report provides a comprehensive analysis of the competitive landscape in the underwater drone market with detailed profiles of all major companies, including:

- ATLAS ELEKTRONIK GmbH

- Blueye Robotics

- Deep Ocean Engineering Inc.

- Delair Marine

- Kongsberg Discovery

- Lockheed Martin Corporation

- Oceaneering International Inc.

- Saab Seaeye Limited

- TechnipFMC plc

- Teledyne Marine Technologies Incorporated

Latest News and Developments:

- December 2024: The German Navy conducted tests of the BlueWhale underwater drone in the Baltic Sea for discreet ship monitoring and anti-submarine missions. The two-week trial investigated its possibilities for future unmanned fleets. The area, a focal point of NATO-Russia-China conflicts, contained essential infrastructure. The drone could improve maritime monitoring due to escalating security issues.

- November 2024: French SME ALSEAMAR presented its submarine-launched UAV, Blackbird, at Euronaval 2024 in Paris. Engineered for profound immersion usage, the underwater drone was operable from a submarine and transmits data instantly. It leveraged the X-SUB remote antenna idea to improve underwater intelligence collection. Created in collaboration with the French Navy and AID, Blackbird facilitated mission management before takeoff and throughout operations.

- June 2024: DRDO teamed up with Sagar Defence to create India's inaugural underwater-launched unmanned aerial vehicles (ULUAVs). These underwater drones aimed to improve the Indian Navy's submarine abilities and extend its operational range. Specialists emphasized this partnership as a significant advancement in India's underwater security. The endeavor represented noteworthy advancement in naval defense technology.

- April 2024: Northrop Grumman introduced its Manta Ray underwater drone, representing a significant innovation in autonomous submersible technology. Created as part of DARPA's Manta Ray initiative, the unmanned underwater vehicle (UUV) was intended for extended missions. The complete prototype demonstrated crucial advancements for prolonged underwater activities. This progress enhanced the future of self-governing naval abilities.

Underwater Drone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV), Hybrid Vehicles |

| Product Types Covered | Micro, Small and Medium, Light Work-Class, Heavy Work-Class |

| Propulsion Systems Covered | Electric System, Mechanical System, Hybrid System |

| Applications Covered | Defence and Security, Scientific Research, Commercial Exploration, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ATLAS ELEKTRONIK GmbH, Blueye Robotics, Deep Ocean Engineering Inc., Delair Marine, Kongsberg Discovery, Lockheed Martin Corporation, Oceaneering International Inc., Saab Seaeye Limited, TechnipFMC plc, Teledyne Marine Technologies Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the underwater drone market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global underwater drone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the underwater drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The underwater drone market was valued at USD 4.40 Billion in 2024.

The underwater drone market is projected to exhibit a CAGR of 8.29% during 2025-2033, reaching a value of USD 9.34 Billion by 2033.

The rising investments in offshore energy projects are driving the demand for efficient underwater inspection solutions. Besides this, the defense sector is adopting underwater drones for surveillance, mine detection, and rescue operations. Moreover, advancements in sensor technology, navigation systems, and communication capabilities are improving drone reliability and expanding their applications.

North America currently dominates the underwater drone market, accounting for a share of 32.3% in 2024, because of the increasing investments in defense, marine research, and offshore energy sectors. The presence of key manufacturers and advancements in underwater drone technology further strengthen the region's market dominance.

Some of the major players in the underwater drone market include ATLAS ELEKTRONIK GmbH, Blueye Robotics, Deep Ocean Engineering Inc., Delair Marine, Kongsberg Discovery, Lockheed Martin Corporation, Oceaneering International Inc., Saab Seaeye Limited, TechnipFMC plc, Teledyne Marine Technologies Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)