Ultrasonic Flowmeter Market Size, Share, Trends and Forecast by Product Type, Number of Paths, Technology, Distribution Channel, Application, and Region, 2025-2033

Ultrasonic Flowmeter Market Size and Share:

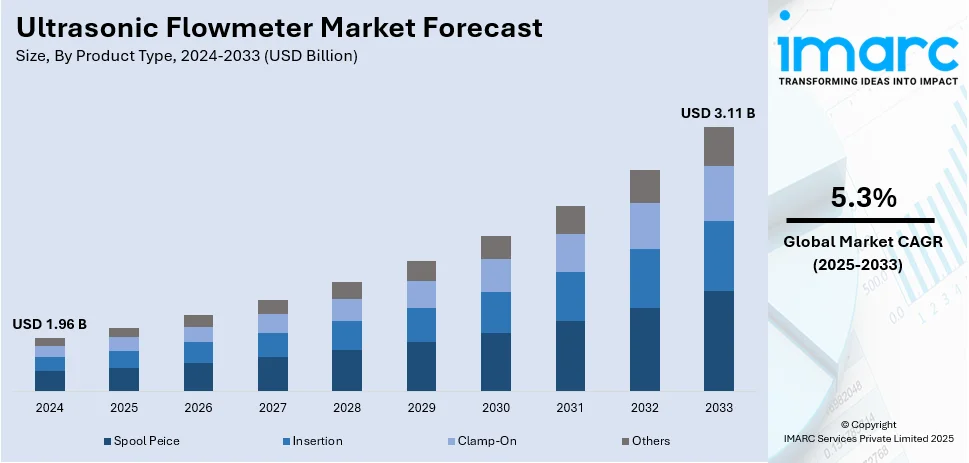

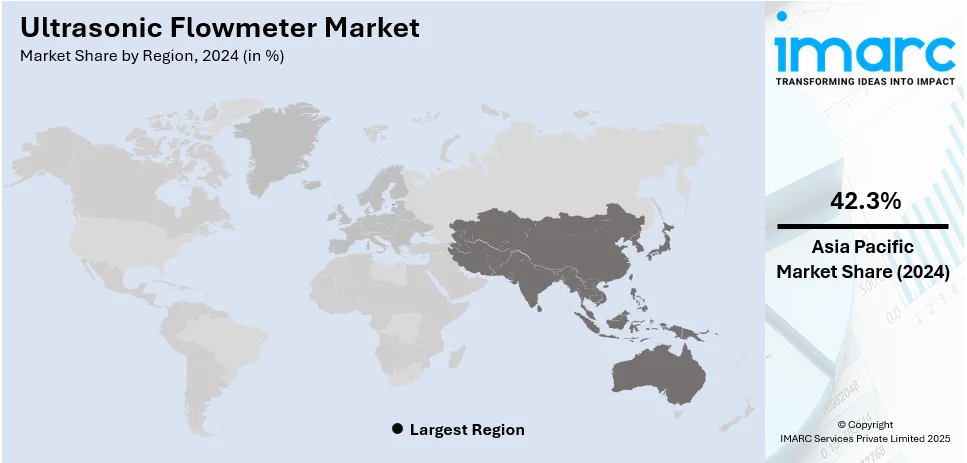

The global ultrasonic flowmeter market size was valued at USD 1.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.11 Billion by 2033, exhibiting a CAGR of 5.3% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 42.3% in 2024. The growing application in the water and wastewater management, oil and gas, and chemical sectors due to their non-invasive nature, precision, low maintenance needs, increasing advancements in technology, and strict environmental regulation are some of the factors propelling the ultrasonic flowmeter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.96 Billion |

|

Market Forecast in 2033

|

USD 3.11 Billion |

| Market Growth Rate (2025-2033) | 5.3% |

The global ultrasonic flowmeter market is driven by rising demand for accurate and non-invasive flow measurement across industries such as oil and gas, water and wastewater, and chemicals. Technological advancements, such as the integration of IoT and AI, enhance device efficiency and data analytics capabilities. Stringent government regulations on energy conservation and environmental monitoring further propel adoption. On 8th August 2024, ABB combined its AquaMaster4 Mobile Comms electromagnetic flowmeter with Topkapi SCADA software through 4G and FTP/FTPS, thereby improving real-time water management and achieving a 60% reduction in power consumption. The need for real-time monitoring and reduced maintenance costs also enhances the ultrasonic flowmeter market growth. Additionally, the expansion of smart city projects and infrastructure development in emerging economies creates significant opportunities. Rising awareness about energy management and the shift towards digitalization further accelerate market expansion.

The United States stands out as a key regional market, primarily driven by the growing demand for efficient and reliable flow measurement solutions in industries such as oil and gas, pharmaceuticals, and food and beverage. Increasing investments in water infrastructure and the need for leak detection in aging pipelines enhance adoption. The push for energy efficiency and sustainability, along with stringent environmental regulations, further accelerates market growth. Advancements in ultrasonic technology, such as improved accuracy and durability, enhance product appeal. Additionally, the rise of industrial automation and the need for real-time monitoring in smart manufacturing processes contribute significantly to the ultrasonic flowmeter market outlook. On 31st January 2025, Nulogy introduced Smart Factory, a real-time monitoring solution designed for manufacturers in North America and Europe. This innovative tool facilitates data-driven insights and enhances the production efficiency of more than 2.6 billion products each year.

Ultrasonic Flowmeter Market Trends:

Technological Innovations in Software Integration

Modern ultrasonic flowmeters are equipped with advanced software that improves their performance and user experience. These advancements consist of immediate data analysis, monitoring from a distance, and smooth integration with industrial control systems. For instance, nearly 89% of organizations are currently utilizing or intend to utilize big data analytics, accompanied by a notable rise in investments in data by enterprises. Improved software functionalities enable users to achieve a better understanding of flow characteristics, leading to enhanced process control and efficiency. Moreover, these characteristics help with anticipatory maintenance by pinpointing possible problems before they become worse, ultimately decreasing expenses and periods of inactivity. The ongoing evolution of superior software solutions is enhancing the versatility and user-friendliness of ultrasonic flowmeters. This enhanced capability addresses the changing requirements of different sectors, such as water management, oil and gas, and chemical processing, leading to increased usage. In 2023, SICK launched the FLOWSIC550, a new high-pressure ultrasonic gas flow meter for natural gas distribution and midstream systems, expanding its product portfolio to include solutions for compact, high-pressure applications. This meter offered significant cost advantages and easy integration into existing systems with its advanced ultrasound technology and FLOWgate software compatibility.

Growing Demand in Water and Wastewater Management

Municipalities and industrial sectors are under pressure to manage water resources more effectively due to the growing urbanization, industrialization, and the emphasis on sustainable practices. According to United Nations, 68% of the world population is projected to live in urban areas by 2050. Ultrasonic flowmeters are essential for accurate flow measurement in monitoring water usage, detecting leaks, and adhering to regulations. Their minimal impact and upkeep needs make them perfect for ongoing observation in water distribution and wastewater treatment facilities. Governing bodies and organizations are dedicating funds to improve their water infrastructure to tackle challenges related to water scarcity and pollution. Investments in ultrasonic flowmeters are benefiting water and wastewater management systems by improving water usage efficiency, waste reduction, and overall operational effectiveness. In March 2023, ATO Flow Meter launched two new flow meters for different industries. The magnetic flow meter was designed for the petroleum and chemical sectors, while the ultrasonic flow meter was created for water systems. These new additions aimed to provide dependable and easy-to-maintain solutions for measuring liquids, gases, and steam.

Adoption of Advanced Calibration Services

The growing incorporation of sophisticated calibration services that improve the accuracy and efficiency of measurements in industrial settings is one of the major ultrasonic flowmeter market trends. As shown by Aserti Metrology's recent launch of a full flowmetering service in May 2024, there is a need for precise and dependable fluid measurement in various sectors. This offering specifically meets the demand for accurate fluid measurement on-site, utilizing mobile standards and a flexible calibration bench. Through improved on-site logistics and increased measurement accuracy, advancements in technology are making ultrasonic flowmeters more attractive to industries including manufacturing, oil and gas, and water management. According to India Brand Equity Foundation, India's manufacturing sector is poised to reach USD 1 Trillion by 2025-26. This trend highlights the shift of the various industries towards advanced, easy-to-use solutions that can be used in field conditions, thus broadening the market for ultrasonic flowmeters.

Ultrasonic Flowmeter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ultrasonic flowmeter market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, number of paths, technology, distribution channel, and application.

Analysis by Product Type:

- Spool Peice

- Insertion

- Clamp-On

- Others

Clamp-on stands as the largest component in 2024, holding around 50.0% of the market. Clamp-on accounts for the majority of the market as they do not require invasive methods for installation or maintenance, making them easy to use without disrupting operations. This segment is especially popular in fields including water and wastewater treatment, oil and gas, and chemical processing, where reducing downtime and operational interruptions is crucial. The attractiveness of clamp-on flowmeters is influenced by their ability to be used on different pipe materials and sizes. Moreover, enhancements in technology are increasing the precision and dependability of clamp-on flowmeters, making them a desirable option for various applications requiring accurate flow measurement. On August 24, 2023, Fuji Electric launched the FSZ S-Flow, a clamp-on ultrasonic flow meter for small pipes and pure water applications, featuring easy installation and integrated display capabilities. Designed for sectors such as pharmaceuticals and semiconductor manufacturing, it improved process reliability and operational efficiency.

Analysis by Number of Paths:

- 3-Path Transit Time

- 4- Path Transit Time

- 5- Path Transit Time

- 6 or More Path Transit Time

3-path transit time ultrasonic flowmeter segment is meant for general industrial processes that need moderate accuracy. These flowmeters use three acoustic paths for flow rate measurement, providing a mix of performance and cost-effectiveness. They are suitable for use in water and wastewater management, heating, ventilation, and air conditioning (HVAC) systems, and other situations with relatively stable flow conditions. The 3-path setup is sufficient for various standard tasks, making it a favored option for industries seeking to enhance precision without overspending.

4-path transit time imp roves measurement precision by utilizing four acoustic paths to gather additional data points throughout the flow profile. This setup enhances dependability and is especially advantageous in scenarios with intricate or fluctuating flow conditions. Sectors including oil and gas, chemical processing, and power generation frequently opt for 4-path flowmeters due to their excellent performance in managing difficult flow situations. The improved precision of these devices makes them appropriate for crucial tasks where accurate flow monitoring is necessary for operational effectiveness and safety.

5-path transit time configurations are designed for high-precision flow measurement applications. By using five acoustic routes, flowmeters offer improved precision and consistency, making them perfect for custody transfer applications where accurate flow measurement is vital for financial transactions. They are employed in situations where there are frequent changes in flow conditions or high turbulence. The 5-path design ensures thorough flow profiling, decreasing the effects of flow disturbances and enhancing measurement reliability in challenging industrial settings.

Analysis by Technology:

- Transit Time - Single/Dual Path

- Transit Time - Multipath

- Doppler

- Hybrid

Transit time - single/dual path leads the market with around 62.3% of the market share in 2024. This can be attributed to its extensive use in industries such as water and wastewater management, oil and gas, and chemicals. This technology appeals to sectors where accurate flow measurement is critical, as it offers high precision by measuring the time it takes for an ultrasonic signal to travel between two transducers. The flexibility of single and dual-path designs allows them to be used in both clean and slightly contaminated liquids, making them suitable for various operational settings. The single/dual path configuration offers sufficient accuracy for many standard applications, ensuring consistent and reliable flow measurement without the need for complex calibration or maintenance, which further contributes to their popularity in the market.

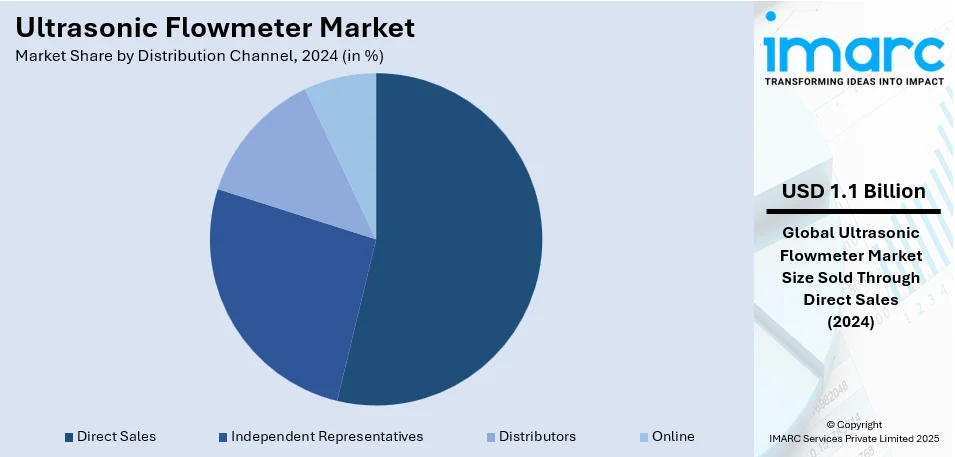

Analysis by Distribution Channel:

- Direct Sales

- Independent Representatives

- Distributors

- Online

Direct sales lead the market with around 53.5% of market share in 2024. Direct sales lead the market due to the growing demand for customized solutions and the importance of strong user relationships. Direct sales channels enable manufacturers to provide personalized flow measurement solutions that satisfy individual needs, delivering enhanced technical assistance and support. This tailored method guarantees that clients get the specific requirements and setups necessary for their individual needs, improving satisfaction and loyalty. In addition, manufacturers are able to improve control over pricing, product quality, and brand image through direct sales. This method also facilitates strong, long-term relationships with key clients in industries, such as oil and gas, water and wastewater management, and chemical processing, where precise flow measurement is critical, and users prefer direct interaction with manufacturers for reliability and assurance.

Analysis by Application:

- Natural Gas

- Non-Petroleum Liquid

- Petroleum Liquid

- Others

Natural gas leads the market with around 42.4% of market share in 2024, due to the crucial requirement for precise and dependable flow measurement in the industry, where accurate monitoring is vital for efficiency, safety, and adherence to regulations. Ultrasonic flowmeters are greatly appreciated in this industry for their capability to offer precise flow readings without creating pressure decreases, which is essential for upholding the effectiveness and reliability of gas pipelines. Furthermore, their unobtrusive quality and minimal maintenance needs make them well-suited for ongoing observation in challenging conditions. Ultrasonic flowmeters are becoming popular in the natural gas industry due to strict standards and the growing global demand for cleaner energy.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 42.3% due to fast industrialization, urbanization, and infrastructural growth. The increasing need for accurate flow measurement solutions in water and wastewater management, oil and gas, and chemical industries is strengthening the market in this area. Moreover, efforts by the government to enhance water management systems and enhance energy efficiency are driving the acceptance of ultrasonic flowmeters. The presence of a large number of manufacturing and process industries, coupled with increasing investments in smart infrastructure projects, contributes to the ultrasonic flowmeter market demand in the Asia Pacific. In February 2024, Panasonic released the GB-L1CMH1B, an ultrasonic meter designed for the Chinese market that can measure hydrogen flow and concentration in high-humidity conditions at the same time. This new advancement is intended to assist in the growth of hydrogen energy technologies by offering accurate measurements in different situations.

Key Regional Takeaways:

United States Ultrasonic Flowmeter Market Analysis

Ultrasonic flowmeter adoption is increasing due to the growing chemical sector, which requires precise and reliable flow measurement solutions. According to International Trade Administration, the U.S. chemical manufacturing industry's total FDI in the industry was USD 766.7 Billion in 2023. Expanding chemical production is driving demand for advanced measurement technologies, ensuring compliance with stringent regulatory requirements. Increased investment in chemical processing facilities is fuelling the need for non-intrusive flow monitoring solutions, as manufacturers seek accurate measurements for various chemicals, including corrosive and hazardous substances. Rising environmental concerns and sustainability initiatives are promoting the integration of ultrasonic flowmeters for leak detection and energy-efficient operations. Technological advancements are further enhancing the capabilities of these devices, supporting automation and remote monitoring in chemical plants. High adoption of ultrasonic flowmeters is evident in applications requiring non-contact measurement, minimizing maintenance and ensuring long-term reliability. Enhanced research and development activities are introducing improved flow measurement solutions, catering to the changing demands of the chemical industry.

Asia Pacific Ultrasonic Flowmeter Market Analysis

Ultrasonic flowmeter adoption is accelerating due to growing investment in wastewater treatment, necessitating efficient and accurate flow measurement solutions. According to the Ministry of Commerce and Industry India, 565 investment projects in water treatment plants subsector in India worth USD 60.43 Billion. Expanding industrialization and urbanization are increasing wastewater generation, leading to higher investments in treatment infrastructure. Rising environmental awareness and stringent discharge regulations are driving the demand for reliable flow monitoring technologies in treatment plants. Increasing adoption of non-invasive and maintenance-free measurement solutions is enhancing operational efficiency in wastewater management facilities. Advancements in ultrasonic technology are supporting precise measurement of flow rates in complex fluid compositions, optimizing treatment processes. Smart water management initiatives and digitalization trends are promoting the deployment of intelligent flow measurement systems, improving monitoring and data analysis capabilities. The expansion of decentralized wastewater treatment plants is creating opportunities for ultrasonic flowmeter manufacturers to cater to diverse industrial and municipal applications. Growing focus on water conservation and resource efficiency is further driving the integration of advanced flow measurement solutions.

Europe Ultrasonic Flowmeter Market Analysis

Ultrasonic flowmeter adoption is increasing due to rapid industrialization and infrastructural developments, necessitating advanced flow measurement technologies for various industrial applications. Expanding industrial manufacturing and production activities are creating a strong demand for efficient and accurate flow monitoring solutions. Reports indicate that the industrial production of the European Union experienced an increase of 8.5% in 2021 when compared to the figures from 2020. It continued with an increase in 2022 by 0.4% compared with 2021. Rising investments in smart infrastructure projects are fostering the deployment of non-intrusive flow measurement technologies, enhancing efficiency in water supply and energy management. The transition towards sustainable and energy-efficient industrial operations is promoting the use of ultrasonic flowmeters in diverse sectors, including power generation, chemical processing, and water management. The expansion of transportation and utility networks is driving the demand for precise flow monitoring systems, ensuring optimal performance and regulatory compliance. Technological advancements and the integration of digital monitoring capabilities are enhancing the operational efficiency of ultrasonic flow measurement solutions. Industrial automation and process optimization initiatives are increasing the adoption of intelligent flow monitoring technologies, reducing maintenance costs, and improving accuracy.

Latin America Ultrasonic Flowmeter Market Analysis

Ultrasonic flowmeter adoption is rising due to the growing online distribution channel, facilitating easy accessibility and procurement of advanced measurement solutions. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Expanding e-commerce platforms and digital marketplaces are enabling seamless purchasing options for industrial and commercial users. Increased digitalization in industrial procurement is streamlining the supply chain, allowing faster delivery and competitive pricing for ultrasonic flowmeters. Growing preference for online product selection and remote purchasing is driving manufacturers to enhance their digital presence, improving customer engagement and sales. Technological advancements in online distribution platforms are supporting better product comparison, technical support, and customization options. Expansion of industrial and municipal applications is fuelling the demand for flow measurement solutions, further accelerating adoption through digital sales channels.

Middle East and Africa Ultrasonic Flowmeter Market Analysis

Ultrasonic flowmeter adoption is expanding due to the growing oil and gas sector, which requires precise flow measurement solutions for exploration, refining, and distribution processes. According to reports, during the period 2024-2028, a total of 668 oil and gas projects are expected to commence operations in the Middle East. Increasing energy demand and production activities are creating a strong need for accurate and reliable flow monitoring technologies. Expansion of oil extraction and refining capacities is driving the use of non-intrusive flow measurement solutions, ensuring operational efficiency and safety. Technological advancements in flow measurement are enhancing real-time monitoring and data-driven decision-making in the oil and gas sector. Rising investments in pipeline infrastructure and storage facilities are fostering demand for efficient and maintenance-free flow monitoring technologies.

Competitive Landscape:

Key players in the ultrasonic flowmeter industry are prioritizing advancements in technology and product innovation to improve precision, dependability, and user-friendliness. They are dedicating resources to research operations in order to incorporate digital technologies and IoT capabilities into their flowmeters, offering improved data analytics and remote monitoring options. Moreover, these corporations are broadening their international reach by forming strategic alliances and mergers and acquisitions (M&As) to enhance their market influence. They are also improving their user service and support system to offer customized solutions and foster solid client relationships, meeting the changing demands of industries including oil and gas, water management, and chemical processing.

The report provides a comprehensive analysis of the competitive landscape in the ultrasonic flowmeter market with detailed profiles of all major companies, including:

- Asea Brown Boveri Ltd.

- Badger Meter Inc.

- Emerson Electric Co.

- Emerson Process Management

- Faure Herman SA

- General Electric

- Hach/Marsh McBirney Inc.

- Honeywell International Inc.

- Index Corporation

- Invensys Process Systems

- Rockwell Automation Inc.

- Siemens AG

- Teledyne Isco Inc.

- Yamatake Co.

- Yokogawa Electric Co.

Latest News and Developments:

- August 2024: Endress+Hauser’s ultrasonic flowmeters have received EPA approval for biogas and renewable natural gas measurement. The Proline Prosonic Flow ultrasonic flowmeters meet stringent accuracy standards set by the EPA. This approval enables biogas and RNG producers to use them under 40 CFR 80.155 regulations. The recognition supports compliance in renewable fuel production.

- June 2024: Sonic Driver has launched the UFM-300, a fixed-installation clamp-on ultrasonic flowmeter for various mounting options. Configurable via an Android app or Windows software, it supports local and remote operation through Modbus RTU RS485. With low-power mode, it enables extended remote measurement in isolated areas via third-party dataloggers.

- June 2024: Baker Hughes launched three advanced Panametrics sensor technologies to enhance safety and productivity in hydrogen and industrial applications. The T5MAX Transducer, featuring four times stronger signal strength than its predecessor, improves ultrasonic flowmeter accuracy in challenging gas flow measurements. It enables precise readings in low-flow rate applications, supporting compliance with World Bank GFMR gas flaring guidelines.

- March 2024: Aichi Tokei Denki Co., Ltd. has launched the ATZTA UW, a large-diameter ultrasonic flowmeter for fuel gas management. Designed for cogeneration systems and continuous furnaces, it is available in 80A, 100A, and 150A sizes. The product aims to enhance energy efficiency amid carbon neutrality trends.

- February 2024: Panasonic to Release the Ultrasonic Flow and Concentration Meter for Hydrogen in China on February 14, 2024. The GB-L1CMH1B model measures hydrogen flow and concentration in high-humidity environments. This launch supports growing hydrogen energy initiatives, aiding fuel cell and electrolyzer development. Panasonic's previous model received positive feedback in Japan and overseas.

Ultrasonic Flowmeter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Spool Peice, Insertion, Clamp-On, Others |

| Number of Paths Covered | 3-Path Transit Time, 4- Path Transit Time, 5- Path Transit Time, 6 or More Path Transit Time |

| Technologies Covered | Transit Time - Single/Dual Path, Transit Time – Multipath, Doppler, Hybrid |

| Distribution Channels Covered | Direct Sales, Independent Representatives, Distributors, Online |

| Applications Covered | Natural Gas, Non-Petroleum Liquid, Petroleum Liquid, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Asea Brown Boveri Ltd., Badger Meter Inc., Emerson Electric Co., Emerson Process Management, Faure Herman SA, General Electric, Hach/Marsh McBirney Inc., Honeywell International Inc., Index Corporation, Invensys Process Systems, Rockwell Automation Inc., Siemens AG, Teledyne Isco Inc., Yamatake Co., Yokogawa Electric Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ultrasonic flowmeter market from 2019-2033.

- The ultrasonic flowmeter market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ultrasonic flowmeter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ultrasonic flowmeter market was valued at USD 1.96 Billion in 2024.

IMARC estimates the ultrasonic flowmeter market to exhibit a CAGR of 5.3% during 2025-2033, reaching a value of USD 3.11 Billion by 2033.

The market is driven by the increasing demand for accurate and non-invasive flow measurement across industries such as oil & gas, water & wastewater, and chemicals. Technological advancements, including IoT and AI integration, enhance efficiency and analytics. Stringent environmental regulations, the push for real-time monitoring, and the rise of smart city projects further fuel market expansion.

Asia-Pacific currently dominates the ultrasonic flowmeter market, accounting for a market share of over 42.3% in 2024. This dominance is fueled by rapid industrialization, urbanization, infrastructure growth, and increasing demand for efficient water and energy management solutions.

Some of the major players in the ultrasonic flowmeter market include Asea Brown Boveri Ltd., Badger Meter Inc., Emerson Electric Co., Emerson Process Management, Faure Herman SA, General Electric, Hach/Marsh McBirney Inc., Honeywell International Inc., Index Corporation, Invensys Process Systems, Rockwell Automation Inc., Siemens AG, Teledyne Isco Inc., Yamatake Co., and Yokogawa Electric Co., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)