UK Warehouse Automation Market Size, Share, Trends and Forecast by Component, Automation Level, Application and Country, 2025-2033

UK Warehouse Automation Market Size and Share:

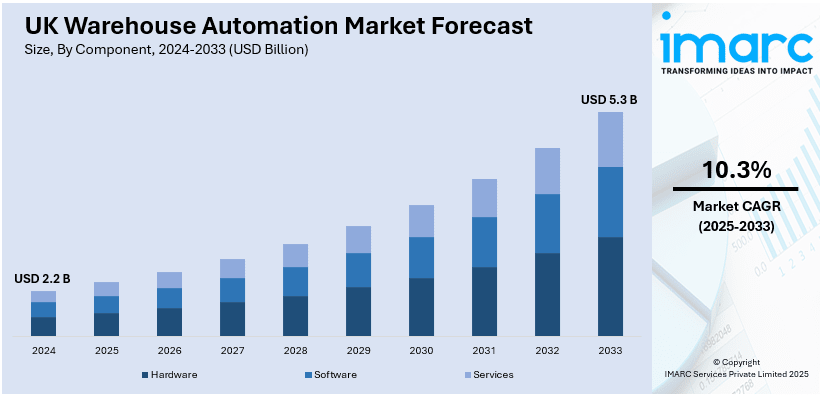

The UK warehouse automation market size was valued at USD 2.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.3 Billion by 2033, exhibiting a CAGR of 10.3% from 2025-2033. The market is growing rapidly due to expanding e-commerce sector in the country, rising labor shortages, increasing focus of cost-efficiency, significant technological advancements, and the growing demand for faster deliveries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Market Growth Rate (2025-2033) | 10.3% |

Currently, UK e-business is exponentially increasing, changing the face of warehouse management and making automation a strategic option within this sector. Currently, e-consumerism comprises 36.3% of the whole retail market, forecasted to generate an anticipated revenue stream of US$285.60 billion by 2025. As online retail develops, warehouse operations continue to feel mounting pressure in managing massive incoming orders both in speed and accuracy. Automated solutions include use of robotics picking systems, automated guided vehicles (AGVs), and conveyor systems that enable the fast turnaround of all products. They not only make a difference in terms of improving operational efficiencies but also help retails cash in on an extremely critical service need in this competitive marketplace. Conditions such as same-day or next-day deliveries are all increasing with the growing seasonal shopping peaks such as Black Friday and Christmas; therefore, the need is even more pressing for flexible systems under such conditions. Automation also helps in the curtailment of human errors, optimization in storage, and betterment in inventory management so that e-commerce organizations can meet growing consumer demand without incurring operational bottlenecks.

The most significant concern related to labor in the UK includes a shrinking workforce because of demographic changes and migration restrictions resulting from Brexit. Recent reports say that Brexit cost the country over 300000 employees. Further, food and drink manufacturers are reported to have incurred a hit of 1.4 billion pound up to July 2023 due to labor shortages. More than half of manufacturing respondents reported a vacancy level of 0%—5% (57%). One potential solution for addressing the labor dynamic is automation, which can replace a number of manual tasks with advanced technology, such as robotic arms, sorting machines, and automatic forklifts. The current threats posed by negligence in mechanizing existing operations will thus reduce dependence on human labor and improve workplace safety by reducing the amount of strenuous work needed to accomplish tasks. Additionally, automated systems can operate 24/7, eliminating downtime and further boosting productivity. In the long term, addressing labor shortages through automation allows warehouses to maintain seamless operations while reallocating human resources to more strategic roles.

UK Warehouse Automation Market Trends:

Cost-Efficiency

Warehouse automation saves much more cost by avoiding labor-related costs such as wages, recruitment, and training. As per the most recent studies, automation can help cut the labor cost by 30% to 40%. Besides, it helped decrease workplace injuries by 25% and increase productivity by 35%. Human errors are minimized, and that results in saving on return and rework. Huge initial investments in automation technology are recovered through productivity increases and cost-cutting measures over time. Automated tracking systems facilitate efficient inventory management, ensuring optimal use of resources and lower holding costs. Moreover, the automation reduces power usage with smart systems that optimize power usage. Therefore, such companies achieve a competitive advantage by reducing costs and helping customers enjoy affordable prices without sacrificing service quality.

Technological Advancements

Integration of the latest technologies in the form of robotics, artificial intelligence (AI), and machine learning (ML) is completely transforming warehouse operations. Robotic vision systems empowered with AI can identify and pick and pack items accurately without error, thereby saving much time. AGVs offer efficient transportation of goods through warehouses without wasting space. Algorithms developed using AI optimize the forecasting of demand and planning for inventory, so the required product is available at the time of demand. The Internet of Things (IoT) devices also enable real-time tracking of assets and environmental conditions to further streamline operations. The technologies thus improve operational efficiency while offering data insights that help businesses refine their strategies. Automation technologies continue to evolve, and thus warehouses stay agile in the increasingly complex supply chain environment.

Changing Consumer Demands

Modern UK consumers expect faster deliveries, instant order tracking, and excellent service quality, which requires warehouses to be automated. Agility in operations is not achievable with traditional manual systems, and the automation solutions like AS/RS and robotic sorters will enable warehouses to process orders quickly and accurately. Moreover, high consumer expectations during peak seasons demand scalable automated solutions that can absorb surges without compromising service. Furthermore, personalized shopping experiences with tailored product recommendations and customized delivery options have become the norm. Automated systems perfectly integrate with e-commerce platforms in support of these features, ensuring a seamless consumer experience. Businesses that invest in automation can not only meet but exceed consumer expectations, thereby fostering brand loyalty and repeat business.

UK Warehouse Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK warehouse automation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, automation level, and application.

Analysis by Component:

- Hardware

- Autonomous Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Sorting Systems

- De-palletizing/Palletizing Systems

- Conveyor Systems

- Automatic Identification and Data Collection (AIDC)

- Software

- Warehouse Management System (WMS)

- Warehouse Execution Systems (WES)

- Labor Management Systems (LMS)

- Services

- Analytics and Reporting Tools

- Consulting, Training & Education

- Installation and Integration

- Maintenance and Support

The hardware segment is the root of warehouse automation systems and entails robotic arms, conveyor systems, automated guided vehicles, sensors, and automated storage and retrieval systems. In a warehouse, all those are the integral elements behind smooth physical operations such as material handling, picking, and sorting. As demands for robotics and sophisticated materials handling equipment are rising sharply, this segment has great potential for growth. Companies are investing in high-performance hardware to improve speed, accuracy, and efficiency. Additionally, the adoption of IoT-enabled devices in warehouses improves real-time monitoring and data-driven decision-making. As warehouses grow larger and more complex, the requirement for robust, scalable hardware solutions continues to rise and this segment is one that significantly contributes to market growth.

The software segment works to coordinate and optimize the automated warehouse systems. WMS, WES, and control software manage warehouses' inventory, streamline workflows, and integrate various components through automation. AI and Machine Learning algorithms are increasingly being implemented for demand forecasting, routing optimization, and predictive maintenance for the platforms. This move towards cloud-based solutions offers scalability and flexibility, thereby enabling warehouses to scale up as per fluctuating demand. As businesses seek operational transparency and seamlessness in the integration between hardware and software, this segment is largely gaining due to ongoing technological progress.

The services segment includes installation, maintenance, and consulting, supporting the deployment and upkeep of warehouse automation systems. As automation technology becomes more complex, the demand for expert guidance in system design, implementation, and customization is growing. Maintenance services are paramount to the long-term performance of automation hardware, and training facilities help warehouse employees take up the maximum benefits from the applications. Consulting services help businesses assess their unique needs and select appropriate automation solutions, ensuring a tailored approach. The services segment is expanding as businesses increasingly prioritize end-to-end support for their automation initiatives, driving customer satisfaction and operational success.

Analysis by Automation Level:

- Basic Automation

- Intermediate Automation

- Advanced Automation

- Autonomous Warehouses

Basic automation involves the use of fundamental tools and systems to enhance efficiency without requiring significant technological integration. This includes conveyor belts, basic material handling equipment, and semi-automated forklifts. These solutions are ideal for small to medium-sized warehouses with limited budgets or simpler operational requirements. Basic automation reduces manual labor in repetitive tasks, improving accuracy and productivity. While lacking the advanced capabilities of higher automation levels, these systems provide a cost-effective way to improve operational efficiency for warehouses at the beginning of their automation journey.

Intermediate automation is something that bridges the gap between very basic tools and a totally automated system, involving such technologies as AS/RS, barcode scanners, and WES. This approach optimizes workflow through a combination of hardware and software to improve the management of inventory and to ensure rapid order fulfillment. In the case of medium to large warehouses, increased complexity in handling higher order volumes dictates the adoption of intermediate automation. These systems allow businesses to scale their operations as needed, making them a popular choice for companies looking to enhance efficiency without fully transitioning to advanced automation.

Advanced automation leverages cutting-edge technologies such as robotics, artificial intelligence (AI), and machine learning (ML) to optimize warehouse operations. Robotic picking systems, automated guided vehicles (AGVs), and AI-driven inventory management systems characterize this level of automation. These solutions significantly reduce errors, improve speed, and enable warehouses to handle complex and high-volume tasks efficiently. Advanced automation is particularly valuable for e-commerce businesses and industries with high throughput requirements. Although it requires substantial upfront investment, the long-term gains in productivity and operational efficiency make it a strategic choice for forward-thinking enterprises.

Autonomous warehouses represent the pinnacle of automation, functioning with minimal to no human intervention. These facilities rely on interconnected systems of robots, IoT devices, and AI-driven software to perform all tasks, from inventory management to order fulfillment. Real-time data analytics and machine learning enable continuous optimization, while IoT integration ensures seamless communication between systems. Autonomous warehouses are especially suited for large-scale operations where speed, accuracy, and scalability are paramount. While the implementation cost is high, these warehouses offer unmatched efficiency and flexibility, establishing new industry standards.

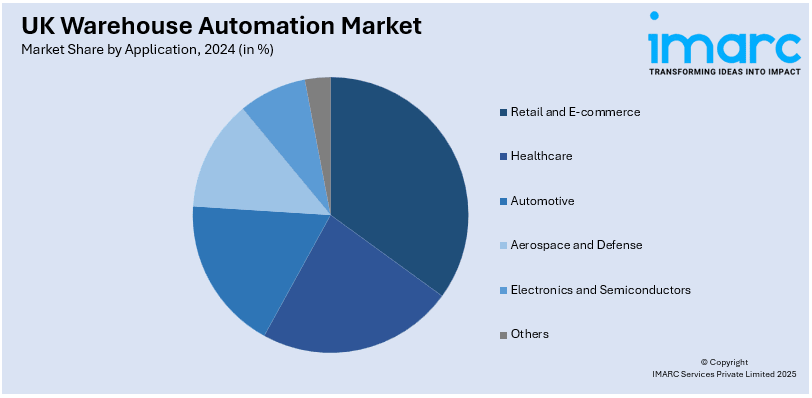

Analysis by Application:

- Retail and E-commerce

- Healthcare

- Automotive

- Aerospace and Defense

- Electronics and Semiconductors

- Others

The retail and e-commerce sector leads the way in the warehouse automation market, fueled by the phenomenal growth of online shopping, the demand for faster order fulfillment, and accurate picking for same-day or next-day delivery. Automated systems, including robotic picking and AS/RS, allow companies to process high volumes of orders. The industry is highly dependent on real-time inventory tracking and advanced sorting solutions to meet customer expectations for speed and accuracy. Seasonal shopping spikes, like holidays, further amplify the demand for scalable automation technologies. Retailers are increasingly adopting warehouse automation to enhance operational efficiency, reduce errors, and maintain competitiveness in a fast-paced market.

Warehouse automation in the healthcare sector focuses on precision and compliance with stringent regulations. Automated solutions manage the storage and distribution of pharmaceuticals, medical devices, and lab equipment, ensuring accuracy and minimizing errors. Temperature-controlled storage systems and real-time monitoring technologies are critical for handling sensitive products like vaccines and biologics. Hospitals and healthcare providers also use automated warehouses for inventory management of consumables and medical supplies. The growing demand for reliable supply chain operations in healthcare drives the adoption of automation, enhancing safety and operational efficiency in this highly regulated industry.

The automotive sector uses warehouse automation to streamline the storage and distribution of components, tools, and finished vehicles. Just-in-time (JIT) manufacturing processes, common in the automotive industry, rely on automated systems for precise inventory management and timely deliveries to production lines. Automated guided vehicles (AGVs), conveyor systems, and robotic arms are widely used to handle bulky and heavy components. As the industry transitions toward electric vehicles (EVs), automation plays a key role in managing the complex supply chain, including battery storage and assembly. Automation helps automotive warehouses achieve higher efficiency and adapt to the industry’s evolving demands.

Warehouse automation in aerospace and defense focuses on managing high-value, complex, and sensitive inventory. Automated systems ensure precise storage, tracking, and retrieval of components, tools, and materials, supporting assembly lines and maintenance operations. Technologies such as automated guided vehicles (AGVs) and robotic arms enhance the handling of oversized and delicate parts. Additionally, real-time tracking systems help manage stringent inventory compliance and reporting requirements. The adoption of automation supports the sector's need for accuracy, security, and efficiency, ensuring operational readiness and reducing downtime in critical operations.

The electronics and semiconductor industry requires highly precise and efficient warehouse automation systems to manage fragile and high-value inventory. Automated storage and retrieval systems (AS/RS), robotics, and IoT-enabled tracking solutions are widely employed to ensure product safety and optimize storage space. The industry’s fast-paced nature, with frequent product updates and high demand for components, makes automation essential for timely delivery and inventory management. Temperature and humidity-controlled environments are critical for sensitive semiconductor components, and automation ensures these conditions are maintained consistently. By adopting advanced automation, the sector meets the demands of rapid innovation cycles and high production volumes effectively.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London is an ideal central location for warehouse automation given its high population density and online shopping penetration. The city is strategically located to enable efficient distribution to the urban and suburban areas, making it an ideal market for automated warehouses. The increasing cost of land and scarcity of space in London have boosted demand for vertical automation, such as AS/RS. In addition, for last-mile delivery networks to meet fast delivery expectations, the highly automated warehouses within the city help increase investment in advanced technologies.

The South East region benefits from its proximity to London and well-established transportation infrastructure, making it a critical area for warehouse operations. The region hosts several large distribution centers catering to both e-commerce and retail sectors. Automation adoption in this region focuses on improving efficiency for high-volume operations. Technologies like robotic picking and automated sorting systems are increasingly prevalent as businesses aim to reduce labor dependency and enhance order accuracy.

The North West is experiencing rapid growth in warehouse automation due to its strategic location near major transport hubs and ports, including Liverpool. Industries such as retail, manufacturing, and healthcare dominate the region’s demand for automated solutions. The push toward modernizing traditional warehouses and improving supply chain efficiencies is driving the implementation of robotics, AGVs, and IoT-enabled systems in this area.

The East of England is a growing hub for automated warehousing, particularly for agriculture, food processing, and pharmaceuticals. The region’s proximity to ports such as Felixstowe supports efficient distribution, making automation essential for handling high volumes of imports and exports. Automated systems in this area are tailored to manage temperature-sensitive goods and high-value products, ensuring compliance with strict industry standards.

The South West, known for its manufacturing and food processing industries, is adopting warehouse automation to streamline operations. The region’s dispersed population and rural nature make automated systems valuable for improving distribution efficiency. Technologies such as AGVs and conveyor systems are widely implemented to reduce operational costs and enhance productivity in logistics and warehousing.

Scotland’s warehouse automation market is growing due to its strong focus on food, beverage, and oil industries. The region's geography requires advanced logistics networks, supported by automated solutions to optimize transportation and storage. Automated cold storage systems are particularly significant for managing perishable goods, while robotic picking systems enhance operational efficiency in large distribution centers.

The West Midlands, with its strong automotive and manufacturing base, heavily invests in warehouse automation to support just-in-time production models. Robotics, conveyor systems, and AGVs are widely used to manage components and finished goods efficiently. The region also benefits from a centralized location within the UK, supporting fast distribution across the country, further driving automation adoption.

Yorkshire and The Humber focus on warehouse automation to support its logistics and food processing industries. The region’s strategic location with access to major road and rail networks facilitates efficient distribution. Automated storage and retrieval systems, along with IoT-enabled inventory management, are widely implemented to handle high-volume operations and improve accuracy in order fulfillment.

The East Midlands is a key logistics hub in the UK, hosting several large-scale distribution centers. Proximity to major transport routes like the M1 motorway makes the region ideal for warehousing and distribution operations. Automation technologies such as AGVs, robotics, and AI-driven inventory systems are increasingly adopted to meet growing e-commerce demand and ensure fast delivery to consumers across the UK.

Competitive Landscape:

Leading players in the UK warehouse automation market are investing heavily in advanced technologies to meet the growing demand. These companies are focusing on robotics, artificial intelligence (AI), and the Internet of Things (IoT) to develop innovative solutions. For example, robotics firms are introducing advanced picking and packing systems capable of handling a diverse range of products, reducing errors, and speeding up order fulfillment. IoT-enabled solutions allow for real-time tracking of inventory and equipment, improving transparency and decision-making. Strategic collaborations and acquisitions are also prominent, enabling companies to expand their portfolios and enter new markets. Some players are partnering with logistics providers to deliver end-to-end automated solutions tailored to specific industry needs. In response to sustainability demands, many companies are designing energy-efficient systems that minimize environmental impact while cutting operational costs.

The report provides a comprehensive analysis of the competitive landscape in the UK warehouse automation market with detailed profiles of all major companies.

Latest News and Developments:

- In March 2024, John Lewis & Partners collaborated with Locus Robotics, a warehouse automation solution provider, to improve the efficiency of its Milton Keynes distribution centre, in the United Kingdom.

-

In June 2024, InPost Group, a leader in logistics solutions for the e-commerce, introduced a new model of Paczkomat machine, which allows the machines to be erected regardless of the availability of the electricity grid, owing to their photovoltaic panels and energy storage. The pilot will be carried out in Krakow and Gdansk, as well as in European markets, such as the UK, France and Italy.

UK Warehouse Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Automation Levels Covered | Basic Automation, Intermediate Automation, Advanced Automation, Autonomous Warehouses |

| Applications Covered | Retail and E-commerce, Healthcare, Automotive, Aerospace and Defense, Electronics and Semiconductors, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK warehouse automation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK warehouse automation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK warehouse automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK warehouse automation market was valued at USD 2.2 Billion in 2024.

The growth of the UK warehouse automation market is driven by the rapid expansion of the e-commerce sector, labor shortages caused by demographic changes and migration restrictions, increasing demand for cost-efficient solutions, advancements in automation technologies, and the need for faster and more accurate deliveries.

The UK warehouse automation market is projected to exhibit a CAGR of 10.3% during 2025-2033, reaching a value of USD 5.3 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)