UK Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

UK Travel Insurance Market Overview:

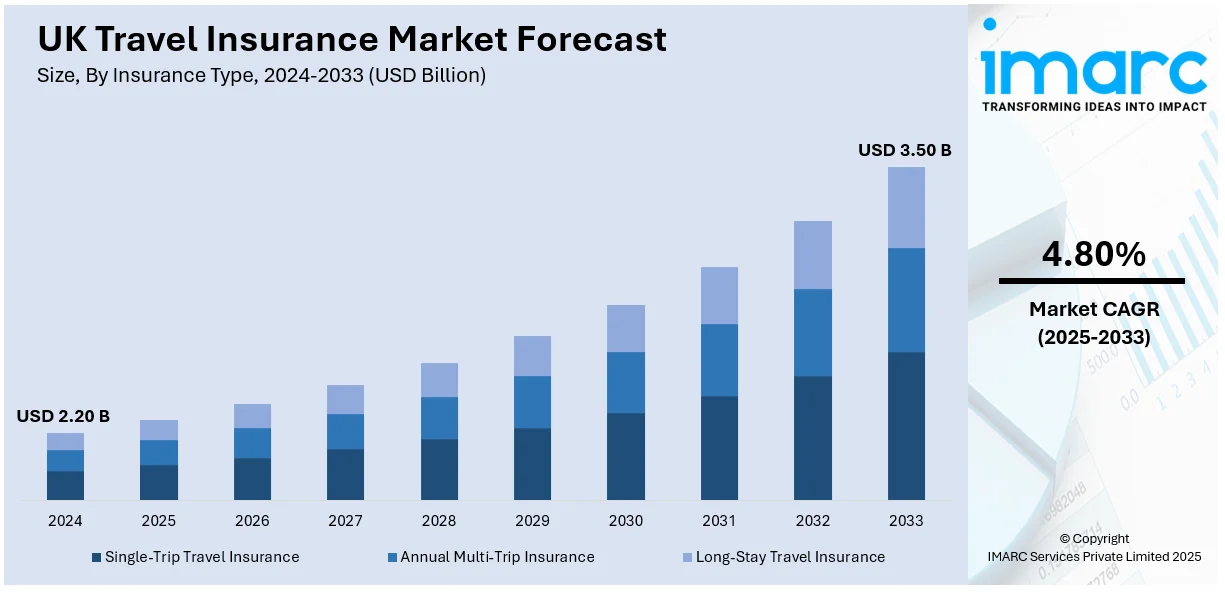

The UK travel insurance market size reached USD 2.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.50 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is primarily driven by the rising demand for comprehensive coverage, accelerated digital transformation for seamless policy management, a growing emphasis on personalized insurance plans leveraging data analytics and AI, digital transformation enhancing accessibility and efficiency, and the increasing need for protection against natural disasters and pandemics among the masses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

UK Travel Insurance Market Trends:

Rising Demand for Comprehensive Coverage

In the UK travel insurance market, there is a growing demand for comprehensive coverage due to an enhanced awareness of the financial risks involved with unplanned events, medical emergencies, and travel delays. For instance, in August 2024, NSM Insurance Group finalized the acquisition of AllClear and InsureandGo to expand its UK travel insurance book to fuel growth, innovation, and improved customer service in international markets. Moreover, the costs and complexities related to travel, including trip cancellations, medical problems overseas, and unforeseen events such as natural catastrophes or political unrest, are becoming are becoming increasingly evident to consumers. They are therefore exhibiting a preference for plans that offer comprehensive protection, including coverage for natural disasters and pandemics, to ensure adequate protection against a variety of possible problems. This trend reflects a shift towards more comprehensive and all-encompassing insurance options designed to offer travelers greater peace of mind.

Digital Transformation of the Insurance Sector

The insurance industry is undergoing a significant digital transformation, with an increasing number of companies offering mobile applications and web platforms for streamlined policy administration and claims processing. This transition to digital solutions facilitates effortless access and management of insurance plans from any location, thereby enhancing client convenience and accessibility. Insurance firms may speed claims processing, cut down on paperwork, and streamline operations by utilizing cutting-edge technologies, giving clients a more streamlined and convenient experience. Furthermore, insurers can customize solutions to meet the unique demands and tastes of their clients through data analytics made possible by digital tools. This technical development gives insurers a stronger competitive advantage in the ever-changing travel insurance market while also increasing client happiness.

Growing Emphasis on Personalized Plans

In the UK, there is an increasing emphasis on developing custom travel insurance policies tailored to meet the specific requirements and desires of each individual. Insurers are leveraging data analytics and customer information to provide tailored policies that suit the unique needs and risk profiles of individual travelers. Insurance providers can create policies with the most appropriate coverage options by studying customer behavior, travel patterns, and preferences. This method results in increased customer satisfaction because travelers believe their specific requirements are being catered to. Furthermore, tailored insurance schemes assist insurance companies in standing out in a crowded market, promoting increased customer loyalty and involvement. Providing customized coverage options increases the perceived worth of the insurance product, appealing more to customers looking for personalized solutions rather than standard coverage. Consequently, there is a trend in the market towards insurance options that are more agile and adaptable to people's specific travel habits and levels of risk.

UK Travel Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on insurance type, coverage, distribution channel and end user.

Insurance Type Insights:

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

- Long-Stay Travel Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes single-trip travel insurance, annual multi-trip insurance, and long-stay travel insurance.

Coverage Insights:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes medical expenses, trip Cancellation, trip delay, property damage, and others.

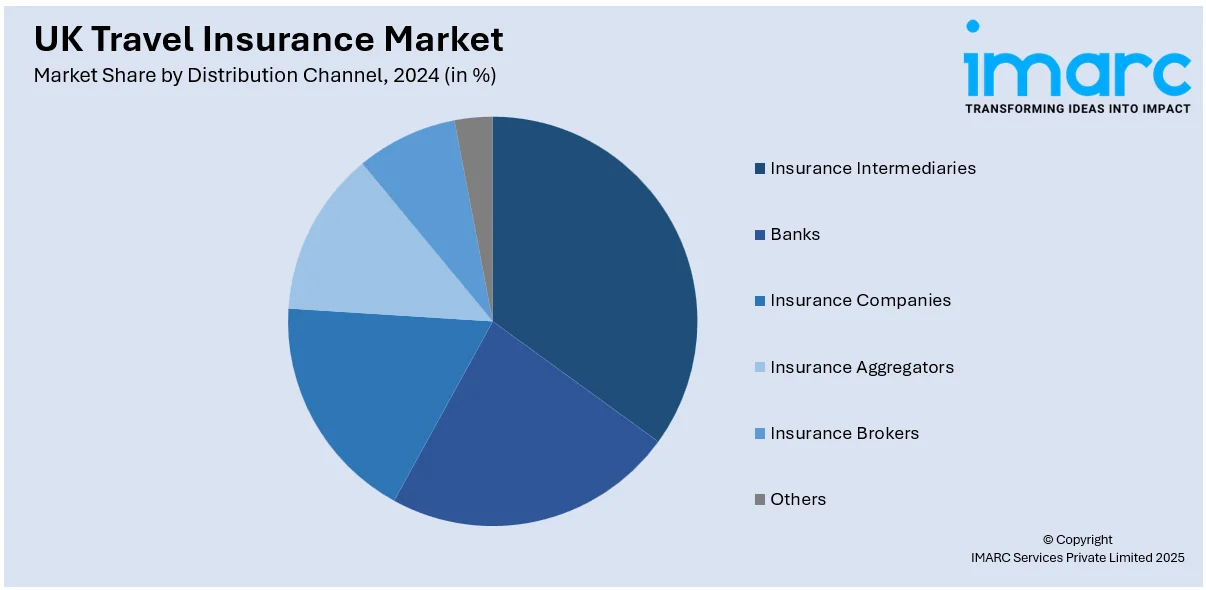

Distribution Channel Insights:

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes insurance intermediaries, banks, insurance companies, insurance aggregators, insurance brokers, and others.

End User Insights:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes senior citizens, education travelers, business travelers, family travelers, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Travel Insurance Market News:

- On 27th June 2024, Collinson, a global leader in travel experiences and loyalty programs, has formed a strategic partnership with World Nomads, a leading provider of travel insurance. As part of this collaboration, the companies have launched a new Annual Multi-Trip (AMT) insurance product in the UK and Ireland. The new product line is designed to elevate the customer experience by offering higher coverage limits, additional benefits for both annual and single-trip policies, and the inclusion of SmartDelay™, an innovative parametric service.

- On 10th July 2024, Allianz Partners UK has been appointed as the travel insurance provider for TUI’s UK business, further solidifying its position as the UK’s largest travel insurance provider. This partnership, covering brands such as Marella Cruises and Crystal Ski Holidays, offers TUI customers the choice of single-trip or annual travel insurance plans, enhancing the process with Allianz’s online platform and automated claims processing.

UK Travel Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK travel insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the UK travel insurance market on the basis of insurance type?

- What is the breakup of the UK travel insurance market on the basis of coverage?

- What is the breakup of the UK travel insurance market on the basis of distribution channel?

- What is the breakup of the UK travel insurance market on the basis of end user?

- What is the breakup of the UK travel insurance market on the basis of region?

- What are the various stages in the value chain of the UK travel insurance market?

- What are the key driving factors and challenges in the UK travel insurance?

- What is the structure of the UK travel insurance market and who are the key players?

- What is the degree of competition in the UK travel insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK travel insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK travel insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)