UK Sustainable Fashion Market Size, Share, Trends and Forecast by Product Type, Fabric Type, Distribution Channel, End User, and Region, 2025-2033

UK Sustainable Fashion Market Overview:

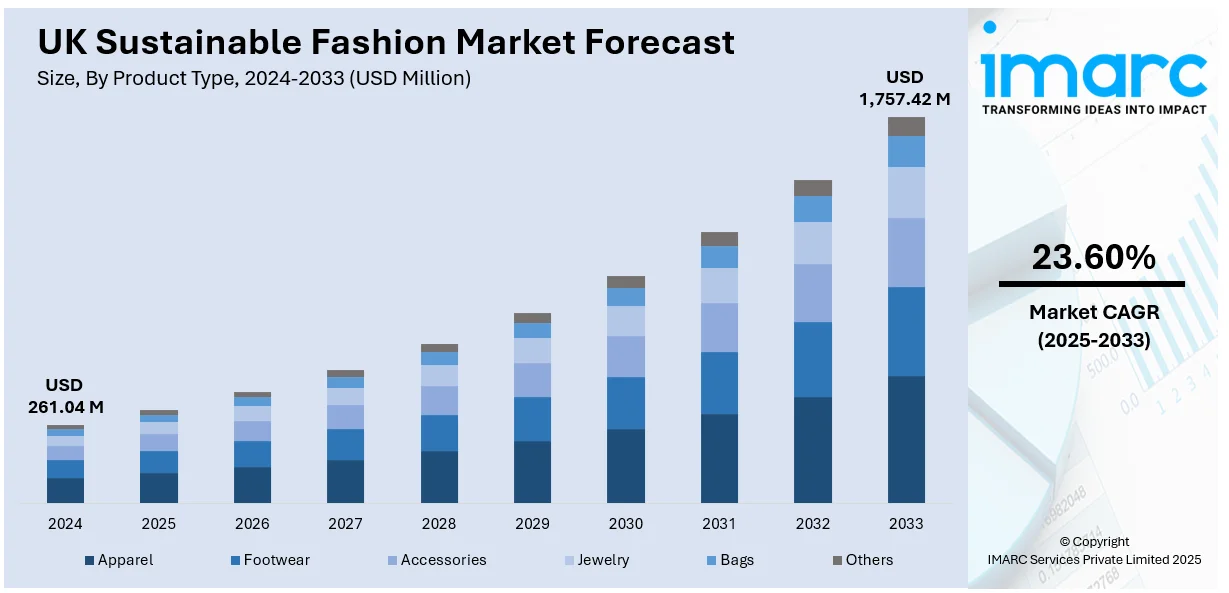

The UK sustainable fashion market size reached USD 261.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,757.42 Million by 2033, exhibiting a growth rate (CAGR) of 23.60% during 2025-2033. The market is primarily driven by rising demand from consumers for ethical products, the higher uptake of zero-waste and circular fashion efforts, and rapid development in sustainable production technologies that emphasize the use of eco-friendly materials and recycling techniques to satisfy environmental standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 261.04 Million |

| Market Forecast in 2033 | USD 1,757.42 Million |

| Market Growth Rate (2025-2033) | 23.60% |

UK Sustainable Fashion Market Trends:

Increased Consumer Demand for Ethical and Eco-Friendly Products

The UK sustainable fashion market is witnessing a significant shift as consumers increasingly prioritize ethical and ecofriendly choices. This shift is driven by a growing awareness regarding the environmental and social impacts of fashion production. UK sustainable fashion market share is expanding as consumers prioritize ethical and eco-friendly choices driving demand for sustainable materials, fair labor practices and waste reduction reshaping the industry towards more responsible production. Consequently, more fashion companies are embracing sustainable solutions like organic cotton sourcing, use of recycled inputs and transparency within manufacturing. This growing demand for sustainable fashion is also driven by the younger age groups who cherish sustainability and pay extra for environmentally friendly products. This trend is redefining the fashion market stimulating innovation and dedication to responsible production. Consistent with this trend, leading industry players are taking proactive measures to incorporate sustainability into their business. For instance, in October 2024, Kering announced its partnership with the Centre for Sustainable Fashion to launch the "Governance for Tomorrow" initiative aimed at embedding sustainability into fashion decision-making. This three-year program will unite experts from various sectors to explore sustainable governance models addressing environmental and social challenges in the luxury fashion industry.

Rapid Adoption of Circular Fashion and Zero-Waste Initiatives

Circular fashion and zero-waste are on the rise in the UK as companies seek new means of prolonging the life of their products. Circular fashion focuses on creating garments that can be reused, repaired or recycled to minimize damage to the environment. Take-back schemes where customers return used clothing for recycling or resale are being adopted by companies as part of their sustainability initiatives. Some companies are turning towards zero-waste manufacturing targeting the reduction of fabric wastage during the process. Such efforts are in compliance with customers' increasing interest in minimizing the carbon footprint of the fashion industry. For instance, in June 2024, John Lewis launched a circular clothing collection aimed at reducing waste and increasing product longevity in response to consumer concerns about fabric quality. The initial 20-piece collection includes pyjamas, babywear and home textiles with plans for expansion to thousands more items by 2028. As awareness about environmental issues continues to grow, circular fashion and zero-waste initiatives are creating a positive UK sustainable fashion market outlook.

Technological Advancements in Sustainable Fashion Production

The UK sustainable fashion industry is taking advantage of ongoing technological advancements that enable ecologically friendly manufacturing processes. Innovative technologies like 3D printing biodegradable products and green dyeing procedures are reducing the environmental footprint of clothing production. For instance, in February 2025, the UK’s first Robotics Living Lab launched in Manchester utilizing collaborative robots to produce sustainable and high-value fashion garments. Funded by the UKRI Arts and Humanities Research Council RoLL aims to modernize manufacturing, address skills shortages and support small designers reinforcing the fashion industry’s role in the UK’s economic strategy. Brands are increasingly utilizing technology to develop fabrics made from renewable sources such as bamboo, algae and recycled plastics which are less harmful to the environment. Digital tools are also enhancing supply chain transparency allowing consumers to trace the sustainability of their purchases. Moreover, new technologies are enabling more efficient water and energy use in production processes contributing to the industry's overall sustainability goals. As technology continues to advance it is expected to play a crucial role in driving the UK sustainable fashion market growth.

UK Sustainable Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, fabric type, distribution channel and end user.

Product Type Insights:

- Apparel

- Footwear

- Accessories

- Jewelry

- Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes apparel, footwear, accessories, jewelry, bags and others.

Fabric Type Insights:

- Recycled Fabrics

- Organic Fabrics

- Regenerated Fabrics

- Natural Fibers

- Alternate Fibers

- Others

A detailed breakup and analysis of the market based on the fabric type have also been provided in the report. This includes recycled fabrics, organic fabrics, regenerated fabrics, natural fibers, alternate fibers and others.

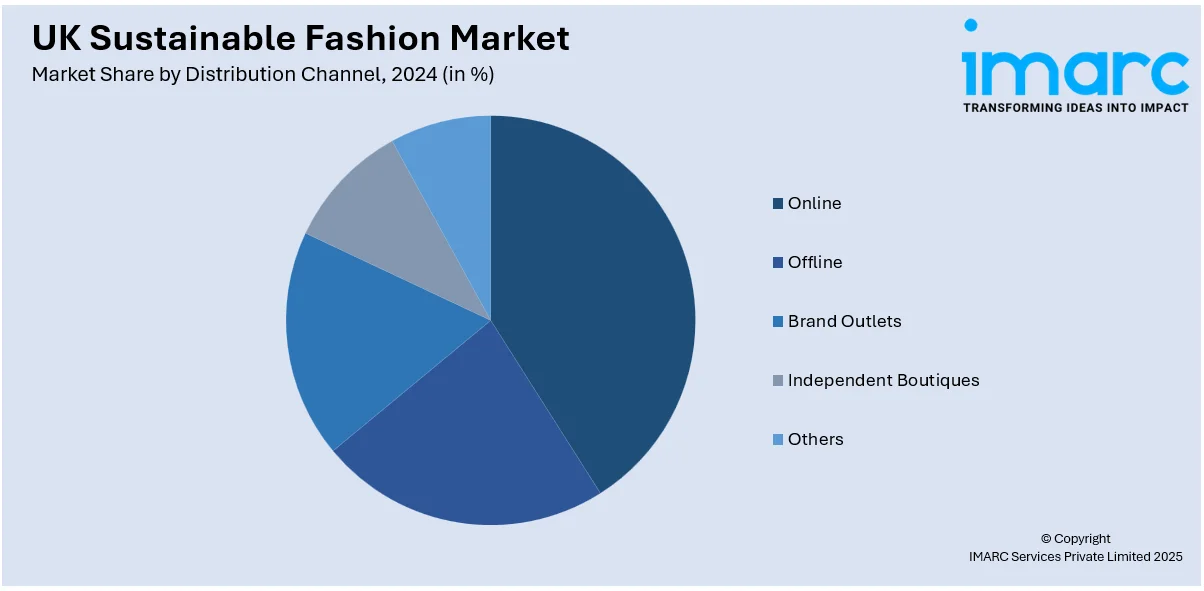

Distribution Channel Insights:

- Online

- Offline

- Brand Outlets

- Independent Boutiques

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online, offline, brand outlets, independent boutiques and others.

End User Insights:

- Men

- Women

- Children

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, Children and unisex.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Sustainable Fashion Market News:

- March 21, 2023: UK tech startup OWNI launched AI digital wardrobe technology to revolutionize fashion resale. By tracking changes in ownership of items and involving businesses in the resale market, this system seeks to decrease waste and alter the fast fashion culture. With the help of OWNI, brands can effectively control their presence in the second-hand market and earn a royalty from the resale of their products.

- November 14, 2023: Men's clothing company Oliver Spencer started a program called Repurpose to promote sustainability. The company partnered with an academic institution for upcycling mixed-fibre garments and plans for single-fibre garments, shoes, and accessories as well. Additionally, materials such as plastics and metals are separated and given new life in various applications. Oliver Spencer hopes to set an example for other brands and enlisted the help of environmental campaigner Jack Harries to promote their initiative.

UK Sustainable Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Apparel, Footwear, Accessories, Jewelry, Bags, Others |

| Fabric Types Covered | Recycled Fabrics, Organic Fabrics, Regenerated Fabrics, Natural Fibers, Alternate Fibers, Others |

| Distribution Channels Covered | Online, Offline, Brand Outlets, Independent Boutiques, Others |

| End Users Covered | Men, Women, Children, Unisex |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK sustainable fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the UK sustainable fashion market on the basis of product type?

- What is the breakup of the UK sustainable fashion market on the basis of fabric type?

- What is the breakup of the UK sustainable fashion market on the basis of distribution channel?

- What is the breakup of the UK sustainable fashion market on the basis of end user?

- What is the breakup of the UK sustainable fashion market on the basis of region?

- What are the various stages in the value chain of the UK sustainable fashion market?

- What are the key driving factors and challenges in the UK sustainable fashion market?

- What is the structure of the UK sustainable fashion market and who are the key players?

- What is the degree of competition in the UK sustainable fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK sustainable fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK sustainable fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK sustainable fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)