UK Robotics Process Automation Market Size, Share, Trends and Forecast by Type, Deployment, Organization Size, Application, and Region, 2025-2033

UK Robotics Process Automation Market Overview:

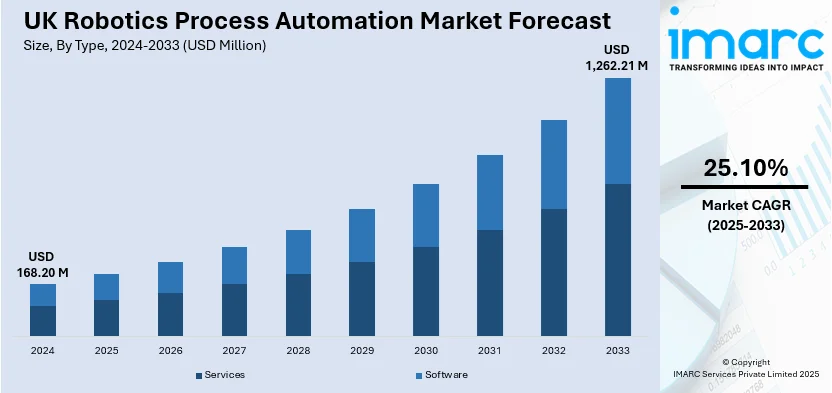

The UK robotics process automation market size reached USD 168.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,262.21 Million by 2033, exhibiting a growth rate (CAGR) of 25.10% during 2025-2033. The growing adoption of automation across a wide range of industries, increasing demand for cost-effective solutions for workforce optimization, and rising adoption of artificial intelligence (AI) and machine learning (ML) solutions in business automation are some of the factors positively impacting the UK robotic process automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 168.20 Million |

| Market Forecast in 2033 | USD 1,262.21 Million |

| Market Growth Rate (2025-2033) | 25.10% |

UK Robotics Process Automation Market Trends:

Demand for Cost Efficiency and Workforce Optimization

The increase in demand for workforce optimization solutions that are cost-effective is propelling the UK robotics process automation market growth. Many businesses are carefully searching for ways to greatly lower costs while keeping up productivity due to economic strain. RPA technology is a solution as it automates repetitive, labor-intensive tasks and frees human employees for more calculated, value-added roles. This transition greatly improves running efficiency. Furthermore, it importantly reduces costs linked to manual labor, training, along human error. For example, UiPath announced that its UiPath Automation Cloud on Microsoft Azure would launch in the UK in 2024. The goal of this expansion is to help organizations safely deploy artificial intelligence (AI) automation programs that also follow each local data residency law. The UiPath Automation Cloud is a software-as-a-service (SaaS) solution that provides the entire UiPath Business Automation Platform as a service, thereby yielding improved performance and elevated security. It simplifies deploying, running, and scaling all digital workforces from the Automation Cloud since hybrid configurations are possible using client components for all robots and studio versions.

Integration of AI and Machine Learning (ML) in RPA Solutions

The integration of AI and machine learning (ML) with RPA is revolutionizing the way automation is implemented in business processes across the UK, which is positively influencing the UK robotics process automation market outlook. Automating repetitive, rule-based operations is the main goal of traditional RPA, but by incorporating AI and ML, RPA systems can now manage more intricate decision-making procedures. These enhanced capabilities allow businesses to automate not just simple tasks but also processes that require analysis, pattern recognition, and predictions. The integration of AI and ML not only allows for more sophisticated automation but also reduces the need for human intervention in processes that require cognitive decision-making. This shift toward intelligent automation is helping companies achieve greater scalability, accuracy, and agility in their operations. In 2023, a UK-based startup, Robotiz3d, announced the launch of the world’s first AI robot to tackle the pothole problem. This robot used AI to locate and fix cracks and potholes on UK roads, and it was developed by combining AI with advanced robotics.

Rising Adoption of Automation in Business Operations

The increasing adoption of automation across a wide range of industries is impelling the growth of the market in the UK. Companies in sectors such as finance, healthcare, retail, and manufacturing are integrating robotic process automation (RPA) tools to enhance the efficiency of repetitive and rule-based tasks. This trend is driven by the need for businesses to minimize human error, improve operational speed, and lower costs associated with manual processes. As businesses continue to prioritize customer satisfaction and efficiency, RPA tools are becoming indispensable. Additionally, as cloud-based RPA options grow, small and medium-sized businesses (SMEs) may now more easily use the technology, enabling wider market adoption. The continued expansion of the RPA market in the UK is mostly due to the growing need for automation as businesses realize how important it is to attain operational agility. Moreover, according to HowToRobot, in 2023, the UK was home to no fewer than 480 robots and automation suppliers, including 311 integrators.

UK Robotics Process Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, deployment, organization size, and application.

Type Insights:

- Services

- Consulting

- Implementing

- Training

- Software

The report has provided a detailed breakup and analysis of the market based on the type. This includes services (consulting, implementing, and training) and software.

Deployment Insights:

- Cloud

- On-premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud and on-premises.

Organization Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

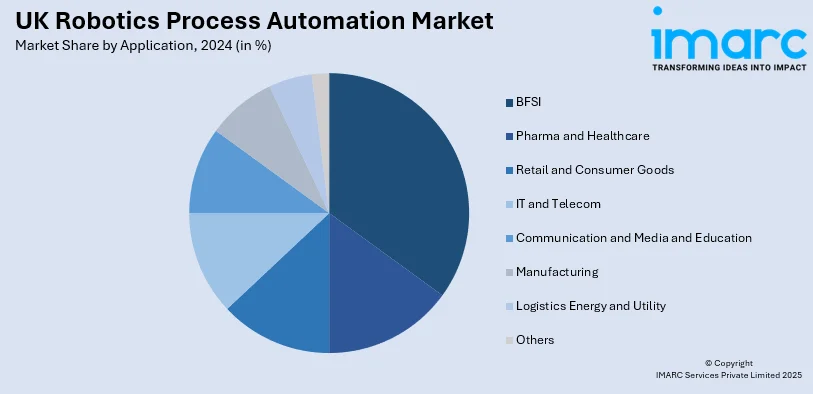

Application Insights:

- BFSI

- Pharma and Healthcare

- Retail and Consumer Goods

- IT and Telecom

- Communication and Media and Education

- Manufacturing

- Logistics Energy and Utility

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes BFSI, pharma and healthcare, retail and consumer goods, IT and telecom, communication and media and education, manufacturing, logistics energy and utility, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Robotics Process Automation Market News:

- July 2023: Maersk announced the installation of a robotic system powered by AI in its newest East Midlands facility in the United Kingdom. The innovative Robotic Shuttle Put Wall System developed by Berkshire Grey, a US-based company, will automate, improve and fast track warehouse operations in the 685,000 sq ft facility.

- January 2024: Cranfield University collaborated with Peyk to create the UK’s first on-campus last-mile robotic deliveries. These robots are expected to be used for mail deliveries and for sending goods and library books around the campus.

UK Robotics Process Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Deployments Covered | Cloud, On-Premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Applications Covered | BFSI, Pharma and Healthcare, Retail and Consumer Goods, IT and Telecom, Communication and Media and Education, Manufacturing, Logistics Energy and Utility, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK robotics process automation market performed so far and how will it perform in the coming years?

- What is the breakup of the UK robotics process automation market on the basis of type?

- What is the breakup of the UK robotics process automation market on the basis of deployment?

- What is the breakup of the UK robotics process automation market on the basis of organization size?

- What is the breakup of the UK robotics process automation market on the basis of application?

- What is the breakup of the UK robotics process automation market on the basis of region?

- What are the various stages in the value chain of the UK robotics process automation market?

- What are the key driving factors and challenges in the UK robotics process automation market?

- What is the structure of the UK robotics process automation market and who are the key players?

- What is the degree of competition in the UK robotics process automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK robotics process automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK robotics process automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK robotics process automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)