UK Residential Solar Market Size, Share, Trends and Forecast by Technology, Type, Connectivity, and Region, 2025-2033

UK Residential Solar Market Overview:

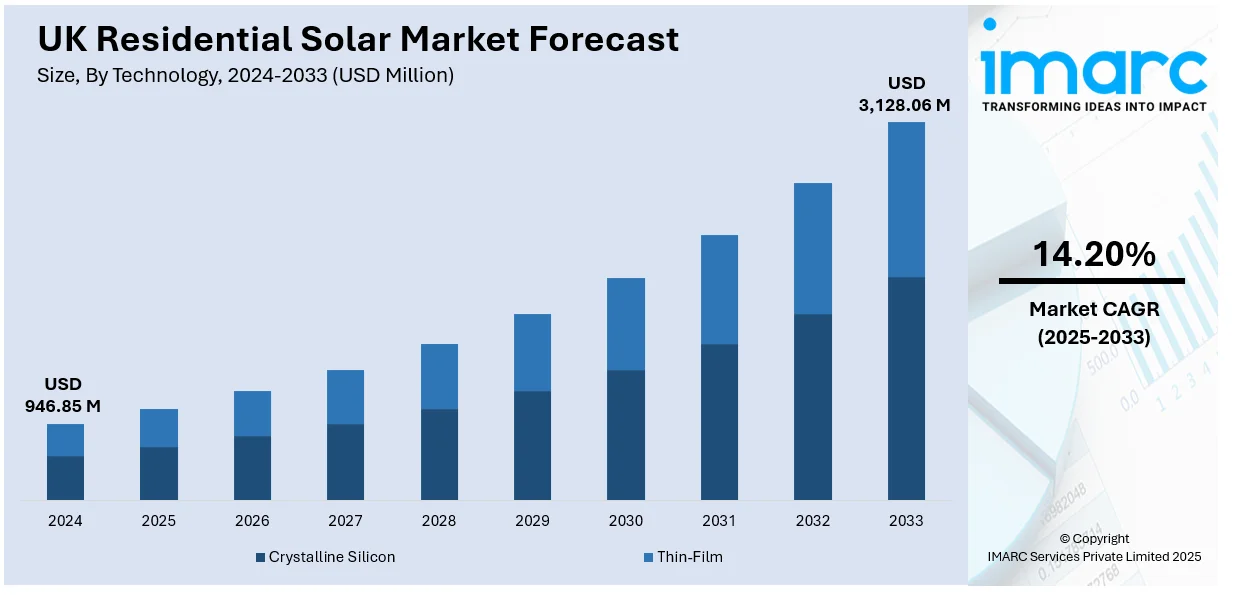

The UK residential solar market size reached USD 946.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,128.06 Million by 2033, exhibiting a growth rate (CAGR) of 14.20% during 2025-2033. Supportive government incentives, affordable installation costs, increasing energy prices, escalating consumer awareness of sustainability, significant advancements in solar technology, growing demand for energy independence, favorable financing options, and a shift towards net-zero carbon emissions targets are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 946.85 Million |

| Market Forecast in 2033 | USD 3,128.06 Million |

| Market Growth Rate (2025-2033) | 14.20% |

UK Residential Solar Market Trends:

Government incentives and policy support

One of the key trends influencing market growth is the robust support from the UK government through various incentives and policies aimed at promoting renewable energy adoption. The introduction of schemes such as the Smart Export Guarantee (SEG) allows homeowners with solar installations to sell excess electricity back to the grid enhancing the financial viability of solar investments. The government's commitment to achieving net-zero carbon emissions by 2050 has resulted in increased funding for renewable energy projects and greater public awareness of climate issues. For instance, in February 2024, the UK government increased residential solar subsidies by 60% making clean energy more accessible for homeowners. This initiative supports the goal of achieving net-zero emissions by 2050 and aims to stimulate the renewable energy sector encouraging innovation and job creation while promoting a sustainable future. Policies like the Renewable Heat Incentive (RHI) have also encouraged solar thermal installations further bolstering the UK residential solar market growth. In addition to lowering the initial cost barrier for homeowners these incentives also help to improve the regulatory climate surrounding solar energy systems thereby aiding in market expansion.

Ongoing technological advancements

Rapid advancements in solar technology are further presenting lucrative opportunities for the UK residential solar market. Innovations such as more efficient photovoltaic (PV) cells, improved energy storage solutions like batteries, and smart energy management systems have made solar power more accessible and effective for homeowners. New solar panels can convert sunlight into electricity with higher efficiency rates, reducing the amount of space required for installations. For instance, in May 2023, Oxford PV achieved a world record efficiency of 28.6% for its commercial-sized perovskite-on-silicon solar cells. This innovative technology produces over 20% more electricity than traditional silicon-only cells making it ideal for residential and commercial rooftops while contributing to a more affordable and sustainable energy future. Moreover, advancements in battery storage technology allow homeowners to store excess energy produced during the day for use at night or during peak demand times. This capability increases energy independence and enhances the reliability and appeal of solar systems, making them a more attractive option for residential users, thus creating a positive UK residential solar market outlook.

Rising energy prices and energy security concerns

Homeowners' decisions to invest in solar energy have been greatly influenced by the rising costs of conventional energy sources. As energy prices continue to climb, consumers are increasingly seeking alternative sources to mitigate their electricity costs. Solar energy offers a sustainable solution that can lead to significant long-term savings on energy bills. Furthermore, recent geopolitical tensions and supply chain disruptions have heightened concerns about energy security. Homeowners are increasingly motivated to adopt solar solutions as a way to insulate themselves from volatile energy markets and reduce reliance on external energy sources. According to industry reports, as of December 2024, 1.4 million UK homes have solar panels a significant increase from just 28,211 in 2010 representing a 4,862% rise over 14 years. The milestone of 500,000 was reached in three years followed by a million in 2021 with 1.5 million expected by early 2025. UK residential solar market share is growing as homeowners turn to solar energy to mitigate rising energy costs, enhance energy security, and reduce reliance on conventional energy sources making it a preferred alternative for long-term savings.

UK Residential Solar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, type and connectivity.

Technology Insights:

- Crystalline Silicon

- Thin-Film

The report has provided a detailed breakup and analysis of the market based on the technology. This includes crystalline silicon and thin-film.

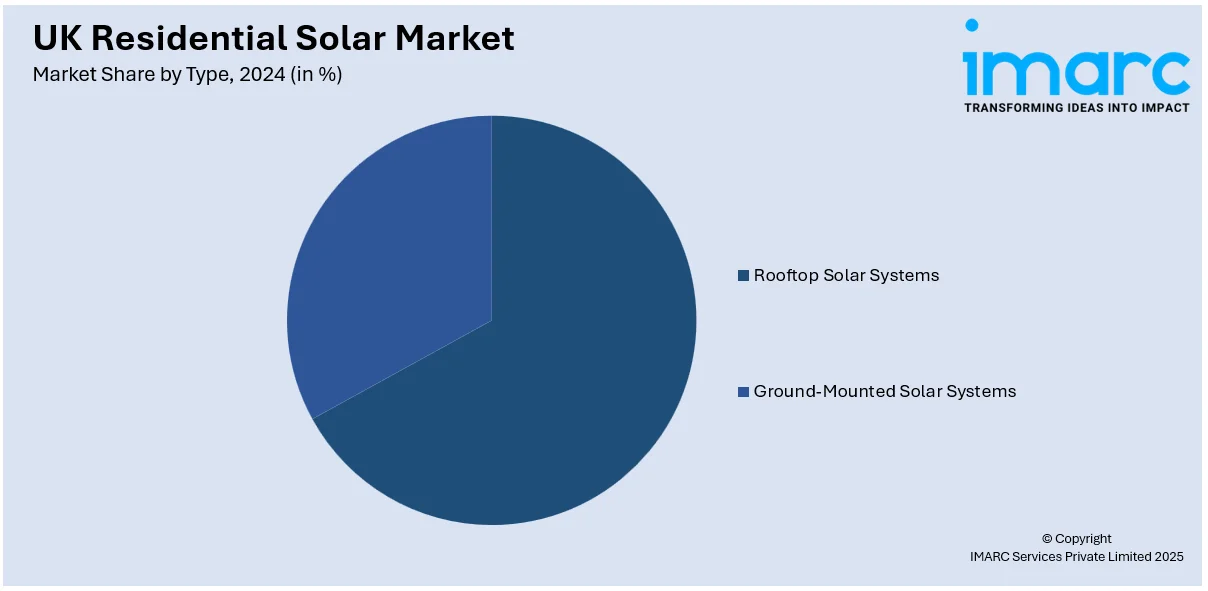

Type Insights:

- Rooftop Solar Systems

- Ground-Mounted Solar Systems

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes rooftop solar systems and ground-mounted solar systems.

Connectivity Insights:

- On-Grid Solar Systems

- Off-Grid Solar Systems

A detailed breakup and analysis of the market based on the connectivity have also been provided in the report. This includes on-grid solar systems and off-grid solar systems.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Residential Solar Market News:

- In January 2025, Upvolt Ltd, a UK renewable energy firm acquired solar installer Solarkw Ltd, marking its growth strategy launch. The deal enhances Upvolt’s offerings in Oxfordshire, Wiltshire and Berkshire. The company aims to expand capabilities in providing solar solutions, battery storage and energy management as part of upcoming acquisitions.

- In August 2024, British Gas partnered with Effective Energy Group and Forster Group to roll out Hive Solar to the UK residential market. Effective Energy will handle installations in England and Wales, while Forster oversees Scotland. Hive Solar, integrated with the Hive app, allows homeowners to monitor solar generation, energy usage, and battery storage while selling excess energy back to the grid via the Smart Export Guarantee.

UK Residential Solar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Crystalline Silicon, Thin-Film |

| Types Covered | Rooftop Solar Systems, Ground-Mounted Solar Systems |

| Connectivities Covered | On-Grid Solar Systems, Off-Grid Solar Systems |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK residential solar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK residential solar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK residential solar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential solar market in the UK was valued at USD 946.85 Million in 2024.

The UK residential solar market is projected to exhibit a CAGR of 14.20% during 2025-2033, reaching a value of USD 3,128.06 Million by 2033.

The UK residential solar market is driven by rising energy prices, supportive government policies promoting renewable adoption, and growing consumer focus on sustainability. Advancements in solar technology, integration with home battery storage, and increasing demand for energy independence are further encouraging households to invest in solar power solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)