UK RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprises Size, Application, End User, and Region, 2025-2033

UK RegTech Market Overview:

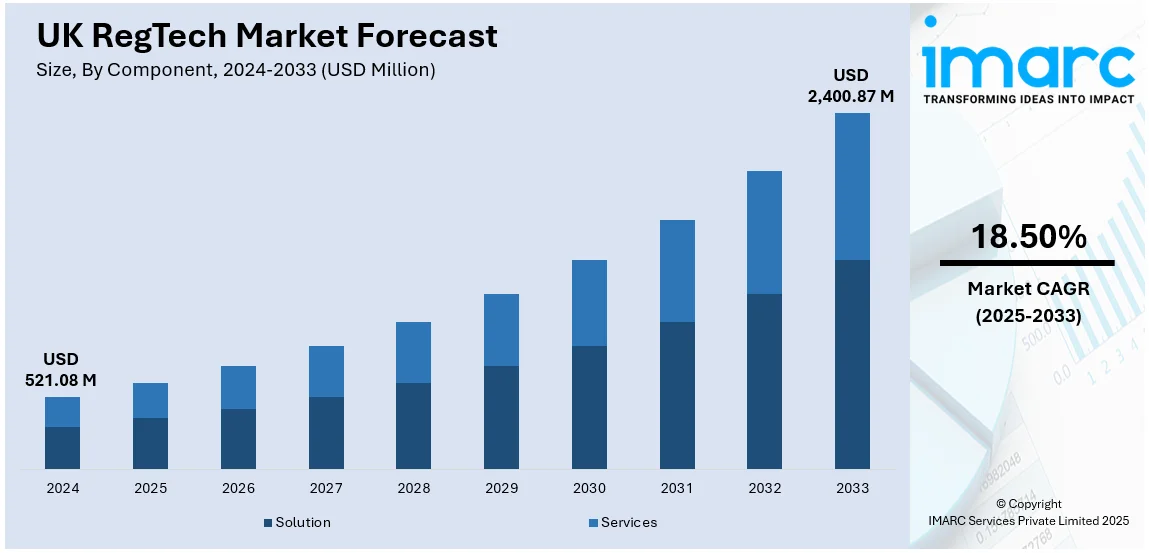

The UK RegTech market size reached USD 521.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,400.87 Million by 2033, exhibiting a growth rate (CAGR) of 18.50% during 2025-2033. The UK RegTech market share is expanding, driven by the rapid adoption of machine learning (ML) and artificial intelligence (AI) for automating compliance processes, increasing need for cloud-based solutions that offer scalability and security, and the rising emphasis on cybersecurity and data privacy due to the implementation of stringent regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 521.08 Million |

| Market Forecast in 2033 | USD 2,400.87 Million |

| Market Growth Rate (2025-2033) | 18.50% |

UK RegTech Market Trends:

Increasing Adoption of AI and ML

The rising usage of AI and ML is impelling the UK RegTech market growth. These technologies are being utilized to monitor compliance, detect fraudulent activities, and enhance the overall efficiency of regulatory reporting. Financial institutions are adopting AI-oriented tools to manage risk assessments and predict compliance challenges, which not only improves the accuracy of these operations but also aids in significantly reducing operational costs. Additionally, ML models offer real-time data analysis, enabling businesses to stay updated with regulatory changes and proactively address potential compliance issues. As the regulatory environment becomes more complex, the demand for AI-focused solutions is further rising. Moreover, efforts are being made by government agencies to sale up AI applications, which is fueling the market growth. In November 2024, the UK government declared an investment in AI assurance for companies aiming to create and utilize reliable AI products and services. The AI assurance market is set to expand six times by 2035, generating over £6.5 Billion.

Rising Demand for Cloud-Based RegTech Solutions

The ongoing shift towards cloud-based infrastructure is transforming how companies are managing regulatory compliance, which is offering a favorable UK RegTech market outlook. In December 2024, The UK government granted a contract valued at up to £1 Billion (USD 1.3 Billion) for technology service firms to assist different organizations and departments in transitioning to the cloud. The Crown Commercial Service, part of the Cabinet Office, granted another portion of the G-Cloud 14 framework, which could potentially see up to £1 Billion spent. Cloud-based RegTech solutions offer scalability, flexibility, and ease of integration, making them an attractive option for organizations of all sizes. These platforms allow businesses to streamline compliance processes by providing centralized real-time data management and reporting capabilities. The rising need for secure and cost-effective solutions in response to increasing regulatory needs is leading many firms to migrate their compliance operations to the cloud.

Growing Focus on Cybersecurity and Data Privacy

The expansion of digital services, coupled with stricter regulations, such as the General Data Protection Regulation (GDPR), is rendering cybersecurity and data privacy central concerns within the market. Companies are prioritizing solutions that not only ensure adherence to these changing regulations but also protect sensitive customer data. RegTech firms are responding by developing advanced tools equipped with encryption, risk management frameworks, and sophisticated breach detection systems to mitigate potential threats. As cyber threats become more complex, businesses are seeking solutions that offer proactive security measures while maintaining regulatory compliance. This growing focus on cybersecurity is driving the demand for RegTech solutions that can adapt to emerging data privacy regulations. Apart from this, government agencies are investing in cybersecurity programs to create a safer interface, which is impelling the market growth. In January 2025, The UK government revealed £1.9 Million (USD 2.3 Million) in funding from both government and the private sector for 30 ‘Cyber Local’ initiatives throughout England and Northern Ireland, aiming to safeguard the digital economy and enhance the country’s cyber skills.

UK RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033 Our report has categorized the market based on component, deployment mode, enterprises size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the components. This includes solution and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment modes have also been provided in the report. This includes cloud-based and on-premises.

Enterprises Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprises sizes. This includes large enterprises and small and medium-sized enterprises.

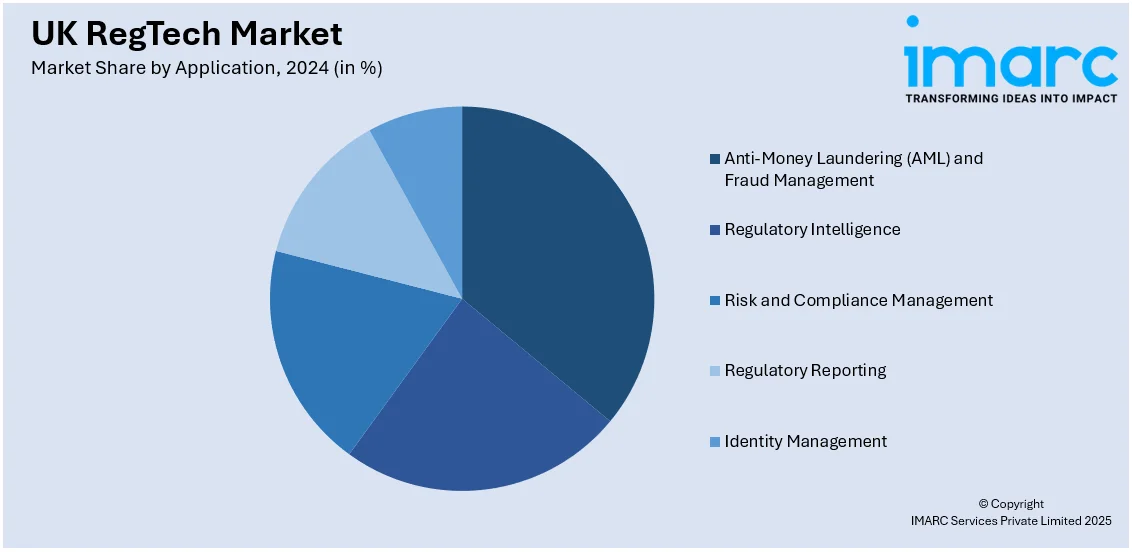

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end users. This includes banks, insurance companies, fintech firms, it and telecom, public sector, energy and utilities, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and end others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK RegTech Market News:

- In May 2024, Corlytics, a worldwide leader in regulatory intelligence and policy compliance technology, purchased a digital RegTech platform from Deloitte UK. This acquisition aimed to strengthen the firm's abilities to understand regulatory shifts and chart policies, enabling users to execute regulatory changes effectively. The agreement involved the relocation of 17 employees from Deloitte UK's RegTech platform to Corlytics. Along with its recent purchases of crucial policy management technologies, the company sought to reinforce its status as a top RegTech partner for financial services companies.

- In February 2024, Napier AI, a key participant in the UK's RegTech sector, secured £45 Million from Crestline to improve its anti-money laundering solutions and broaden its market reach. This investment underscored a major dedication to progressing the RegTech industry in the UK, aiding financial institutions in efficiently addressing changing compliance requirements. Crestline viewed Naier AI-driven technology as advantageous for financial organizations encountering increasing transaction volumes and regulatory demands.

UK RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprises Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK RegTech market performed so far and how will it perform in the coming years?

- What is the breakup of the UK RegTech market on the basis of component?

- What is the breakup of the UK RegTech market on the basis of deployment mode?

- What is the breakup of the UK RegTech market on the basis of enterprises size?

- What is the breakup of the UK RegTech market on the basis of application?

- What is the breakup of the UK RegTech market on the basis of end user?

- What are the various stages in the value chain of the UK RegTech market?

- What are the key driving factors and challenges in the UK RegTech?

- What is the structure of the UK RegTech market and who are the key players?

- What is the degree of competition in the UK RegTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK RegTech market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)