UK Real Estate Investment Trusts (REITs) Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UK Real Estate Investment Trusts (REITs) Market Overview:

The UK real estate investment trusts (REITs) market size reached USD 78.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 143.10 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. Strong demand for income-generating assets, rising tax advantages for investors, growing diversification benefits, the UK's stable legal framework, rapid urbanization, increasing interest from institutional investors, and rising focus on sustainable and residential properties are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 78.30 Billion |

| Market Forecast in 2033 | USD 143.10 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

UK Real Estate Investment Trusts (REITs) Market Trends:

Rising Tax Efficiency

The UK Real Estate Investment Trust (REIT) offer tax advantages, making them attractive to investors seeking income-generating assets without corporate tax on rental profits. This is acting as a pivotal factor driving the market growth. In 2023, the UK government made important easements to the UK REIT regulations. A major change permits UK REITs to pay income from their corporation tax-free property rental trades to partnerships without the usual 20% withholding tax, if the partnership members would have qualified for gross payments (e.g., UK companies paying corporation tax) if the payments had been made to them directly. In addition, a new double tax treaty between the UK and Luxembourg, entered into in 2022, will be in full force by April 2024. Pursuant to this treaty, Luxembourg tax-resident real estate-holding vehicles are now liable to UK tax on chargeable gains on indirect disposals of UK property.

Strong Demand for Property Investment

The growing urbanization and increasing demand for residential, commercial, and sustainable properties drive investments in REITs, especially from institutional investors. For instance, in September 2024, Starwood Capital made a £673.5m (€799.3m) offer for the UK real estate investment trust (REIT) Balanced Commercial Property Trust (BCPT). Starwood, through its funds, has agreed to offer the FTSE 250 REIT’s shareholders 96.00p in cash for each share held in a take-private deal that requires 75% of shareholder votes. As of 3 September, the last business day before this announcement, BCPT’s market capitalization was about £598.4m. BCPT's diversified portfolio of 28 properties worth £882.7m is invested in the UK alone. In April, BCPT launched a review to consider options for enhancing shareholder value. This involved selling the business or its assets. Following interest from a number of companies, BCPT stated it chose Starlight Bidco a newly established company owned by Starwood funds to buy the business, stating that the BCPT board unanimously recommends the deal proposed.

UK Real Estate Investment Trusts (REITs) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

-market.webp)

- Equity REITs

- Mortgage REITs

- Hybrid REITs

The report has provided a detailed breakup and analysis of the market based on the type. This includes equity REITs, mortgage REITs, and hybrid REITs.

Application Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, commercial, and residential.

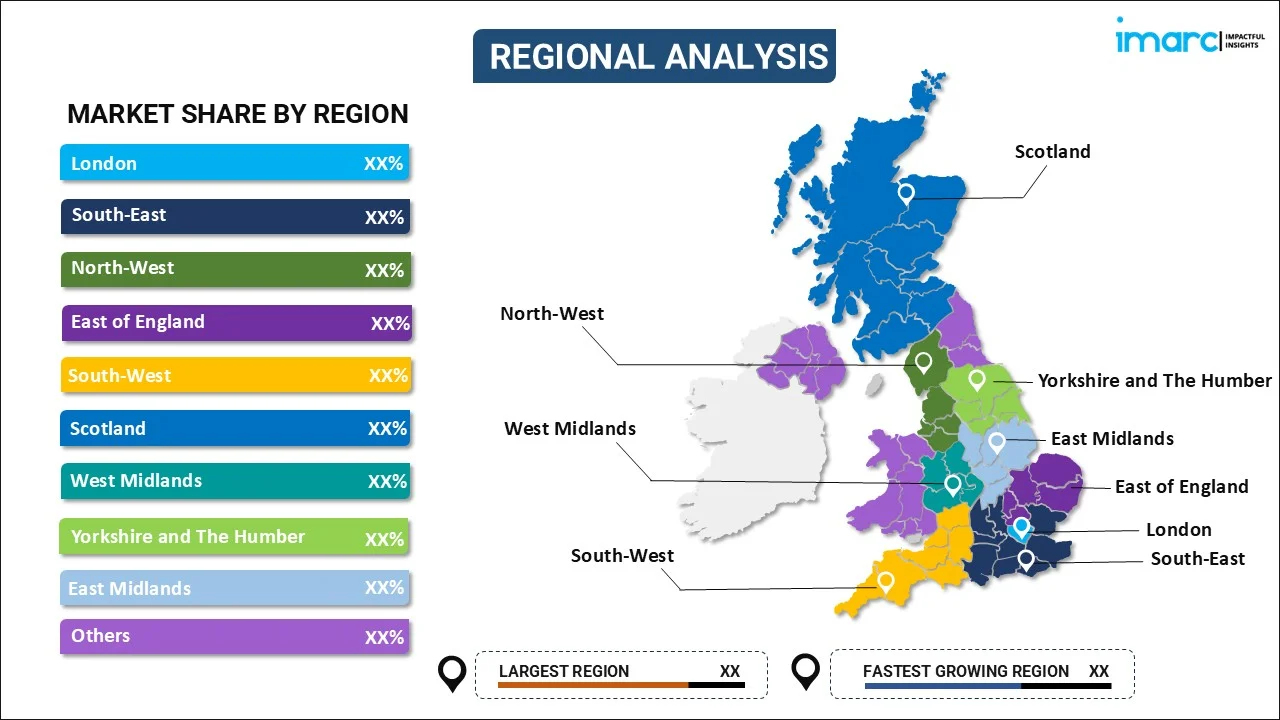

Regional Insights:

- London

- Southeast

- Northwest

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, Southeast, Northwest, East of England, Southwest, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Real Estate Investment Trusts (REITs) Market News:

- In July 2024, ELITE UK Real Estate Investment Trust (REIT) entered into a facilities agreement for term and revolving facilities of up to £135 million (S$235.3 million) over a term of 39 months. This was done through REIT’s wholly owned subsidiary Elite Gemstones Properties. As revealed when it won a committed bid from the lenders in March this year, the money raised from the facilities will be employed to refinance the REIT's current loans.

UK Real Estate Investment Trusts (REITs) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Equity REITs, Mortgage REITs, Hybrid REITs |

| Applications Covered | Industrial, Commercial, Residential |

| Regions Covered | London, Southeast, Northwest, East of England, Southwest, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK real estate investment trusts (REITs) market performed so far and how will it perform in the coming years?

- What is the breakup of the UK real estate investment trusts (REITs) market on the basis of type?

- What is the breakup of the UK real estate investment trusts (REITs) market on the basis of application?

- What is the breakup of the UK real estate investment trusts (REITs) market on the basis of region?

- What are the various stages in the value chain of the UK real estate investment trusts (REITs) market?

- What are the key driving factors and challenges in the UK real estate investment trusts (REITs)?

- What is the structure of the UK real estate investment trusts (REITs) market and who are the key players?

- What is the degree of competition in the UK real estate investment trusts (REITs) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK real estate investment trusts (REITs) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK real estate investment trusts (REITs) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK real estate investment trusts (REITs) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)