UK Online Auctions Market Size, Share, Trends and Forecast by Auction Format, Product Category, Target Audience, Auction Type, Pricing Model, and Region, 2025-2033

UK Online Auctions Market Overview:

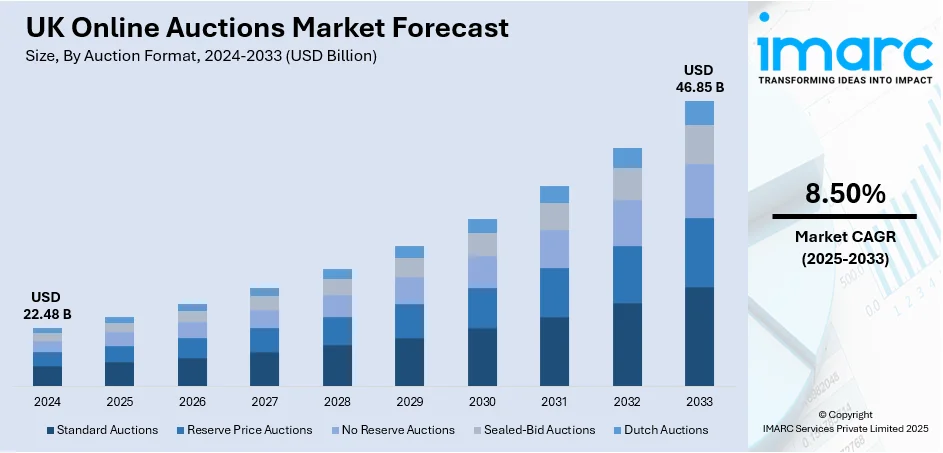

The UK online auctions market size reached USD 22.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 46.85 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The increasing digitization, mobile-friendly platforms, and a rise in niche auctions for collectibles and art are positively impacting the UK online auctions market share. Artificial intelligence (AI) and data analytics are enhancing user experiences, while global reach and live streaming auctions are expanding participation. This, in turn, is driving the market toward growth significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.48 Billion |

| Market Forecast in 2033 | USD 46.85 Billion |

| Market Growth Rate (2025-2033) | 8.50% |

UK Online Auctions Market Trends:

Use of Artificial Intelligence (AI) and Data Analytics

The use of artificial intelligence (AI) and data analytics enhances personalization and bidding strategies, which further enhances UK online auctions market outlook. AI algorithms are used to evaluate user behavior, preferences, and past bids for personalized item recommendations, thus enhancing customer experience. Moreover, platforms apply predictive analytics to optimize bidding strategies, suggesting amounts and timings of bids that would maximize the chances of winning. AI-powered chatbots offer real time customer support, while machine learning helps detect fraudulent activities, enhancing security. Online auction platforms utilize data insight to stay ahead of trends and foster engagement through personalized services. For instance, in March 2024, Jogiton, a brand-new online auction platform in the UK, was launched with a focus on the user experience and artificial intelligence (AI) features to assist sellers. The platform allows sellers to list items for free and provides various product categories. The commercial director of the platform expressed excitement over its launch and highlighted the platform's commitment to user feedback and continuous improvement.

Rising Popularity of Niche Markets

The increasing demand for specialist markets within the online auction market, particularly for artwork, vintage products, and collectibles is driving UK online auctions market expansion. Buyers and collectors find the increasing rarity and uniqueness of products, who go online for more accessibility and choices. These websites provide niches with auctions for particular interests, including fine art, luxury items, memorabilia, and antiques. This niche draws loyal clientele and greater bidding participation, since consumers rely on these sites to deliver authentic, hand-curated offerings that appeal to their interests, thereby increasing the general auction experience. For example, in September 2024, Christie's, an auction house known for high-end art and luxury goods, announced the acquisition of Gooding & Company, a California-registered collector car auction house. Specifics of the transaction have not been disclosed, and it is expected to close by the end of 2024, with Gooding & Co. to be branded as Gooding Christie's. This acquisition represents Christie's entry into the expanding classic and collector car market, with an aim to cement its position within the luxury sector.

UK Online Auctions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on auction format, product category, target audience, auction type, and pricing model.

Auction Format Insights:

- Standard Auctions

- Reserve Price Auctions

- No Reserve Auctions

- Sealed-Bid Auctions

- Dutch Auctions

The report has provided a detailed breakup and analysis of the market based on the auction format. This includes standard auctions, reserve price auctions, no reserve auctions, sealed-bid auctions, and dutch auctions.

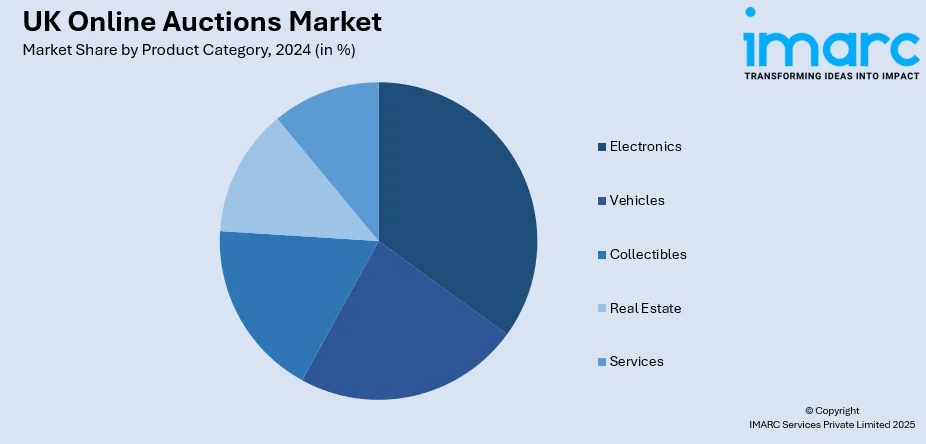

Product Category Insights:

- Electronics

- Vehicles

- Collectibles

- Real Estate

- Services

A detailed breakup and analysis of the market based on the product category have also been provided in the report. This includes electronics, vehicles, collectibles, real estate, and services.

Target Audience Insights:

- Individuals

- Businesses

- Government Agencies

- Non-Profit Organizations

- Collectors

The report has provided a detailed breakup and analysis of the market based on the target audience. This includes individuals, businesses, government agencies, non-profit organizations, and collectors.

Auction Type Insights:

- Live Auctions

- Silent Auctions

- Online Auctions

- Hybrid Auctions

A detailed breakup and analysis of the market based on the auction type have also been provided in the report. This includes live auctions, silent auctions, online auctions, and hybrid auctions.

Pricing Model Insights:

- Flat Fees

- Commission-Based Fees

- Subscription-Based Fees

- Hybrid Pricing Models

The report has provided a detailed breakup and analysis of the market based on the pricing model. This includes flat fees, commission-based fees, subscription-based fees, and hybrid pricing models.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Online Auctions Market News:

- In March 2024, two leading online auction companies My Auction and Bamboo Auctions announced their partnership to create a new brand called Rocket Auctions. With an estimated 1,100 estate agent partners, Rocket Auctions aims to be one of the largest online auction providers in the UK. The new brand will use Bamboo's technology platform and will be led by qualified auctioneer Stuart Collar-Brown. Rocket Auctions is committed to making property auctions fairer and more accessible.

- On June 2024, NRLA announced a new partnership with SDL Property Auctions, offering members priority access to residential and commercial property auctions. This collaboration aims to provide efficient and user-friendly online auction services for NRLA members. SDL Property Auctions' expertise in property auctions aligns with NRLA's mission to simplify landlords' lives. This partnership reflects NRLA's commitment to forming alliances with innovative organizations.

UK Online Auctions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Auction Formats Covered | Standard Auctions, Reserve Price Auctions, No Reserve Auctions, Sealed-Bid Auctions, Dutch Auctions |

| Product Categories Covered | Electronics, Vehicles, Collectibles, Real Estate, Services |

| Target Audiences Covered | Individuals, Businesses, Government Agencies, Non-Profit Organizations, Collectors |

| Auction Types Covered | Live Auctions, Silent Auctions, Online Auctions, Hybrid Auctions |

| Pricing Models Covered | Flat Fees, Commission-Based Fees, Subscription-Based Fees, Hybrid Pricing Models |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK online auctions market performed so far and how will it perform in the coming years?

- What is the breakup of the UK online auctions market on the basis of auction format?

- What is the breakup of the UK online auctions market on the basis of product category?

- What is the breakup of the UK online auctions market on the basis of target audience?

- What is the breakup of the UK online auctions market on the basis of auction type?

- What is the breakup of the UK online auctions market on the basis of pricing model?

- What is the breakup of the UK online auctions market on the basis of region?

- What are the various stages in the value chain of the UK online auctions market?

- What are the key driving factors and challenges in the UK online auctions market?

- What is the structure of the UK online auctions market and who are the key players?

- What is the degree of competition in the UK online auctions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK online auctions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK online auctions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK online auctions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)