UK Neobanking Market Size, Share, Trends and Forecast by Account Type, Application and Region, 2025-2033

UK Neobanking Market Overview:

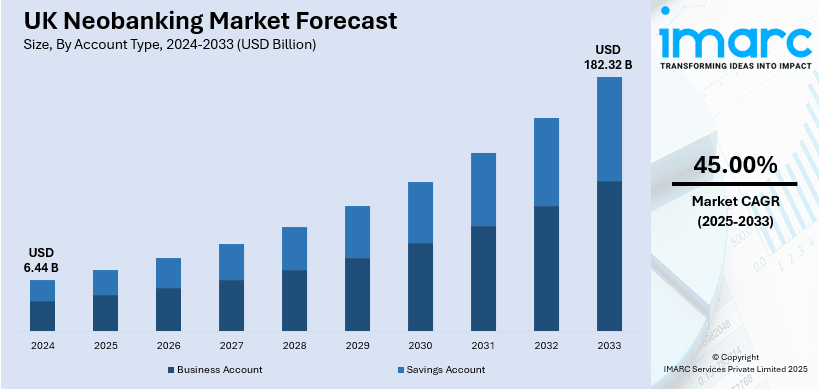

The UK neobanking market size reached USD 6.44 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 182.32 Billion by 2033, exhibiting a growth rate (CAGR) of 45.00% during 2025-2033. The market is growing very fast due to the continued developments in digital technology, increasing demand from consumers for low-cost and convenient banking, imposition of supportive regulatory environment, growing emphasis on financial inclusion, and increasing venture capital investments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.44 Billion |

| Market Forecast in 2033 | USD 182.32 Billion |

| Market Growth Rate 2025-2033 | 45.00% |

UK Neobanking Market Trends:

Rapid Technological Advancements and Digital Innovation:

The rapid expansion in digital technology and growing use of fintech solutions are major drivers responsible for the UK neobanking market growth. Neobanks have taken advantage of innovations in artificial intelligence (AI), blockchain, and cloud computing, allowing them to deliver highly customized banking services. Additionally, the fluid connection of mobile applications with banking capabilities, including real-time balance information, AI-based financial guidance, and budgeting features, is changing the way consumers engage with their finances. To this end, neobanks utilize advanced technologies to provide services that have long been the domain of physical banks, including loans, investments, and insurance, via digital channels. Further, the increased capacity to scale rapidly because of cloud infrastructure, coupled with the responsiveness to create and roll out new features based on consumer input, is driving the growth of the market.

Imposition of Favorable Regulatory Policies:

The UK neobanking market outlook shows the imposition of several regulatory policies promoting fintech innovation. The prudential regulation authority (PRA) and the financial conduct authority (FCA) have provided a framework which promotes competition among banks while securing consumer protection. Additionally, the onset of initiatives like the open banking standard has pressured incumbent banks to disclose customer data to approved third-party providers to enable neobanks to provide enhanced and more bespoke services. Aside from this, the FCA's openness to issuing licenses for neobanks as well as implementing regulatory sandboxes to test out new financial instruments without complete regulation adherence have also been conducive to innovation. These rules reduce entry barriers for new neobanks and give them a chance to compete with the incumbent players.

Growing Demand for Convenient and Low-Cost Banking:

The increasing consumer demand for more convenient, user-friendly, and cost-effective banking solutions is another major factor catalyzing the UK neobanking market share. Traditional banks have higher operating costs due to physical branches and legacy systems, leading to more expensive services. In contrast, neobanks operate entirely online, eliminating the need for physical infrastructure and allowing them to reduce fees for customers. According to reports, neobanks such as Monzo, Starling, and Revolut collectively serve 20 million users in the UK. Moreover, neobanks offer low-cost services, as they eliminate fees for account maintenance, automated teller machine (ATM) withdrawals, or international transactions. Besides this, the convenience of opening an account quickly through an app, combined with lower fees, is attractive to younger generations and freelancers who prefer more flexible financial products. Additionally, many neobanks offer transparent pricing models, helping consumers avoid hidden fees. This affordability and accessibility are leading to an increase in the number of people opting for neobanks over traditional banks.

UK Neobanking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on account type, application and region.

Account Type Insights:

- Business Account

- Savings Account

A detailed breakup and analysis of the market based on the account type have also been provided in the report. This includes business account, and savings account.

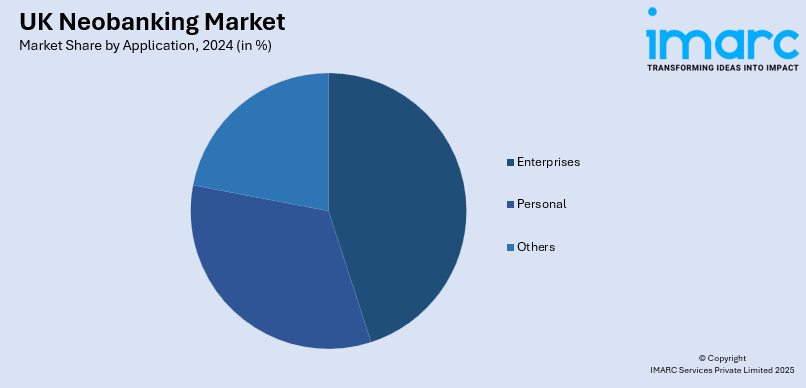

Application Insights:

- Enterprises

- Personal

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes enterprises, personal, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Neobanking Market News:

- In July 2024, Revolut secured a UK banking licence that will enable the fintech firm to compete more directly with other international banking giants. The company has reached the mobilisation phase of its UK operations, meaning that they will be able to scale up their operations before it can become a full-fledged operating bank. After mobilisation, the full rights will be issued. Revolut will subsequently be in a position to offer overdrafts, loans, and savings products. The firm's nine million customers in the nation will also be protected on deposits of up to £85,000.

- In September 2024, Dutch neobank Bunq revealed its intention to increase its staff by 70% by the end of the year to support smooth growth in the UK and US.

UK Neobanking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Account Types Covered | Business Account, Savings Account |

| Applications Covered | Enterprises, Personal, and Others. |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK neobanking market performed so far and how will it perform in the coming years?

- What is the breakup of the UK neobanking market on the basis of account type?

- What is the breakup of the UK neobanking market on the basis of application?

- What is the breakup of the UK neobanking market on the basis of region?

- What are the various stages in the value chain of the UK neobanking market?

- What are the key driving factors and challenges in the UK neobanking market?

- What is the structure of the UK neobanking market and who are the key players?

- What is the degree of competition in the UK neobanking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK neobanking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK neobanking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK neobanking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)