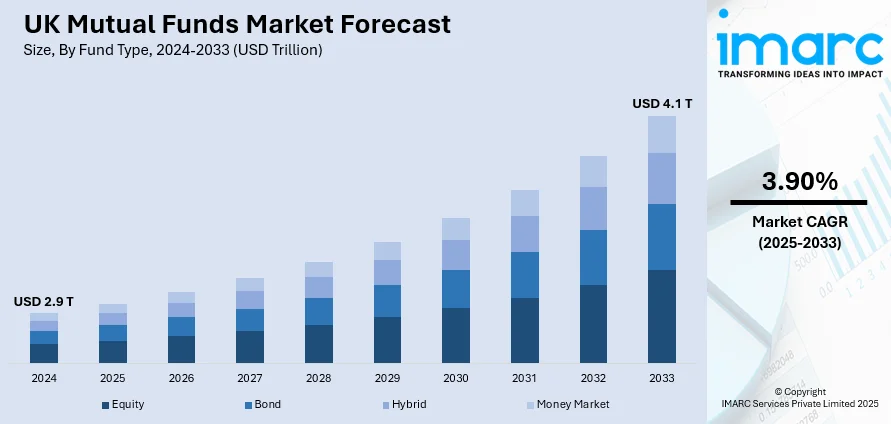

UK Mutual Funds Market Report by Fund Type (Equity, Bond, Hybrid, Money Market), Investor Type (Households, Institutions), Channel of Purchase (Discount Broker/Mutual Fund Supermarket, Distributed Contribution Retirement Plan, Direct Sales from Mutual Fund Companies, Professional Financial Adviser), and Region 2025-2033

UK Mutual Funds Market Overview:

The UK mutual funds market size reached USD 2.9 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Trillion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is propelled by the changing investor demographics and preferences, rising adoption of digital platforms and fintech solutions, and the presence of established players and new entrants, including traditional asset management firms, banks, and fintech companies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.9 Trillion |

| Market Forecast in 2033 | USD 4.1Trillion |

| Market Growth Rate (2025-2033) | 3.90% |

UK Mutual Funds Market Trends:

Regulatory Environment

The regulatory environment is a key factor in the UK mutual fund market. The Financial Conduct Authority (FCA) establishes strict regulations to preserve openness, safeguard investors, and uphold market integrity. Moreover, regulations, such as the Markets in Financial Instruments Directive II (MiFID II) and the Packaged Retail and Insurance-based Investment Products (PRIIPs) legislation, have increased transparency requirements, thus boosting investor trust and creating a more robust market environment. These regulations ensure that mutual funds operate with high levels of openness and accountability, thereby attracting both domestic and international investors. Furthermore, the regulatory environment fosters market innovation by encouraging the development of new products that fulfill a wide range of investor needs.

To get more information on this market, Request Sample

Technological Advancements

Technological improvements have had a huge impact on the UK mutual funds business, accelerating expansion and accessibility. As per Datareportal, there were 66.33 million internet users in the United Kingdom at the start of 2024, when internet penetration stood at 97.8%. The increasing internet penetration and rise of digital platforms and robo-advisors has democratized investment opportunities, allowing a larger portion of the population to participate in mutual funds. These technologies offer tailored investment advice and portfolio management at a cheaper cost than traditional financial advisors. Furthermore, improvements in data analytics and artificial intelligence have improved fund managers' ability to make informed investment decisions, resulting in better fund performance. The simplicity of internet transactions and smartphone apps has also streamlined the investment process, making it easier for investors to manage portfolios.

Economic Conditions

The UK mutual funds market is heavily influenced by the macroeconomic situation. Economic growth, interest rates, and inflation have a significant impact on investor behavior and fund performance. As published by Fidelity International, the Bank of England has said that, according to the path implied by the market, UK rates will reach an average of 5.5% over the next three years– that is higher than the current rate of 5.25%. During periods of economic expansion, more disposable incomes and enhanced investor confidence usually result in increased mutual fund investment. In contrast, low-interest rate situations make mutual funds more appealing than typical savings accounts, as investors seek larger returns. Inflation has an impact on the market, with inflation-linked bonds and ETFs becoming increasingly popular as a hedge against rising prices.

UK Mutual Funds Market News:

- In December 2023, BlackRock introduced a UK version of its LifePath Target Date fund range, aiming to compete with similar offerings from Vanguard and Legal and General Investment Management.

UK Mutual Funds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fund type, investor type, and channel of purchase.

Fund Type Insights:

- Equity

- Bond

- Hybrid

- Money Market

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes equity, bond, hybrid, and money market.

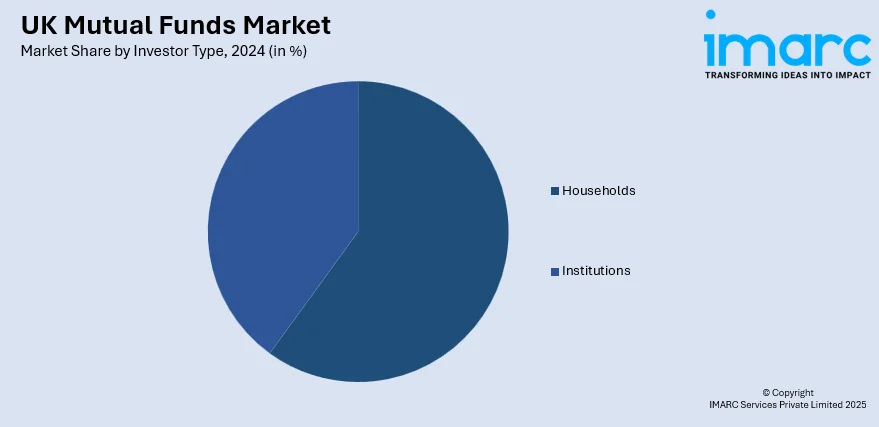

Investor Type Insights:

- Households

- Institutions

A detailed breakup and analysis of the market based on the investor type have also been provided in the report. This includes households and institutions.

Channel of Purchase Insights:

- Discount Broker/Mutual Fund Supermarket

- Distributed Contribution Retirement Plan

- Direct Sales from Mutual Fund Companies

- Professional Financial Adviser

The report has provided a detailed breakup and analysis of the market based on the channel of purchase. This includes discount broker/mutual fund supermarket, distributed contribution retirement plan, direct sales from mutual fund companies, and professional financial adviser.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Mutual Funds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Equity, Bond, Hybrid, Money Market |

| Investor Types Covered | Households, Institutions |

| Channel of Purchases Covered | Discount Broker/Mutual Fund Supermarket, Distributed Contribution Retirement Plan, Direct Sales from Mutual Fund Companies, Professional Financial Adviser |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK mutual funds market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UK mutual funds market?

- What is the breakup of the UK mutual funds market on the basis of fund type?

- What is the breakup of the UK mutual funds market on the basis of investor type?

- What is the breakup of the UK mutual funds market on the basis of channel of purchase?

- What are the various stages in the value chain of the UK mutual funds market?

- What are the key driving factors and challenges in the UK mutual funds?

- What is the structure of the UK mutual funds market and who are the key players?

- What is the degree of competition in the UK mutual funds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK mutual funds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK mutual funds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK mutual funds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)