UK Motor Insurance Market Report by Policy Type (Liability Insurance, Comprehensive Coverage, Collision Coverage, Personal Injury Protection), Premium Type (Personal Insurance Premiums, Commercial Insurance Premiums), Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, and Others), and Region 2025-2033

UK Motor Insurance Market Overview:

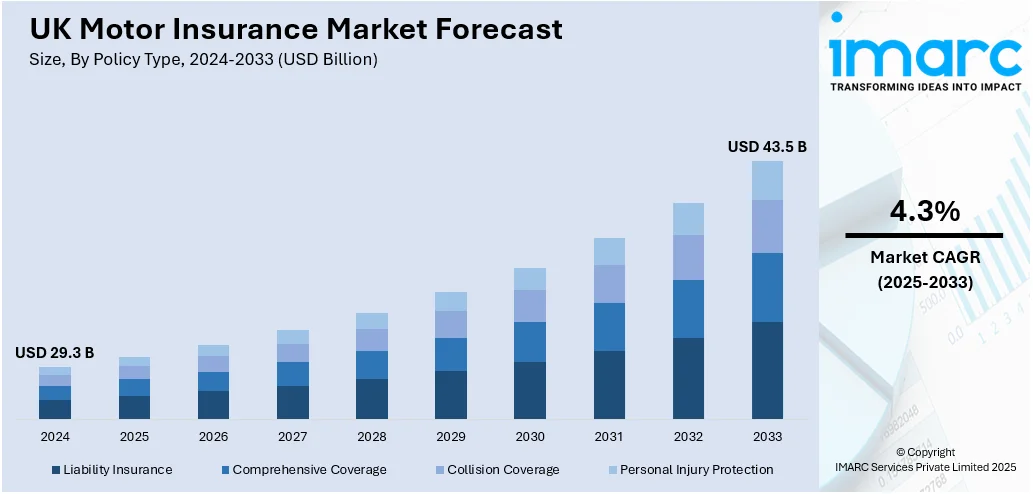

The UK Motor insurance market size reached USD 29.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. The market is growing rapidly, driven by the rising vehicle ownership and market competition, increasing regulatory changes, rapid technological advancements in vehicle safety and telematics. Moreover, enhanced focus on effective claims management and fraud prevention, and the ongoing shift towards electric vehicles (EVs) are positively contributing to UK motor insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.3 Billion |

| Market Forecast in 2033 | USD 43.5 Billion |

| Market Growth Rate (2025-2033) | 4.3% |

UK Motor Insurance Market Trends:

Rising Vehicle Ownership and Market Competition

The rise in vehicle ownership is a significant driver of the United Kingdom motor insurance market. As the number of vehicles on the road increases, so does the demand for motor insurance. In 2023, according to industry reports, the number of vehicles on UK roads was growing at a 0.5% rate, reaching a record high of 40.7 million, with car ownership rising for the first time since 2019. Factors such as population growth, urbanization, and economic stability contribute to higher vehicle ownership rates, directly impacting the insurance market. Additionally, the market share motor insurance UK landscape is highly competitive, with numerous insurers vying for dominance. This competition drives innovation, leading to the development of diverse insurance products tailored to meet varying customer needs.

To get more information on this market, Request Sample

Increasing Regulatory Changes and Compliance Requirements

The increasing regulatory changes and compliance requirements are pivotal factors driving the market growth. The UK motor insurance market statistics reflect how the industry operates under a stringent regulatory framework governed by bodies such as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). These regulations ensure market stability, protect consumer interests, and promote fair competition. Additionally, recent regulatory developments, such as the implementation of the General Data Protection Regulation (GDPR) and the Insurance Distribution Directive (IDD), that necessitate significant changes in how insurers handle data and interact with customers, are contributing to the expansion of this industry. Besides this, the rising commitment of the government to reduce uninsured driving through the Continuous Insurance Enforcement (CIE) initiative has had a notable impact. The CIE requires vehicle owners to have valid insurance at all times unless they officially declare their vehicle off-road. This policy has become a significant element in motor insurance market analysis, as it directly influences coverage rates and enforcement trends.

Rapid Technological Advancements in Vehicle Safety and Telematics

Technological advancements in vehicle safety and telematics are significantly influencing the motor insurance market in the UK. Modern vehicles are increasingly equipped with advanced driver-assistance systems (ADAS), which include features such as automatic emergency braking, lane departure warnings, and adaptive cruise control. These innovations are contributing to changes in risk assessment and premium calculations, ultimately impacting the motor insurance market size in the UK. Furthermore, these technologies aim to reduce the frequency and severity of accidents, thereby lowering the risk for insurers. Additionally, telematics, which involves the use of in-car devices to monitor driving behavior, is also playing a crucial role. Insurers use telematics data to assess the risk profile of drivers more accurately and offer personalized premiums based on individual driving habits.

Insurtech Transforms the Insurance Landscape

Insurtech is transforming the insurance sector by bringing in revolutionary technologies that refine policy issuing, claims processing, and customer service. Insurers can now provide premiums based on an individual's driving behaviour, promoting safer and less expensive driving, through tools like data analytics, telematics, and sophisticated software systems. Simultaneously, expanded automation is streamlining administrative tasks, cutting processing times, and enhancing the customer experience. As such innovations gain traction, they are creating improved efficiency, transparency, and flexibility throughout the industry. Insurers who adapt these advances are well positioned to respond to the changing expectations of today's consumers and stay ahead of a rapidly shifting market. These advancements are also enabling insurers to differentiate themselves and capture a larger UK motor insurance market share.

Growth of Electric Vehicle Insurance

The insurance for electric vehicles is growing as more buyers turn towards electric vehicles (EVs), spurred by sustainability objectives and government subsidies. Insurers are adapting in response to designing policies that protect distinct EV features, including damage to batteries, charging stations, and increased repair expenses. EV owners are also opting for customized coverage that factors in the increased purchase price of these cars. As the EV market continues to grow, UK car insurance statistics reflect a rising trend in specialized policy offerings, as insurers adapt their risk models to address the specific needs of electric vehicle owners. This shift is encouraging more innovation within the sector, prompting companies to develop specialized products that provide comprehensive protection for the increasing number of electric vehicles on the road. The rise of electric vehicle insurance is, therefore, driving new business opportunities and expanding the scope of the insurance market.

Rising Claims Inflation Challenges the Industry

Claims inflation is significantly impacting the insurance industry, fueled by rising vehicle repair costs, shortages of parts, and increased labor costs. The escalating vehicle repair costs, especially for new cars with sophisticated technologies, are driving overall claims expenses, which consequently increase insurance premiums. Insurers are responding to this challenge by embracing new technologies like telematics and artificial intelligence, which provide better damage evaluation and automate the claims process. Insurers can reduce some of the increasing costs and gain efficiency through the use of these tools. Also, use of digital platforms to monitor and manage repairs and claims is assisting in cost control, allowing insurers to ensure competitive pricing while reacting to the effects of inflation in claims. This is a persistent problem that is forcing insurers to innovate and modify their strategies so they can continue to provide affordable premiums despite the upward pressure on the cost of claims.

UK Motor Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on policy type, premium type, and distribution channel.

Policy Type Insights:

- Liability Insurance

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

The report has provided a detailed breakup and analysis of the market based on the policy type. This includes liability insurance, comprehensive coverage, collision coverage, and personal injury protection.

Premium Type Insights:

- Personal Insurance Premiums

- Commercial Insurance Premiums

A detailed breakup and analysis of the market based on the premium type have also been provided in the report. This includes personal insurance premiums and commercial insurance premiums.

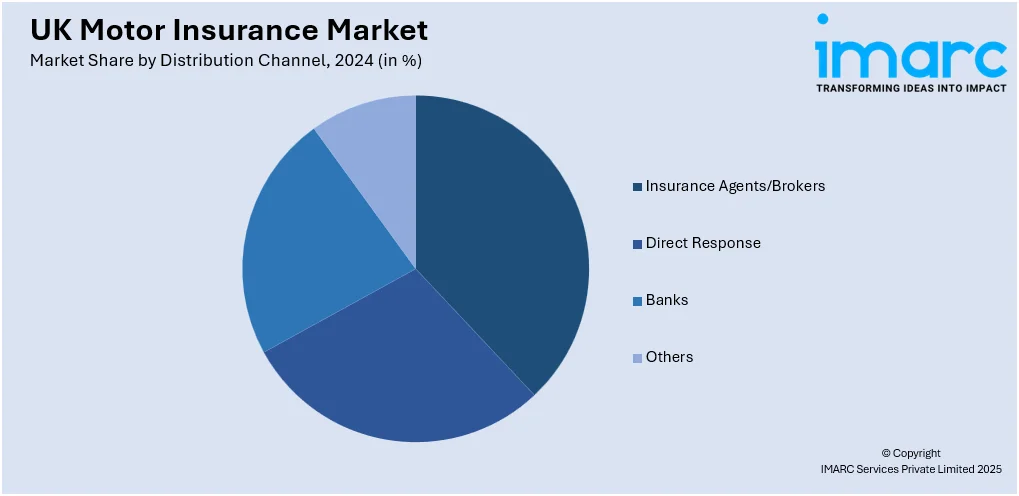

Distribution Channel Insights:

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes insurance agents/brokers, direct response, banks, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Biggest Motor Insurance Companies in United Kingdom:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Motor Insurance Market News:

- In May 2025, Lloyds Bank, in partnership with Axa UK, launched its first motor insurance products. This collaboration introduced two new coverage levels to new customers, with plans to expand offerings through Halifax and Bank of Scotland. This move enhanced competition and innovation in the UK motor insurance market.

- In May 2025, Roadzen partnered with a leading telematics provider to launch a connected vehicle protection solution in the UK. The integrated product combines real-time tracking and GAP insurance, addressing rising vehicle theft and insurance premiums. This innovation is expected to generate significant revenues and transform the UK motor insurance market.

- In October 2024, Lotus launched a tailored insurance solution for UK customers, offering comprehensive coverage for new and used vehicles. The program provides access to Lotus-approved bodyshops, trained technicians, and genuine parts, enhancing customer experience. This move strengthened Lotus' market presence and fostered greater loyalty in the UK motor insurance sector.

- In July 2024, AXA Retail Intermediary announced the launch of online motor claims. Online claims will enable the broker or customer, to log a claim online, 24/7 at a time that is convenient. The customers can also claim for 95% of incidents via this method.

- In October 2023, Direct Line, owned by the Direct Line Group launched a new ‘Essentials’ car insurance product. The offering is targeted at customers who are looking for an entry level comprehensive car insurance policy, with fewer bells and whistles. It gives priority for consumers with Courtesy Car cover, which provides customers with a replacement car at no extra cost, for the duration of the repair if fixed by an approved repairer. It also includes the brand’s Uninsured Driver Promise and Vandalism Promise which protects a driver’s no claims discount if the other driver involved in an accident is uninsured or if damage to the vehicle is caused by vandalism.

UK Motor Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Policy Types Covered | Liability Insurance, Comprehensive Coverage, Collision Coverage, Personal Injury Protection |

| Premium Types Covered | Personal Insurance Premiums, Commercial Insurance Premiums |

| Distribution Channels Covered | Insurance Agents/Brokers, Direct Response, Banks, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK motor insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK motor insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK motor insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK motor insurance market was valued at USD 29.3 Billion in 2024.

The UK motor insurance market is expected to grow at a CAGR of 4.3% during 2025-2033.

The UK motor insurance market is influenced by factors such as the increasing number of vehicles on the road, rising vehicle theft rates, and regulatory changes. Additionally, the growing adoption of electric vehicles and demand for personalized, data-driven insurance policies are major drivers.

The COVID-19 pandemic led to reduced driving, which resulted in fewer claims and lower premiums. Insurers responded by offering premium reductions, while the pandemic accelerated the shift toward digital services, including telematics and online platforms, for more flexible insurance solutions.

Based on the policy type, the UK motor insurance market has been segmented into liability insurance, comprehensive coverage, collision coverage, and personal injury protection.

Based on the premium type, the UK motor insurance market has been segmented into personal insurance premiums and commercial insurance premiums.

Based on the distribution channel, the UK motor insurance market has been segmented into insurance agents/brokers, direct response, banks, and others.

On a regional level, the UK motor insurance market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)