UK Mortgage Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UK Mortgage Market Overview:

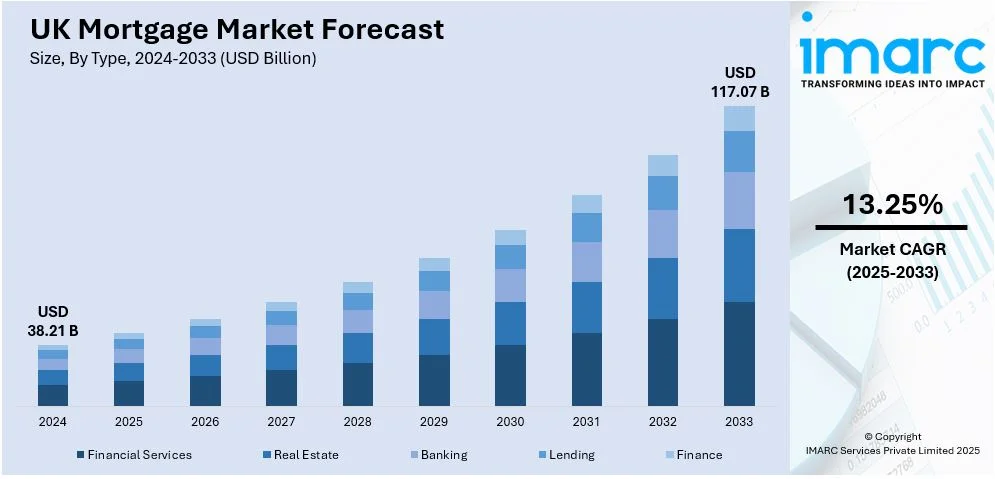

The UK mortgage market size reached USD 38.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 117.07 Billion by 2033, exhibiting a growth rate (CAGR) of 13.25% during 2025-2033. The market is driven by rising economic growth and stability in the country, rapid technological advancements in mortgage lending, and banks' focus on reducing interest rates. Gross mortgage lending surged by over 7% in 2024, surpassing GBP 200 Billion. Lending for house purchases grew by 11% in 2024, with a 10% growth forecast for 2025. Additionally, buy-to-let lending remains a significant contributor to market activity, reflecting the positive UK mortgage market outlook 2025.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.21 Billion |

| Market Forecast in 2033 | USD 117.07 Billion |

| Market Growth Rate 2025-2033 | 13.25% |

UK Mortgage Market Trends:

Rising Economic Growth and Stability:

The rising economy of the United Kingdom, which is encouraging consumers to make large financial commitments such as purchasing homes, is positively impacting the mortgage market. As per the IMF forecast, the gross domestic product (GDP) is expected to rise by 0.7% in 2024, up from 0.5% in 2023. Moreover, the introduction of government and private sector initiatives such as stimulus packages or incentives for first-time buyers is also acting as a growth-inducing factor. For instance, UK’s Lloyds Banking Group announced in August 2024 that the company will allow new buyers to take out loans worth up to 5.5 times their household annual income, higher than the traditional maximum. This has encouraged first-time buyers to purchase new homes, thereby enhancing the UK mortgage market 2024 growth.

To get more information on this market, Request Sample

Imposition of Government Housing Policies and Schemes:

The application of government policies to promote homeownership and reduce the cost of home buying is another significant driver of the UK mortgage market. Initiatives like Help to Buy, Shared Ownership, and Stamp Duty holidays have facilitated entry into the housing market for first-time buyers and low-income households. These schemes offer fiscal assistance in terms of equity loans, lower deposits, or tax relief that reduce the expense of purchasing a home. For instance, the Help to Buy initiative has played a central role in rejuvenating the mortgage market by improving access to newly built homes to a greater cross-section of potential buyers. The UK mortgage market 2025 share is expanding as government policies and Stamp Duty holidays enhance affordability, increase homeownership rates, and drive mortgage demand among first-time buyers and low-income households.

Rising Demographic Changes and Population Growth:

The increasing population, urbanization, and changing household structures are contributing to the demand for housing and mortgages in the UK. The country is estimated to host a population of 69,138,192 people in 2024, with 84.4% of the population living in urban areas. Moreover, the rising demographic shift in population as younger individuals tend to buy their first homes, creating a new wave of demand for mortgages, is bolstering the expansion of the market. Along with this, the rise in single-person households and smaller family units is increasing the demand for smaller properties with mortgages. For example, in the year 2023, the number of people living alone in the country totaled at 8.4 million, which is an increase from 7.8 million in 2013. This gradual demographic shift is creating a positive UK mortgage market research outlook as increasing urbanization, population growth, and evolving household structures drive demand for mortgages, particularly for first-time buyers and smaller property units.

Increased Popularity of Mortgage Switching and Refinancing:

As mortgage rates rise, many homeowners in the UK are turning to mortgage switching and refinancing as strategies to reduce their monthly payments or secure better terms. Homeowners are increasingly looking for competitive rates, with many refinancing to shorter terms, fixed rates, or adjustable ones based on their financial goals. This trend is driven by the desire to save money, avoid higher rates after initial fixed terms, and lock in favorable conditions before rates rise further. Lenders are making the switching process easier, offering better incentives and advice, fueling more people to review their mortgage options and explore potential savings. The latest mortgage market report UK highlights this trend as one of the primary factors influencing the market.

Surge in Demand for Second Charge Mortgages:

Second charge mortgages are gaining traction as an alternative to remortgaging in the UK. These loans, which are secured against a home in addition to the primary mortgage, allow homeowners to access capital without refinancing their original mortgage. The growth of second charge mortgages is linked to rising property values, growing home equity, and the need for flexible financing solutions. Homeowners are using these loans for home improvements, consolidating debt, or funding large purchases while retaining their current mortgage terms. Lenders are providing more tailored options, making them an attractive option for those seeking a cost-effective borrowing solution. This trend is part of the UK remortgage market statistics.

Growing Interest in Green Mortgages:

The demand for green mortgages in the UK is on the rise as more homeowners seek sustainable living options. Green mortgages offer lower rates or incentives to those purchasing energy-efficient homes or making environmentally-friendly upgrades to their current properties. As awareness of climate change increases, buyers and homeowners are motivated to reduce their carbon footprint while benefiting financially from energy-saving improvements. Lenders are responding by offering these specialized products, supporting the transition toward greener homes. This trend aligns with broader efforts to meet sustainability goals, with government initiatives also promoting energy-efficient home ownership and retrofitting programs. The UK mortgage market size 2025 will likely reflect the growing interest in these products as more consumers make eco-conscious decisions.

Increased Market Size and Demand for Mortgages:

The overall demand for mortgages in the UK is seeing an upward trajectory, especially as more buyers seek homes amid rising prices and a competitive lending environment. Predictions for the UK mortgage market size 2024 show that the total value of outstanding mortgage loans will continue to grow. As home prices remain high, buyers are expected to seek greater loan amounts, thus driving the expansion of the mortgage market. Additionally, shifting economic conditions and government interventions are expected to play a role in increasing the demand for mortgage loans as more individuals look to purchase homes in the coming year.

UK Mortgage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Financial Services

- Real Estate

- Banking

- Lending

- Finance

The report has provided a detailed breakup and analysis of the market based on the type. This includes financial services, real estate, banking, lending, and finance.

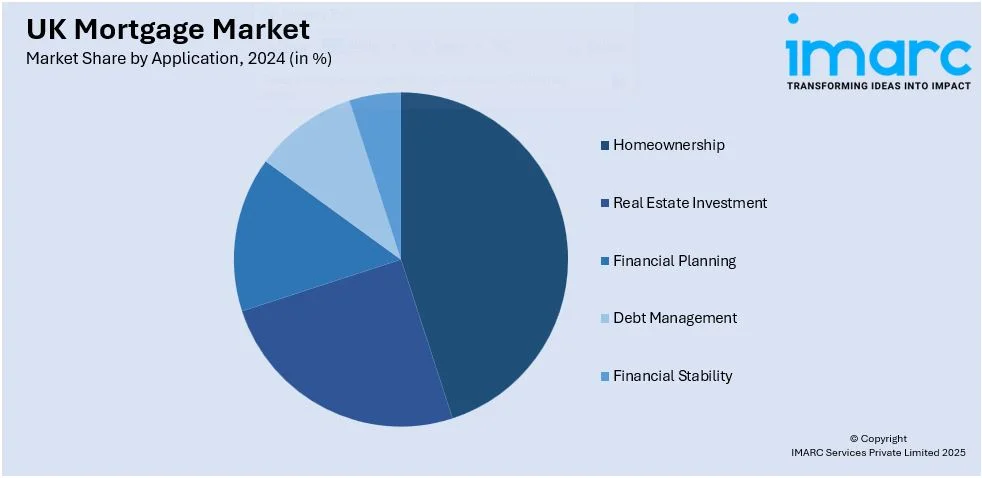

Application Insights:

- Homeownership

- Real Estate Investment

- Financial Planning

- Debt Management

- Financial Stability

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes homeownership, real estate investment, financial planning, debt management, and financial stability.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Mortgage Market News:

- In July 2025, the UK government removed financial red tape with major reforms to boost homeownership. Nationwide would widen access to its ‘Helping Hand’ mortgage, supporting 10,000 additional first-time buyers. The changes, part of the Chancellor’s Leeds Reforms, allow more high loan-to-income mortgages, increasing options for first-time buyers. With lower salary thresholds, Nationwide’s mortgage will now be available to those earning GBP 30,000, helping thousands get onto the housing ladder.

- In March 2025, the UK saw the highest mortgage completions since September 2021, with a 50% increase as buyers rushed to secure savings before stamp duty changes. First-time buyers saw a 70% jump in completions. However, homebuyers now need an additional GBP 13,530 for taxes and fees. Renters' confidence in buying within five years fell, and 25% of homeowners cite stamp duty as a barrier to moving. Rising bills continue to strain household budgets, affecting confidence.

- In September 2024, Virgin Money announced a reduction in certain fixed rates across its residential and buy-to-let offerings, with cuts of up to 0.2 percentage points. Among the new options is a residential purchase rate of 5.03 percent with no fees, available to buyers who have a 5 percent cash deposit. This deal also offers £300 cashback upon completion.

- In September 2024, Accord Mortgages decreased the rates on selected buy-to-let products for both purchases and remortgaging by as much as 0.3 percentage points. The mutual offers a two-year fixed rate for buy-to-let purchases at 5.09% with a fee of £3,495, as well as a five-year fixed rate for buy-to-let remortgaging at 4.14% with a fee of £995.

UK Mortgage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Financial Services, Real Estate, Banking, Lending, Finance |

| Applications Covered | Homeownership, Real Estate Investment, Financial Planning, Debt Management, Financial Stability |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK mortgage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK mortgage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK mortgage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mortgage market was valued at USD 38.21 Billion in 2024.

The UK mortgage market is projected to exhibit a CAGR of 13.25% during 2025-2033, reaching a value of USD 117.07 Billion by 2033.

Key factors driving the UK mortgage market include interest rates, housing demand, government policies, economic growth, inflation, and consumer confidence. Rising property prices, tightening lending criteria, and shifts in employment trends also play crucial roles, influencing borrowing costs and the accessibility of homeownership.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)