UK Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Region 2025-2033

Market Overview:

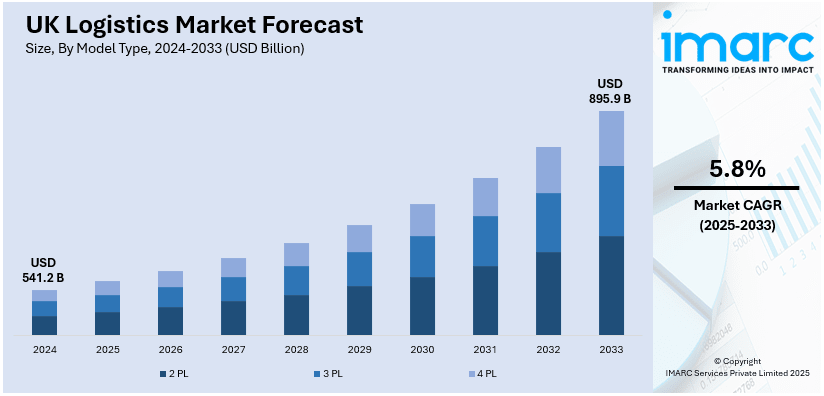

The UK logistics market size reached USD 541.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 895.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The rapid expansion of trade agreements and international business relationships, the escalating demand for efficient transportation and delivery services and the growing investments in warehousing, last-mile delivery, and fulfillment centers are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 541.2 Billion |

| Market Forecast in 2033 | USD 895.9 Billion |

| Market Growth Rate 2025-2033 | 5.8% |

Logistics is the detailed planning, organization, and implementation of complex operations involving the movement of goods, information, or people. It encompasses procurement, transportation, warehousing, and distribution, working together to ensure timely and cost-effective delivery. Logistics plays a vital role in various industries, including manufacturing, retail, and e-commerce. It not only involves moving products from manufacturers to consumers but also includes selecting appropriate transportation modes, optimizing routes, managing inventory, and maintaining quality control. The goal is to deliver the right product to the right place at the right time, efficiently and reliably. Modern logistics integrates technology to enhance tracking, visibility, and automation, resulting in a more streamlined and responsive supply chain. Effective logistics management is key to satisfying customer needs and maintaining a competitive edge in the market.

The expansion of global trade agreements and international business relationships majorly drives the market. This interconnectedness necessitates a more robust and agile logistics network capable of handling the increasing complexity of international shipments, compliance with various regulations, and different trade policies. Along with this, the growth of urban areas in the UK has led to increased demand for efficient transportation and delivery services. Simultaneously, investments in infrastructure development such as roads, ports, and airports facilitate smoother logistics operations, contributing to the industry's growth. In addition, the accelerating shift in expectations pressuring logistics providers to innovate and invest in new strategies and technologies to meet these demands is driving growth. Apart from this, the pandemic further accelerated the e-commerce trend, pushing more consumers online and creating an urgent need for robust logistics solutions. As a result, investments in warehousing, last-mile delivery, and fulfillment centers have increased. Moreover, the emergence of innovative business models, such as shared logistics platforms and on-demand delivery services is creating a positive market outlook.

UK Logistics Market Trends/Drivers:

Sustainability and Regulatory Compliance

Environmental concerns and regulatory compliance are increasingly shaping the UK logistics industry. There is a growing awareness among consumers, governments, and businesses about the environmental impact of transportation and logistics activities. The UK government has set ambitious targets to reduce carbon emissions, and logistics companies are expected to align with these goals. This has led to investments in greener technologies such as electric vehicles, alternative fuels, and energy-efficient warehousing. The UK Logistics Market Report 2025 highlights that sustainability-driven innovations are becoming a strategic priority for logistics providers. The focus on sustainability is driving innovations in packaging, route optimization, and collaborative logistics models to minimize waste and emissions. Furthermore, adherence to regulations around safety, quality control, and international trade agreements necessitates compliance management, which impacts operational processes and strategic decisions. The surge in UK e-commerce is also contributing to logistics transformation, as increasing online consumer demand requires more agile, fast, and eco-conscious delivery solutions. Overall, sustainability and regulatory compliance are shaping the way the UK logistics industry operates, driving innovation, and promoting responsible business practices.

Continuous Technological Advancements

The UK logistics industry has witnessed significant growth due to the rapid technological advancements taking place in the sector. Automation, artificial intelligence, and data analytics have become critical components in optimizing the supply chain logistics and transportation networks. Technologies like real-time tracking, route optimization, and robotic process automation have enabled companies to enhance efficiency, reduce costs, and improve customer satisfaction. The integration of Internet of Things (IoT) devices with cloud-based platforms provides seamless monitoring and control over various logistical functions. The UK government's commitment to supporting technological innovation has facilitated the growth and adoption of these technologies. E-commerce companies are also investing heavily in technology to provide faster and more reliable delivery services. These innovations are further improving the resilience and responsiveness of the UK supply chain, helping businesses navigate disruptions and evolving consumer expectations. All these technological advancements have driven growth and transformation in the UK logistics industry, enabling it to adapt to the changing demands of the global market.

UK Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the UK logistics market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on model type, transportation mode and end use.

Breakup by Model Type:

- 2 PL

- 3 PL

- 4 PL

3PL dominates the market

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL. According to the report, 3 PL represented the largest segment.

The 3PL model stands as a pivotal player, driven by the rise in e-commerce activities, coupled with changing consumer preferences for efficient and timely deliveries. Furthermore, the need for cost optimization and streamlined supply chain management has led businesses to harness the expertise of specialized 3PL providers. Amidst growing environmental concerns, companies are gravitating towards 3PL solutions to enhance sustainability practices through consolidated shipments and optimized route planning. As the industry witnesses technological advancements, the integration of AI-driven analytics and IoT-based tracking within the 3PL framework augments visibility and control. As a result, this convergence of factors reinforces the 3PL model's prominence, making it a critical instrument for stakeholders striving to navigate the evolving logistics landscape in the UK, thereby contributing to the market growth.

Breakup by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Roadways dominates the market

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways. According to the report, roadways represented the largest segment.

The roadways transportation mode is propelled by the nation's intricate network of roadways that serves as a lifeline for the movement of goods, and its significance has influenced with the exponential growth of e-commerce. Along with this, consumers' heightened expectations for rapid deliveries have thrust road transportation into the forefront, prompting logistics companies to optimize routes and enhance last-mile delivery efficiency. Additionally, the flexibility and accessibility offered by roadways cater to the diverse needs of businesses across sectors, contributing to its continued dominance. The logistics market UK has seen a substantial boost from this trend, as companies invest in infrastructure and smart technologies to support increased demand and efficiency. The UK's commitment to sustainable practices has driven the adoption of eco-friendly technologies, such as electric and hybrid vehicles, aligning with the global push for reduced carbon emissions. Furthermore, the interplay of these drivers underscores roadways transportation as a pivotal force driving the evolution of the UK logistics landscape, exemplifying its adaptability, reliability, and pivotal role in catering to the nation's supply chain demands.

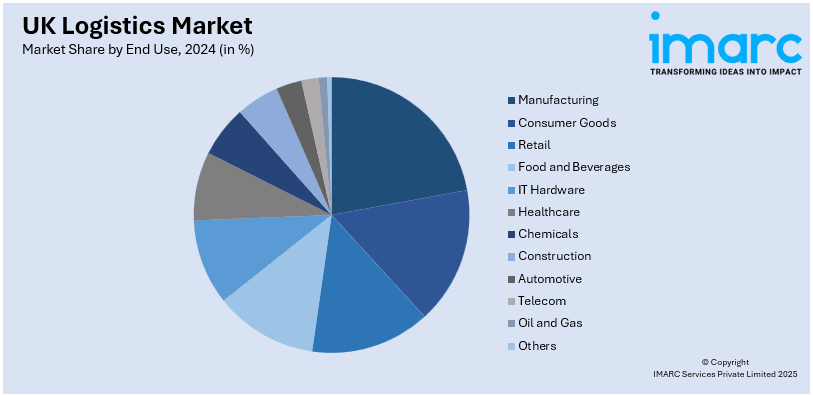

Breakup by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. According to the report, manufacturing represented the largest segment.

The manufacturing sector emerges as a significant driver, fueled by a multitude of compelling market forces. As manufacturing processes become increasingly intricate and globally interconnected, the demand for efficient and timely supply chain solutions intensifies. Just-in-time manufacturing practices, which minimize inventory costs, rely on seamless logistics networks for timely raw material deliveries. Furthermore, the rise of customization and personalization in products necessitates agile logistics systems that can swiftly adapt to varying production requirements. The pursuit of operational excellence and cost optimization prompts manufacturers to collaborate with logistics partners capable of offering value-added services. In the modern era, where sustainability is a paramount concern, manufacturers seek logistics solutions that align with eco-friendly practices, fostering a demand for green supply chains. The interplay of these drivers underscores the pivotal role of the manufacturing sector in shaping the trajectory of the UK logistics landscape, bridging the gap between production prowess and effective distribution.

Breakup by Region:

- North West England

- Yorkshire and the Humber

- West Midlands

- East of England

- South West England

- South East England

- East Midlands

- North East England

- Greater London

- Others

North West England exhibits a clear dominance, accounting for the largest UK logistics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North West England, Yorkshire and the Humber, West Midlands, East of England, South West England, South East England, East Midlands, North East England, Greater London, and others. According to the report, North West England represented the largest share.

In North West England's logistics industry, a confluence of robust market drivers propels its growth and evolution. The region's strategic geographical location, serving as a gateway to both national and international markets, establishes it as a pivotal logistical hub. The rise in e-commerce activities amplifies the demand for efficient and well-connected supply chains, driving logistics providers to enhance their capabilities. The region's diverse industrial landscape, ranging from manufacturing to technology, creates a demand for specialized logistics solutions tailored to the distinct needs of various sectors.

With sustainability gaining prominence, there's an increasing emphasis on eco-friendly transportation modes and green practices, aligning with the global push for reduced carbon footprint. The technological revolution further fuels the industry, with innovations, such as IoT-based tracking and AI-driven analytics enhancing visibility and efficiency. These dynamic market drivers collectively reinforce North West England's position as a thriving logistics epicenter, fostering economic growth and facilitating seamless trade connections.

Competitive Landscape:

The key players in the market are offering efficient last-mile deliveries and streamlined supply chains. Along with this, the pursuit of cost optimization and operational efficiency encourages businesses to collaborate with logistics partners offering specialized solutions. The emergence of sustainable practices, driven by environmental concerns, leads to a demand for eco-friendly transportation modes and greener supply chains. In addition, geopolitical shifts, such as changes in trade agreements and regulations, impact global trade routes and logistics strategies. Apart from this, technological advancements, including IoT-based tracking, AI-driven analytics, and automation, enhance visibility, efficiency, and overall logistics performance. Additionally, the diversification of industries and the increasing need for tailored solutions contribute to the market's growth. These factors collectively underscore the dynamic nature of the global UK logistics market, fostering innovation and adaptability in response to changing demands and trends.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

UK Logistics Market News:

- In June 2025, the UK Department for Transport (DfT) and Centre for Connected and Autonomous Vehicles (CCAV) released the Transport AI Action Plan, proposing how AI and automated vehicles can enhance safety, emissions reduction, and transport efficiency. It also includes consultations on safety principles and marketing restrictions for autonomous vehicles. Logistics UK supports the plan, highlighting its potential to improve logistics operations while stressing the need for collaboration and regulatory frameworks that reflect industry realities and operational complexities.

- In May 2025, Maritime Transport launched two new intermodal rail services connecting DP World London Gateway with inland terminals at Ham Hall and iPort Doncaster, in partnership with GB Railfreight. The services support DP World's £1 billion expansion. More routes, including Southampton to Northampton and Manchester to Felixstowe, are planned. Logistics UK stresses the importance of rail freight for emissions reduction and efficiency but highlights the need for greater government investment in capacity, electrification, and intermodal infrastructure to meet growth targets.

UK Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | North West England, Yorkshire and the Humber, West Midlands, East of England, South West England, South East England, East Midlands, North East England, Greater London, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the UK logistics market to exhibit a CAGR of 5.8% during 2025-2033.

The rising demand for green logistics, along with the advent of tech-driven logistics services and IoT-enabled connected devices, that assist in tracking objects and remotely controlling elements of the transport process, is primarily driving the UK logistics market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of logistic facilities to cater to the surging demand for numerous essential goods and healthcare products, during the lockdown scenario across the nation.

Based on the model type, the UK logistics market can be categorized into 2 PL, 3 PL, and 4 PL. Currently, 3 PL accounts for the majority of the total market share.

Based on the transportation mode, the UK logistics market has been segregated into roadways, seaways, railways, and airways, where roadways currently hold the largest market share.

Based on the end use, the UK logistics market can be bifurcated into manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. Among these, the manufacturing sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North West England, Yorkshire and the Humber, West Midlands, East of England, South West England, South East England, East Midlands, North East England, Greater London, and others, where North West England currently dominates the UK logistics market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)