UK IT Services Market Report by Service Type (Professional Services (System Integration and Consulting), Managed Services), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Deployment Mode (On-premises, Cloud-based), End Use Industry (BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, and Others), and Region 2026-2034

UK IT Services Market Overview:

The UK IT services market size reached USD 44.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 110.5 Billion by 2034, exhibiting a growth rate (CAGR) of 10.63% during 2026-2034. The market is driven by rapid technological advancements, increasing demand for cloud-based solutions, and strong government support for digital transformation across public and private sectors, positioning it as a leader in European IT services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 44.5 Billion |

|

Market Forecast in 2034

|

USD 110.5 Billion |

| Market Growth Rate 2026-2034 | 10.63% |

Access the full market insights report Request Sample

UK IT Services Market Trends:

Technological Advancements

The UK IT services market is significantly driven by continual technological advancements. Innovations in areas such as artificial intelligence, machine learning, and blockchain are reshaping industries by enhancing operational efficiencies and creating new business opportunities. The integration of these technologies into IT services allows businesses to stay competitive and meet evolving consumer demands more effectively. Additionally, advancements in cybersecurity solutions are crucial for protecting data and ensuring compliance with stringent regulations, further augmenting demand for sophisticated IT services. Companies are increasingly reliant on advanced IT frameworks to streamline operations, reduce costs, and bolster security, thereby fueling the growth of the IT services sector. This trend is expected to continue as technological innovations become even more integral to business strategies and consumer interactions in the digital age.

Demand for Cloud-Based Solutions

The shift towards cloud-based solutions is a major driver of growth in the UK IT services market. Businesses across the UK are increasingly adopting cloud services to gain scalability, flexibility, and cost-efficiency. This transition is supported by the widespread acceptance of remote working models, which require reliable and scalable cloud infrastructures. The cloud also facilitates innovation, collaboration, and a faster time-to-market for products and services, making it indispensable for companies looking to leverage digital transformation strategies. As a result, IT service providers specializing in cloud solutions are experiencing substantial growth, catering to sectors ranging from finance and healthcare to education and government. This widespread adoption is propelled by the cloud's ability to offer enhanced data analytics, improved business continuity, and reduced IT maintenance costs, driving the continuous expansion of the cloud services market.

Government Initiatives and Digital Transformation

Government programs and measures for the development of digitalization also stimulate the growth of the UK IT services market. The UK government’s efforts in digitalizing public services and policies that promote investments in the digital economy via funding for information and communication technologies, cyber security, and skills are crucial. Such programs not only result in improved service provision and productivity in the public sector but also the general IT market through the additional incentive for cooperation and creativity offered by the outsourcing projects. The increasing emphasis on digitalization means that IT services will be seen as an indispensable factor for meeting compliance requirements, improving efficiency, and boosting the level of service in both the public and private domains, which bodes well for the market’s growth prospects. Furthermore, initiatives by the government that focus on upskilling the consumers towards digital proficiency are also training the talents for employment, which would further add to the IT services industry.

UK IT Services Market News:

- On May 8, 2024, Wipro, a leading technology and consulting firm, along with Kognitos Inc., a top player in Generative AI Automation and part of Wipro Ventures' portfolio, announced their collaboration to implement GenAI-based Business Automation Solutions. Furthermore, Wipro Ventures has invested in Kognitos during its Series A funding round, solidifying their partnership.

- On May 16, 2024, Infosys, a global leader in digital services and consulting, announced a multi-year strategic collaboration with Telstra, Australia's top telecommunications company, to accelerate Telstra's IT transformation and enhance customer experience. This partnership builds on a longstanding relationship, aiming to support Telstra's company-wide strategy.

UK IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on service type, enterprise size, deployment mode, and end use industry.

Service Type Insights:

To get detailed segment analysis of this market Request Sample

- Professional Services (System Integration and Consulting)

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes professional services (system integration and consulting) and managed services.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

End Use Industry Insights:

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, telecommunication, healthcare, retail, manufacturing, government, and others.

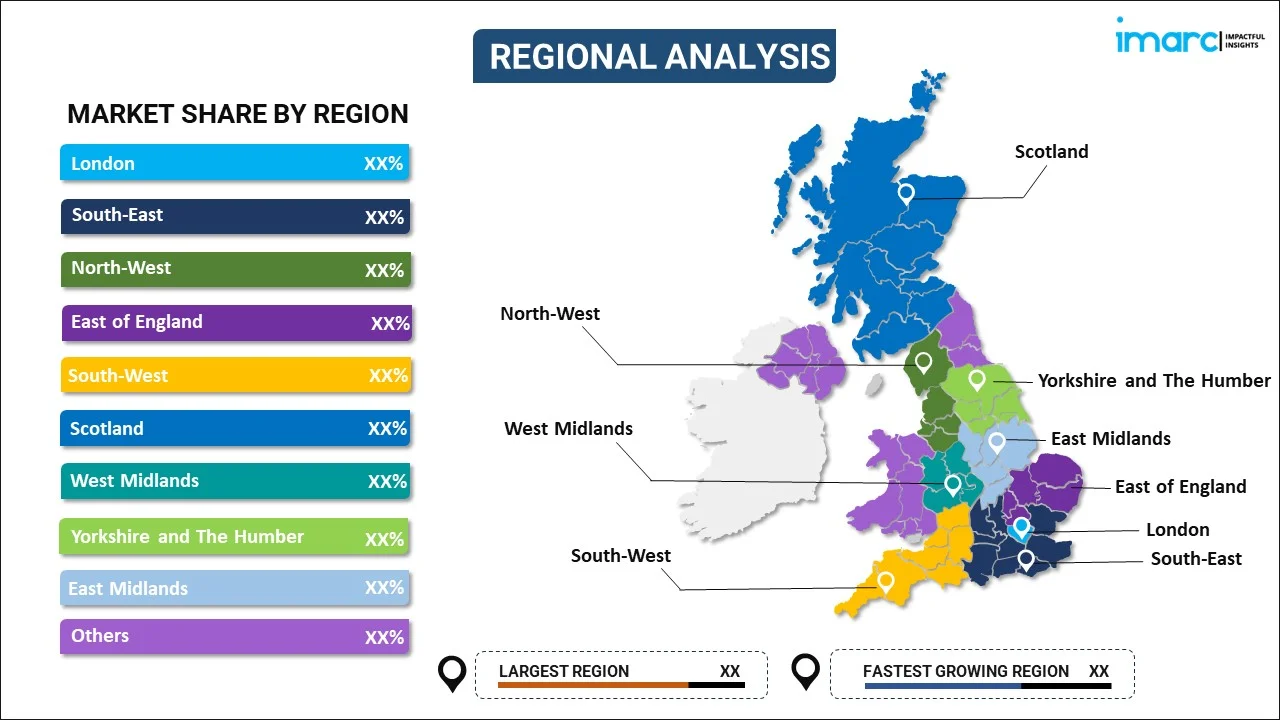

Regional Insights:

To get detailed regional analysis of this market Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Professional Services (System Integration and Consulting), Managed Services |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK IT services market performed so far and how will it perform in the coming years?

- What is the breakup of the UK IT services market on the basis of service type?

- What is the breakup of the UK IT services market on the basis of enterprise size?

- What is the breakup of the UK IT services market on the basis of deployment mode?

- What is the breakup of the UK IT services market on the basis of end use industry?

- What are the various stages in the value chain of the UK IT services market?

- What are the key driving factors and challenges in the UK IT services?

- What is the structure of the UK IT services market and who are the key players?

- What is the degree of competition in the UK IT services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK IT services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)