UK Home Improvement Market Report by Project (DIY, DIFM), Type (Kitchen Improvement and Additions, Bath Improvement and Additions, System Upgrades, Exterior Replacements, Interior Replacements, Property Improvements, Disaster Repairs, and Others), and Region 2026-2034

UK Home Improvement Market Overview:

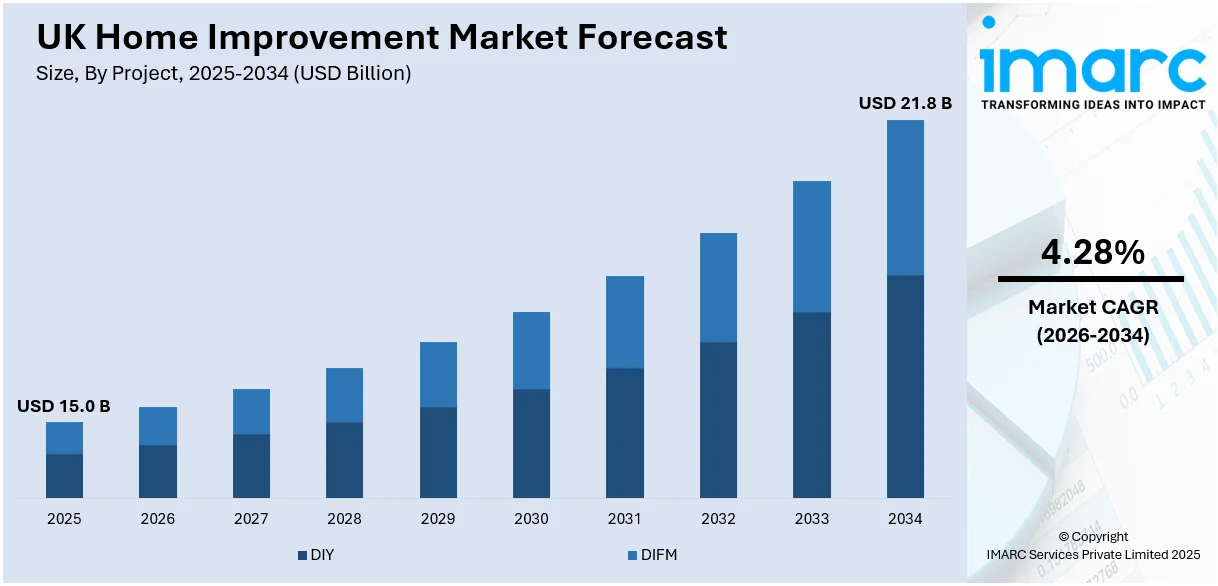

The UK home improvement market size reached USD 15.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 21.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.28% during 2026-2034. The market is driven by rising demand for energy-efficient living spaces, greater emphasis on interior design, and expanding use of smart home solutions. The pandemic boosted DIY activity and renovation spending, with 80% of homeowners using savings for upgrades. Consumer behavior indicates a strong intention to maintain this momentum, as 21% of Brits plan to invest in home improvements in 2025, reflecting a clear preference for personalized, modernized homes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.0 Billion |

| Market Forecast in 2034 | USD 21.8 Billion |

| Market Growth Rate 2026-2034 | 4.28% |

UK Home Improvement Market Trends:

Rising Demand for Energy-Efficient Homes

The UK home improvement market is significantly influenced by the growing emphasis on energy efficiency. Due to the continually rising energy costs, homeowners are motivated to invest in improvements that reduce their energy consumption and lower their utility bills. For instance, installing double-glazed windows, better insulation, energy-efficient lighting, and solar panels are helping to achieve energy efficiency. Moreover, the UK government has also introduced various initiatives to encourage energy-efficient upgrades. The Green Homes Grant, for instance, is a valuable incentive for homeowners. Beyond monetary savings, green home improvements also reduce carbon footprints. This appeals to environmentally conscious consumers. According to the World Bank Group, renewable energy consumption in the UK reached 12.20% in 2021, reflecting the growing adoption of energy-efficient sources. This growing interest in sustainable, energy-smart homes continues to attract investments in new materials and solutions, strengthening the outlook for the home improvement industry statistics UK.

To get more information on this market Request Sample

Increased Focus on Home Aesthetics and Interior Design

The growing trend toward home design improvements to enhance the look and functionality of homes has notably increased, particularly since the COVID-19 pandemic. Individuals started spending more time inside their homes due to lockdowns and social distancing measures. Due to this, there was a resurgence in interior design as they became much more inclined to make their living spaces comfortable and aesthetic. Home renovations increased with individuals remodeling their kitchens and baths and refurnishing their living spaces. Moreover, UK citizens are trying to personalize their spaces more, and home improvement retailers have obliged with a wide array of products. This trend is partly driven by the popularity of TV home renovation shows and individuals taking on DIY home projects that are inspired by social media platforms. The focus on style and comfort has driven steady growth for UK home renovation, as people continue to see value in tailored, attractive living spaces.

Growing “Improve, Not Move” Mindset

Across the UK, more households are choosing to enhance what they already own instead of entering a costly housing market. Higher property prices and rising borrowing costs have made relocation less appealing, encouraging families to extend, convert lofts, or modernize interiors instead. Many see upgrading existing spaces as a practical answer to changing lifestyles, whether for remote work, growing families, or energy savings. This shift is driving steady demand for better insulation, smart devices, and stylish finishes that refresh living areas without the need to move. Companies in the home improvement sector are meeting this demand by providing more tailored products, flexible payment plans, and skilled support to guide renovation projects from idea to completion. With more people aiming to make their homes more efficient and comfortable for the long term, this “improve, not move” approach is set to remain a key factor shaping the future of house renovation in UK.

Growth in Smart Home Technology Adoption

The popularity of smart home technology is having a considerable impact on the UK home improvement market. Homeowners are increasingly seeking to integrate smart systems that enhance convenience, security, and energy efficiency. According to Gitnux, 49% of households in the UK owned smart home devices in 2020. Smart thermostats, lighting systems, home security cameras, and voice-controlled devices are some of the innovations that are gaining widespread adoption in UK homes. These technologies provide added convenience and increase the value of properties. This makes smart devices an attractive investment for homeowners who are seeking to upgrade. Moreover, smart home technology is evolving rapidly, with new products constantly entering the market, driving ongoing demand for home upgrades. With rising awareness among consumers about the benefits of smart home devices, the demand for incorporating these systems into home improvement projects is increasing. As per Gitnux, the percentage of homes with smart devices was expected to reach 17.9% by 2023 in the UK. This increasing reliance on technology to streamline daily tasks, improve security, and reduce energy usage is contributing substantially to the growth of the UK home improvement market.

UK Home Improvement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on project and type.

Project Insights:

- DIY

- DIFM

The report has provided a detailed breakup and analysis of the market based on the project. This includes DIY and DIFM.

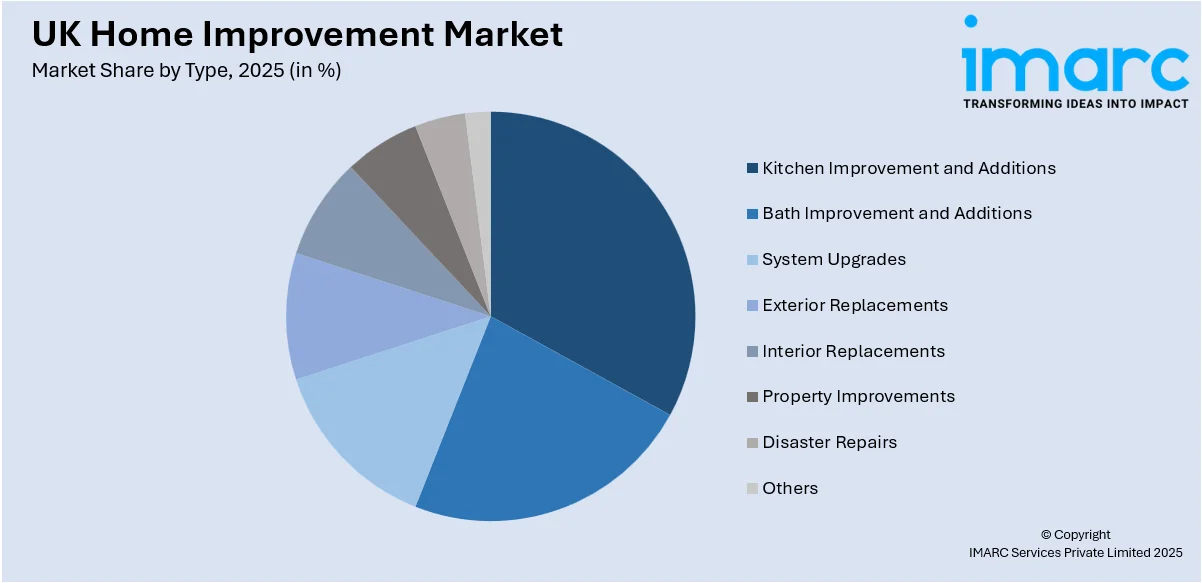

Type Insights:

Access the comprehensive market breakdown Request Sample

- Kitchen Improvement and Additions

- Bath Improvement and Additions

- System Upgrades

- Exterior Replacements

- Interior Replacements

- Property Improvements

- Disaster Repairs

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes kitchen improvement and additions, bath improvement and additions, system upgrades, exterior replacements, interior replacements, property improvements, disaster repairs, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Home Improvement Market Recent News:

- April 2024: BRE launched BREEAM UK New Construction Residential, replacing the Home Quality Mark. This update brought improved lifecycle assessment and clearer sustainability benchmarks. It strengthened standards for new homes, encouraging developers to deliver higher-quality, sustainable improvements that support the growth of the UK home improvement market.

- January 2025: Checkatrade launched the UK’s first Home Improvement Index, tracking over 10 Million jobs. It revealed a 19% rise in average building costs in Q3 2024, but showed that demand remained strong, highlighting continued growth and spending resilience in the UK home improvement market.

- July 2024: The National Home Improvement Council (NHIC) announces support for the “Get Britain Building Again” initiative by the new government. The pledge aims to increase the rates of construction and renovation in the UK housing market and improve the standard of living and energy efficiency of UK households.

- June 2024: Oxford City Council announces a £7 Million reconstruction project for 316 social housing accommodations to make these homes more energy efficient. The initiative is a key component of ongoing efforts to make Oxford more environmentally friendly and is partly financed by the Social Housing Decarbonization Fund (SHDF) of the UK government.

UK Home Improvement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Projects Covered | DIY, DIFM |

| Types Covered | Kitchen Improvement and Additions, Bath Improvement and Additions, System Upgrades, Exterior Replacements, Interior Replacements, Property Improvements, Disaster Repairs, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK home improvement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK home improvement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK home improvement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK home improvement market is expected to grow at a CAGR of 4.28% during 2026-2034.

Higher house prices, older homes needing updates, and a strong push for energy-saving upgrades drive the UK home improvement market. Many homeowners choose to renovate instead of moving. Smart technology, stylish interiors, and tailored spaces also keep spending levels steady.

COVID-19 changed how people used their homes, boosting demand for upgrades. More time at home led to increased spending on extensions, garden makeovers, and workspace improvements. DIY activity rose sharply, and many households focused on energy savings and comfort, supporting ongoing market growth.

Based on the project, the UK home improvement market has been segmented into DIY and DIFM.

Based on the type, the UK home improvement market has been segmented into kitchen improvement and additions, bath improvement and additions, system upgrades, exterior replacements, interior replacements, property improvements, disaster repairs, and others.

On a regional level, the UK home improvement market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)