UK Green Energy Market Size, Share, Trends and Forecast by Type, End-Users, and Region, 2025-2033

UK Green Energy Market Overview:

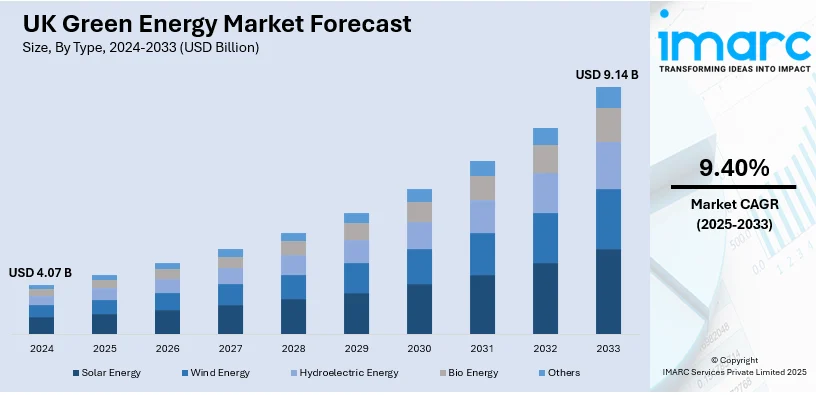

The UK green energy market size reached USD 4.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.14 Billion by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. The UK green energy market share is expanding, driven by the increasing implementation of government policies aimed at providing rewards and incentives to renewable energy businesses, along with the rise in green energy capacity, attracting more investments to build better infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.07 Billion |

| Market Forecast in 2033 | USD 9.14 Billion |

| Market Growth Rate (2025-2033) | 9.40% |

UK Green Energy Market Trends:

Supportive Government Policies

The rising implementation of supportive government policies is impelling the UK green energy market growth. The UK government announced a £22 Million increase in funding for its flagship renewables initiative in 2023, the Contracts for Difference (CfD) scheme, which could unlock contracts for renewable energy generation worth billions over its duration. This funding was made to support established technologies like solar and offshore wind, some of the most affordable domestic energy sources, helping to ensure that the UK maintains its status as a worldwide leader in renewable energy. According to the Energy Security Secretary Grant Shapps, this multi-million-pound investment would make Britain the preferred option for investors seeking cleaner and more secure energy sources. The overall budget for the next auction hit £227 Million. During the first quarter of 2023, renewable energy sources accounted for a record 48% of electricity production, propelling the country closer to its targets of a decarbonized power sector by 2035 and attaining net zero emissions by 2050. The additional fund, used in tandem with an annual auction plan, was intended to assist in boosting investments in Britain's leading renewable sector, further bolstering the UK’s energy security, and reducing reliance on volatile and imported gas prices. Thus, these measures of the government constitute financial aid, rewards, and incentives for renewable energy businesses, as well as policies enabling operators to follow tougher norms to spur cleaner technologies.

Increasing Renewable Energy Capacity

The expansion of renewable energy capacity with increasing investment in wind power is offering a favorable UK green energy market outlook. According to the Department for Energy Security and Net Zero, in the first quarter of 2024, renewable electricity accounted for 50.9% of the UK's total generation, totaling 39.2 TWh, which was a 3.7% increase compared to the same quarter in 2023. This growth was attributed to a 7.4% increase in onshore wind generation due to improved wind speeds. Overall wind generation is the largest source of electricity in the UK for the second consecutive quarter, surpassing gas plants.Bottom of Form Moreover, the expansion of offshore and onshore wind farms, along with investments in solar and biomass, has diversified the energy mix and enhanced energy security. As the UK strengthens its renewable infrastructure, it also positions itself as a leader in the market, attracting further funding and creating jobs.

UK Green Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and end-users.

Type Insights:

- Solar Energy

- Wind Energy

- Hydroelectric Energy

- Bio Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes solar energy, wind energy, hydroelectric energy, bio energy, and others.

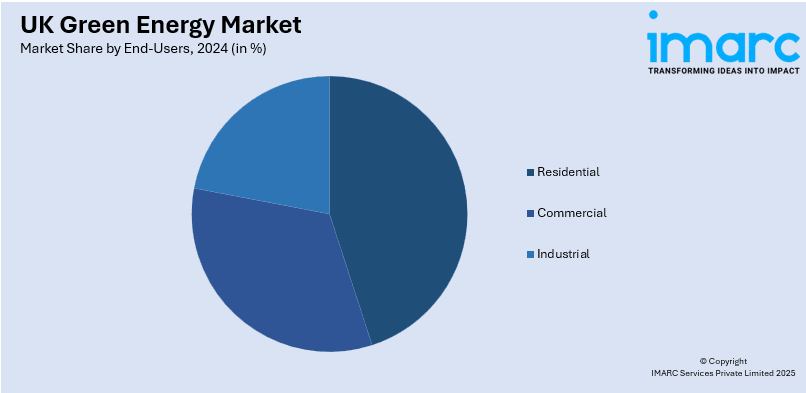

End-Users Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end-users have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Green Energy Market News:

- In July 2024, The UK Government teamed up with Great British Energy (GB Energy) and the Crown Estate to establish a new offshore wind farm, anticipated to produce as much as 30 GW (gigawatts) of energy by 2030, enough to provide green power to almost 20 Million homes. This project represented the initial major proposal from Great British Energy, the government’s new organization aimed at enhancing renewable energy, which was expected to secure £8.3 Billion in government funding over the next five years.

- In March 2024, The Science Museum in London, UK, introduced the Energy Revolution: the Adani Green Energy Gallery. It was an important new free exhibition centered on sustainable energy production and consumption to address climate change. It showcased engaging exhibits of modern and historical artifacts from the UK and elsewhere. Complemented by interactive digital installations and uniquely designed models, the gallery demonstrated the impact of human creativity and innovations on the past, present, and future. It also emphasized the significance of personal contributions in influencing our energy landscape.

UK Green Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar Energy, Wind Energy, Hydroelectric Energy, Bio Energy, Others |

| End-Users Covered | Residential, Commercial, Industrial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK green energy market performed so far and how will it perform in the coming years?

- What is the breakup of the UK green energy market on the basis of type?

- What is the breakup of the UK green energy market on the basis of end-users?

- What are the various stages in the value chain of the UK green energy market?

- What are the key driving factors and challenges in the UK green energy market?

- What is the structure of the UK green energy market and who are the key players?

- What is the degree of competition in the UK green energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK green energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK green energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK green energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)