UK Furniture Market Size, Share, Trends and Forecast by Product, Material, End Use, and Region, 2025-2033

UK Furniture Market Size and Share:

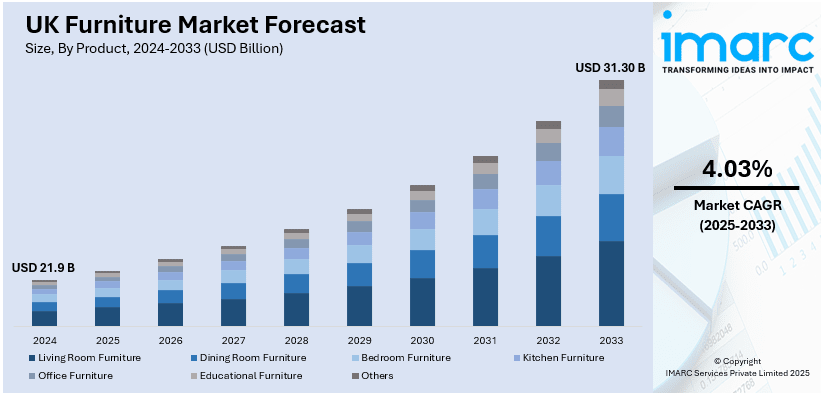

The UK furniture market size is estimated at USD 21.9 Billion in 2024, and is expected to reach USD 31.30 Billion by 2033, at a CAGR of 4.03% during the forecast period 2025-2033. The UK furniture market share is expanding, driven by the rising number of housing projects that require compact and multi-functional designs to enhance aesthetics and save space, along with the growing adoption of online shopping platforms, which allows easy comparison of prices and products, with the added benefit of home delivery.

Key Insights:

- The UK furniture market reached a value of USD 21.9 Billion in 2024.

- By 2033, the market is expected to hit USD 31.30 Billion, growing at a CAGR of 4.03% between 2025-2033.

- Rising demand for eco-friendly materials, growing e-commerce penetration, urban housing expansion, shifting interior trends, inflationary pressures, increased DIY culture, flexible workspace needs, aging population, import competition, and changing consumer priorities are shaping the UK furniture market.

The increasing demand for customization is impelling the market growth in the UK. Individuals prefer furniture that fits their specific needs, whether it is choosing the size, color, fabric, or layout. This trend is especially popular among younger people who want their homes to reflect their personal style. Customization also helps homeowners to maximize their space, especially in smaller apartments, with made-to-measure furniture like modular shelves or corner sofas. Showrooms make it easier for users to design their own pieces by providing hands-on experiences and personalized services. Brands that offer flexibility and customization attract more customers, as people value having furniture tailored to their requirements and lifestyles.

To get more information on this market, Request Sample

The rising adoption of sustainability, with more people prioritizing eco-friendly choices, is offering a favorable furniture market outlook in UK. People look for furniture made from eco-conscious materials like retrieved wood, bamboo, or recycled metals, reducing the environmental impact of their purchases. Brands respond by offering products with certifications for ethical sourcing and low-carbon manufacturing processes. Minimalist and durable designs also gain popularity, as they promote longevity and lower waste. Additionally, individuals are willing to spend more resources on high-quality and environmentally responsible furniture, aligning with their values. Moreover, circular economy initiatives, such as furniture recycling and rental services, are becoming more common. As awareness among the masses about climate change and sustainability grows, the demand for green furniture solutions rises, encouraging companies to innovate items.

UK Furniture Market Trends:

Growing demand in workspaces

The rising office employment is driving the demand for furniture in the country. As businesses expand and hire more employees, they need to furnish new workspaces with desks, chairs, storage units, and meeting room furniture. According to the Labor Force Survey, the projected rate of employment in the UK for individuals aged 16 to 64 years was 74.8% from September to November 2024. Estimates for UK payrolled workers increased by 95,000 (0.3%) from November 2023 to November 2024. The shift towards more ergonomic designs also plays a big role, as companies prioritize employee comfort and productivity. Startups and small businesses contribute to this requirement, as they set up new offices. Hybrid models add to the trend, with people investing in home office furniture to improve their work-from-home setups. As more employees join the workforce and businesses emphasize functional and appealing office environments, the need for stylish, comfortable, and efficient furniture continues to grow.

Tech-driven shopping reshaping smart living

The UK furniture market is seeing a shift driven by the fusion of interactive shopping and intelligent product design. Augmented reality (AR) is changing how consumers explore and purchase home furnishings, offering realistic previews of products in their actual living spaces. This digital tool helps shoppers assess style, scale, and compatibility with their interiors, reducing returns and boosting confidence in online purchases. At the same time, smart furniture is carving a space in UK homes. Products like height-adjustable desks with memory settings, beds that monitor sleep, and tables with built-in tech features reflect growing demand for multifunctional and connected living. These aren’t just trend pieces; they reflect a lifestyle shift toward efficiency and customization. Retailers are starting to bridge the two trends. AR shopping experiences are being tailored to highlight the unique features of smart furniture, helping consumers understand the value before buying. As tech-savvy Gen Z and millennial homeowners continue to shape demand, the integration of AR in promoting smart solutions is likely to become standard. Together, AR and smart furniture are reshaping the furniture industry UK into one that’s more interactive, informed, and aligned with modern living.

Enlargement of e-commerce platforms

The increasing emergence of e-commerce platforms across the region is impelling the UK furniture market growth. According to the data provided on the official website of the Office for National Statistics, 30.1% of total retail sales comprised online sales in the UK in December 2024. Shopping for furniture online is convenient, letting people browse tons of options from the comfort of their homes. Websites and apps make it easy to compare prices, read reviews, and see how a piece might look in a room using augmented reality (AR) tools. With quick delivery and flexible payment options, online stores cater to the fast-paced lifestyles of modern shoppers. Additionally, e-commerce platforms often offer exclusive discounts and deals that physical stores cannot match. Smaller furniture brands also benefit from reaching more users without needing retail locations. As more people get comfortable with online shopping, the furniture market UK keeps growing, making stylish and functional pieces accessible to everyone.

Rising urbanization in certain areas and investments new housing developments

Increasing urbanization in certain areas and new housing developments are fueling the market growth. Government agencies wager on housing infrastructure building or re-modeling projects. As per the information provided on the official website of the Government of the UK, Michael Gove, the leveling up Secretary, revealed a £208 Million (USD 258.72 Million) investment for the North aimed at transforming towns and cities. In Blackpool, £90m (USD 111.86 Million) was allocated to construct new housing and improve substandard properties unfit for habitation as part of a significant redevelopment initiative spearheaded by Homes England and Blackpool Town Council. As more people move to cities, there is a high need for furniture that works in smaller and modern spaces. Compact and multi-functional designs like storage beds or foldable tables have become popular because they help to make the most of limited room. New housing projects also mean fresh demand for all kinds of furniture, ranging from basics like sofas and dining tables to stylish and space-saving options. Additionally, younger city dwellers want furniture that is both trendy and practical, fitting into their busy urban lifestyles. With cities expanding and more homes being built, furniture brands step up by offering smart and affordable designs that suit the preferences of modern living.

UK Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK furniture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material, and end use.

Analysis by Product:

- Living Room Furniture

- Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Office Furniture

- Educational Furniture

- Others

Living room furniture features sofas, armchairs, coffee tables, and TV units. People look for comfortable and stylish designs to create cozy spaces for relaxing and entertaining. Multifunctional pieces, like storage ottomans or sofa beds, are popular, especially in smaller homes. Modern and modular furniture options are also in demand to match contemporary interiors.

Dining room furniture includes tables, chairs, and sideboards, focusing on both functionality and aesthetics. Families choose sturdy and expandable tables for gatherings while urban buyers prefer sleek and compact designs. Individuals opt for a balance of durability and style, with wood and glass being popular materials.

Bedroom furniture revolves around comfort and storage, with essentials like beds, wardrobes, and bedside tables in high demand. Upholstered beds, sliding wardrobes, and space-saving designs appeal to modern buyers. Storage beds and built-in wardrobes are particularly sought after, as people prioritize organization. People also prefer materials and finishes that give a calm and cozy feel.

Kitchen furniture focuses on practicality and efficiency, with cabinets, islands, and dining sets being the main products. Modular kitchen units are popular for maximizing storage in smaller spaces while custom cabinetry is a favorite for those renovating homes. Users look for durable materials like solid wood or medium density fiberboard (MDF), with designs that blend functionality and aesthetics seamlessly.

Office furniture is employed to respond to the work-from-home trend. Desks, ergonomic chairs, and storage solutions like filing cabinets are essentials for setting up comfortable home offices. Adjustable desks and minimalist designs are particularly popular, catering to people looking for functionality that fits well with home interiors.

Educational furniture meets the needs of schools, colleges, and universities, including desks, chairs, and storage units. Durable and lightweight materials are a priority for easy movement and long-lasting utilization. Stackable and modular furniture is common in classrooms, as it offers flexibility for different layouts. Institutions also focus on ergonomics to ensure comfort for students and staff.

Analysis by Material:

- Metal

- Wood

- Plastic

- Glass

- Others

The metal furniture segment in the UK is known for its durability and modern appeal. It includes products like beds, tables, and chairs, often favored for their sleek and industrial designs. Metal furniture works well for both indoor and outdoor use, as it withstands wear and tear. People like it for its low maintenance and sturdy nature, making it popular in commercial spaces like offices and cafes.

Wood is noted for its timeless appeal and versatility. Products range from solid oak dining tables to pine wardrobes, catering to various tastes and budgets. Wooden furniture is valued for its durability and the warmth it adds to spaces. Moreover, sustainable and reclaimed wood options have become popular, as people prioritize eco-friendliness. Many users also prefer wooden furniture for its ability to blend with both modern and traditional interiors, making it a go-to choice for home and office décor.

Plastic furniture is valued for being lightweight, affordable, and versatile. It is employed in outdoor settings, kids' rooms, and casual dining areas because of its easy maintenance and resistance to weather. Available in a range of colors and designs, plastic furniture appeals to budget-conscious buyers and those seeking vibrant and modern styles. Improvements in manufacturing also introduce more durable and eco-friendly options, such as recycled plastic furniture. Its portability and adaptability make it a practical choice for those looking for convenient and fuss-free solutions.

Glass furniture includes items like coffee tables, dining sets, and shelves, often paired with other materials for added stability and style. People like glass furniture for its ability to create a sense of space and light, especially in smaller rooms. Easy to clean and modern in appearance, it appeals to those with a preference for contemporary designs. As tempered glass becomes more common, safety concerns are reduced, enhancing its popularity across households and commercial spaces.

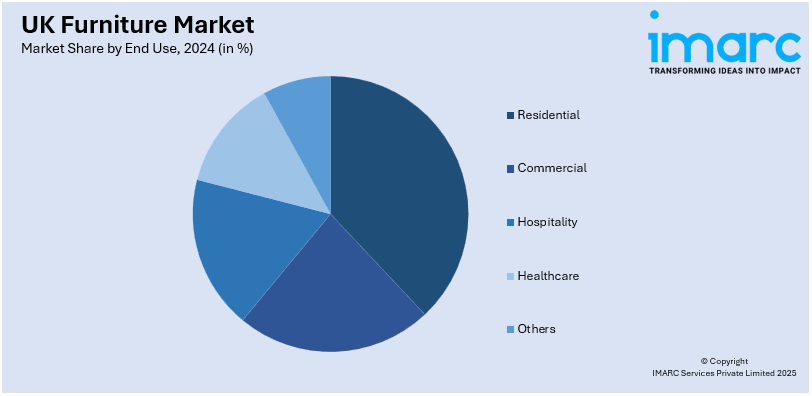

Analysis by End Use:

- Residential

- Commercial

- Hospitality

- Healthcare

- Others

The residential furniture is popular, as people invest in making their homes comfortable and stylish. It includes living room, bedroom, kitchen, and garden furniture, catering to various choices and budgets. Trends like multifunctional furniture and sustainable designs encourage the usage of furniture, especially among urban households. With the rise of remote work, there is also a high focus on home office furniture like desks and ergonomic chairs.

The commercial furniture section caters to offices, schools, and other professional spaces. It focuses on functional and ergonomic designs to support productivity and comfort. Office furniture, such as chairs, desks, and storage units, is in high demand due to the hybrid work culture. Educational institutions also require durable and practical furniture for classrooms and libraries. Additionally, commercial furniture prioritizes bulk production and cost efficiency while still offering sleek designs to match modern aesthetics.

Hospitality furniture is employed in hotels, restaurants, and cafés, focusing on style, durability, and comfort. In this sector, aesthetics is prioritized where furniture plays a big role in creating the right ambiance. From luxurious hotel beds to trendy restaurant seating, this segment caters to diverse themes and budgets. Outdoor furniture for patios and terraces is also popular in hospitality.

Healthcare furniture meets the specific needs of hospitals, clinics, and care homes. It prioritizes comfort, hygiene, and safety, with products like adjustable beds, patient chairs, and medical trolleys. Furniture in this segment is often designed to be easy to clean and durable, ensuring it can handle daily use in busy healthcare environments. Ergonomic and supportive designs are utilized, as they enhance patient comfort and support caregivers in their daily tasks.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London is noted for its large population, urban lifestyle, and high disposable incomes. Modern and compact furniture is in high demand to fit smaller living spaces. Luxury and designer furniture also perform well here, catering to affluent buyers. Online furniture shopping is popular since it offers convenience and variety. With many renters in the city, affordable and multifunctional furniture sees steady growth.

The South East region has large-scale presence of suburban families and affluent homeowners. People in this region prefer high-quality and durable furniture. With spacious homes, traditional and classic styles are popular, especially for dining and living rooms. Outdoor furniture is also in high demand, as the area has plenty of homes with gardens and patios.

The North West experiences a high requirement for affordable and stylish furniture, with a mix of urban and rural households. Industrial-style furniture is popular in cities like Manchester while families in smaller towns look for practical and durable options. The region also values sustainability, with increasing interest in eco-friendly materials and second-hand furniture.

In the East of England, homeowners seek functional and stylish designs. This area has a mix of urban and rural buyers, so both modern and traditional furniture sell well. Garden furniture is especially popular, as many homes have outdoor spaces. Customization options also attract buyers looking for personalized items.

The South West focuses on comfortable and rustic furniture, reflecting the relaxed lifestyle of the region. Coastal and countryside homes encourage the employment of natural wood and wicker designs. Many people wager on durable outdoor furniture for their gardens, patios, or holiday homes. Affordable and functional pieces are also common choices.

Scotland values long-lasting and cozy furniture, often highlighting the country’s colder climate. Rustic wooden furniture is a favorite, especially in rural and traditional homes. Urban areas like Glasgow and Edinburgh prefer contemporary designs while the hospitality sector, including hotels and bed and breakfasts (B&Bs), drives the demand for high-quality furnishings.

The West Midlands market is influenced by a mix of urban and suburban lifestyles. Affordable and practical furniture is highly sought after, especially for young families and first-time homeowners. The region also has a high interest in sleek and modern designs, reflecting urban tastes in cities like Birmingham.

Yorkshire and The Humber is famous for its balance of demand for traditional and modern furniture. Families often choose functional and durable options for everyday use while urban buyers look for stylish and space-saving designs. Eco-friendly furniture is high in popularity, with many people seeking sustainable and budget-friendly options.

The East Midlands favors practical and affordable furniture, catering to families and first-time buyers. Rural homes choose traditional styles while cities like Nottingham drive the demand for trendy and compact designs. Outdoor furniture is also popular, as many households enjoy garden spaces for entertaining and relaxing.

UK Furniture Manufacturers:

Key players in the market work on developing new designs to meet the demand for UK furniture industry. Well-known big brands and retailers focus on offering stylish, functional, and affordable furniture to cater to diverse user needs. They invest in trends like sustainability, customization, and compact designs to address modern lifestyles. These companies also lead the way in e-commerce, making it easier for people to shop online with features like virtual room planners and flexible delivery options. Smaller and niche brands add to the mix by offering unique and eco-friendly furniture items that appeal to specific markets. By staying innovative and responsive to user requirements, key players keep the market competitive, ensuring there is something for every type of buyer, whether they are furnishing a flat or upgrading a home office. For instance, in January 2025, Forte, a prominent European producer of self-assembly furniture, announced a major expansion into the UK market in 2025. This comes after the successful introduction of its EasyKlix line at certain John Lewis locations earlier this year.

The report provides a comprehensive analysis of the competitive landscape in the UK furniture market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Pottery Barn, part of Williams-Sonoma Inc., announced its plans to enter the UK furniture market in Autumn 2025. The launch includes a dedicated UK website featuring a curated range of furniture, bedding, lighting, and décor. Known for its focus on craftsmanship and timeless design, Pottery Barn’s expansion brings its signature home furnishings to British customers, marking a notable addition to the UK’s premium home retail landscape.

- December 2024: LIVHOME, a furniture and lifestyle retailer, was set to launch its inaugural UK store in Merseyside this month. The company selected Racecourse Retail Park in Liverpool as the site for its first physical store in the region. The furniture brand aims to offer a beautifully designed assortment of practical items.

- November 2024: Arlo & Jacob, a family furniture business based in Nottinghamshire, England, declared its plans to open a store in Kent, UK. The business additionally offers home decor items, chairs, tables, and footrests and stated it discovered "the ideal location" on Mount Pleasant Road in Tunbridge Wells. It also aims to launch one more store in St Albans, increasing its UK showrooms to 11.

- November 2024: Matahari Interiors, a renowned company recognized for its craftsmanship in reclaimed elm wood items, announced its release in the UK featuring top-quality wooden furniture from the Far East. The site was introduced with a 20% discount promotion for the rest of the year.

- October 2024: The Cotswold Company, an upscale furniture and home goods brand, announced that its latest store is set to launch on Marlow High Street, UK. It proposed designs to renovate the town’s former Natwest branch earlier this month, two years after the bank closed, pointing to a shift towards mainly digital services. Chief Executive Officer Ralph Tucker referred to the expansion into Bucks as an exciting chance to highlight the brand’s ranges for bedrooms, living rooms, and dining areas, along with a custom upholstery center, featuring swatches, styles, and fabrics to meet all decorating preferences.

UK Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Office Furniture, Educational Furniture, Others |

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| End Uses Covered | Residential, Commercial, Hospitality, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK furniture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK furniture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK furniture market in the region was valued at USD 21.9 Billion in 2024.

The UK furniture market is projected to exhibit a CAGR of 4.03% during 2025-2033, reaching a value of USD 31.30 Billion by 2033.

The rising demand for new housing and renovations, with homeowners and renters seeking stylish, functional, and space-efficient furniture, is increasing furniture sales. Besides this, the growing usage of online platforms is making furniture shopping more accessible, with options for customization, easy delivery, and competitive pricing. Moreover, people are looking for eco-friendly and sustainable furniture options, encouraging brands to use recycled materials and adopt green practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)