UK Fleet Management Market Size, Share, Trends and Forecast by Component, Vehicle Type, Technology, Deployment Type, End Use Sector and Region, 2025-2033

UK Fleet Management Market Overview:

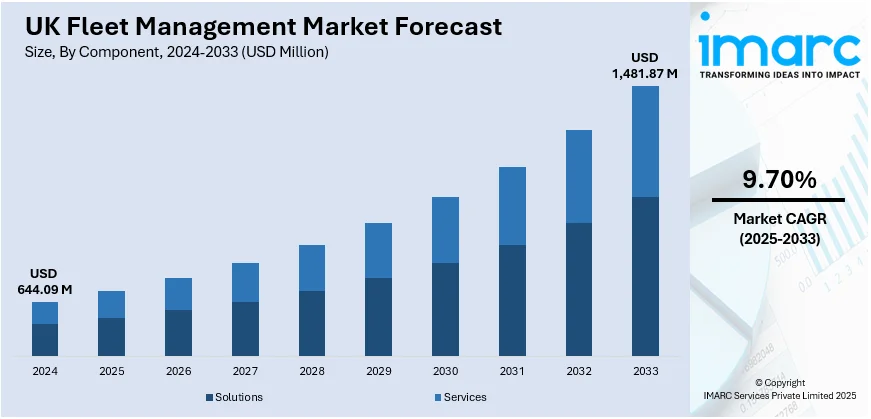

The UK fleet management market size reached USD 644.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,481.87 Million by 2033, exhibiting a growth rate (CAGR) of 9.70% during 2025-2033. The market is driven by the increasing demand for better customer service and delivery times, rising labor costs, the globalization of supply chains, and an enhanced focus on real-time tracking and monitoring of goods. Additionally, the paradigm shift towards electric and hybrid vehicles, growing insurance costs, and the rising stringency of vehicle safety standards are favoring UK fleet management market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 644.09 Million |

| Market Forecast in 2033 | USD 1,481.87 Million |

| Market Growth Rate 2025-2033 | 9.70% |

UK Fleet Management Market Trends:

Rapid digital transformation involving 5G implementation

According to the UK fleet management market outlook, the growing use of digital technology is crucial for providing insight into warehouse supply chains. At present, fleet operators are able to track products in real time due to the implementation of 5G technology. Accuracy in their location is offered, which is expected to lead to a rise in the demand for fleet management systems in the coming years. Anticipated benefits in predictive maintenance, safety, and asset management are expected to be substantial from this information. Businesses have the opportunity to utilize advanced technologies to oversee storage conditions and automatically make necessary adjustments. If any item goes missing, the authorities are immediately notified, improving the chances of finding the item and identifying the individual accountable for the incident. Numerous network providers are providing satellite communication options to improve fleet vehicle monitoring. On 23rd September 2024, Vodafone announced an earlier agreement with Intelsat to add satellite communication capabilities for fleet management and disaster response in remote areas across the United Kingdom. Vodafone is also using Intelsat's GEO satellite-powered Flex services to offer Communications-on-the-Move (COTM) and Communications-on-the-Pause (COTP) solutions for business and humanitarian applications. This agreement also strengthens the Vodafone Foundation’s work on connected health and education across Europe and Africa. Additionally, smart digital platforms are becoming increasingly intuitive and flexible for customers. Digital platforms and AI customer service systems are widely being utilized in various industries to provide increased personalization and replace traditional car dealerships. All these factors are playing a pertinent role in the expanding size of the fleet management market in the UK.

Increasing fuel prices

The escalating fuel prices in the UK are significantly influencing the UK fleet management market share, prompting companies to adopt more efficient operational strategies. As fuel constitutes a substantial portion of total operational costs for fleet operators, the rising prices compel businesses to seek ways to mitigate these expenses. This has led to an increased focus on fuel management solutions, which enable real-time tracking of fuel consumption and the implementation of more efficient routing practices. Furthermore, fleet management systems equipped with advanced telematics technologies allow companies to monitor driver behavior and vehicle performance, facilitating the identification of inefficiencies that lead to excessive fuel usage. On 30th December 2024, Nayax announced deploying its EasyFuelPlus fuel management system across Tesco's delivery fleet across the UK, a fleet that consists of 5,000 vehicles and 14 distribution centers by 2026. This dive enhances fleet management through the means of decreased fuel consumption, reduced reckless usage, and the ability to track the automobile in real time. This solution enables Tesco to reduce costs and promote sustainability through automated fuel monitoring while developed by OTI PetroSmart. Additionally, these systems assist in optimizing routes to reduce overall travel distances and improve fuel efficiency. Moreover, the pressure of rising fuel costs has accelerated the shift towards alternative fuel vehicles, such as electric and hybrid models, which present long-term savings despite higher initial investments. Fleet operators are increasingly integrating these vehicles into their fleets, not only to reduce fuel dependency but also to align with government regulations aimed at lowering emissions.

UK Fleet Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, vehicle type, technology, deployment type, and end use sector.

Component Insights:

- Solutions

- Fleet Telematics

- Driver Information Management

- Vehicle Maintenance

- Safety and Compliance Management

- Others

- Services

- Installation and Integration Services

- After-Sales Support Services

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (fleet telematics, driver information management, vehicle maintenance, safety and compliance management, and others), and services (installation and integration services, after-sales support services, and consulting services).

Vehicle Type Insights:

- Commercial Vehicles

- Passenger Cars

- Aircrafts

- Watercrafts

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes commercial vehicles, passenger cars, aircrafts, and watercrafts.

Technology Insights:

- GNSS

- Cellular Systems

The report has provided a detailed breakup and analysis of the market based on the technology. This includes GNSS and cellular systems.

Deployment Type Insights:

- Cloud-based

- On-premises

- Hybrid

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based, on-premises, and hybrid.

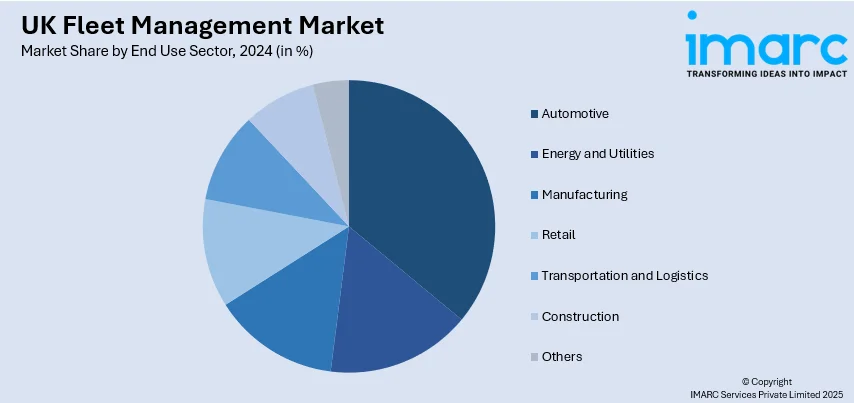

End Use Sector Insights:

- Automotive

- Energy and Utilities

- Manufacturing

- Retail

- Transportation and Logistics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Fleet Management Market News:

- May 19, 2023: Holman secured a landmark fleet management agreement, one of the largest of its kind to date, assuming responsibility for BT Group's fleet of 37,000 commercial vehicles. This extensive contract encompasses all categories of BT’s vehicles, including light and large commercials, specialist vehicles, HGVs, as well as plant and ancillary equipment. A significant portion of this fleet is managed by Openreach, the division dedicated to rapidly deploying full-fibre broadband throughout the UK.

- August 29, 2024: At IAA Transportation 2024, Continental unveiled its latest innovation in tire management for commercial vehicles: automated and continuous tread depth measurement. Continental introduced an automated system for continuous tread depth measurement for commercial vehicle tires. This innovation, showcased at IAA Transportation 2024, combines sensors with AI algorithms to provide precise, real-time data on tire wear, enhancing fleet safety and efficiency. These advancements will be publicly showcased for the first time at the event in Hanover, taking place from September 17 to 22, with a market launch planned for summer 2025.

UK Fleet Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends, Market Outlook, Industry Catalysts, Challenges, Segment-Wise Historical, Future Market Assessment:

|

| Components Covered |

|

| Vehicle Types Covered | Commercial Vehicles, Passenger Cars, Aircrafts, Watercrafts |

| Technologies Covered | GNSS, Cellular Systems |

| Deployment Types Covered | Cloud-based, On-premises, Hybrid |

| End Use Sectors Covered | Automotive, Energy, Utilities, Manufacturing, Retail, Transportation, Logistics, Construction, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire, The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF, Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK fleet management market performed so far and how will it perform in the coming years?

- What is the breakup of the UK fleet management market on the basis of component?

- What is the breakup of the UK fleet management market on the basis of vehicle type?

- What is the breakup of the UK fleet management market on the basis of technology?

- What is the breakup of the UK fleet management market on the basis of deployment type?

- What is the breakup of the UK fleet management market on the basis of end use sector?

- What is the breakup of the UK fleet management market on the basis of region?

- What are the various stages in the value chain of the UK fleet management market?

- What are the key driving factors and challenges in the UK fleet management market?

- What is the structure of the UK fleet management market and who are the key players?

- What is the degree of competition in the UK fleet management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK fleet management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK fleet management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK fleet management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)