UK EV Battery Pack Market Size, Share, Trends and Forecast by Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type, and Region, 2025-2033

UK EV Battery Pack Market Size and Share:

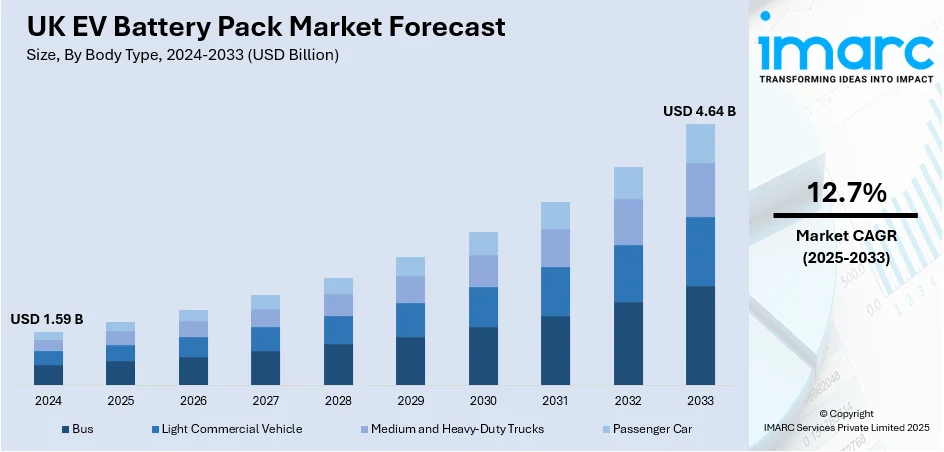

The UK EV battery pack market size was valued at USD 1.59 Billion in 2024. The market is projected to reach USD 4.64 Billion by 2033, exhibiting a CAGR of 12.7% from 2025-2033. The market is witnessing strong growth fueled by favorable government policies, growing electric vehicle penetration, and technological progress in batteries. Growing demand for passenger vehicles, particularly BEVs, is underlining the requirement for lean battery chemistries and formats. Manufacturability improvements and critical component optimization are improving performance, safety, and scalability. The increased interest in sustainable materials and mid-range capacity needs further underlines broad adoption. All these factors combined contribute to the growth of the UK EV battery pack market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.59 Billion |

| Market Forecast in 2033 | USD 4.64 Billion |

| Market Growth Rate (2025-2033) | 12.7% |

Government regulation and incentives have become a major driving force of the UK EV battery pack market. The urgency to attain net-zero carbon emissions in 2050 has triggered the UK government to enforce tight policies for the adoption of electric vehicles. Policies like zero-emission vehicle grants, lower road charges, and exemption from congestion charges encourage consumers to adopt electric vehicles. Moreover, the forthcoming ban on new petrol and diesel car sales from 2035 provides a clear policy direction that stimulates the growth of indigenous battery manufacturing facilities. Local governments have also promoted clean air zones, further pushing commercial and private vehicle owners to shift towards electric vehicles. These initiatives not only promote consumer demand but also build investor confidence in developing a healthy EV ecosystem. Therefore, regulatory support is still a crucial driver in fueling the expansion of battery pack manufacturing and related infrastructure in the UK.

To get more information on this market, Request Sample

The expansion of the UK's charging network is a key driver of the EV battery pack market growth. An adequately distributed and high-capacity charging network is essential in alleviating range anxiety and boosting consumer trust in electric mobility. The UK government and private sector players are heavily investing in high-capacity charging hubs, particularly in urban centers, highways, and rural regions. These advancements facilitate quicker and more convenient recharging, enabling higher-capacity battery packs that support increased vehicle range. Ultra-fast charging innovations and the embedding of smart grid technologies are in line with innovations in battery design and energy management systems. In addition, an increasing number of residential and workplace charging solutions contribute to greater accessibility. This infrastructure development not only supports the everyday use of EVs but also confirms the demand for effective, high-performance battery packs, which pushes further innovation and manufacturing in the UK market for EV battery technology.

UK EV Battery Pack Market Trends:

Government Incentives and Regulations

The UK government has been a significant catalyst in driving the adoption and development of EV battery packs through a series of incentives and regulatory frameworks. One of the most impactful initiatives is the "Road to Zero" strategy, which aims to ban the sale of new petrol and diesel cars by 2030. This ambitious target has accelerated the demand for electric vehicles (EVs) and, consequently, the need for efficient and reliable EV battery packs. To support this transition, the government has introduced various financial incentives for both manufacturers and consumers. Additionally, grants are available for the installation of home charging points, further reducing the barriers to EV adoption. In 2024, Britain registered its millionth EV as the new car market grows 8.2%, this rise in the effectiveness of government policies in promoting EV adoption and, by extension, the demand for EV battery packs.

Increasing Investment in Research and Development (R&D)

Investment in research and development (R&D) is a crucial factor driving the UK EV battery pack market. The Government of the UK committed over 2 Billion Euros in research and development (R&D) funding for the automotive sector. The UK is home to several leading research institutions and universities that are at the forefront of battery technology innovation. These institutions are working on improving battery efficiency, lifespan, and sustainability, which are critical for the widespread adoption of EVs. The UK government, in collaboration with private sector partners, has been investing heavily in R&D initiatives. For instance, the Faraday Institution is investing £19 million in four battery research projects to maximize their impact and contribute to the economy of the UK and energy landscape. Moreover, collaborations between academia and industry are fostering a robust ecosystem for innovation. Companies such as Jaguar Land Rover and Nissan have partnered with universities to develop next-generation battery technologies. These collaborations are advancing the technical capabilities of EV batteries and also ensuring that the UK remains competitive in the global market.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is another vital factor driving the growth of the UK EV battery pack market trends. The availability of a comprehensive and accessible charging network is essential for the adoption of electric vehicles, as it addresses one of the primary concerns of potential EV buyers range anxiety. The UK government has set ambitious targets to expand the public charging network, with plans to expand the public electric vehicle (EV) charging network to 300,000 charge points by 2030, backed by £1.6 billion, making charging easier and cheaper than refueling conventional cars. The government has also introduced grants and funding schemes to support the installation of charging points in residential areas, workplaces, and commercial establishments. Private sector such as are also playing a crucial role in expanding the charging infrastructure. Companies such as BP Pulse, Shell Recharge, and Gridserve are investing heavily in building and upgrading charging stations across the country. These companies are focusing on installing high-speed chargers that can significantly reduce the time required to charge an EV, making it more convenient for users.

UK EV Battery Pack Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK EV battery pack market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on body type, propulsion type, battery chemistry, capacity, battery form, method, component, and material type.

Analysis by Body Type:

- Bus

- Light Commercial Vehicle

- Medium and Heavy-Duty Trucks

- Passenger Car

Passenger car had a commanding 59.9% share in the UK EV battery pack market forecast in 2024 due to growing consumer uptake of electric vehicles for personal transportation. The transition away from internal combustion towards more sustainable forms of transport is particularly marked in urban centers, where zero-emission zones and congestion charges are incentivizing EV purchase. Passenger vehicles are enjoying widespread government incentives, including purchase incentives, tax breaks, and investment in charging points. In addition, improvements in battery performance, along with decreasing prices, have made electric passenger vehicles affordable to a wider audience. Auto manufacturers are also increasing their line-up of EVs with a series of models featuring different battery sizes to suit customer demands. The steady launch of small, mid-size, and premium electric vehicles continues to drive demand for efficient and long-lasting battery packs, solidifying the passenger car segment's dominance in the market through 2024.

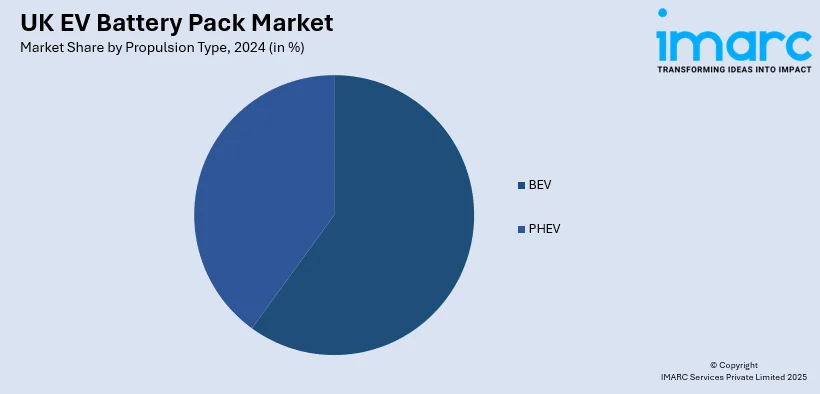

Analysis by Propulsion Type:

- BEV

- PHEV

Battery Electric Vehicles (BEVs) held a massive 70.8% share in the UK EV battery pack market outlook in 2024, indicating a decisive choice of fully electric drivetrains over hybrid options. This is in tandem with national policies supporting zero-tailpipe emission vehicles and the phase-out of new petrol and diesel cars. BEVs, depending solely on electricity for motive power, need advanced battery packs as their only energy supply, thus generating steady demand for developments in battery technology. Advances in range, efficiency, and cost have further boosted consumer confidence in BEVs. Public and private investments in charging infrastructure are assisting in eradicating the range anxiety, which is a key driver for the development of this segment. Further, enhanced availability of high-capacity battery systems enables BEVs to be as good as conventional vehicles on long-distance use. This high growth adoption of plug-in-only propulsion solidifies BEVs as the dominant propulsion type driving battery pack development and deployment in the UK.

Analysis by Battery Chemistry:

- LFP

- NCA

- NCM

- NMC

- Others

Lithium Iron Phosphate (LFP) chemistry dominated the UK EV battery pack market in 2024 with a 40.8% share, being increasingly popular for its trifecta of safety, long life, and affordability. LFP batteries are more stable at elevated temperatures and have lower thermal runaway risks, making them suitable for passenger cars used in urban conditions and fleet operations. Their long cycle life and stability against degradation from repeated charging cycles make them more desirable for consumers looking for long-term dependability. Also, the lower dependence on essential minerals such as cobalt and nickel is more in line with attempts at global sustainability and ethically sourced battery supply chains. The chemistry's cost benefits also favor the mass production of cheap electric vehicles, which leads to increased market penetration. With continually improving energy density, LFP batteries are better and better positioned to offer competitive range, leading ever further to their increasing take-up. Their growing visibility in mass-market and commercial EVs adds to LFP's dominance among battery chemistries for 2024.

Analysis by Capacity:

- Less than 15 kWh

- 15 kWh to 40 kWh

- 40 kWh to 80 kWh

- Above 80 kWh

Battery packs of 40 kWh to 80 kWh capacity dominated a leading 51.2% of the UK market in 2024, fueled by increasing demand for electric vehicles that compete on range, performance, and price. This capacity level is at the core specification of mid-range passenger cars, with enough energy storage for urban daily commutes and moderate use for intercity travel. It provides an optimal trade-off between battery size, weight, and cost, making it particularly attractive to consumers transitioning from internal combustion engine vehicles. Technological advancements have also improved the energy density of packs within this range, enabling manufacturers to design sleeker, more efficient vehicles. Moreover, this capacity bracket supports compatibility with fast-charging infrastructure, allowing users to recharge their vehicles conveniently and quickly. Since the majority of mass-market battery-electric vehicles are priced in this range, the 40–80 kWh category is at the forefront of market growth, attracting a wide customer base and pushing battery pack standardization within the UK.

Analysis by Battery Form:

- Cylindrical

- Pouch

- Prismatic

Prismatic cells became the UK EV battery pack market leader, with 46.2% share in 2024, owing to their very compact shape and structural effectiveness. Their prismatic shape supports a greater packing density, enhancing space efficiency in battery modules and packs, particularly in vehicles that have limited space demands. Prismatic cells are recognized for providing enhanced mechanical stability and improved safety features, such as in the case of thermal stress or incidental impact. With vehicle design becoming more streamlined, automakers choose prismatic cells due to their ease of integration in different chassis architectures. These cells also enable reduced thermal management systems and enhanced structural support. In addition, their standardization of module sizes with prismatic formats makes assembly and maintenance more convenient. Their scalability and applicability in consumer as well as commercial purposes guarantees broad adoption. In 2024, prismatic cells remained market leaders by harmonizing manufacturing efficiency with performance and safety considerations.

Analysis by Method:

- Laser

- Wire

Laser welding had the largest percentage in battery assembly techniques with 55.6% of the UK EV battery pack market in 2024, thanks to its precision, rapidness, and structural strength. The process is more preferred in battery manufacturing because it can produce clean, strong, and highly durable joints between battery cells and modules without adding excess heat and mechanical stress. It lowers material contamination considerably and improves the electrical conductivity, both factors which are very important to the performance and safety of a battery pack. Laser welding also enables automated, high-volume manufacturing lines, which are consistent with manufacturers' desires for increased output while still having quality control. Its non-contact process minimizes wear on the tooling components, reducing maintenance and downtime. As battery structures grow more complex and compact, the accuracy of laser welding accommodates advanced configurations. The technique's contribution to the improvement of manufacturing efficiency and product reliability consolidated its status as the top joining technology in 2024.

Analysis by Component:

- Anode

- Cathode

- Electrolyte

- Separator

The cathode component dominated the UK EV battery pack market with a 35.7% market share in 2024 owing to its central role in defining energy density, charge-discharge efficiency, and battery lifetime. Since the cathode is the sole host of lithium ions, its impact on the driving range and performance of the vehicle makes it the focus of both innovation and investment. Improved cathode formulations that maximize voltage output while improving thermal stability and durability are being prioritized by manufacturers. Next-generation material trends, including high-nickel and cobalt-free compositions, further increase the significance of cathode R&D. This emphasis is not only enhancing the general efficiency of batteries but also minimizing environmental footprint and supply chain risk related to key raw materials. The high material cost of the cathode and its large influence on overall battery performance make it the most technically advanced and valuable component. Its engineering innovations and changing compositions have secured its dominance position in the 2024 market.

Analysis by Material Type:

- Cobalt

- Lithium

- Manganese

- Natural Graphite

- Nickel

- Others

Lithium was the top material in the UK EV battery pack market, with 50.3% share in 2024, since it is the basic component of the makeup of today's rechargeable batteries. Being the main substance that enables electrochemical reactions in cells, lithium supports smooth energy storage and transfer. It makes possible high energy density and comparably light weight, which are properties important in maximizing electric vehicle range and performance. Lithium's universality in different chemistries, both LFP and NMC, has made it a universal input in battery production. Furthermore, strategic measures for ensuring stable and sustainable lithium supply chains, both domestic and foreign, are solidifying its core significance. Advances in technologies for lithium extraction and purification are also gradually decreasing costs and increasing purity levels, further enhancing its usage. With increasing demand for electric mobility, lithium remains the fulcrum material driving the design, performance, and scalability of battery packs employed on UK electric vehicle platforms.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London dominates the UK market for EV battery packs because of its high level of electric vehicle penetration, sound regulatory environment, and advanced charging infrastructure. Low-emission areas and financial incentives in the city also increase consumer demand, while urban density enhances demand for compact, efficient battery systems for both passenger and commercial fleets.

The South East has a mix of high vehicle ownership and strong investment in EV infrastructure. Accessibility to key transport corridors and manufacturing centers also facilitates battery logistics and supply chains. Demand for sustainable mobility solutions from consumers is also increasing, driving steady EV battery pack demand growth.

The North West area illustrates increasing pace in EV take-up, underpinned by the initiatives of local authorities and industrial investment. Availability of skilled labor and changing transportation policy supports a promising climate for battery production, while local initiatives promote innovation in battery efficiency and electric fleet conversion.

In the East of England, the EV battery pack industry is growing with strategic infrastructure development and incentives for consumers. The region's focus on sustainability and access to technologically advanced research institutions enable support for uptake. Its mix of urban and rural areas also fuels demand for mid-range EVs, promoting utilization of flexible battery capacities.

The South West is also proving to be an area of growth in the UK EV battery pack market, backed by increasing green awareness and the need for green tourism. Rural charging networks and low-emission transport schemes are being invested in. The focus on decarbonization is driving consumer and municipal electric vehicle adoption in the region.

Scotland is a key player in market expansion with government-supported net-zero ambitions and a robust public charging system. Regional incentives and rural mobility schemes enable battery car use across various landscapes. Emphasis on integrating renewable energy also boosts Scotland's position in sustainable battery innovation and electric transport technologies.

The West Midlands is at the heart of the UK's automotive evolution, with increasing demand for EV battery packs fueled by local innovation and advanced manufacturing capabilities. The region enjoys automotive heritage and continued investment in clean technology research, enabling scale-up of battery production and electric mobility infrastructure.

Yorkshire and The Humber experiences growing demand for the EV battery pack market because of clean transport schemes and local charging infrastructure development. Regional plans aimed at decreasing emissions in city areas are promoting EV use, with local authorities backing the integration of battery technology into public and commercial transport modes.

The East Midlands accommodates market growth with logistics prowess and industrial activity. Soaring use of electric delivery vans and local fleet electrification projects are growing demand for low-weight battery packs. Investment in charging infrastructure and local green policies also help create a suitable atmosphere for EV development.

Other parts of the UK are gradually adopting electric mobility, fueled by a combination of government incentives, local sustainability agendas, and infrastructure growth. Semi-urban and rural places are investing in charging access for communities, and regional awareness campaigns and incentives schemes encourage adoption of battery electric vehicles, enhancing overall market penetration across the country.

Competitive Landscape:

The UK EV battery pack market boasts a dynamic competitive environment influenced by technology development, manufacturing innovation, and strategic partnerships. Market players are engaging to enhance battery energy density, thermal management, and cycle life to address changing vehicle performance standards. Localization of production is emphasized in order to improve supply chain resilience and minimize import reliance. Producer differentiation is also occurring with the use of more advanced battery types such as prismatic cells and technologies such as laser welding, enhancing efficiency and safety. Partnerships with research centers and material providers are facilitating rapid commercialization of new-generation chemistries, especially lithium-based ones. Battery pack customization to fit different types of vehicles and performance levels yet again contributes to competitive pressures. Companies are also committing to government sustainability targets, using policy incentives to expand operations. Further, these initiatives drive ongoing innovation and diversification in a fast-growing and highly competitive UK EV battery pack market.

The report provides a comprehensive analysis of the competitive landscape in the UK EV battery pack market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: UK startup Allye Energy launched two industrial battery storage systems, MAX1000 and MAX1500, using up to 18 repurposed EV battery packs with mixed chemistries. These systems offered 1 MWh and 1.5 MWh capacity, reduced carbon footprint by over 40%, and improved energy diversity and reliability for industrial applications.

- March 2025: DHL and Cox Automotive launched the UK’s largest EV battery services center at DHL’s Rugby facility, offering repair, remanufacturing, and storage across 35,000 sq ft. The center aimed to enhance battery circularity, handle thousands of batteries annually, and support EV adoption by improving battery lifecycle management and transparency.

- February 2025: UK startup Ionetic launched a £5 million pilot plant in Northamptonshire to produce low-cost, custom EV battery packs for low-volume automakers. Using AI-driven technology, Ionetic reduced development time and costs by over 80%, enabling smaller manufacturers to electrify vehicles affordably. Partnerships include Alexander Dennis and undisclosed clients.

- February 2025: National Grid began a multi-million-pound project to connect the UK’s largest EV battery factory in Somerset to the grid. The 40GWh Agratas facility, opening in 2026, aims to supply nearly half of the UK’s automotive battery demand by the 2030s and create 4,000 green tech jobs, supported by new 33kV and 400kV infrastructure.

UK EV Battery Pack Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Body Types Covered | Bus, Light Commercial Vehicle, Medium and Heavy-Duty Trucks, Passenger Car |

| Propulsion Types Covered | BEV, PHEV |

| Battery Chemistries Covered | LFP, NCA, NCM, NMC, Others |

| Capacities Covered | Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh |

| Battery Forms Covered | Cylindrical, Pouch, Prismatic |

| Methods Covered | Laser, Wire |

| Components Covered | Anode, Cathode, Electrolyte, Separator |

| Material Types Covered | Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK EV battery pack market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK EV battery pack market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK EV battery pack industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The EV battery pack market in the UK was valued at USD 1.59 Billion in 2024.

The UK EV battery pack market is projected to exhibit a CAGR of 12.7% during 2025-2033, reaching a value of USD 4.64 Billion by 2033.

Government incentives, increasing electric vehicle adoption, growth of charging infrastructure, technological improvements in batteries, and heightened environmental consciousness are the primary drivers of the UK EV battery pack market. Growing demand for more secure, longer-lasting, and cost-effective batteries, as well as rising investments in local production and eco-friendly materials, is further fueling market expansion and innovation throughout the industry

Battery Electric Vehicles (BEVs) is the leading segment in the UK EV battery pack market, with a strong 70.8% share. It is propelled by robust policy support, zero-emission goals, and increasing charging facilities. The segment depends solely on battery power, thus boosting demand for high-capacity packs and solidifying its dominant market position nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)