UK Electric Vehicle Charging Market Size, Share, Trends and Forecast by Charging Type, Power Output, Location, Phase, and Region, 2026-2034

UK Electric Vehicle Charging Market Summary:

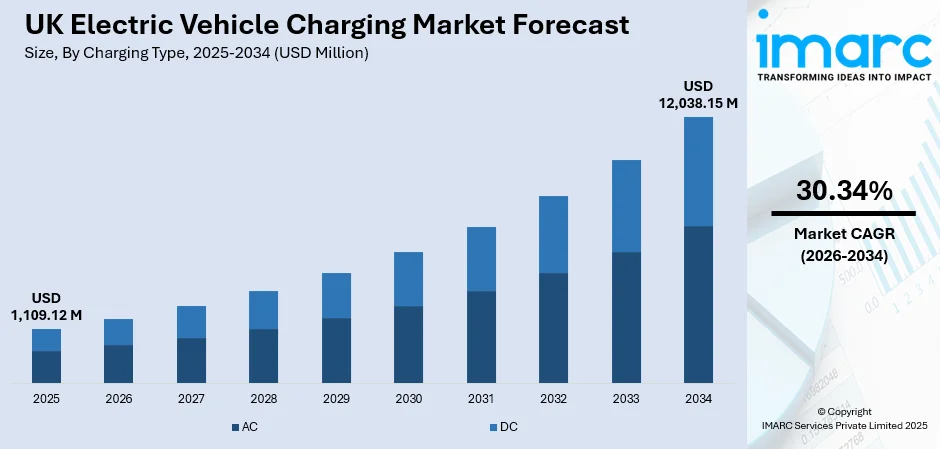

The UK electric vehicle charging market size was valued at USD 1,109.12 Million in 2025 and is projected to reach USD 12,038.15 Million by 2034, growing at a compound annual growth rate of 30.34% from 2026-2034.

The UK electric vehicle charging market is experiencing accelerated expansion as the country advances its net-zero emissions objectives and strengthens infrastructure for sustainable mobility. Government initiatives supporting charging deployment, combined with private sector investments and technological advancements in high-powered charging systems, are driving widespread network development. Rising consumer adoption of electric vehicles, favorable company car tax arrangements, and increasing availability of affordable EV models continue strengthening the UK electric vehicle charging market share.

Key Takeaways and Insights:

- By Charging Type: AC charging dominates the market with a share of 80.5% in 2025, reflecting its cost-effectiveness and widespread availability across residential and commercial settings.

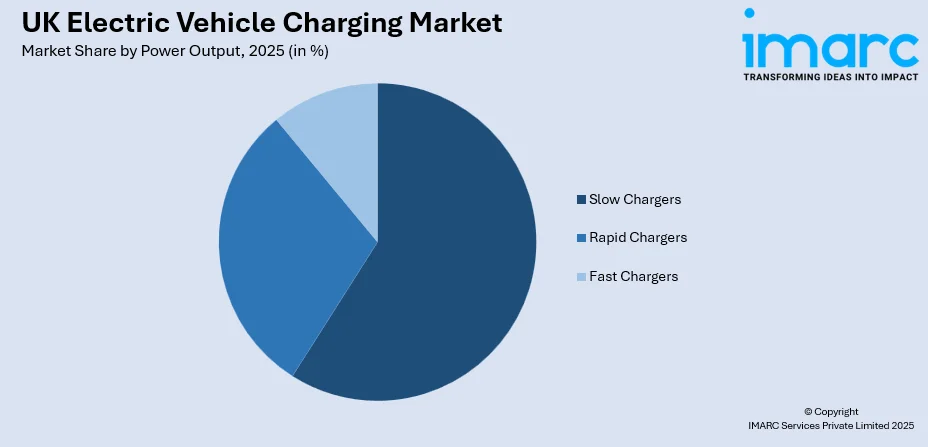

- By Power Output: Slow chargers lead the market with a share of 59.7% in 2025, driven by their prevalence in home charging installations and overnight charging requirements.

- By Location: Street parking holds the largest share in 2025, owing to its convenience, cost effectiveness, along with benefits of traffic management.

- By Phase: Three phase dominates the overall market in 2025 because it allows for faster charging speeds that shorten car connection times by delivering more power than single-phase options.

- By Region: London represents the largest regional market with a share of 38.7% in 2025, supported by substantial infrastructure investments and high EV adoption rates among urban residents.

- Key Players: The UK electric vehicle charging market features dynamic competition among established energy companies, specialized charging operators, and technology providers, with participants focusing on network expansion, technological innovation, and strategic partnerships to capture market opportunities.

To get more information on this market Request Sample

The UK electric vehicle charging market is advancing rapidly as the country positions itself as Europe's leading EV market with over 382,000 electric vehicles sold in 2024 alone. Infrastructure development has accelerated significantly, with approximately 86,000 public charge points now installed nationwide and new chargers being added at a rate of one every thirty minutes. The government has committed substantial funding to charging infrastructure, including a £63 Million investment announced in July 2025 specifically targeting households without driveways, NHS fleet electrification across over 200 sites, and depot charging for commercial vehicles.

UK Electric Vehicle Charging Market Trends:

Rapid Expansion of Ultra-Rapid Charging Networks

The UK is witnessing substantial growth in ultra-rapid charging infrastructure capable of delivering power outputs exceeding 150kW. These high-powered chargers enable electric vehicle owners to add significant driving range in minimal time, addressing range anxiety concerns. In November 2025, motorway service area operator Extra MSA announced partnerships with multiple charging operators to deploy new EV Super Hubs featuring 400kW-capable chargers across seven locations, with the first site at Beaconsfield Services scheduled for December 2025, demonstrating continued infrastructure enhancement.

Destination Charging Integration at Retail Locations

Retailers and commercial property owners are increasingly recognizing electric vehicle charging as a valuable amenity that extends customer dwell time and attracts new visitors. In May 2025, Sainsbury's reported that its Smart Charge network had powered over 60 Million miles of electric driving since launching in January 2024, having deployed over 650 ultra-rapid charging bays across 75 store locations. This trend reflects broader integration of charging infrastructure into daily consumer routines.

Innovation in Residential Charging Solutions

Addressing barriers for households without private driveways has become a priority for market development. Cross-pavement charging technology enabling cables to run safely beneath pavements from homes to parked vehicles is gaining regulatory support. Government initiatives are focusing on streamlining planning permission requirements for such installations, aiming to reduce costs for residents and significantly accelerate deployment timelines for those without off-street parking access.

Market Outlook 2026-2034:

The UK electric vehicle charging market is positioned for robust expansion as infrastructure development accelerates to meet growing EV adoption targets. The government's commitment to ending sales of new petrol and diesel cars continues driving investment across public and private sectors. The Local Electric Vehicle Infrastructure Fund allocation through 2027 will support deployment of new local chargers across England, particularly benefiting residents without private parking access. The market generated a revenue of USD 1,109.12 Million in 2025 and is projected to reach a revenue of USD 12,038.15 Million by 2034, growing at a compound annual growth rate of 30.34% from 2026-2034.

UK Electric Vehicle Charging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Charging Type | AC | 80.5% |

| Power Output | Slow Chargers | 59.7% |

| Region | London | 38.7% |

Charging Type Insights:

- AC

- DC

AC charging dominates the market with 80.5% share of the total UK electric vehicle charging market in 2025.

Alternating current charging infrastructure maintains its dominant position due to cost-effective installation requirements and compatibility with standard electrical systems. AC chargers are predominantly utilized for residential applications where vehicles charge overnight, as well as workplace installations supporting employees during working hours. The lower capital expenditure compared to direct current alternatives makes AC charging particularly attractive for property developers, local authorities, and residential installations. In January 2025, the National Wealth Fund and Aviva Investors announced a £65 Million investment in Connected Kerb to support expansion toward 40,000 on-street charging sockets, primarily featuring AC technology designed for overnight residential use.

The widespread deployment of AC infrastructure reflects practical charging patterns, with approximately 90% of UK EV drivers utilizing overnight home charging as their primary method. This charging type efficiently serves daily driving requirements without necessitating rapid energy transfer, making it well-suited for the majority of consumer use cases where vehicles remain stationary for extended periods.

Power Output Insights:

Access the comprehensive market breakdown Request Sample

- Rapid Chargers

- Fast Chargers

- Slow Chargers

Slow chargers lead the market with 59.7% share of the total UK electric vehicle charging market in 2025.

Slow charging infrastructure delivering power outputs below 7kW represents the foundational layer of the UK's charging network, predominantly serving residential and workplace applications. These chargers align with typical overnight charging patterns where vehicles remain connected for extended periods, enabling full battery replenishment without requiring high-powered equipment. The affordability of slow chargers facilitates widespread deployment across diverse settings. According to according to Zapmap data, lower-powered chargers below 50kW accounted for approximately 68,665 units, representing nearly 80% of total UK public installations.

Slow charging infrastructure benefits from straightforward grid connection requirements and lower installation costs, making it accessible for residential properties, small businesses, and local authorities seeking to expand charging availability. The technology supports efficient overnight charging while minimizing strain on local electricity distribution networks.

Location Insights:

- Street Parking

- Depot

- Highways

- Workplaces

- Retail Spaces

- Others

Street parking represents the biggest location in UK electric vehicle charging market in 2025.

Street parking charging infrastructure addresses a critical barrier for the substantial proportion of UK households that do not have access to private driveways or garages. To meet this need, local authorities are actively implementing a range of on-street charging solutions, including lamp post chargers, dedicated curbside charging bays, and innovative cable channel systems. These measures allow residents without off-street parking to conveniently charge electric vehicles at home, often at standard residential electricity rates. By providing reliable and accessible overnight charging options, this infrastructure not only encourages wider adoption of electric vehicles but also promotes equitable access to sustainable transportation across all types of housing.

Phase Insights:

- Single Phase

- Three Phase

Three phase charging holds the biggest share in the UK electric vehicle charging market in 2025.

Three-phase charging has emerged as a leading technology in the UK electric vehicle charging sector due to its ability to deliver significantly higher power outputs compared to conventional single-phase alternatives. By supporting faster charging times, it meets the growing demand for efficiency in both commercial and residential environments where rapid vehicle turnaround is essential. Three-phase chargers are widely deployed at public charging hubs, workplaces, and high-traffic locations, providing reliable and efficient power to multiple users simultaneously. This capability helps reduce vehicle connection times, enhances user convenience, and supports the broader adoption of electric vehicles by ensuring charging infrastructure can meet increasing demand.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London holds the largest regional market share at 38.7% of the total UK electric vehicle charging market in 2025.

London's position as the UK's largest regional market reflects the capital's substantial infrastructure investments and high EV adoption rates among urban populations. The city benefits from concentrated charging deployment across public spaces, residential streets, and commercial locations. Greater London recently hosted 22,871 on-street chargers, representing the majority of the UK's residential street charging infrastructure according to Zapmap statistics. Transport for London's continued partnerships with charging operators support ongoing network expansion.

The concentration of charging infrastructure in London aligns with high population density, elevated EV ownership rates, and proactive local authority initiatives. Ultra-Low Emission Zone requirements and congestion charge exemptions for electric vehicles have stimulated adoption, creating corresponding demand for charging infrastructure.

Market Dynamics:

Growth Drivers:

Why is the UK Electric Vehicle Charging Market Growing?

Comprehensive Government Policy Support and Investment

The UK government has implemented extensive policy measures accelerating electric vehicle charging infrastructure deployment. Regulatory frameworks including the Zero Emission Vehicle mandate requiring manufacturers to achieve specified proportions of electric vehicle sales, combined with substantial public investment, create favorable conditions for market expansion. Government initiatives specifically target charging access barriers, including funding for local authorities to expand residential charging for households without driveways through innovative cross-pavement solutions, support for NHS fleet electrification across healthcare sites, and investment in depot charging at commercial premises nationwide. These commitments build upon previous infrastructure funding and demonstrate sustained policy focus on removing adoption barriers.

Accelerating Electric Vehicle Adoption Driving Infrastructure Demand

The UK has established itself as a leading European electric vehicle market, with sales demonstrating consistent year-on-year growth. The expanding electric vehicle population creates sustained demand for charging infrastructure across residential, commercial, and public settings. Rising consumer environmental awareness, improving vehicle affordability, and expanding model availability continue driving adoption rates upward. The government's confirmation of deadlines for ending new petrol and diesel car sales provides long-term market certainty, encouraging infrastructure investment to support anticipated growth trajectories. Fleet operators are also accelerating transitions to electric vehicles, further strengthening infrastructure requirements across depot and commercial locations.

Substantial Private Sector Investment and Network Expansion

Private sector commitment to UK charging infrastructure development remains strong, with industry associations and their members pledging significant investment through the end of the decade to ensure charging deployment keeps pace with demand. Charge point operators are securing substantial funding from institutional investors, national wealth funds, and private equity to support ambitious network expansion plans. This investment pattern demonstrates commercial confidence in long-term market opportunities and supports rapid network growth across diverse locations and property types. Strategic partnerships between charging operators, property owners, and energy companies continue facilitating infrastructure deployment at scale.

Market Restraints:

What Challenges the UK Electric Vehicle Charging Market is Facing?

Persistent Regional Infrastructure Disparities

Despite overall network growth, significant regional imbalances persist in charging infrastructure distribution. Greater London accounts for the majority of on-street chargers, while other regions host substantially fewer installations despite higher car dependency. These disparities create uneven access to charging, potentially limiting EV adoption in underserved areas.

Grid Connection Constraints and Delays

Charging infrastructure deployment faces bottlenecks in securing electrical grid connections required for high-powered installations. Distribution network operator processes for assessing and completing connections can extend project timelines significantly, with industry stakeholders identifying varying standards and slow processes as substantial impediments to network expansion.

Reliability and Consumer Confidence Concerns

Public charging infrastructure reliability remains a concern for some EV drivers, with frustrations regarding malfunctioning equipment, insufficient charging bay availability, and service speed. Although new regulations mandate reliability standards and require contactless payment options, achieving consistent service quality across diverse operators continues presenting challenges.

Competitive Landscape:

The UK electric vehicle charging market exhibits dynamic competition among diverse participants including energy companies, specialized charging operators, and technology providers. Major charging point operators are investing heavily in network expansion, with companies deploying thousands of new chargers annually across varied location types. Competition increasingly focuses on service quality, charging speed, and user experience as differentiating factors. Strategic partnerships between charging operators, property owners, and local authorities facilitate access to prime locations while spreading infrastructure costs. Technology innovation continues advancing, with providers introducing higher power outputs, improved payment systems, and enhanced digital services. Industry consolidation through acquisitions and mergers shapes market structure as companies seek scale advantages.

Recent Developments:

- In April 2025, Leading European charging operators Atlante, Electra, Fastned, and IONITY formed the Spark Alliance, creating access to over 1,700 charging stations and 11,000 high-powered charging points across 25 European countries including the UK, enabling drivers to use any member's app for seamless cross-network charging.

- In February 2025, BP Pulse opened its first dedicated EV charging hub in the UK at Cromwell Road in Hammersmith, London, featuring five ultra-fast 300kW chargers capable of charging two vehicles simultaneously, replacing a former fuel station with purpose-built EV infrastructure and convenience facilities.

UK Electric Vehicle Charging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Types Covered | AC, DC |

| Power Outputs Covered | Rapid Chargers, Fast Chargers, Slow Chargers |

| Locations Covered | Street Parking, Depot, Highways, Workplaces, Retail Spaces, Others |

| Phases Covered | Single Phase, Three Phase |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK electric vehicle charging market size was valued at USD 1,109.12 Million in 2025.

The UK electric vehicle charging market is expected to grow at a compound annual growth rate of 30.34% from 2026-2034 to reach USD 12,038.15 Million by 2034.

AC charging holds the largest share at 80.5%, driven by its cost-effectiveness, compatibility with residential installations, and suitability for overnight charging applications serving the majority of EV driver requirements.

Key factors driving the UK electric vehicle charging market include comprehensive government policy support with substantial public investment, accelerating electric vehicle adoption creating infrastructure demand, and significant private sector investment commitments supporting rapid network expansion.

Major challenges include persistent regional infrastructure disparities limiting charging access outside London, grid connection constraints delaying high-powered installations, reliability concerns affecting consumer confidence, and the need for continued investment to meet growing EV population requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)